How to get URL link on X (Twitter) App

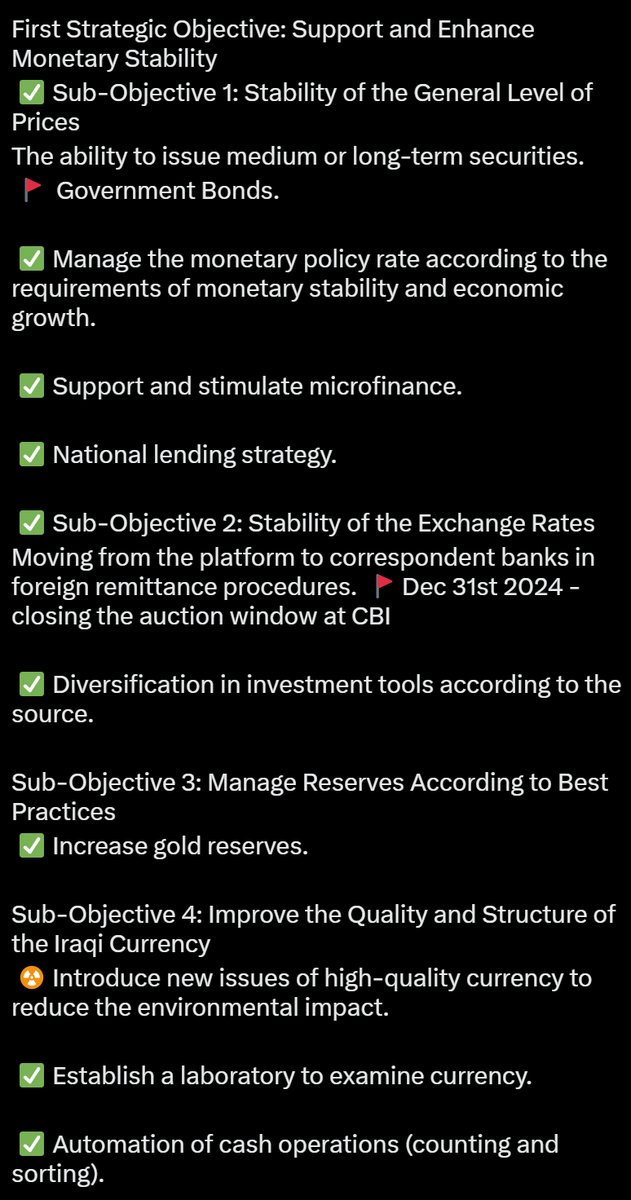

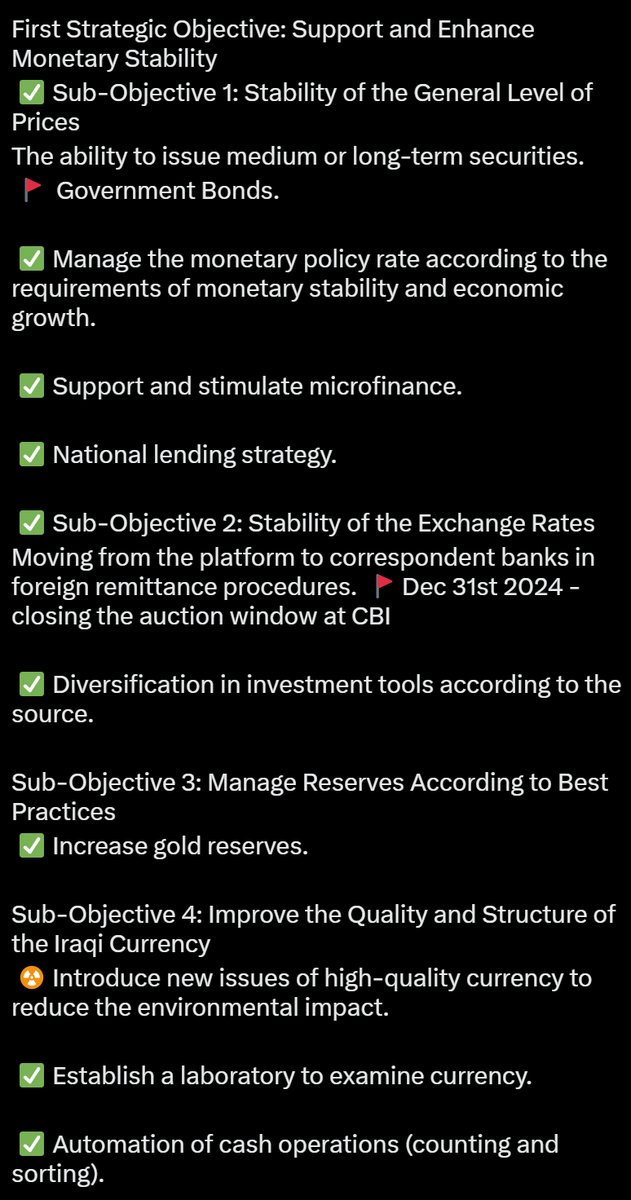

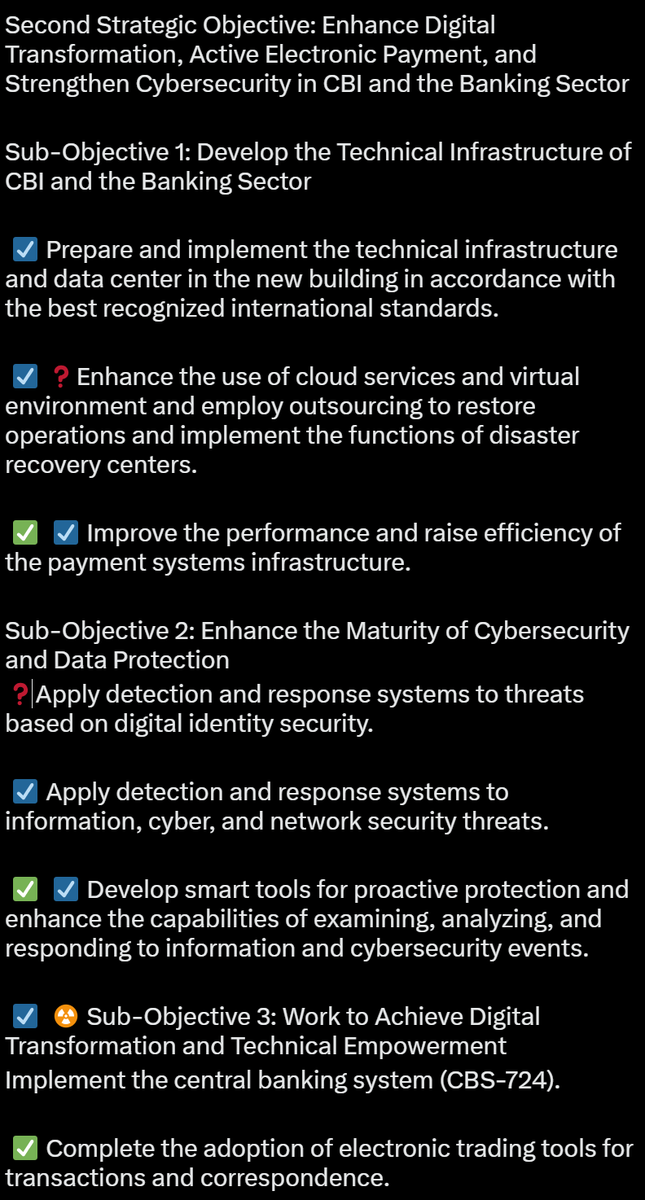

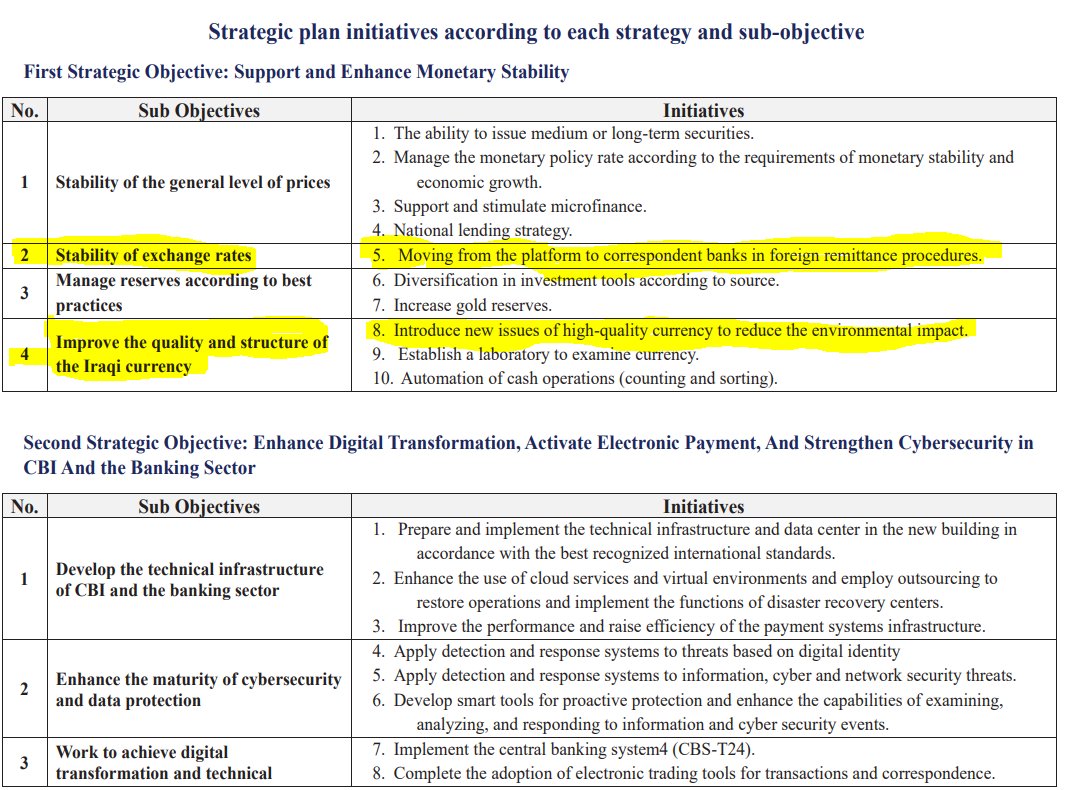

(Moving from the platform to correspondent banks in foreign remittance procedures) This is ending the currency auction. When they do, it'll end the parallel market, they can have lowers notes (Introduce new issues of high-quality currency to reduce the environmental impact.)

(Moving from the platform to correspondent banks in foreign remittance procedures) This is ending the currency auction. When they do, it'll end the parallel market, they can have lowers notes (Introduce new issues of high-quality currency to reduce the environmental impact.)

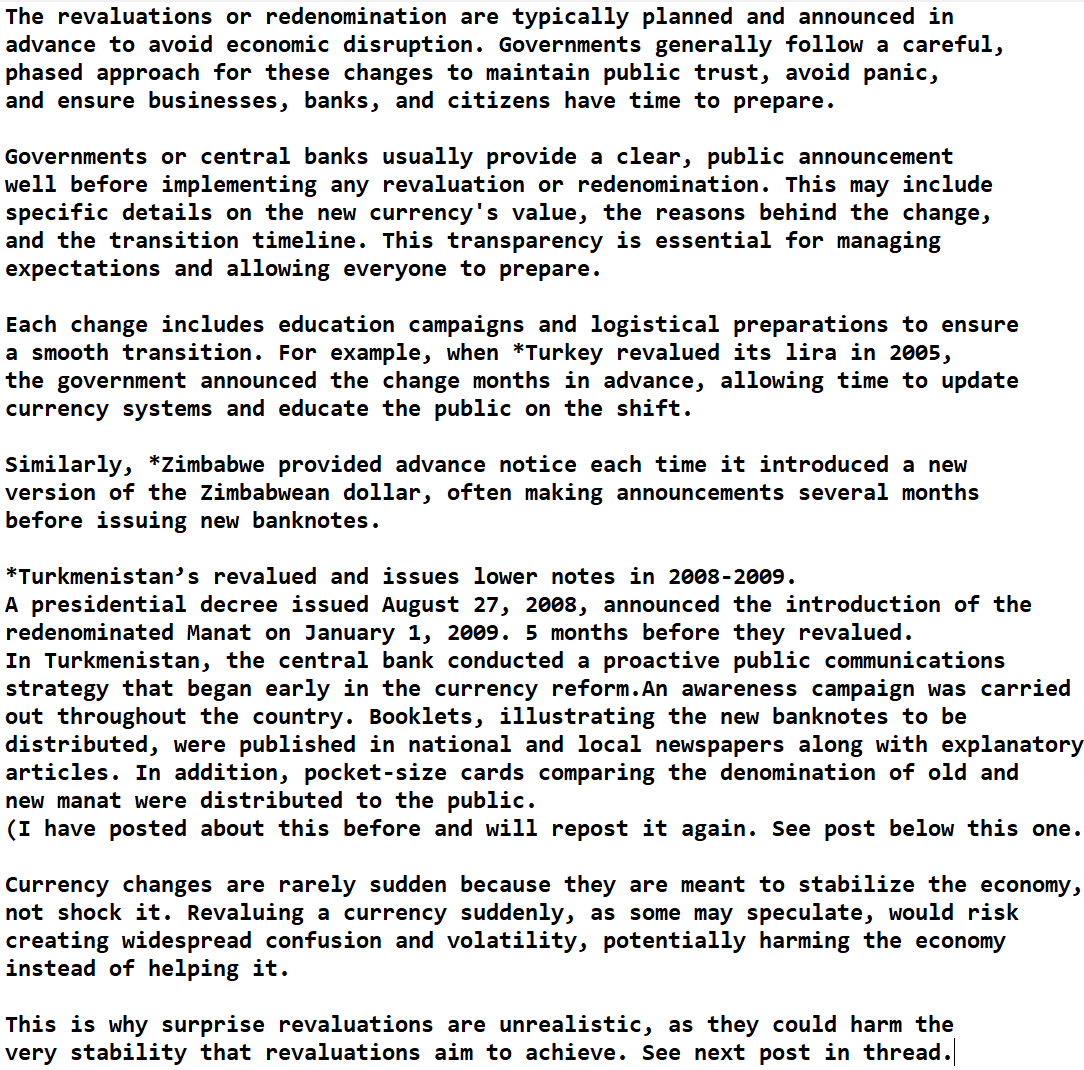

I posted this on Oct 16th. It is the steps for just the revalue part. Also see next post for 1st steps of auditor's and preparations of public education campaign.

I posted this on Oct 16th. It is the steps for just the revalue part. Also see next post for 1st steps of auditor's and preparations of public education campaign. https://x.com/ajsallen/status/1846631860732121155