Founder, Across The Spread. 🌏markets analysis via 🇯🇵/Asia lens. Former derivatives trader @ Goldman & Jefferies + original content @ RealVision & Blockworks

8 subscribers

How to get URL link on X (Twitter) App

1/

1/

1/

1/

1/

1/

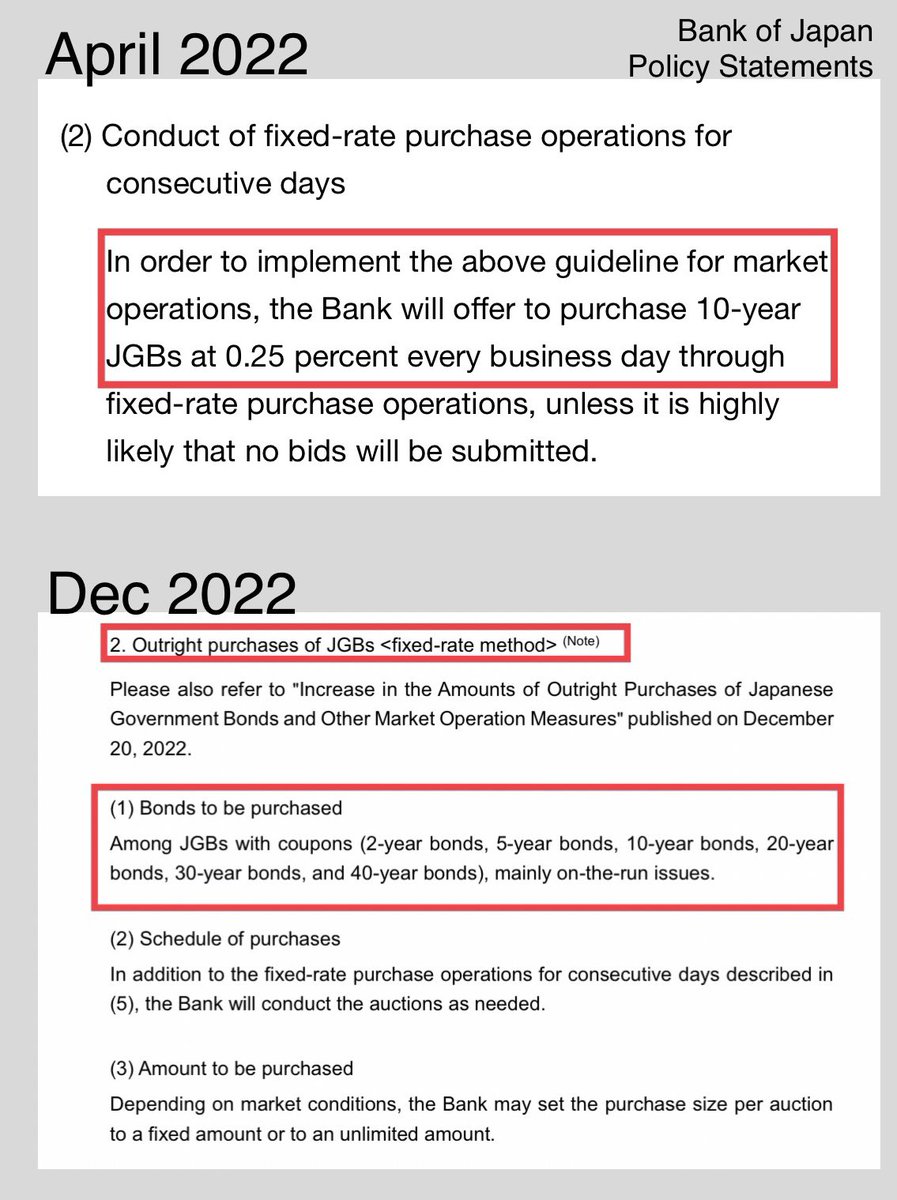

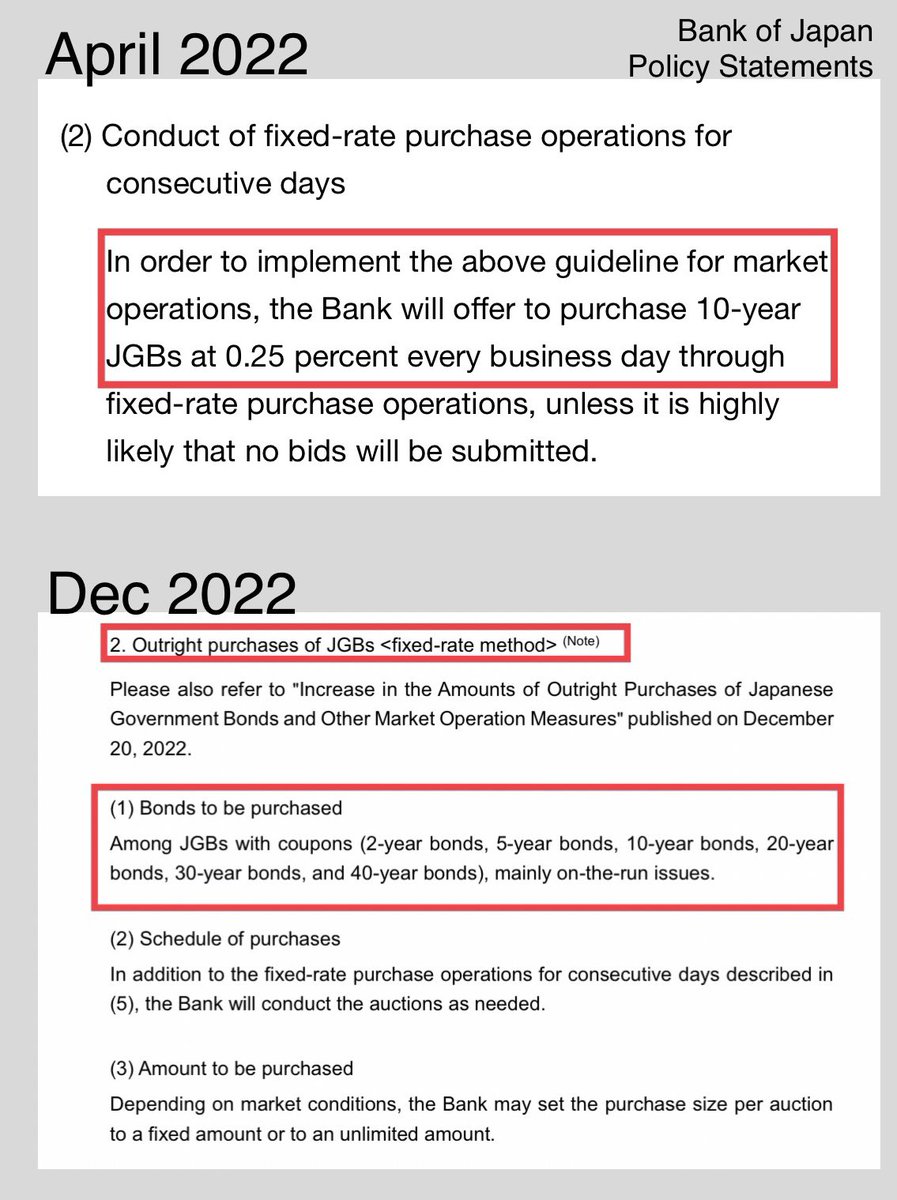

https://twitter.com/Bank_of_Japan_e/status/1615539504747810818

https://twitter.com/business/status/16133732064081756211/

https://twitter.com/business/status/16079223434640261142/

1/ Fri Oct 21st at ~10:30am EST:

1/ Fri Oct 21st at ~10:30am EST:

1/Recall March FOMC earlier this year when FOMC first lifted rates +25bps w/ a massive equity rally into the close w/ NDX +4%, starting from last ~10 mins of Powell press conf

1/Recall March FOMC earlier this year when FOMC first lifted rates +25bps w/ a massive equity rally into the close w/ NDX +4%, starting from last ~10 mins of Powell press confhttps://twitter.com/acrossthespread/status/1504199423165104128

https://twitter.com/acrossthespread/status/1584305141054050304

1/

1/

6/ Fri $¥ was ¥ futures traders, not spot FX participants (& thereby likely not 🇯🇵gov)

6/ Fri $¥ was ¥ futures traders, not spot FX participants (& thereby likely not 🇯🇵gov)

2/Unlike last, been NO official word of ¥tervene from🇯🇵

2/Unlike last, been NO official word of ¥tervene from🇯🇵

2/ …and that late 90s 🇺🇸🇯🇵 official joint intervention didn’t exactly work either

2/ …and that late 90s 🇺🇸🇯🇵 official joint intervention didn’t exactly work either

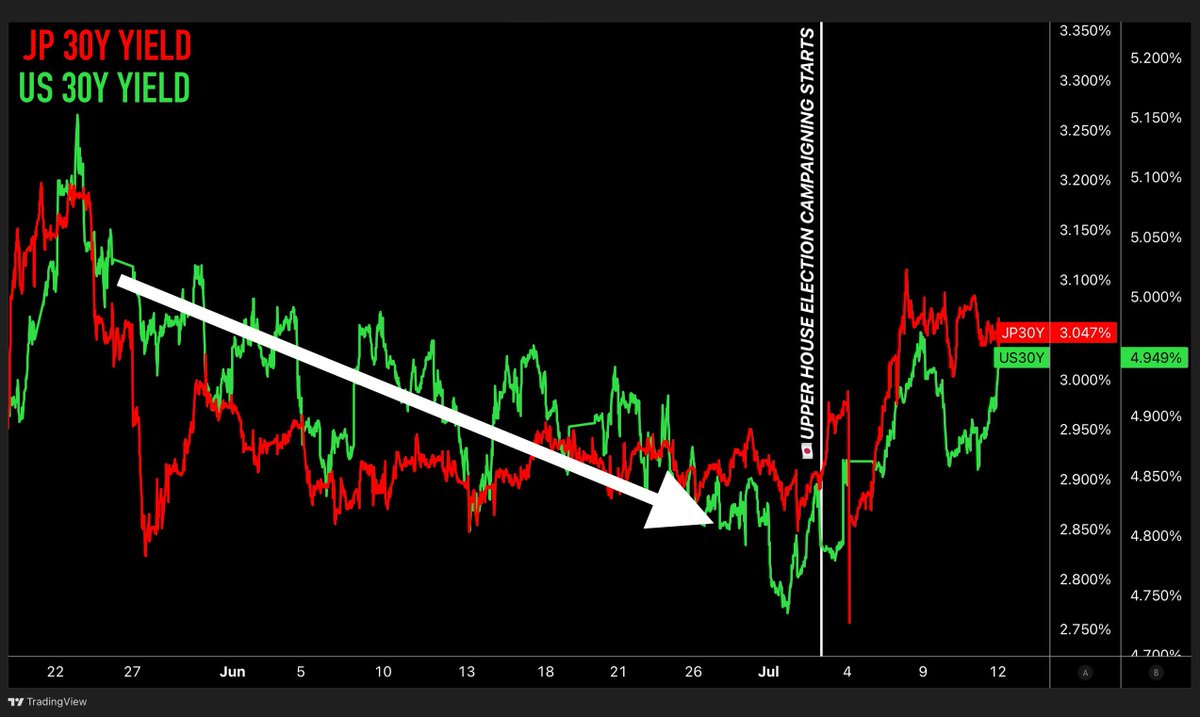

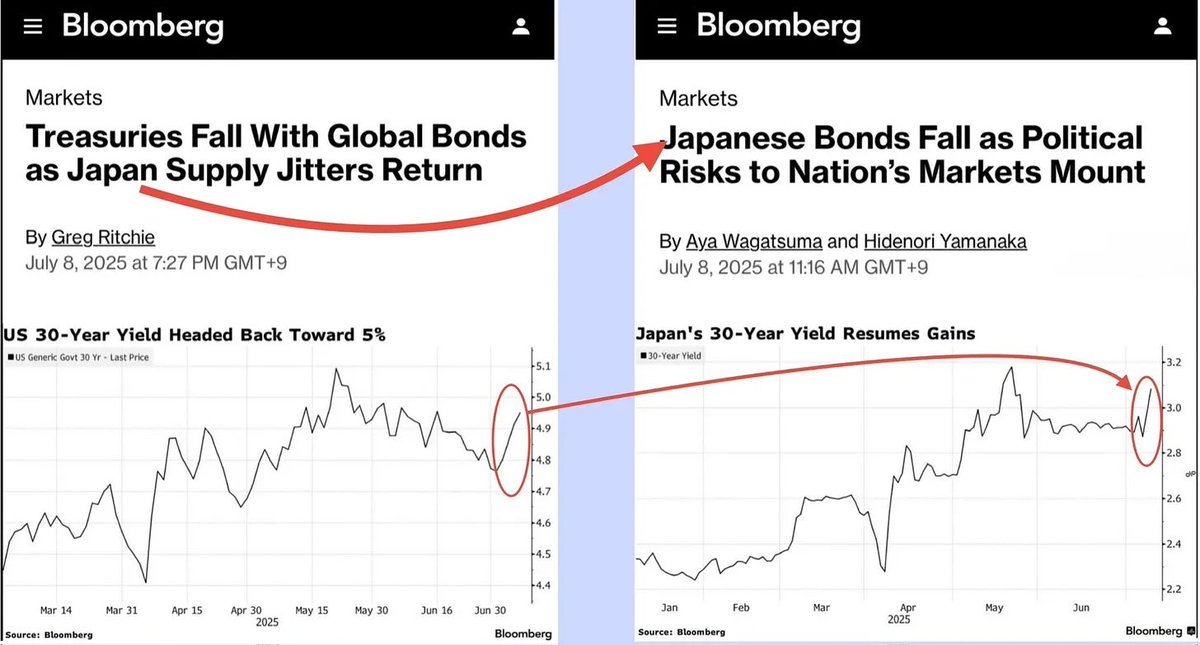

2/ Rates (JGBs)

2/ Rates (JGBs)

1/ Mar 7 ‘22

1/ Mar 7 ‘22

Yes, just to repeat- key issue for Japan voters/candidates this cycle: inflation

Yes, just to repeat- key issue for Japan voters/candidates this cycle: inflation