Finance count-bishop. Now here for 😎🍿🤡.

Pronounciation: Jew ZEP pay pah lay AW low go.

Sister account: @yogappygappy.

13 subscribers

How to get URL link on X (Twitter) App

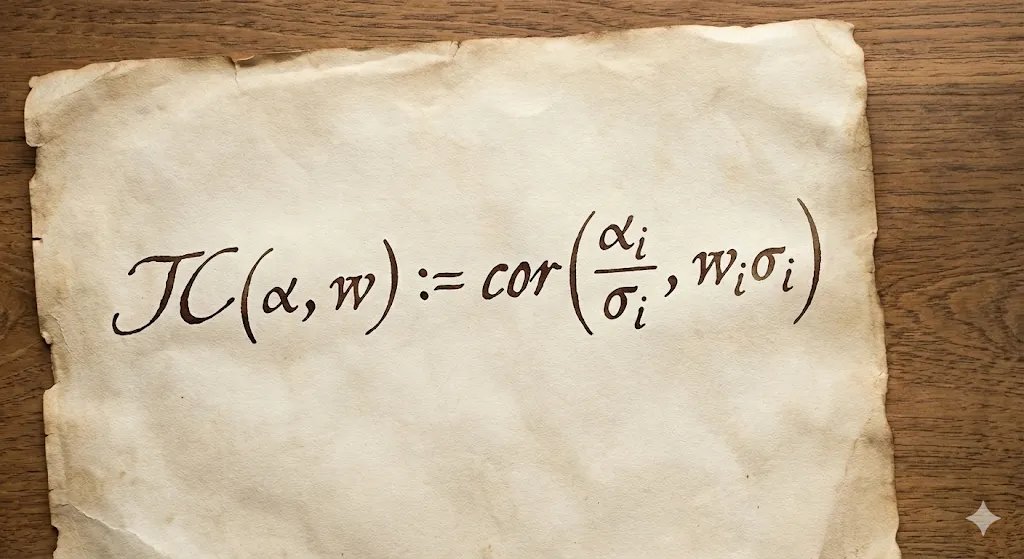

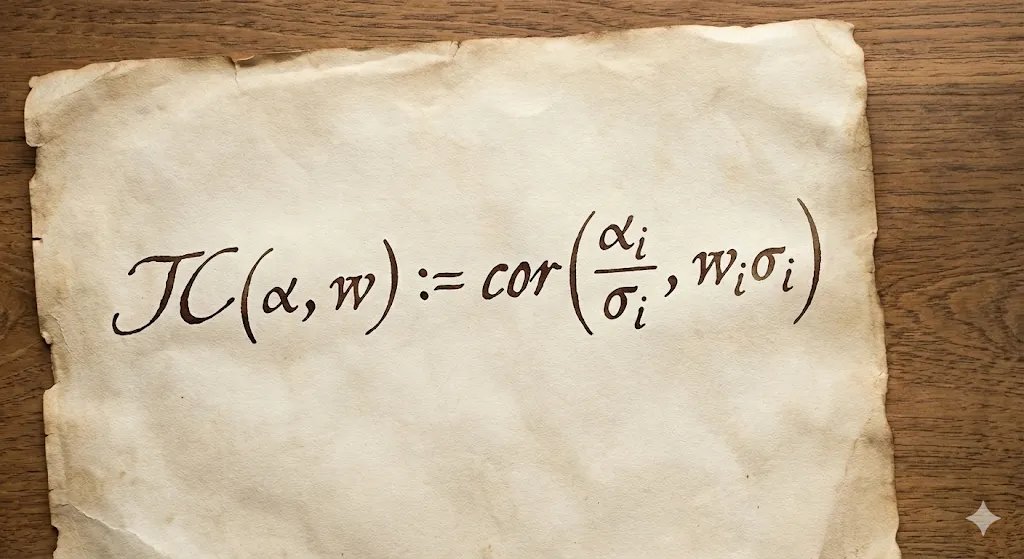

So: first, there is an introduction on the Information Coefficient. And also an intro to (Xsectional) quantitative investing using this concept. If you have bought my red book, you already know. This part connects to the Backtesting chapter over there.

So: first, there is an introduction on the Information Coefficient. And also an intro to (Xsectional) quantitative investing using this concept. If you have bought my red book, you already know. This part connects to the Backtesting chapter over there.

https://twitter.com/__paleologo/status/1918017112724971561And Var(Y) is given by the Blackwell-Girshick formula () which is another conditioning argument.

First, this is the quintessential "outsider" paper: academics (no slight intended) "looking into" a strategy run by traders. That's ok, although it is a few decades late and not very precise. This paper is the equivalent of seasons 7&8 of Game of Thrones.

First, this is the quintessential "outsider" paper: academics (no slight intended) "looking into" a strategy run by traders. That's ok, although it is a few decades late and not very precise. This paper is the equivalent of seasons 7&8 of Game of Thrones.

However, for an even more concise (free) introduction, Newman is very good.

However, for an even more concise (free) introduction, Newman is very good.

https://twitter.com/__paleologo/status/1843277776364691501Let's recap the common wisdom:

https://x.com/__paleologo/status/1834359510762197442Here is the question. I remember reading something like this on X. It's a suitable question for a quant interview. 2/

https://x.com/ByrneHobart/status/1745149539676217358So I am non-compete now. LinkedIn profile notwithstanding, I have not been forcibly unemployed that long for hedge fund standards.