*No longer here - on bsky*

Chief exec @taxjusticenet. Opinions mine. #Palma inequality. New book: What do we know and what should we do about tax justice?

How to get URL link on X (Twitter) App

https://twitter.com/alexcobham/status/17599583033401715621. The blockers' lines are clear and they were echoed by some of the more 'neutral' OECD members as well as the hardcore havens:

https://twitter.com/KevinPinner/status/1757924747852087368@Law360 @MathiasCormann This is the most eyebrow-raising statement from Cormann's spokesperson: the claim that the now head of the OECD, who was Australia's minister for finance from Sep.2013 to Oct.2020, did not know Sayers "during his time as CEO of PwC Australia" (Apr.2012-May 2020).

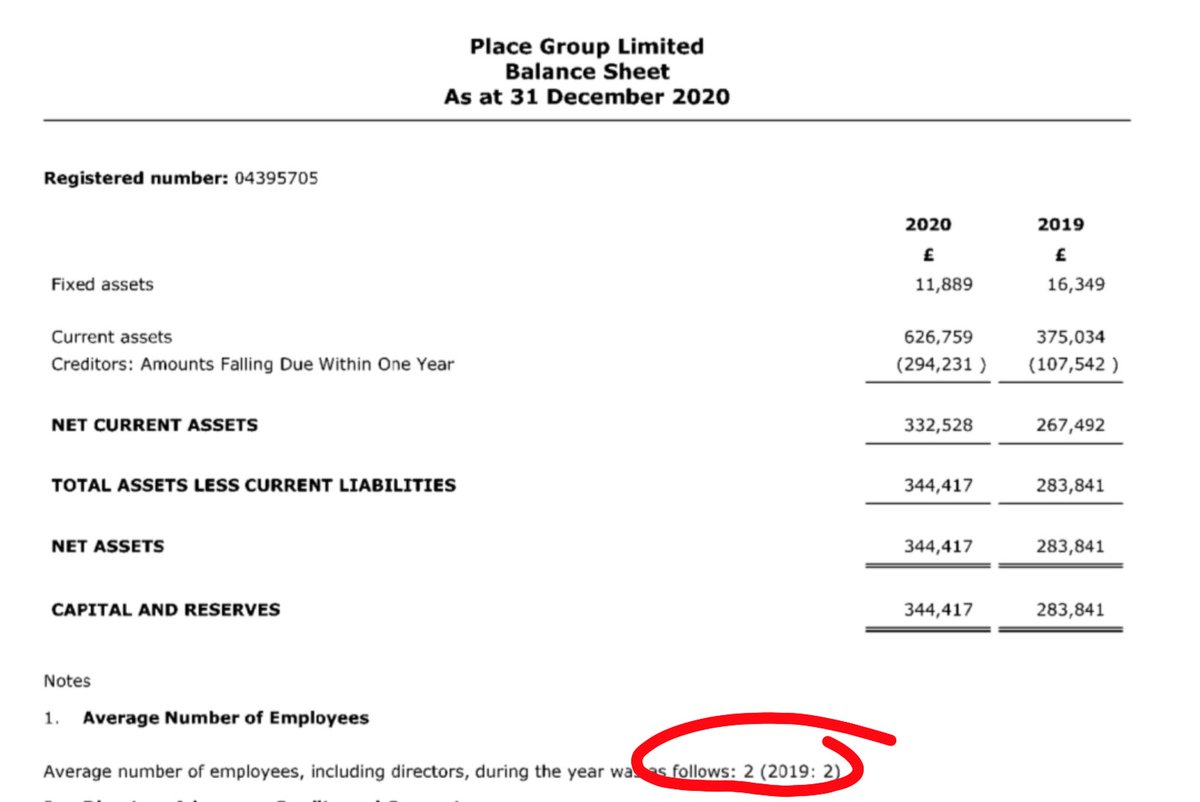

https://twitter.com/JolyonMaugham/status/1554160249766137858

Helpful and worrying explanation of how the (up to) £70bn contract may be operated

Helpful and worrying explanation of how the (up to) £70bn contract may be operated https://twitter.com/antlerboy/status/1554349391644921856?t=Ny3CGlEos7eLbhG9ZVyBiQ&s=19

https://twitter.com/JohanLangerock/status/1392437590087843840Thinking more about @ATAFtax proposal, it seems highly significant. It returns to the spirit of G24 proposal which Inclusive Framework backed in early 2019 for OECD to evaluate (as 1 of 3). It was never evaluated, just discarded in favour of the secretariat's 'unified' proposal.

https://twitter.com/EUCourtPress/status/1392413488883044354While confirming Lux state aid to Engie...

https://twitter.com/EUCourtPress/status/1392408852319117313?s=20

https://twitter.com/QParrinello/status/1385483234788642816The French government's two-pager on its negotiating position - its critical demands - has been leaked. According to the scoop in @Contexte, the metadata of the pdf reveal the hand not of diplomats or ministers, but of a senior employee of MEDEF - the French business lobby group.

https://twitter.com/JohanLangerock/status/1382641937681879044It has long been something of a mystery why the OECD secretariat pushed 12.5% in the 'pillar 2' discussions.

https://twitter.com/TaxJusticeNet/status/1334553772350115840?s=19

https://twitter.com/TaxJusticeNet/status/1334483926702764034Here's the full first panel #ImperialInequalities, with @JuliaMcClure_ (U. Glasgow) David Brown (Trinity) @madeline_woker (Brown U.) & Laura Channing (Cambridge) and moderated by @GKBhambra

https://twitter.com/NimiHoffmann/status/13247125372676218891. Why did the MDGs overlook non-aid finance? This was by design: the MDGs were driven by aid donors, and were largely conceived of as ensuring better alignment of donors and recipient states - setting common goals so aid would deliver more.

https://twitter.com/NimiHoffmann/status/1324739437343944705?s=20