How to get URL link on X (Twitter) App

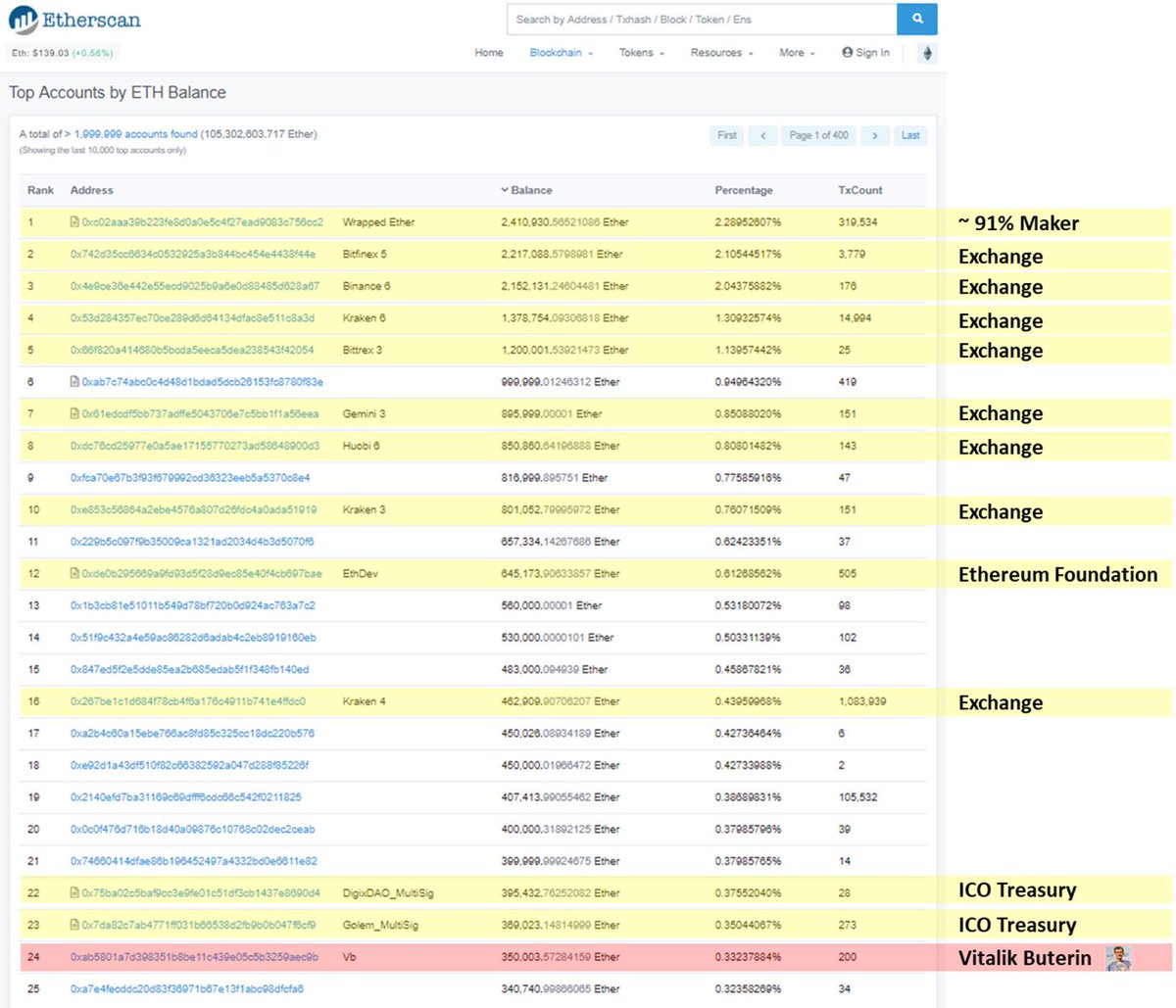

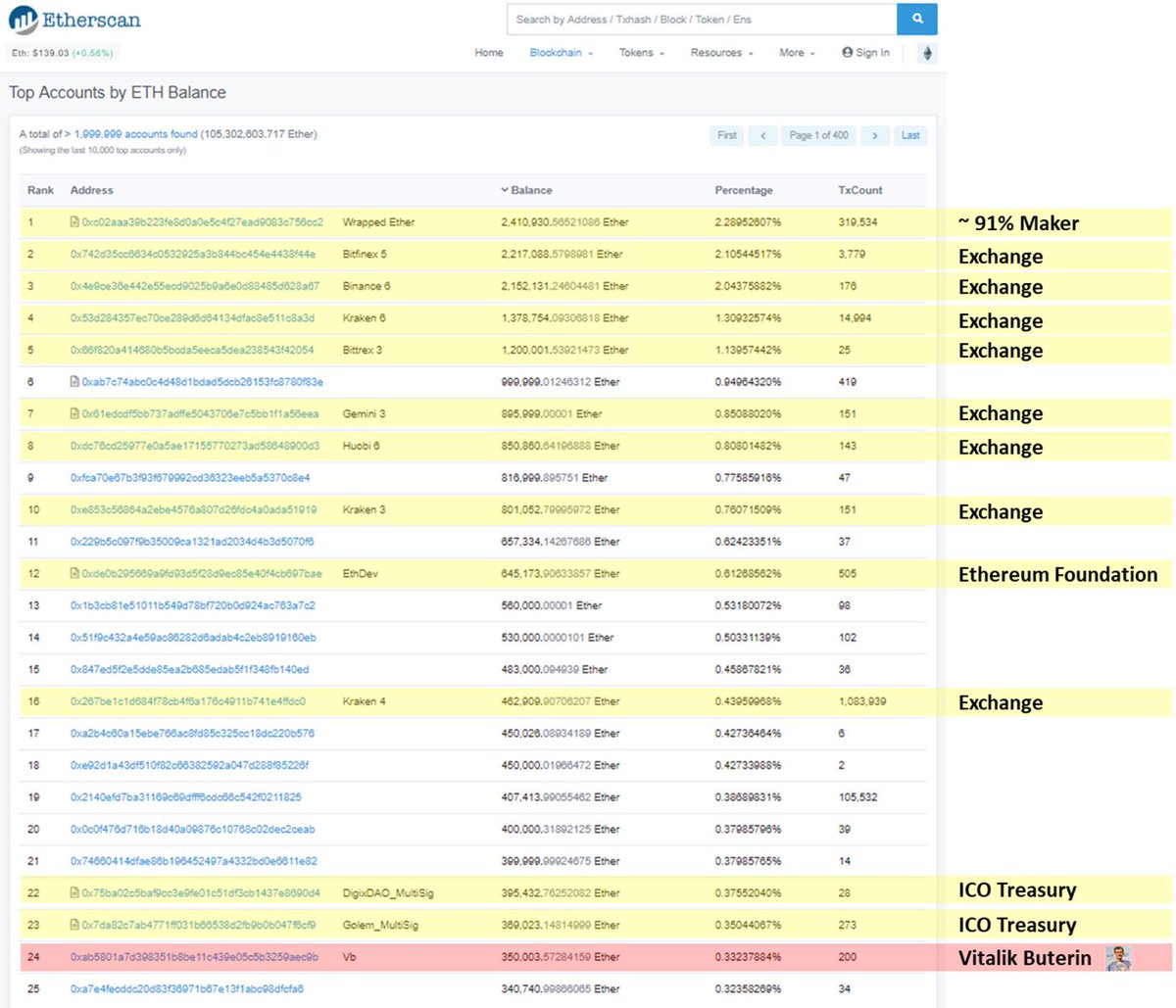

2/ Vitalik’s main ETH address is currently Ethereum’s 24th largest at ~ 350,000 ETH.

2/ Vitalik’s main ETH address is currently Ethereum’s 24th largest at ~ 350,000 ETH.https://twitter.com/VitalikButerin/status/1050126908589887488

https://twitter.com/alexsunnarborg/status/10833606620452372482/ There is currently ~ $2m (~ 13k ETH) of ‘total money at stake’ on Augur

2/ Currently there are ~ 22 million BTC addresses

2/ Currently there are ~ 22 million BTC addresses

https://twitter.com/alexsunnarborg/status/940598100648972289