Political machinations, Geopolitics concerning Europe & transatlantic relations. Often political economics rants. Eurodollar and US foreign policy explainer.

7 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/JerryHendrixII/status/1622242003080577027

within the Fed say Powell wants the data to be inflationary to get Yellen and the White House off his back. Yellen is said to be offsetting the Fed's Quantitative Tightening (QT) by issuing short-dated bills and Treasury General Account (TGA) and i believe this is causing a

within the Fed say Powell wants the data to be inflationary to get Yellen and the White House off his back. Yellen is said to be offsetting the Fed's Quantitative Tightening (QT) by issuing short-dated bills and Treasury General Account (TGA) and i believe this is causing a

https://twitter.com/galacticbarrier/status/1615674805977595905which was added during the Great Depression.

https://twitter.com/jimiuorio/status/1598283978536288257Crypto losers calling for $1m btc should be put in jail and beaten daily.

help combat China long term. The biggest concerns for the US is China is simply making huge progress on technology on its own (of course after we handed it all to them and they stole the rest) and the fact they are indespensible to the world in terms of supply chains.

help combat China long term. The biggest concerns for the US is China is simply making huge progress on technology on its own (of course after we handed it all to them and they stole the rest) and the fact they are indespensible to the world in terms of supply chains.

https://twitter.com/amlivemon/status/1372844775506857985

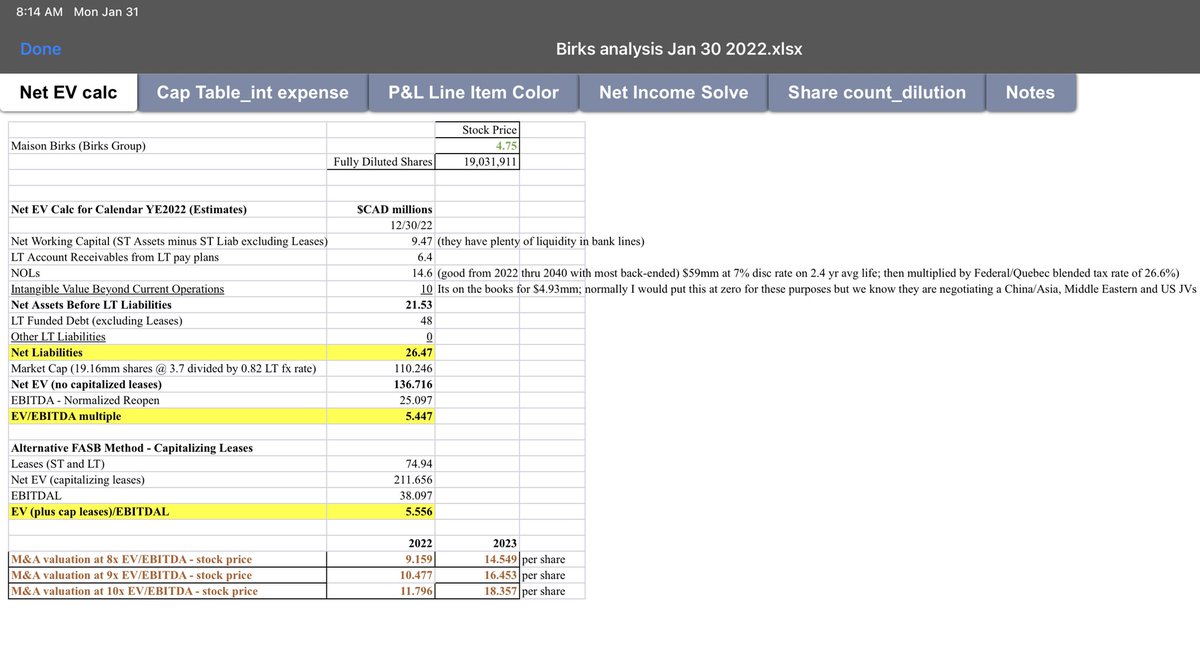

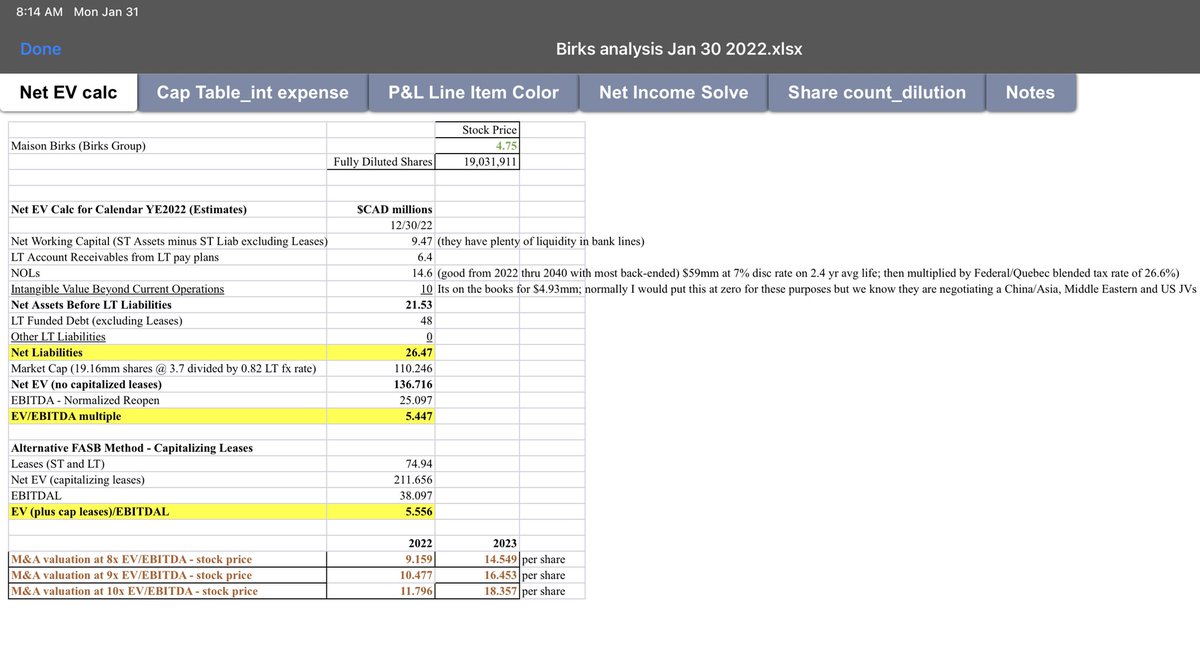

year ago that it is still cheap now. We have it earning $0.79 in calendar 2022 and $1.40 in calendar 2023. So at $4.75/share its trading at a 6 p/e for 2022 and 3.4 p/e for 2023. EBITDA multiples are 5.4x for 2022 and 3.4x in 2023.

year ago that it is still cheap now. We have it earning $0.79 in calendar 2022 and $1.40 in calendar 2023. So at $4.75/share its trading at a 6 p/e for 2022 and 3.4 p/e for 2023. EBITDA multiples are 5.4x for 2022 and 3.4x in 2023.

https://twitter.com/vola2vola/status/1427727111327031298had lost significant influence and any real footprint in Central Asia. After being booted out of Uzbekistan, the reality in keeping forces in Afghanistan became much more evident if the Pentagons long term lily pad strategy was to be properly implemented across the region. Since

https://twitter.com/complete_intel/status/1427604580226027552⁃The likelihood of tapering is low based on multiple political and economic realities. First, we have midterms in 2022 and Yellen nor Powell can ill afford a market crash that close to midterms. Secondly, in the near term, we have a fiscal problem brewing where the GOP is

https://twitter.com/GaryHaubold/status/1317137261088079872that Pelosi had run into is gross miscalculation of her political leverage and the risk associated with stalling stimulus checks and UI on the down tickets of House races. Originally, the Dems were going to lose 8-10 seats but this error in judgment will now likely cause 10-15