Indian #Taxation #Bengaluru

#Cars #F1 #Tifosi #Jeep

#007 #CalvinandHobbes

My political views don't define me. I won't judge you for yours.

How to get URL link on X (Twitter) App

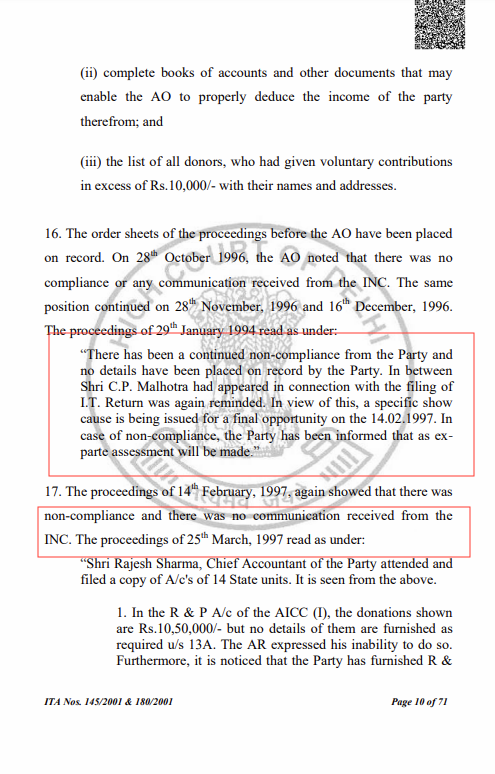

They were asked to file the return. Even after filing the return only after a notice was issued... there was noncompliance. See the notings of the assessing officer as noted by the Hon Delhi HC. None of these are now.

They were asked to file the return. Even after filing the return only after a notice was issued... there was noncompliance. See the notings of the assessing officer as noted by the Hon Delhi HC. None of these are now.