|Premier Source of Economic Data +Analysis|zimbollarindex@gmail.com |Local Focus, Global Reach|

4 subscribers

How to get URL link on X (Twitter) App

1) Exporter A produces and exports goods worthy USD1m. On processing their CD1s, their Bank takes 25% or USD 250k in line with the 25% foreign currency retentions for onward transmission to the RBZ

1) Exporter A produces and exports goods worthy USD1m. On processing their CD1s, their Bank takes 25% or USD 250k in line with the 25% foreign currency retentions for onward transmission to the RBZ

Here are a few implications of this directive:

Here are a few implications of this directive:

HISTORY CHECK:

HISTORY CHECK:

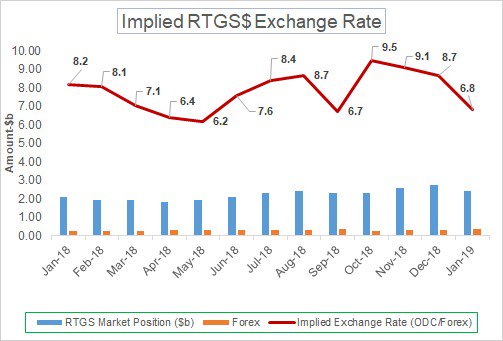

b) The move is mearnt to divert pressure that was coming on the exchange rate from borrowing customers. By increasing the cost of borrowing, the RBZ has limited credit creation and hence money supply. This is essential for exchange rate stability.

b) The move is mearnt to divert pressure that was coming on the exchange rate from borrowing customers. By increasing the cost of borrowing, the RBZ has limited credit creation and hence money supply. This is essential for exchange rate stability.

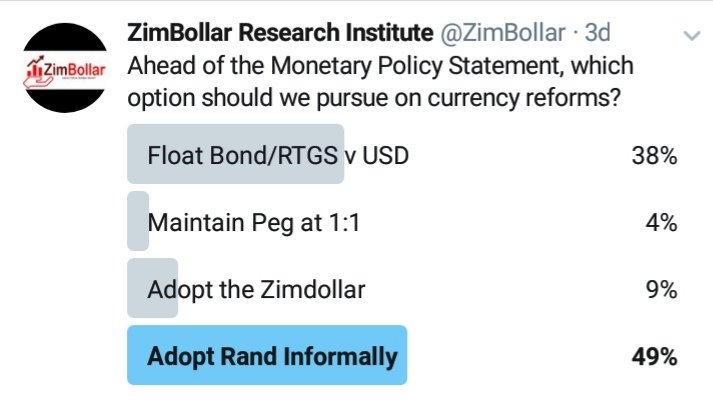

... the absence of the necessary prerequisites like 1) Acceptable Inflation target 2) Acceptable Debt/GDP ratio 3) Adherence to prudent fiscal measures 4) Own currency. So if the Governor was to go by the people's wishes he had to go by the Second best option- Floating the RTGS!

... the absence of the necessary prerequisites like 1) Acceptable Inflation target 2) Acceptable Debt/GDP ratio 3) Adherence to prudent fiscal measures 4) Own currency. So if the Governor was to go by the people's wishes he had to go by the Second best option- Floating the RTGS!