China research director for Gavekal Dragonomics. Aspiring blogger. Former Wall Street Journal. Places I've lived: Louisiana, Beijing, Pacific Northwest.

How to get URL link on X (Twitter) App

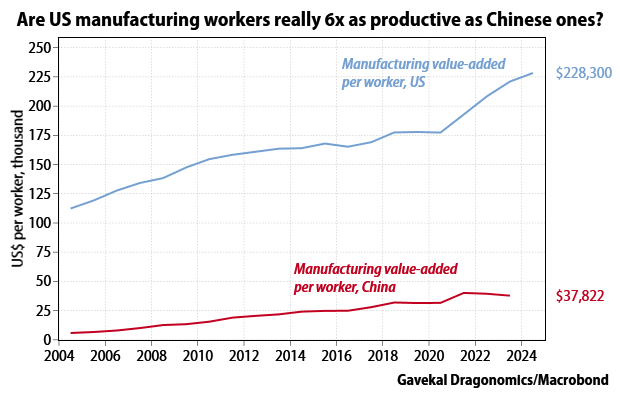

This means that on a per-worker basis, US manufacturing still looks insanely productive: each worker produces over $200,000 in value-added, while in China each manufacturing worker produces less than $40,000 in value-added. So the US still has a productivity edge. 2/

This means that on a per-worker basis, US manufacturing still looks insanely productive: each worker produces over $200,000 in value-added, while in China each manufacturing worker produces less than $40,000 in value-added. So the US still has a productivity edge. 2/

It's a good book, short and readable, mixing together the authors' personal experiences with the Chinese educational and the results of their long careers analyzing that system. For me it was eye-opening.

It's a good book, short and readable, mixing together the authors' personal experiences with the Chinese educational and the results of their long careers analyzing that system. For me it was eye-opening.

https://twitter.com/Brad_Setser/status/1664253367705645058Since we know the value of manufacturing exports (~18% of GDP) and the share of domestic value-added in those exports (~80%) we can break down manufacturing value-added into the portions serving external and domestic demand

In its 2021 financial stability report, the PBOC ran banking-system stress tests based on various growth scenarios. In the worst one, the "severely adverse" scenario, it assumed 2.8% GDP growth in 2022. In other words, China is now actually in the severely adverse scenario.

In its 2021 financial stability report, the PBOC ran banking-system stress tests based on various growth scenarios. In the worst one, the "severely adverse" scenario, it assumed 2.8% GDP growth in 2022. In other words, China is now actually in the severely adverse scenario.

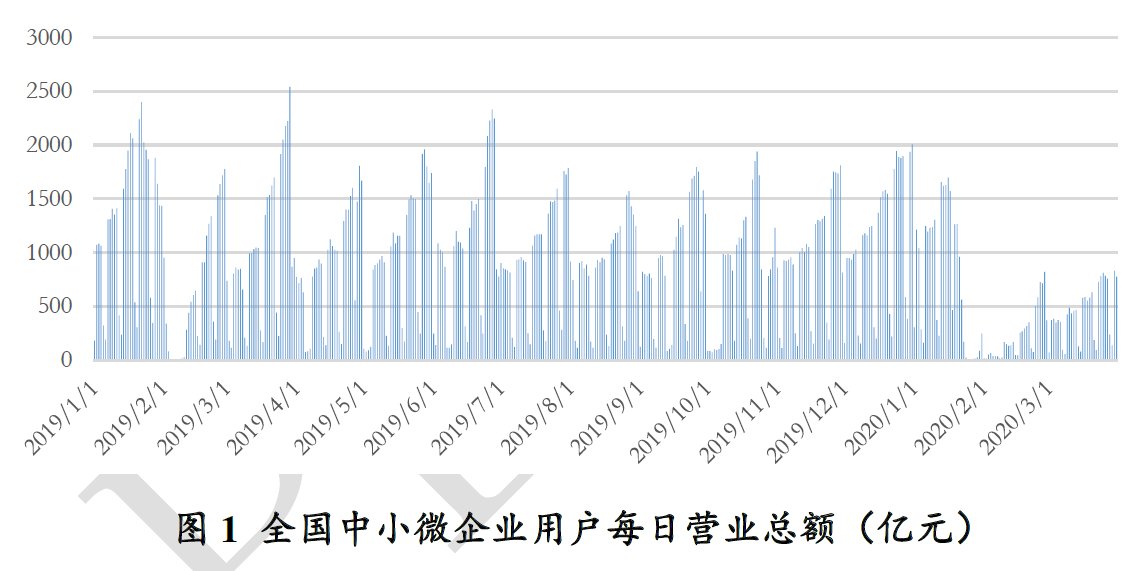

h/t to the Australian Financial Review for highlighting this interesting data

h/t to the Australian Financial Review for highlighting this interesting data https://twitter.com/MikeSmithAFR/status/1391224916414853124

https://twitter.com/JulianGewirtz/status/1263570672078422017

https://twitter.com/michaelxpettis/status/1254387885085777922Enabling all this of course is the rapid expansion of the financial sector, which is itself the sector with the highest level of state ownership. Other things being equal, rapid growth of finance, infrastructure & real estate increases the state's share of the economy.

https://twitter.com/_alice_evans/status/1104523471512576000China in fact is irrelevant to the debate over "neoliberal" economic policies in democratic countries. China's economic policies are not the result of making rational, technocratic choices from a menu of options available to all modern mixed economies.