Co-Founder & Managing Director, Enduring Ventures.🌳 Co-Founder: ZOLA Electric, Better World Books, EcoSafi

12 subscribers

How to get URL link on X (Twitter) App

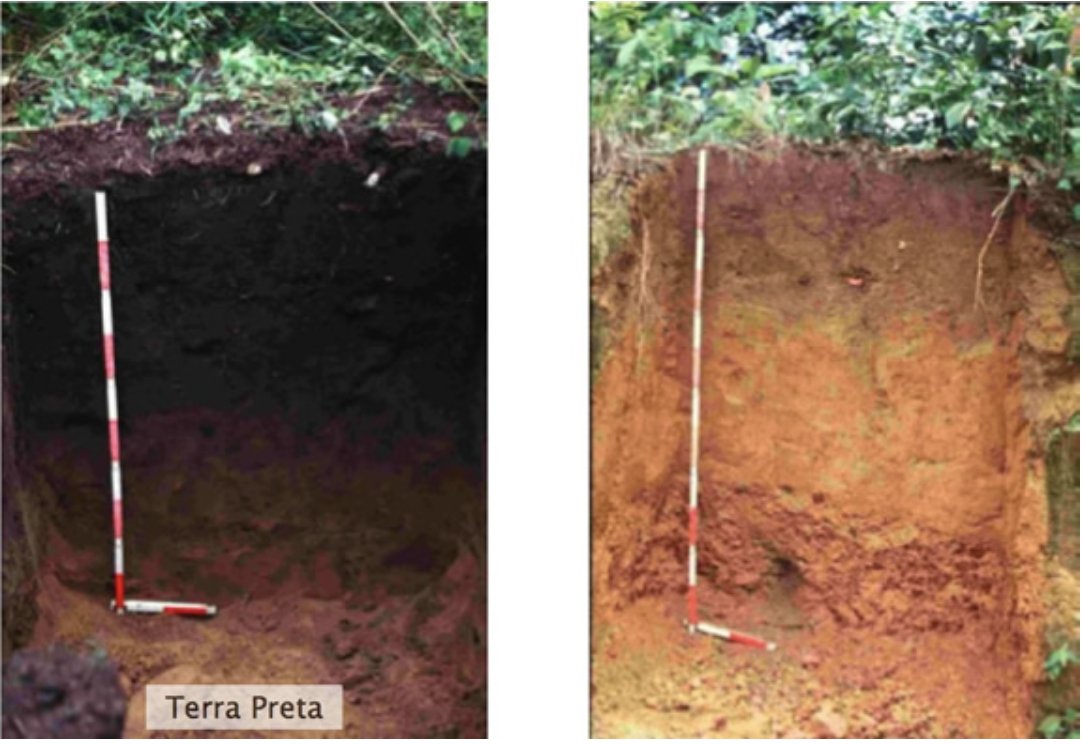

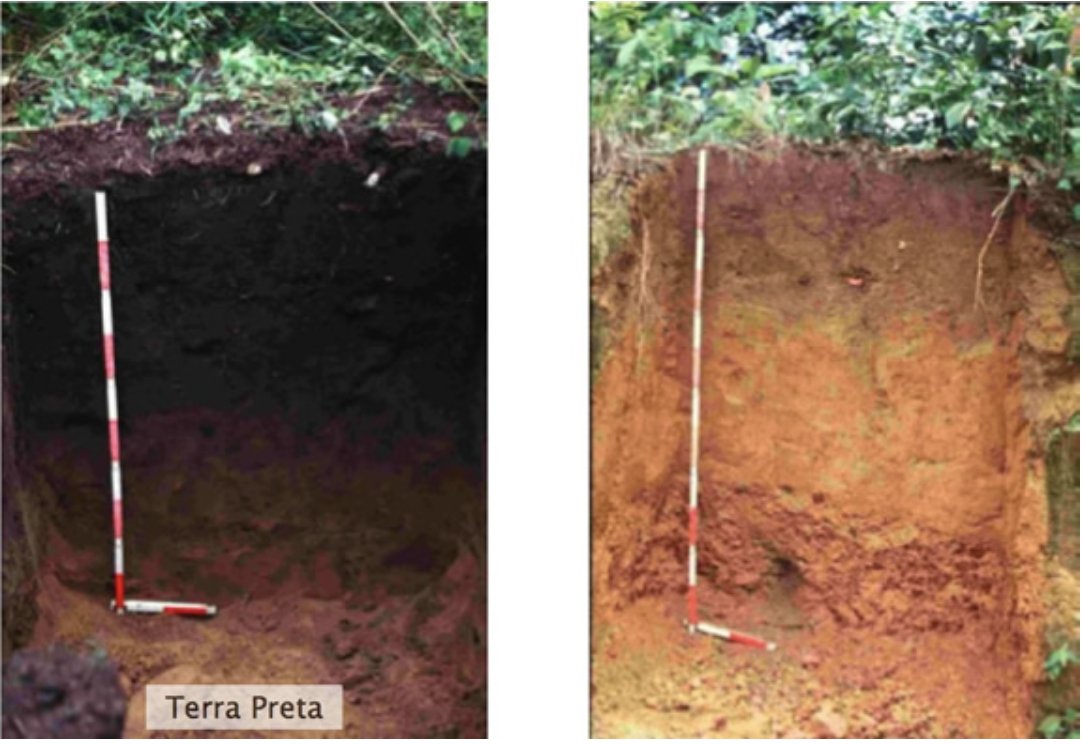

Humans have a rich history of amending our soil with carbon.

Humans have a rich history of amending our soil with carbon.

I ended up here because I met one of Prenuvo’s team members on my Calendly calls earlier this year.

I ended up here because I met one of Prenuvo’s team members on my Calendly calls earlier this year.

2/ Most key of all was strict price discipline and creative deal structuring

2/ Most key of all was strict price discipline and creative deal structuring