I build magnetic products, brands and companies for the highest performing people on the planet //// Founder & CEO - @joinsequel / 1 x exit - Velocity Black

2 subscribers

How to get URL link on X (Twitter) App

1. Build relationships ahead of time

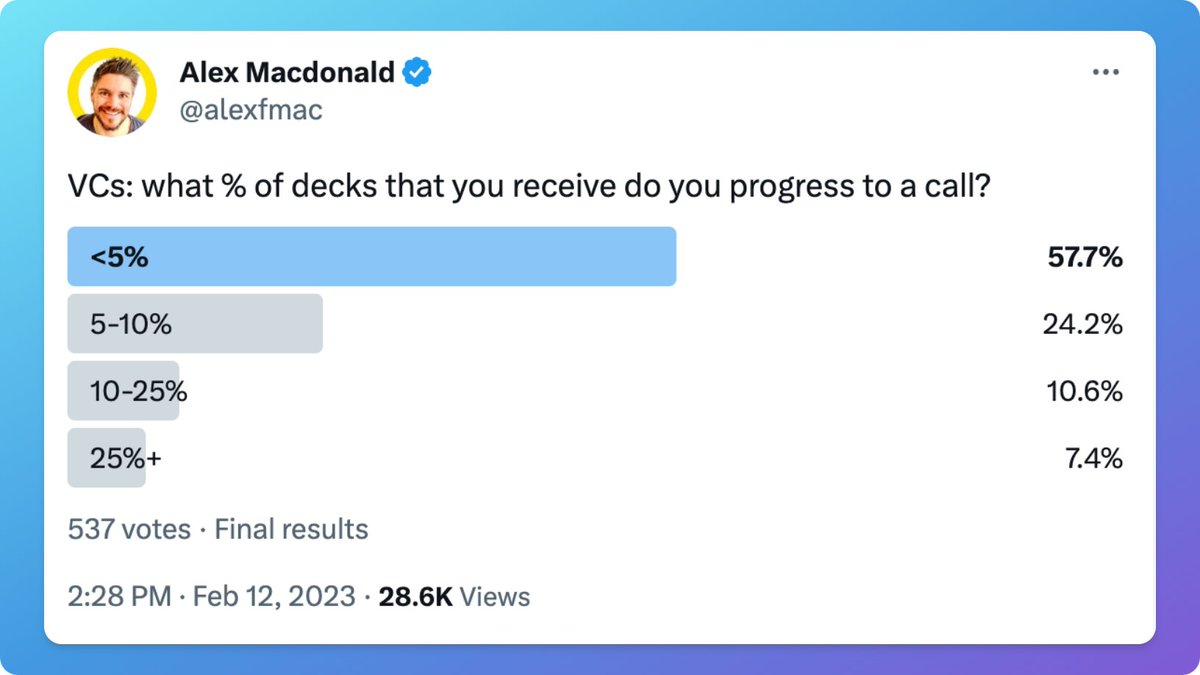

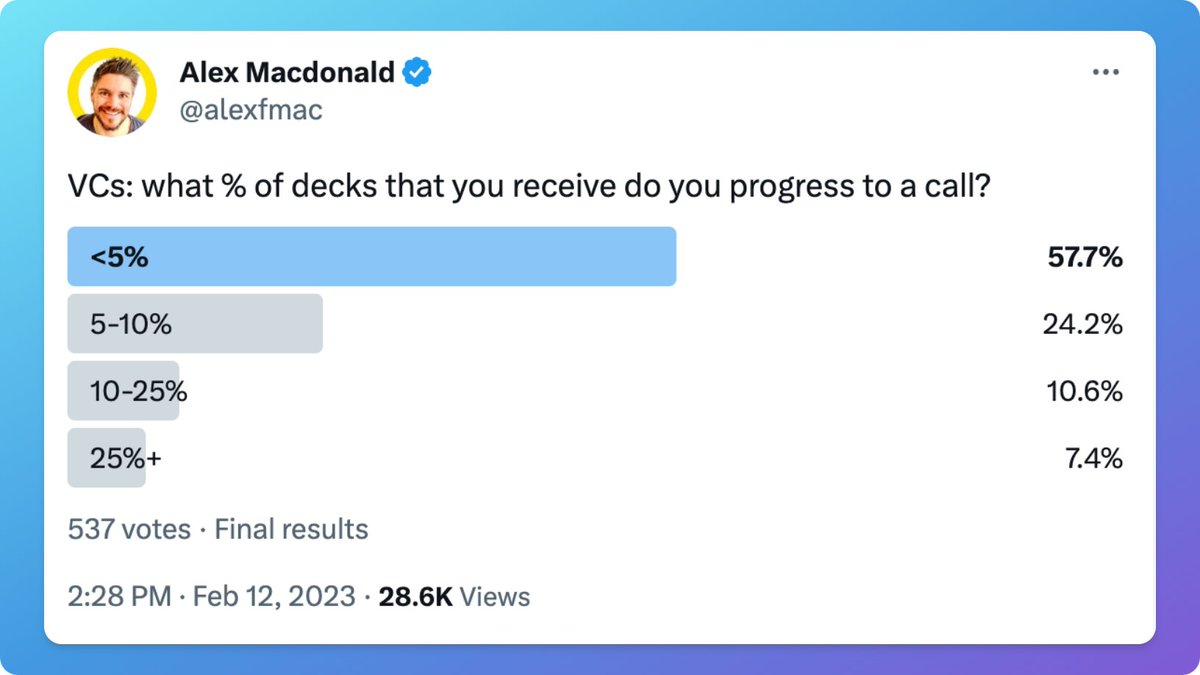

1. Build relationships ahead of timehttps://twitter.com/alexfmac/status/1521179335222247428?s=20

I've ordered these in terms of utility (contact details and other built-in features)

I've ordered these in terms of utility (contact details and other built-in features)

First: What are secondaries?

First: What are secondaries?

1/ Firstly: I’m not a doctor or nutritionist, so get your own advice (though I reckon I’m in better shape than most health ministers 😉).

1/ Firstly: I’m not a doctor or nutritionist, so get your own advice (though I reckon I’m in better shape than most health ministers 😉). https://twitter.com/siddharth_ram/status/1434831601788018689?s=20

https://twitter.com/HarryStebbings/status/1114311446127624192?s=20