Economist at @BristolUni. Interested in macroeconomics. Retweet is not endorsement. From #Bhera/#Islamabad!

How to get URL link on X (Twitter) App

https://twitter.com/javedhassan/status/19985762155365787232/n: This view is very comforting. Who controls power can be entirely discounted. As professionals, we don't have to disassociate ourselves with extractive elites and risk paying professional or financial cost in terms of career progression or privileges.

https://twitter.com/FahdSheikh3/status/1659849499613753344

In simple terms, these were profits that were not paid out in dividends but were held back. But held back as what? Note, Lucky Cement has only close to 1bn in cash and deposits. This only means these profits were invested in different types of assets - both short and long-term.

In simple terms, these were profits that were not paid out in dividends but were held back. But held back as what? Note, Lucky Cement has only close to 1bn in cash and deposits. This only means these profits were invested in different types of assets - both short and long-term.

$610million worth of Eurobonds were also restructured in Dec 1999 to comply with the requirements of Paris Club that Pak should secure similar treatment from other private creditors. Another $415million which was owed to commercial banks was also restructured in the same month.

$610million worth of Eurobonds were also restructured in Dec 1999 to comply with the requirements of Paris Club that Pak should secure similar treatment from other private creditors. Another $415million which was owed to commercial banks was also restructured in the same month.

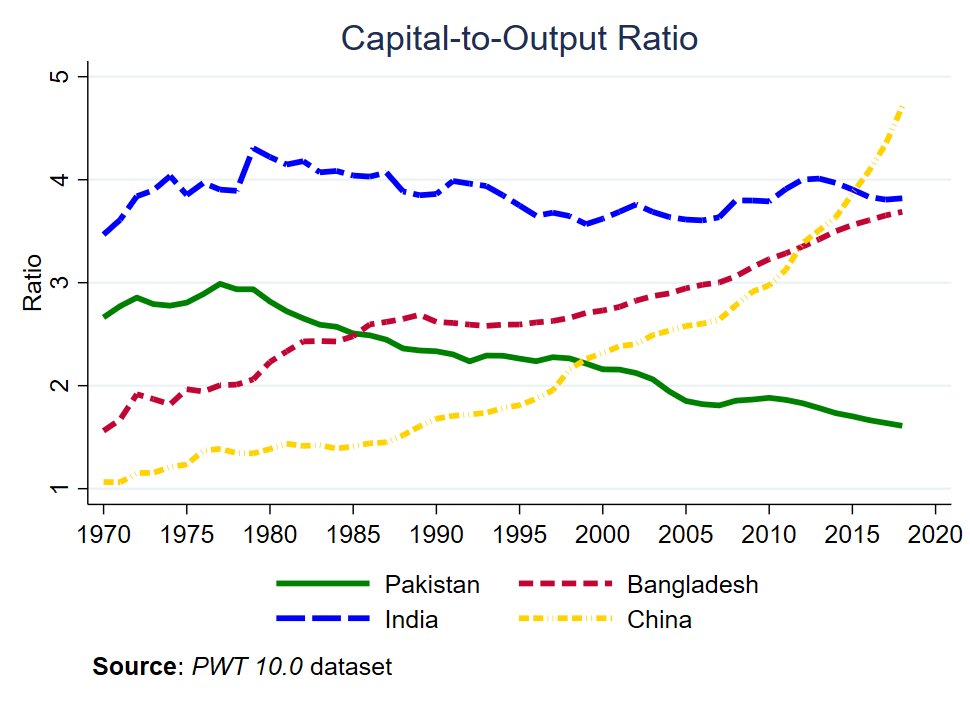

Let's first put this in perspective. The decline in capital-to-output ratio we see for Pak is the exact opposite of what we see in the region. The ratio has remained stable for India. However, both Bangladesh and China have accumulated much more capital over the same time period.

Let's first put this in perspective. The decline in capital-to-output ratio we see for Pak is the exact opposite of what we see in the region. The ratio has remained stable for India. However, both Bangladesh and China have accumulated much more capital over the same time period.

https://twitter.com/MIshaqDar50/status/1596160899781656578

2/5: As far as CDS is concerned, the paper assessing Bloomberg's model clearly suggests that CDS is a better indicator than whatever the Bloomberg model is telling us. Hard to disagree when the model only throws out a default probability of 17% one month before it happens.

2/5: As far as CDS is concerned, the paper assessing Bloomberg's model clearly suggests that CDS is a better indicator than whatever the Bloomberg model is telling us. Hard to disagree when the model only throws out a default probability of 17% one month before it happens.

The story is quite simple. Govt borrowing (net) from external sources remained almost negligible. Public external debt only increased by about $8bn between Jul-08 and Jun-13. And since there were less dollars in the system, there was less to spend on imports during this period.

The story is quite simple. Govt borrowing (net) from external sources remained almost negligible. Public external debt only increased by about $8bn between Jul-08 and Jun-13. And since there were less dollars in the system, there was less to spend on imports during this period.

(2/n) ... this is not bec rest of the world thinks of Pak as an attractive place to invest. If this was the case (e.g. India), we wouldn't have to worry too much. The world would invest in us (e.g. FDI) and the country would produce enough in future (i.e. exports) to pay it back.

(2/n) ... this is not bec rest of the world thinks of Pak as an attractive place to invest. If this was the case (e.g. India), we wouldn't have to worry too much. The world would invest in us (e.g. FDI) and the country would produce enough in future (i.e. exports) to pay it back.

https://twitter.com/StateBank_Pak/status/1528703030425681925If TBill rates were up because market was anticipating SBP to raise rates, then nothing interesting will happen. TBill rates will stay roughly the same.

https://twitter.com/SyedaZohaNaqvi/status/1519726806693203968(2/n) A survey 2009 found that only 250 of the khokhas operating in Islamabad had such permission. CDA issued 235 new licenses in the same year, taking the total to 485. For context, the then mayor claimed that there were more than 2000 khokhas operating in the city illegally.

https://twitter.com/ajpirzada/status/1472936616285155329?s=20&t=nSRalILhFq9EPs8xSmWpJwbut later gave up on this line of reasoning. I dont promise that most of u will follow this. So, here is an extremely technical response:

https://twitter.com/2paisay/status/1521912712388919296(2/n) The key issue is that these are very different injections and cannot be added together to draw conclusions for inflation outlook. The OMO injection here is to stabilise repo market. Repo rate is the short end of the yield curve and CBs want this to be closer to policy rate.

(2/n) Raza Baqir took on the task of reversing this to contain inflationary pressures over medium to long-term. Over the three years of his tenure, he decreased SBP's holdings of government bonds by more than a trillion.

(2/n) Raza Baqir took on the task of reversing this to contain inflationary pressures over medium to long-term. Over the three years of his tenure, he decreased SBP's holdings of government bonds by more than a trillion.

https://twitter.com/AtifRMian/status/1512908323623825408The few times I had the opportunity to interact with some of policymakers, I felt a sense of paralysis. Most were almost always waiting for the right time even when they knew the whole rent seeking enterprise was unsustainable. In the end, old ideas came back to dominate policy.

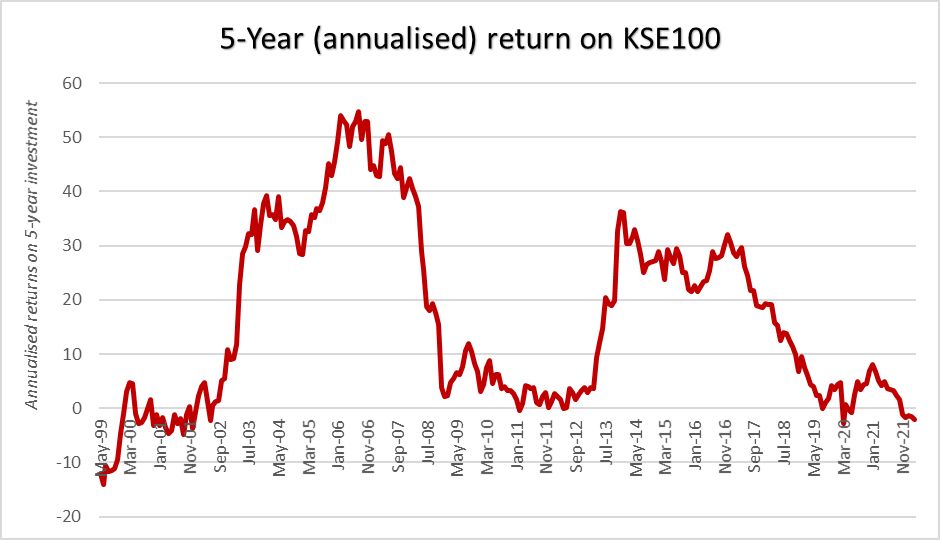

On average, u can expect to get an annual return of 16%. However, the standard deviation is also quite large at 17%. Meaning, investing in KSE100 index over a 5-year period comes with considerable risk. If u r risk averse, you may be better-off investing in bonds than in KSE100.

On average, u can expect to get an annual return of 16%. However, the standard deviation is also quite large at 17%. Meaning, investing in KSE100 index over a 5-year period comes with considerable risk. If u r risk averse, you may be better-off investing in bonds than in KSE100.

(2/n) While global economic conditions did have a significant negative effect on Pak export performance during 2020 (blue bars), the sharp recovery since then meant that the effect has been positive during most of FY21. See -ve blue bars during 2020, followed by +ve bars in FY21.

(2/n) While global economic conditions did have a significant negative effect on Pak export performance during 2020 (blue bars), the sharp recovery since then meant that the effect has been positive during most of FY21. See -ve blue bars during 2020, followed by +ve bars in FY21.

https://twitter.com/AliKhizar/status/1476171086534516738

Also, I am not sure why everyone is assuming treasury yields should move one-to-one with the policy rate i.e. no change in spreads. If market anticipates that govt's repayment capacity will weaken in the future, treasury yields may go up by more than one-to-one with policy rate.

Also, I am not sure why everyone is assuming treasury yields should move one-to-one with the policy rate i.e. no change in spreads. If market anticipates that govt's repayment capacity will weaken in the future, treasury yields may go up by more than one-to-one with policy rate.

https://twitter.com/ProPakistaniPK/status/1475469818648313857

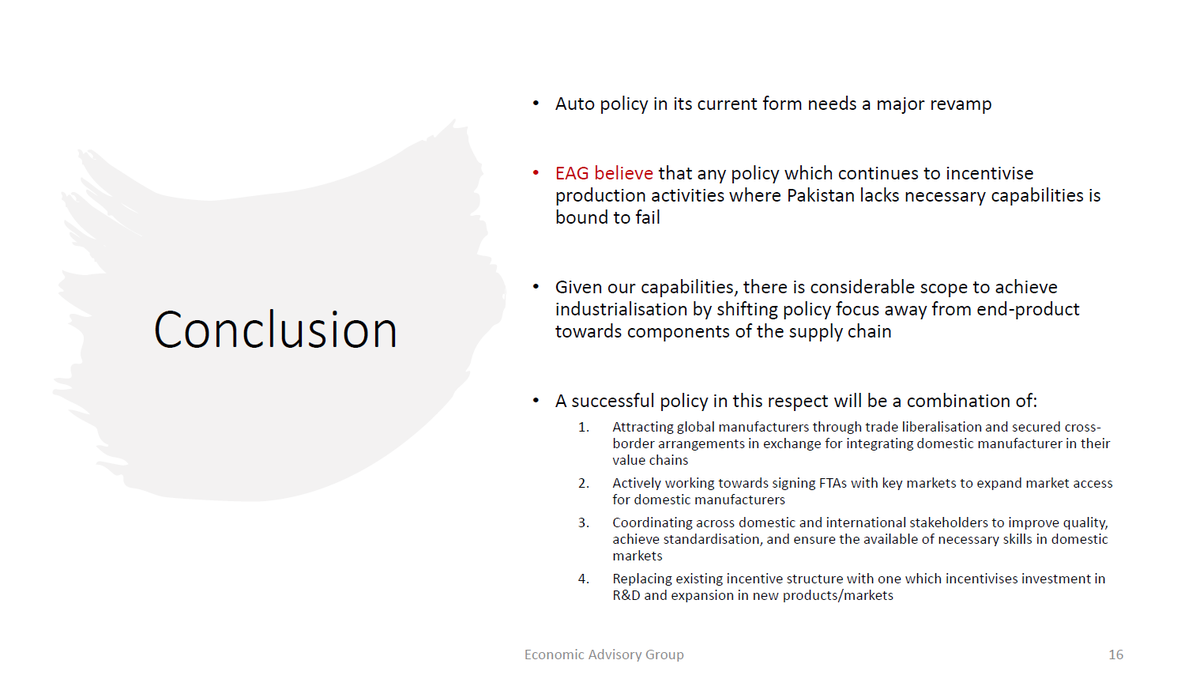

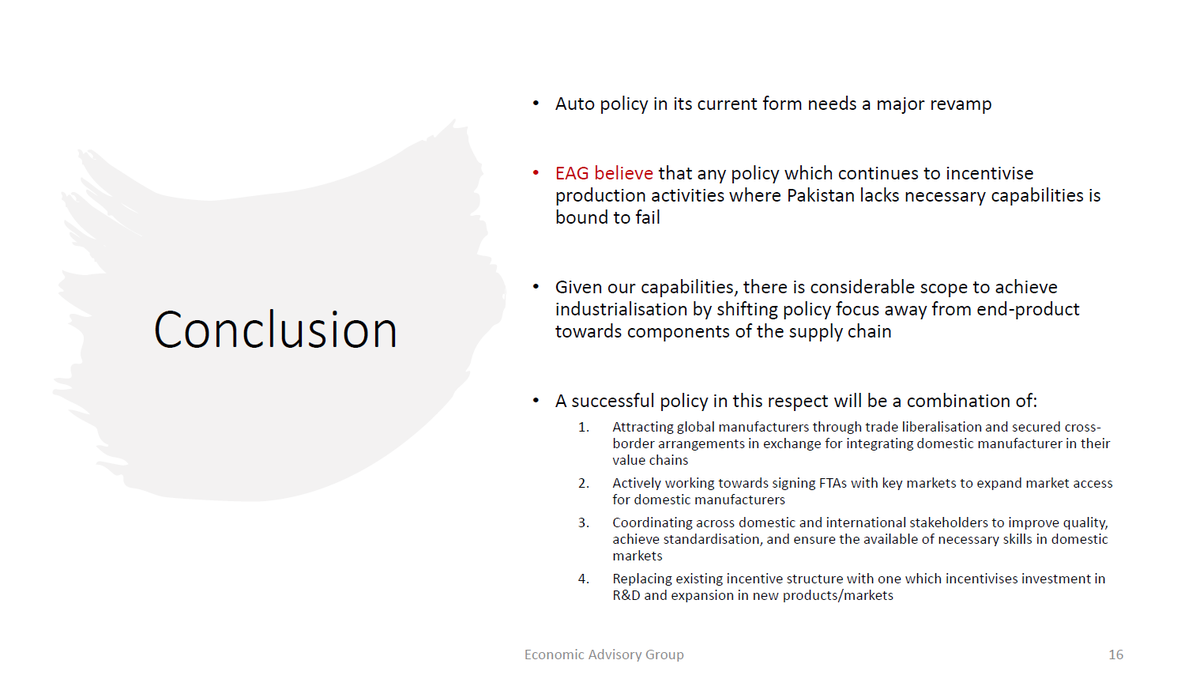

(2/5) We started with looking at the changing nature of trade in recent decades which is increasingly dominated by different components of the supply chain rather than the end product.

(2/5) We started with looking at the changing nature of trade in recent decades which is increasingly dominated by different components of the supply chain rather than the end product.

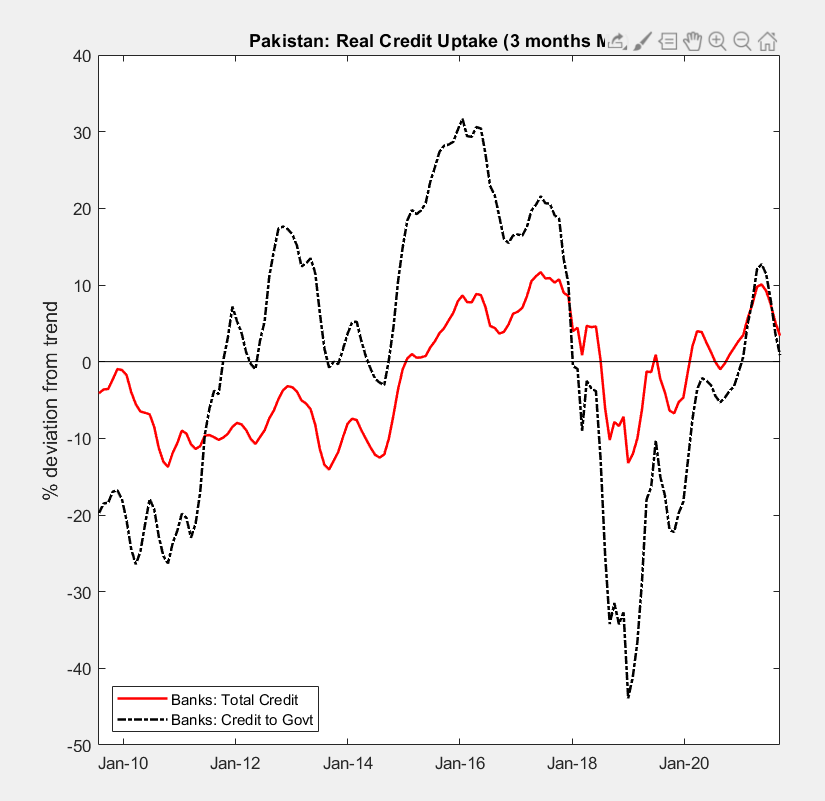

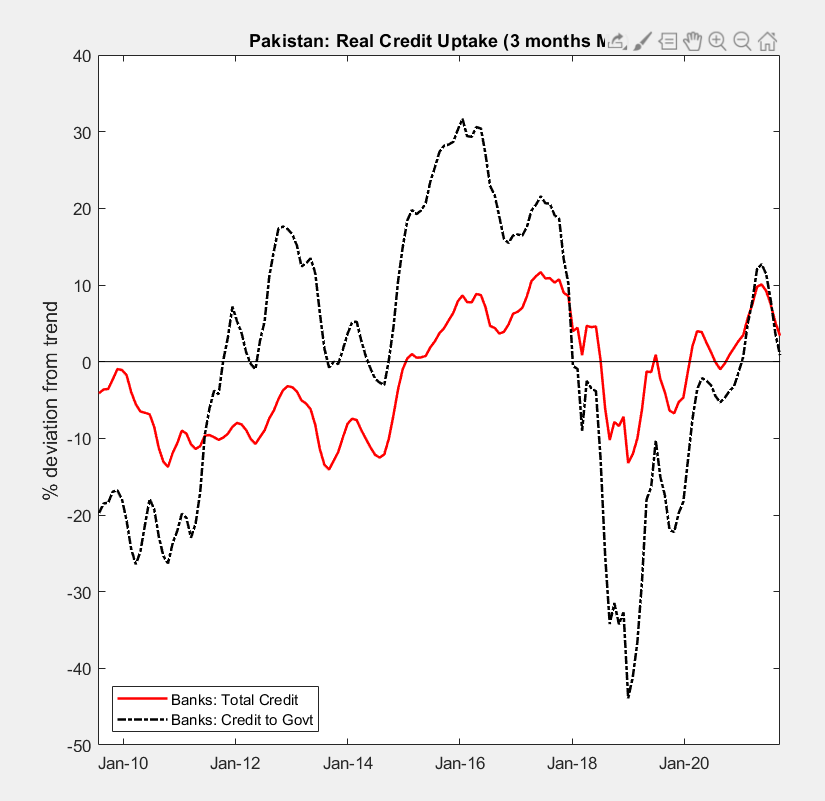

(2/4) In previous periods, every time govt decreased its borrowing from banks in response to increase in borrowing costs, it ended up increasing its borrowing from SBP. So far, this time around, we are not seeing this. However, in its place, there is something else going on ...

(2/4) In previous periods, every time govt decreased its borrowing from banks in response to increase in borrowing costs, it ended up increasing its borrowing from SBP. So far, this time around, we are not seeing this. However, in its place, there is something else going on ...

https://twitter.com/AliKhizar/status/1462054686022905856

(2/n) I have used the information provided by the PBS to decompose the increase in dollar value of textile exports into 'price' and 'quantity' effects. It turns out that the contribution of 'quantity' to increase in textile exports is negative, whereas that of prices is positive.

(2/n) I have used the information provided by the PBS to decompose the increase in dollar value of textile exports into 'price' and 'quantity' effects. It turns out that the contribution of 'quantity' to increase in textile exports is negative, whereas that of prices is positive.