How to get URL link on X (Twitter) App

If you just look at government bonds, the market is rational. China’s household savings rate is marginally higher than it was pre-pandemic. But less of that savings is going into housing, so the net financial surplus has increased a lot. 2/

If you just look at government bonds, the market is rational. China’s household savings rate is marginally higher than it was pre-pandemic. But less of that savings is going into housing, so the net financial surplus has increased a lot. 2/

There are two main differences between RS and HH consumption. First, RS don’t capture a large share of the services HHs consume – education, medical care, housing, etc. But this isn’t the recent problem. Stripping those services out of consumption widens the growth gap. 2/

There are two main differences between RS and HH consumption. First, RS don’t capture a large share of the services HHs consume – education, medical care, housing, etc. But this isn’t the recent problem. Stripping those services out of consumption widens the growth gap. 2/

China became the top exporter of excavators and related construction machinery in 2022. This surge in exports followed a sharp downturn in its domestic demand for excavators as its housing boom went bust. 2/

China became the top exporter of excavators and related construction machinery in 2022. This surge in exports followed a sharp downturn in its domestic demand for excavators as its housing boom went bust. 2/

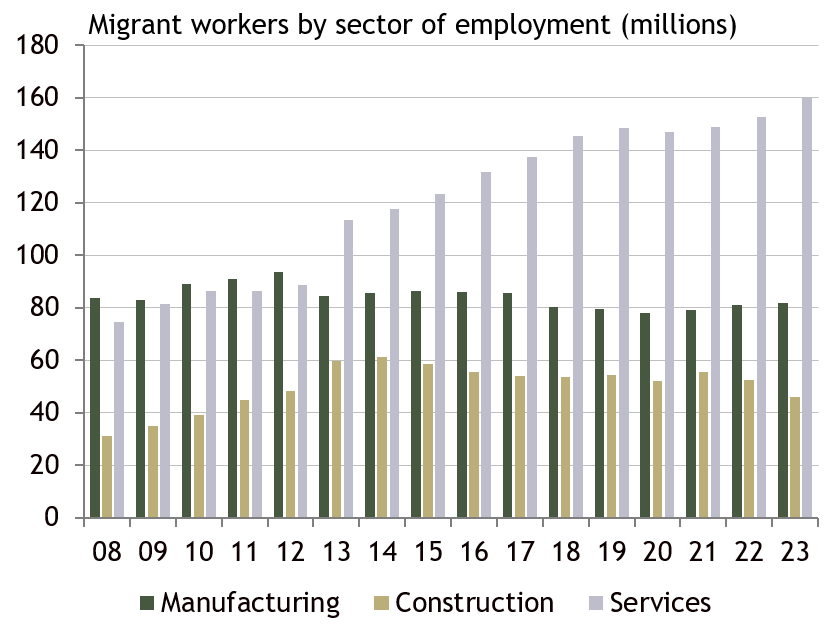

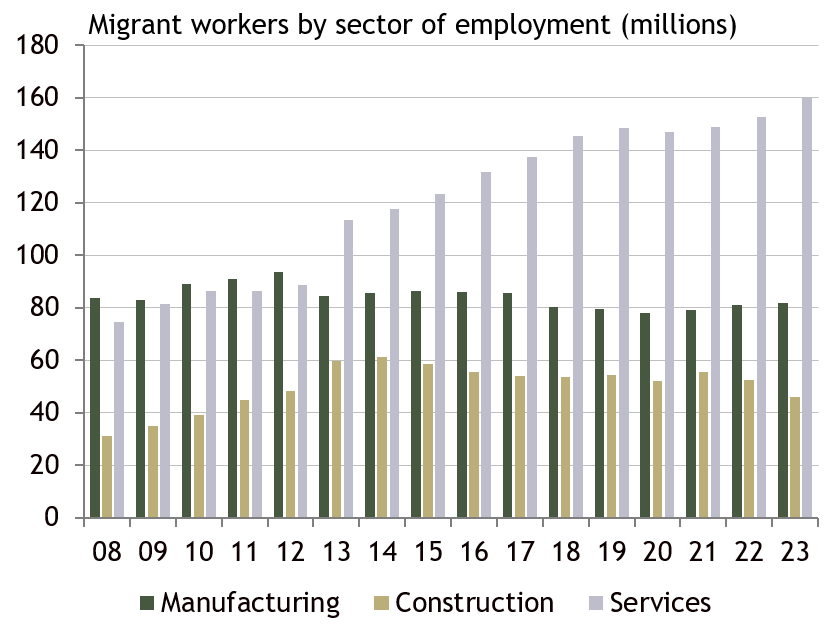

Of course, it was the service sector that absorbed those workers. The re-opening of consumer-facing services helped 7.2 million migrants find work in the sector. Something policymakers should think about as they put all their eggs in the manufacturing bucket. 2/

Of course, it was the service sector that absorbed those workers. The re-opening of consumer-facing services helped 7.2 million migrants find work in the sector. Something policymakers should think about as they put all their eggs in the manufacturing bucket. 2/

As the chart above shows, the relationship between the US import and Chinese export data has flipped. Before 2018, the US always recorded imports from China worth about 25% more than China reported sending to the US. 2/

As the chart above shows, the relationship between the US import and Chinese export data has flipped. Before 2018, the US always recorded imports from China worth about 25% more than China reported sending to the US. 2/

Inflation in EMs that eat more wheat than rice rose sharply as wheat prices spiked, but the run up in rice eating countries was much smaller. 2/

Inflation in EMs that eat more wheat than rice rose sharply as wheat prices spiked, but the run up in rice eating countries was much smaller. 2/

To understand why, we can start with an accounting identity:

To understand why, we can start with an accounting identity:

First, the “record high” is for a measure of unemployment that only dates back to 2018. We have no idea what youth unemployment looked like before then, at least measured in a consistent way. That alone should make us cautious. 2/

First, the “record high” is for a measure of unemployment that only dates back to 2018. We have no idea what youth unemployment looked like before then, at least measured in a consistent way. That alone should make us cautious. 2/

First, a bit about the data. The NBS reports China’s real estate data in year-to-date format for the levels (yuan or volumes) and growth rates. The chart above shows how the two measures for investment have diverged the past 2 months. 2/

First, a bit about the data. The NBS reports China’s real estate data in year-to-date format for the levels (yuan or volumes) and growth rates. The chart above shows how the two measures for investment have diverged the past 2 months. 2/

Here’s the basic issue. According to China’s customs agency, its trade surplus was $970bn in the year through March, while the State Administration of Foreign Exchange data pegs the goods surplus at only $670bn in the balance of payments. 2/

Here’s the basic issue. According to China’s customs agency, its trade surplus was $970bn in the year through March, while the State Administration of Foreign Exchange data pegs the goods surplus at only $670bn in the balance of payments. 2/

But that doesn’t mean China is being engineered out of supply chains. In fact, it seems to be capturing a larger share of the value-added in the production of iphones and the like, while it gives up final assembly due to US tariffs. 2/

But that doesn’t mean China is being engineered out of supply chains. In fact, it seems to be capturing a larger share of the value-added in the production of iphones and the like, while it gives up final assembly due to US tariffs. 2/