🏗️ 🧑🔬 @GyroStable. Decentralized finance, applied math, network science. Prev: PhD @Cornell, analytics MBS/ETFs/indices.

How to get URL link on X (Twitter) App

https://twitter.com/aklamun/status/1181520472501936129What is a deleveraging spiral?

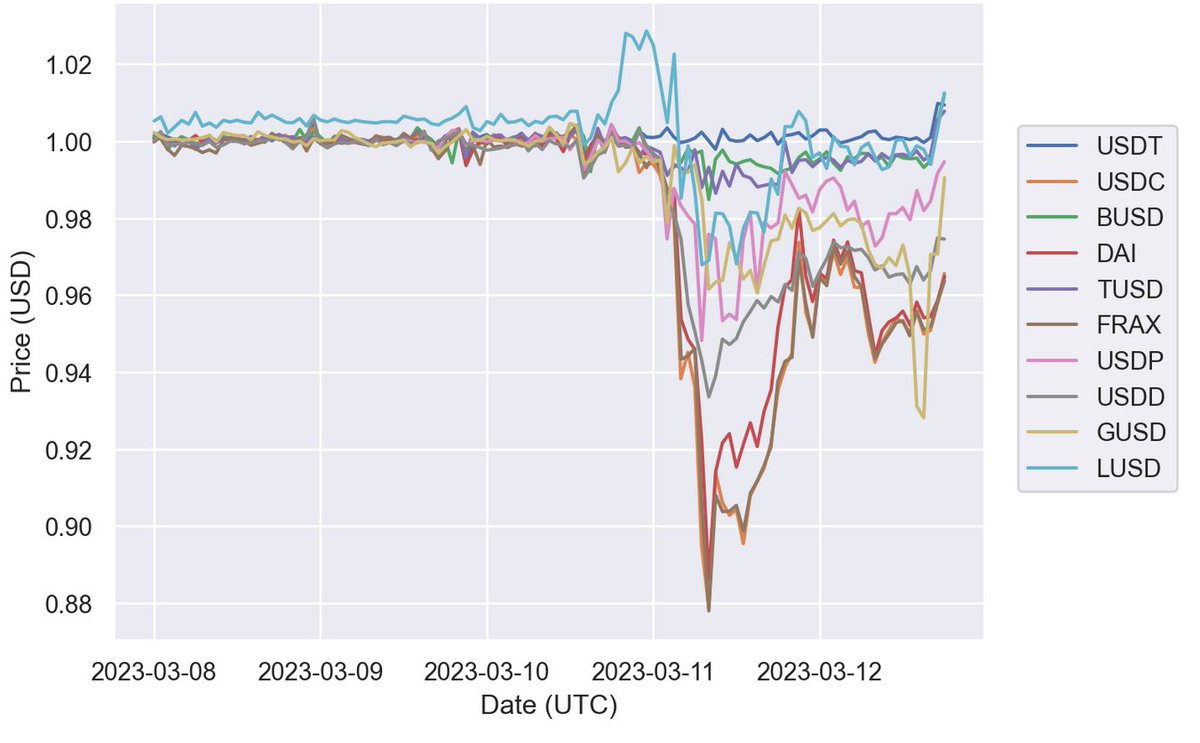

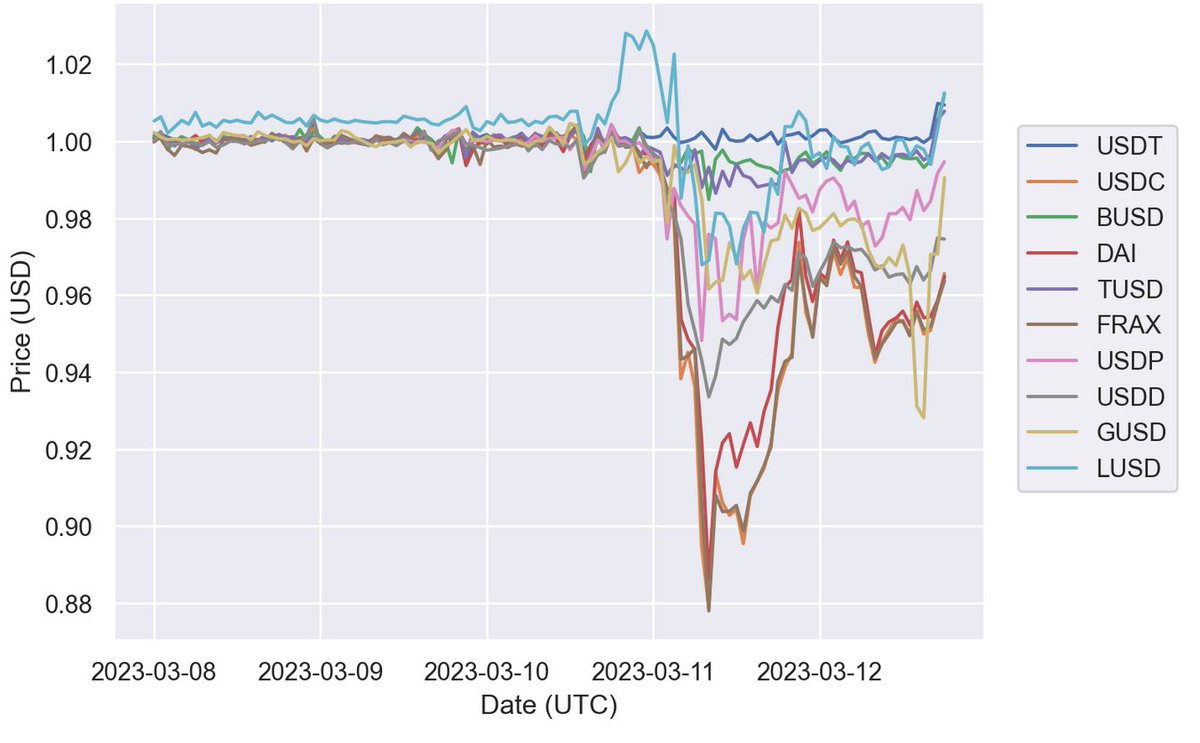

2/ The trigger was a bank run on SVB and subsequent closing of the bank amidst illiquidity and insolvency worries

2/ The trigger was a bank run on SVB and subsequent closing of the bank amidst illiquidity and insolvency worrieshttps://twitter.com/bantg/status/1557742913924186117Gyroscope’s "PSM 2.0" increases resilience in several ways

It's not pure basis, which hopefully everyone can now agree doesn't work! They have something that is ~ a reserve. In that respect, essentially like Nubits with different parameters (larger reserve but still too small). Reminder of how that worked out 👇

It's not pure basis, which hopefully everyone can now agree doesn't work! They have something that is ~ a reserve. In that respect, essentially like Nubits with different parameters (larger reserve but still too small). Reminder of how that worked out 👇

The Terra design is based on endogenous collateral, or seigniorage shares: the value of Luna derives in a ~self-fulfilling way from the anticipated usage of UST. While this brought benefits on the upside, it is now materializing in dangerous spirals on the downside.

The Terra design is based on endogenous collateral, or seigniorage shares: the value of Luna derives in a ~self-fulfilling way from the anticipated usage of UST. While this brought benefits on the upside, it is now materializing in dangerous spirals on the downside.

https://twitter.com/SBF_Alameda/status/13342472830811381782) Kelly criterion (max E[log V]) makes sense in context of an entire portfolio and effectively heavily penalizes possibilities of portfolio wipeouts. But when only modeling a component of a portfolio, it makes less sense. 2/7

https://twitter.com/rohangrey/status/1334258771204325378For non-custodial stablecoins, it's more complex. Where they rely on central governors, they may have fiduciary risks. But where non-custodial stablecoins aim to align incentives of agents decentrally and remove custodial and fiduciary points, then the risks are very different

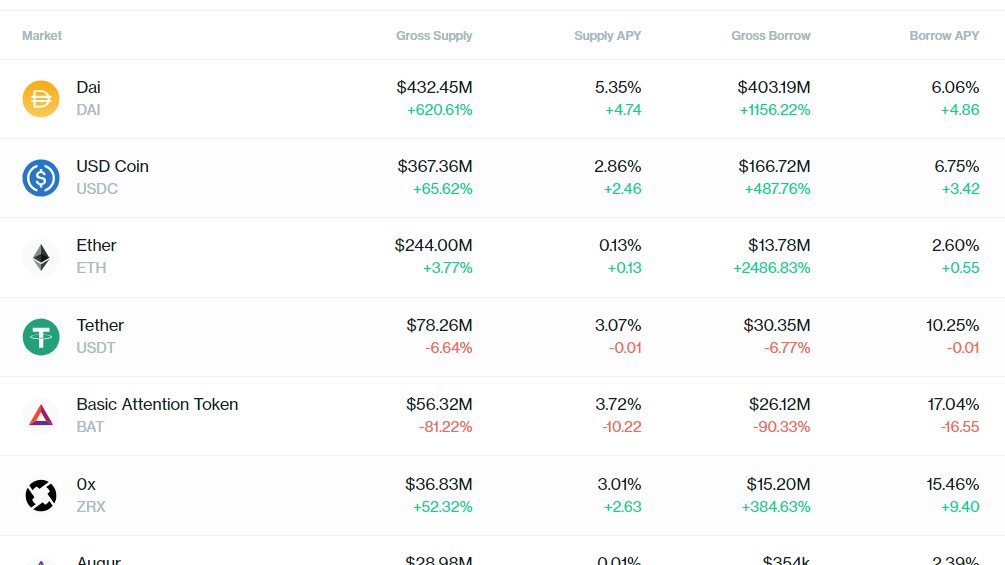

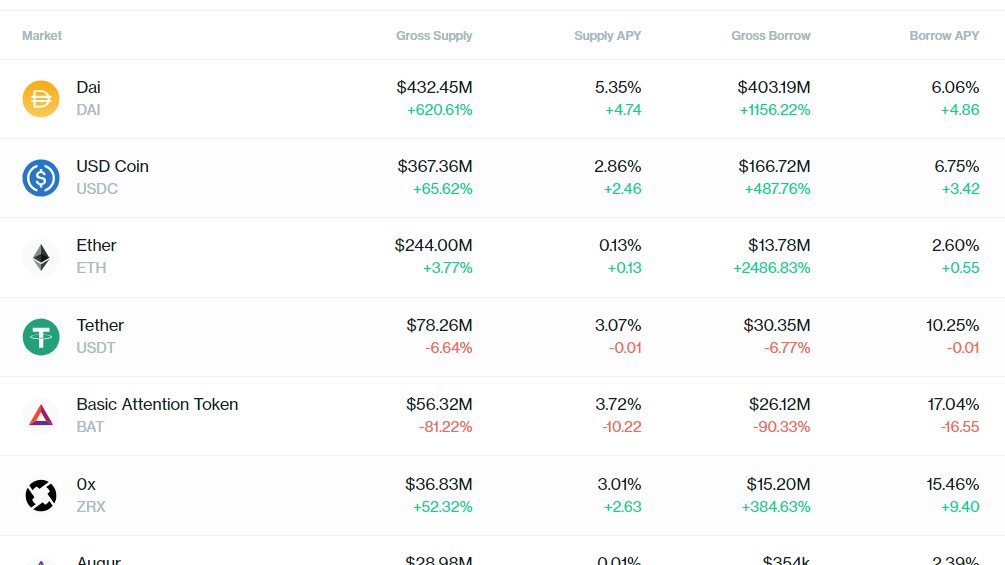

As with $BAT before, this leads to concerns about deleveraging effects. Demand for Dai is high with price close to $1.02 and Dai interest rates are already low. Dai issuance is struggling to keep up with COMP farming demand in this otherwise 'normal' time

As with $BAT before, this leads to concerns about deleveraging effects. Demand for Dai is high with price close to $1.02 and Dai interest rates are already low. Dai issuance is struggling to keep up with COMP farming demand in this otherwise 'normal' time