Former Wall Street professional. Special situations, awareness, logic, Buddhism.

8 subscribers

How to get URL link on X (Twitter) App

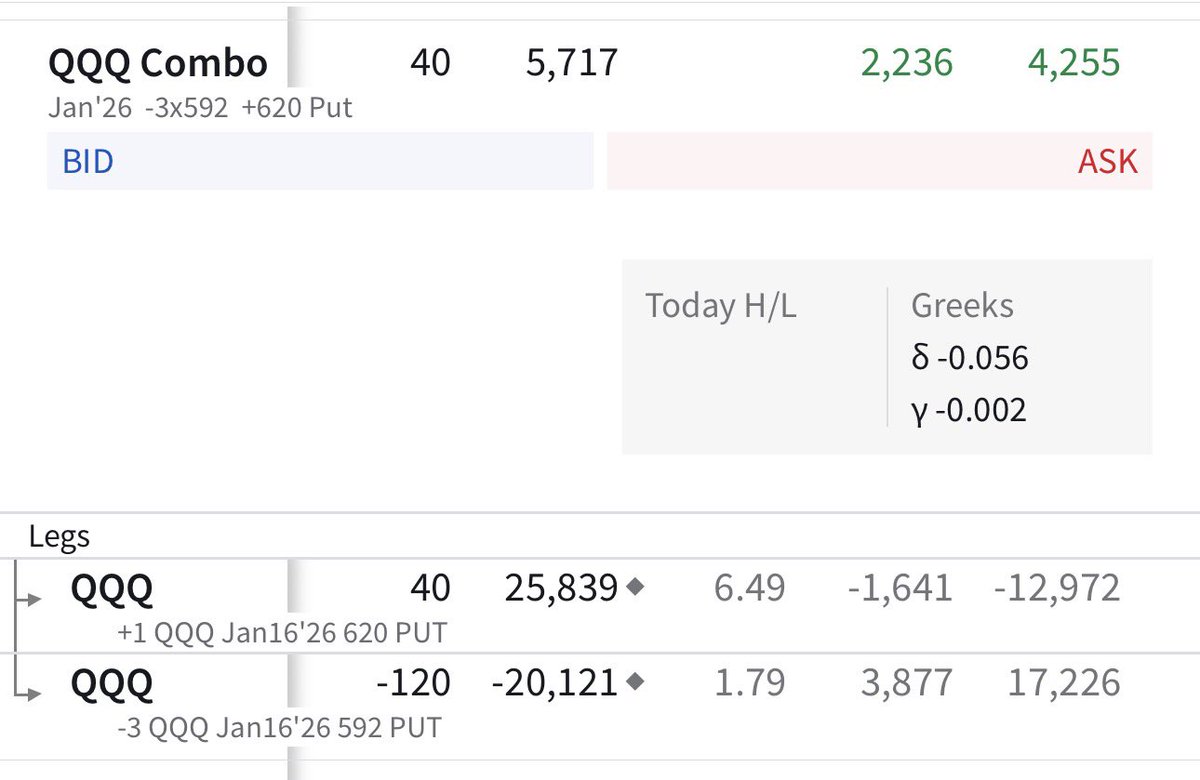

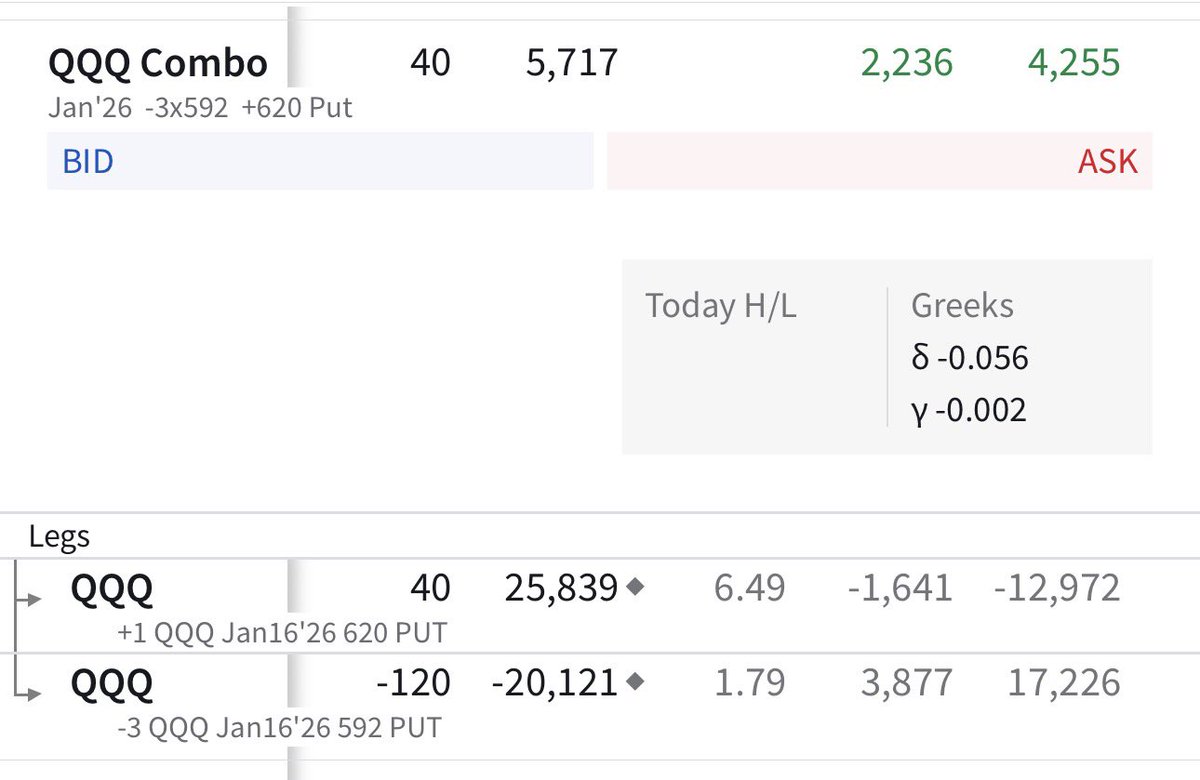

Very similar logic to the $NBIS trade I published last week.

Very similar logic to the $NBIS trade I published last week.

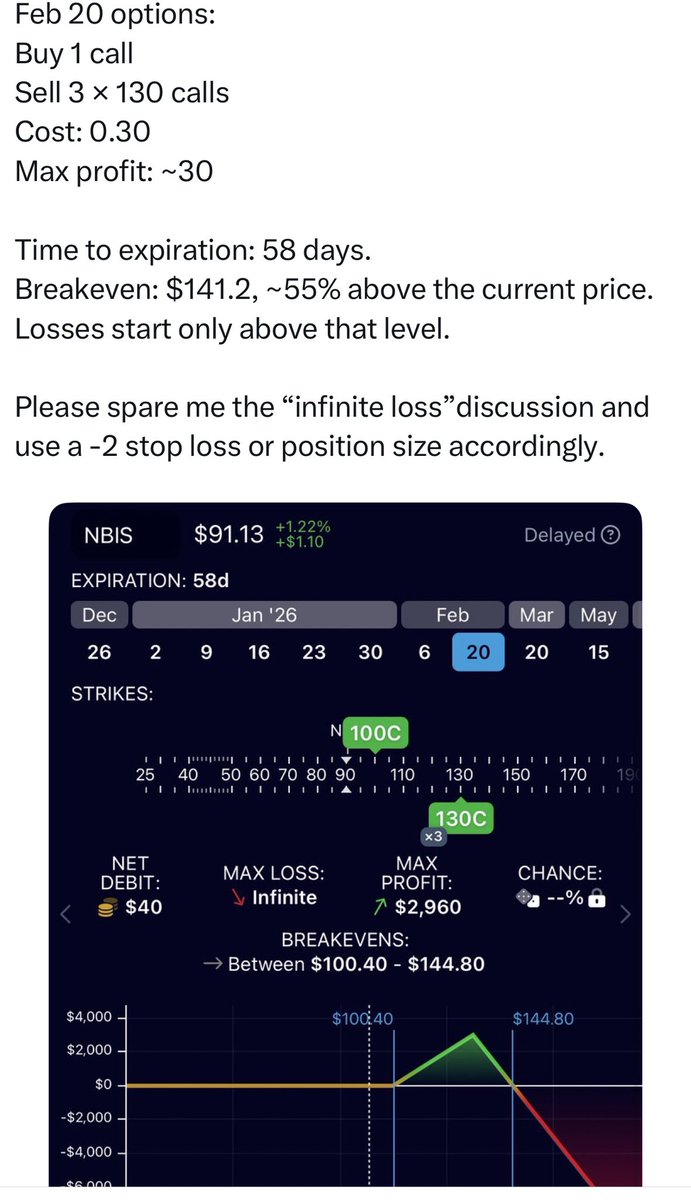

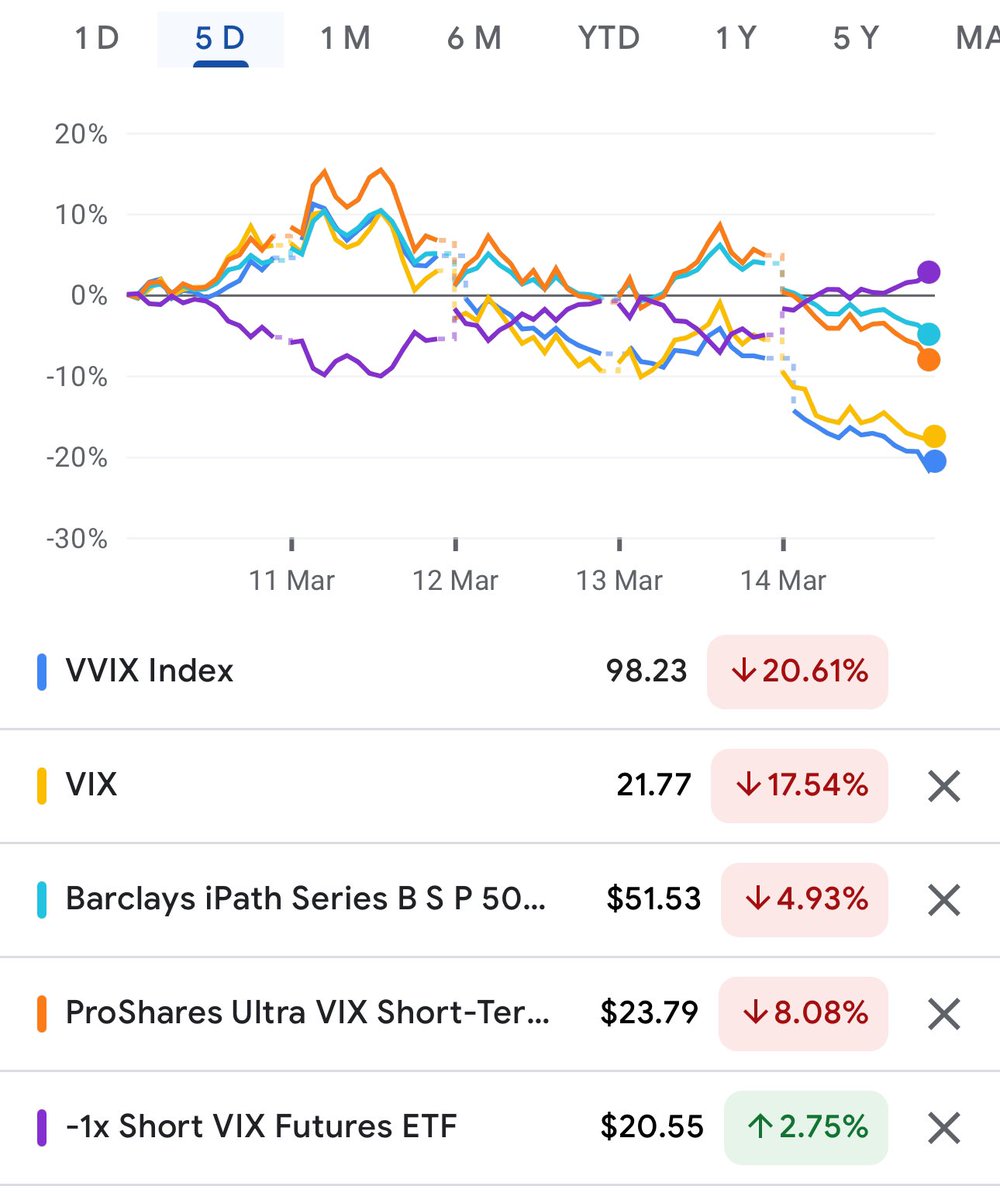

That said, $VIX remains elevated, but I believe the pain trade is to the upside.

That said, $VIX remains elevated, but I believe the pain trade is to the upside.

Two years passed before he finally came home. His family was overjoyed. His wife, overwhelmed with happiness, rushed to the market to buy food, eager to prepare a great feast to celebrate his return. In the meantime, the man sat down with his daughter, eager to reconnect with her.

Two years passed before he finally came home. His family was overjoyed. His wife, overwhelmed with happiness, rushed to the market to buy food, eager to prepare a great feast to celebrate his return. In the meantime, the man sat down with his daughter, eager to reconnect with her.

https://twitter.com/zeecontrarian1/status/1788629977740800098

VIX stays below 13: The true risk lies in $VIX staying low. While I can't guarantee a spike in the next 30-60 days, it's a reasonable assumption that it will happen eventually. Even a modest increase to 15 within that timeframe would suffice.

VIX stays below 13: The true risk lies in $VIX staying low. While I can't guarantee a spike in the next 30-60 days, it's a reasonable assumption that it will happen eventually. Even a modest increase to 15 within that timeframe would suffice.

VIX Spreads Option Advantage: $VIX options grant you the right, but not the obligation, to buy or sell the VIX at a specific price by a certain date (expiration). If the VIX suddenly jumps near expiration, your options will benefit from the full increase in the VIX.

VIX Spreads Option Advantage: $VIX options grant you the right, but not the obligation, to buy or sell the VIX at a specific price by a certain date (expiration). If the VIX suddenly jumps near expiration, your options will benefit from the full increase in the VIX.

The one who got slapped was hurt, but without saying anything, wrote in the sand “Today my best friend slapped me in the face”.

The one who got slapped was hurt, but without saying anything, wrote in the sand “Today my best friend slapped me in the face”.

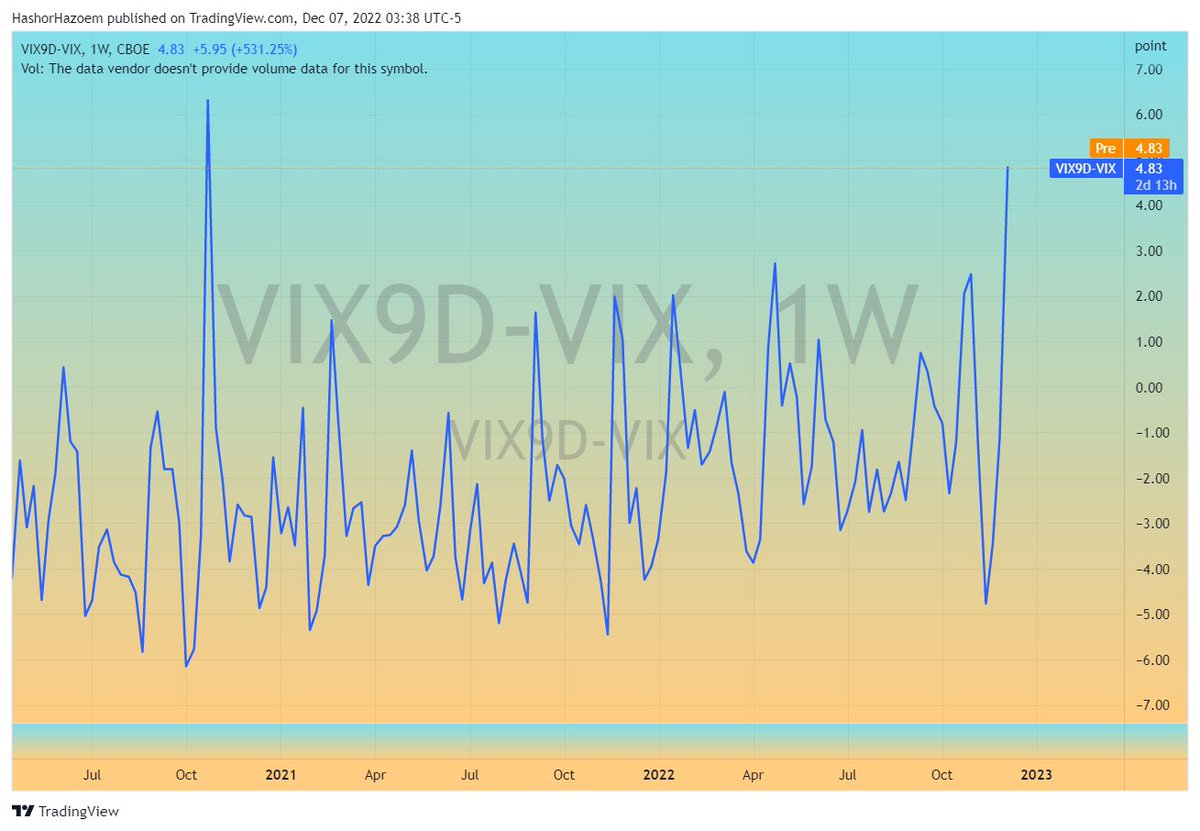

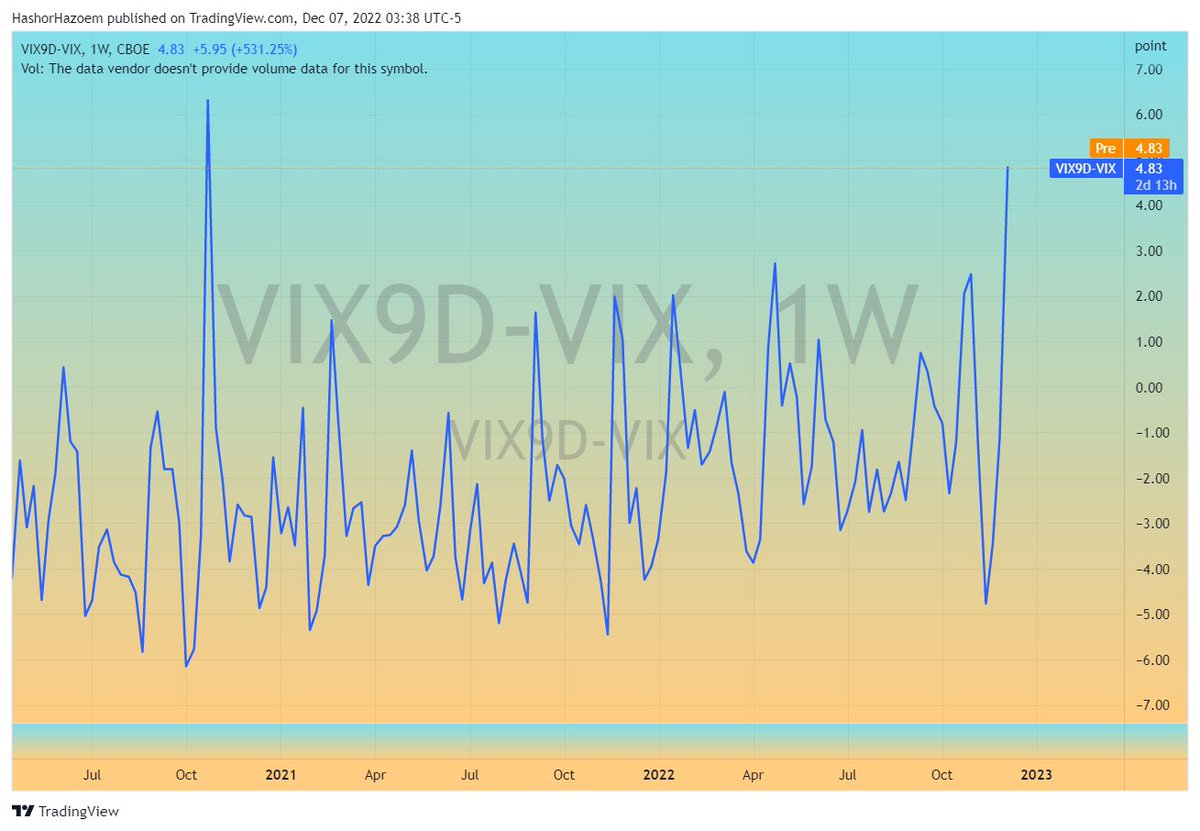

If you are wondering why I referenced the second and third $VIX futures contango and not the first and second, it's because, as a general rule, $VIX products roll over one $VIX contract every day from the front month to the second month,

If you are wondering why I referenced the second and third $VIX futures contango and not the first and second, it's because, as a general rule, $VIX products roll over one $VIX contract every day from the front month to the second month,

Once upon a time,

Once upon a time,

Minimalism: this does not imply becoming a monk. Rather, it means removing everything from your life which you do not need and keeping only what is necessary for your happiness, be it possessions or social circles. This frees up extra time and money which can be utilised better.

Minimalism: this does not imply becoming a monk. Rather, it means removing everything from your life which you do not need and keeping only what is necessary for your happiness, be it possessions or social circles. This frees up extra time and money which can be utilised better.

The American complimented the Mexican on the quality of his fish and asked how long it took to catch them. The Mexican replied, “only a little while. The American then asked why didn’t he stay out longer and catch more fish? The Mexican said he had enough to support his family.

The American complimented the Mexican on the quality of his fish and asked how long it took to catch them. The Mexican replied, “only a little while. The American then asked why didn’t he stay out longer and catch more fish? The Mexican said he had enough to support his family.

but additional movements behind the scenes present a different picture. Most of you are familiar with the $VIX, which is calculated from the implied standard deviation of the options on the S&P 500 index. When this index rises, it reflects an increase in the risk perception

but additional movements behind the scenes present a different picture. Most of you are familiar with the $VIX, which is calculated from the implied standard deviation of the options on the S&P 500 index. When this index rises, it reflects an increase in the risk perception

So maybe experiences bring happiness? Well, would a fifty-year-old successful man that had countless parties, expensive vacations, sex, money, and possessions define his life as great if he just had everything taken away in a financial crisis or an accident? probably not.

So maybe experiences bring happiness? Well, would a fifty-year-old successful man that had countless parties, expensive vacations, sex, money, and possessions define his life as great if he just had everything taken away in a financial crisis or an accident? probably not.

Hostel world is a platform like Booking.com and Expedia, however it specializes in the hostel niche in which 𝐢𝐭 𝐢𝐬 𝐭𝐡𝐞 𝐝𝐨𝐦𝐢𝐧𝐚𝐧𝐭 𝐩𝐥𝐚𝐲𝐞𝐫 and caters to a global customer base with an extensive inventory of hostels for booking.

Hostel world is a platform like Booking.com and Expedia, however it specializes in the hostel niche in which 𝐢𝐭 𝐢𝐬 𝐭𝐡𝐞 𝐝𝐨𝐦𝐢𝐧𝐚𝐧𝐭 𝐩𝐥𝐚𝐲𝐞𝐫 and caters to a global customer base with an extensive inventory of hostels for booking.