Blue collar financial economist (codes, debugs, daily) @federalreserve. Ph.D. @FisherOSU. https://t.co/d4vMeEAZZy. Views are my own.

How to get URL link on X (Twitter) App

There's a reason for the sacred cow. Post-hoc theorizing leads to overfitted ideas. As a result,

There's a reason for the sacred cow. Post-hoc theorizing leads to overfitted ideas. As a result,

https://twitter.com/AlexZevelev/status/1775905842602352945First download and install the Cursor AI IDE. Go to and click Download. (If you already use VScode, Cursor will port over all your settings, easy peasy).cursor.com

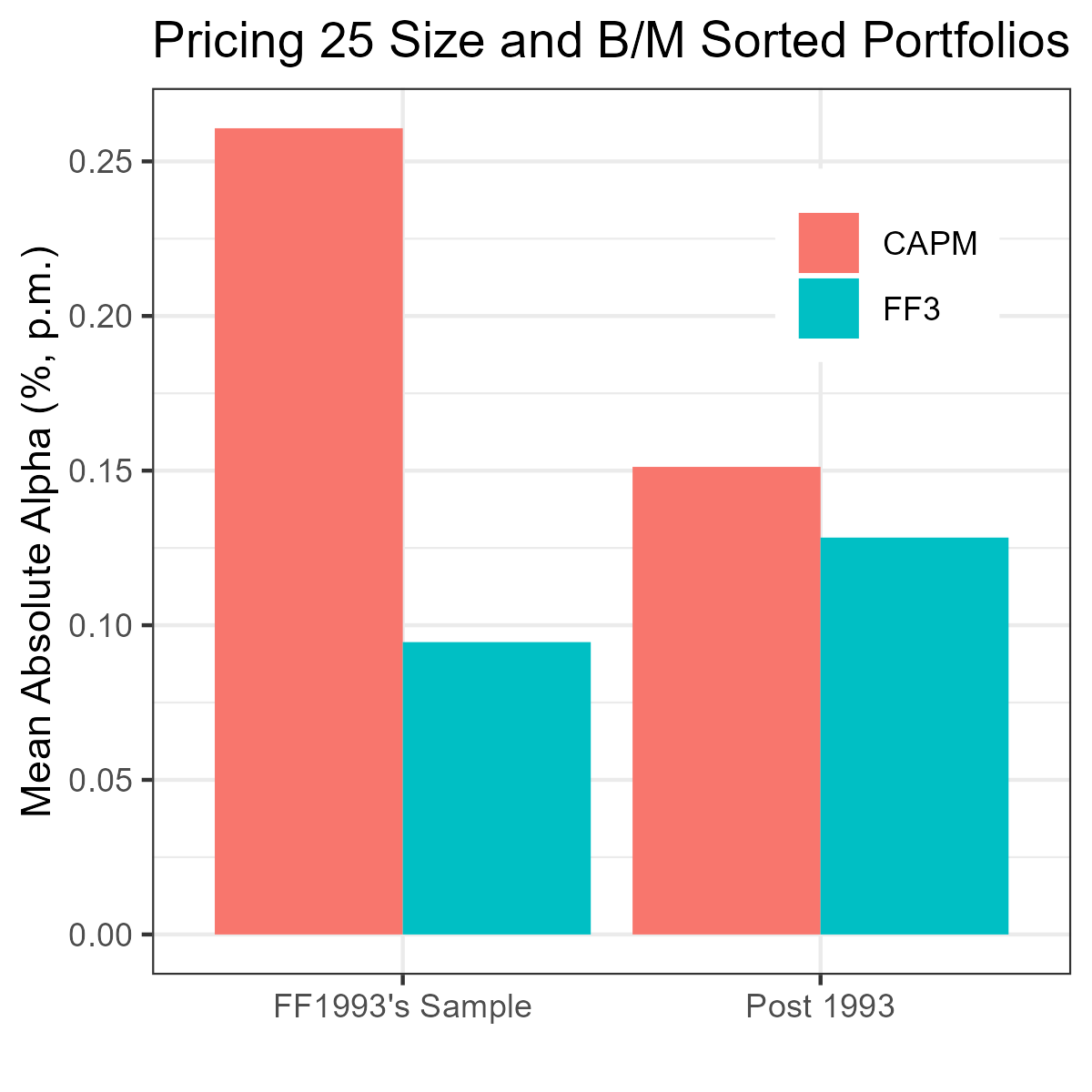

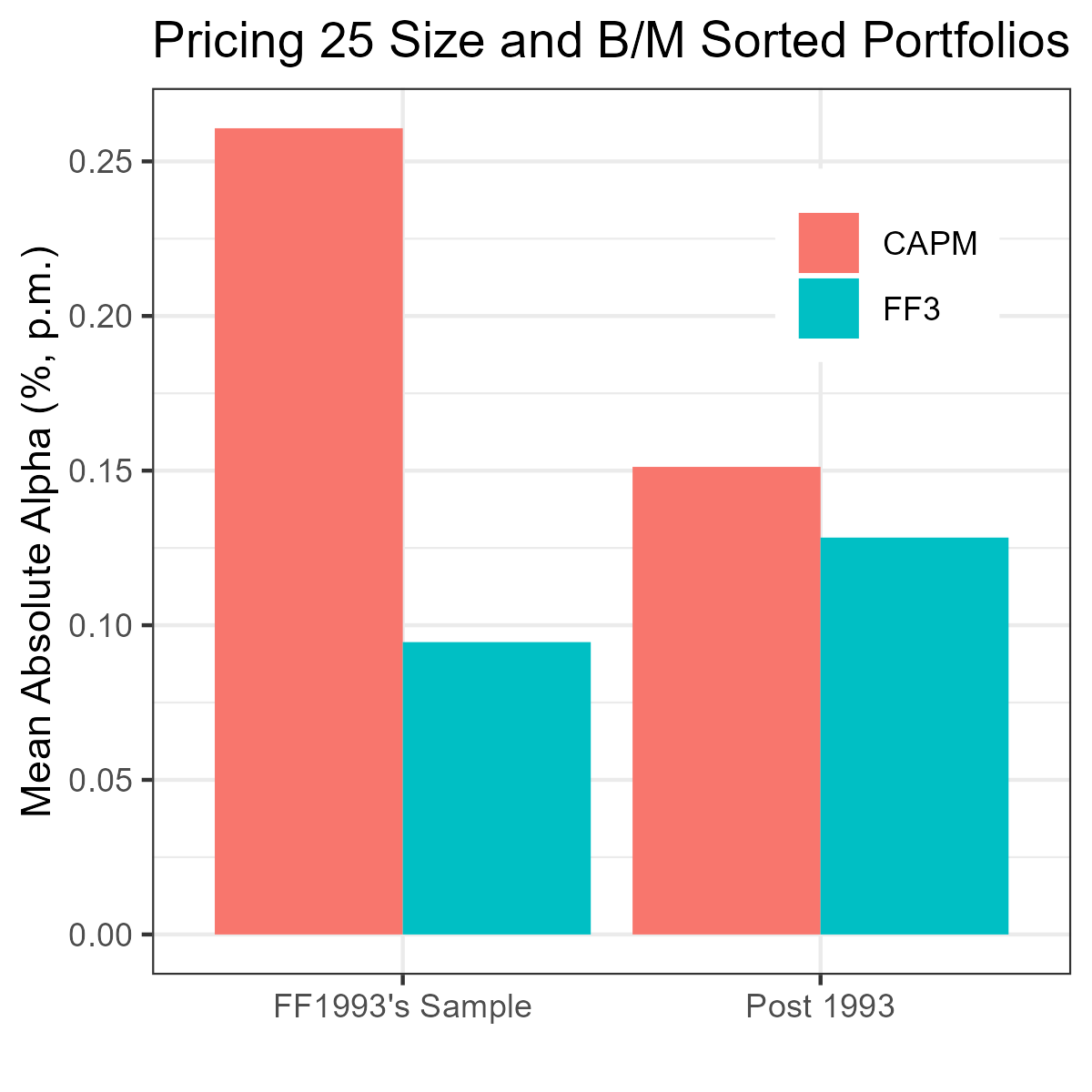

FF's size and value factors are not beautiful nor theoretically well-founded. And they fail to explain most anomalies. But they are supposed to provide an improved empirical description of, well, **size and value sorted portfolios**!! I guess they did, until 1993.

FF's size and value factors are not beautiful nor theoretically well-founded. And they fail to explain most anomalies. But they are supposed to provide an improved empirical description of, well, **size and value sorted portfolios**!! I guess they did, until 1993.

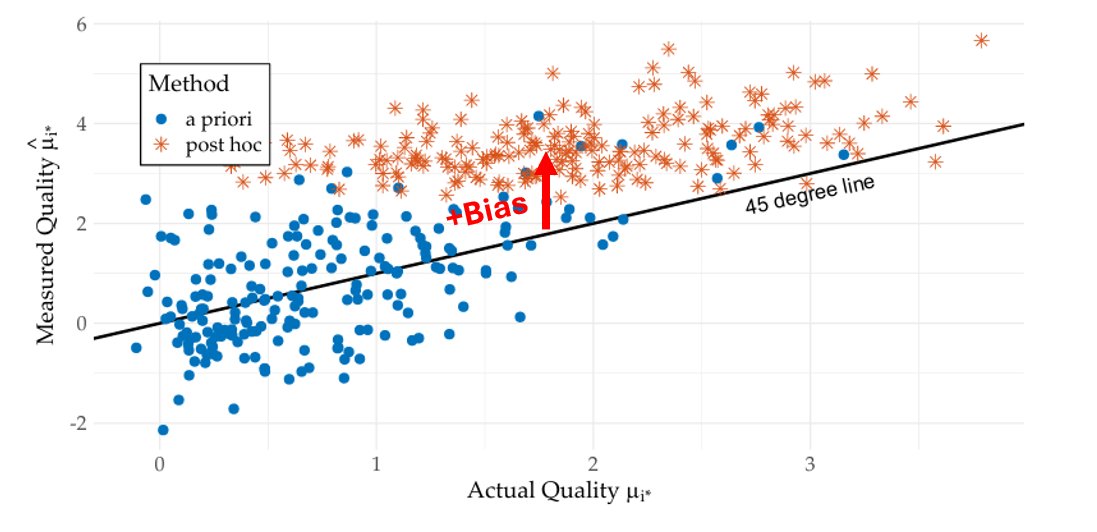

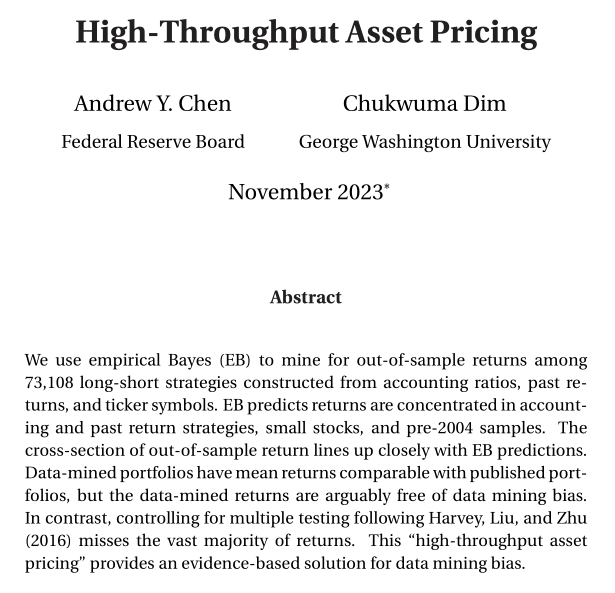

How can you stop worrying and ❤️ data mining? You can if you do a good job!---if you mine data *rigorously*. We demonstrate by mining 73,108 long-short strategies based on accounting, past returns, and ticker symbol data using empirical Bayes shrinkage.

How can you stop worrying and ❤️ data mining? You can if you do a good job!---if you mine data *rigorously*. We demonstrate by mining 73,108 long-short strategies based on accounting, past returns, and ticker symbol data using empirical Bayes shrinkage.

2/5 I was taught that expected returns are high in recessions. In recessions, risk is high, so returns are high. My JMP (and first pub) is a quantitative GE model of this fundamental idea.

2/5 I was taught that expected returns are high in recessions. In recessions, risk is high, so returns are high. My JMP (and first pub) is a quantitative GE model of this fundamental idea.