Founder of @carryhq_. Founded @teachable (sold to @hotmart). On a mission to help people be better with money. Not financial advice, views are personal.

6 subscribers

How to get URL link on X (Twitter) App

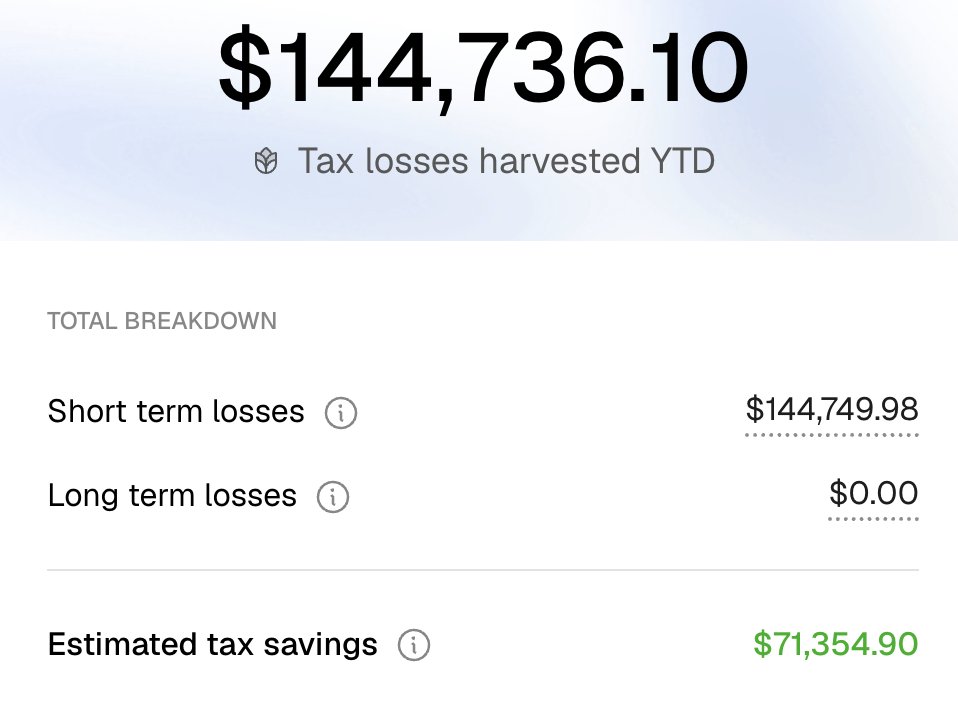

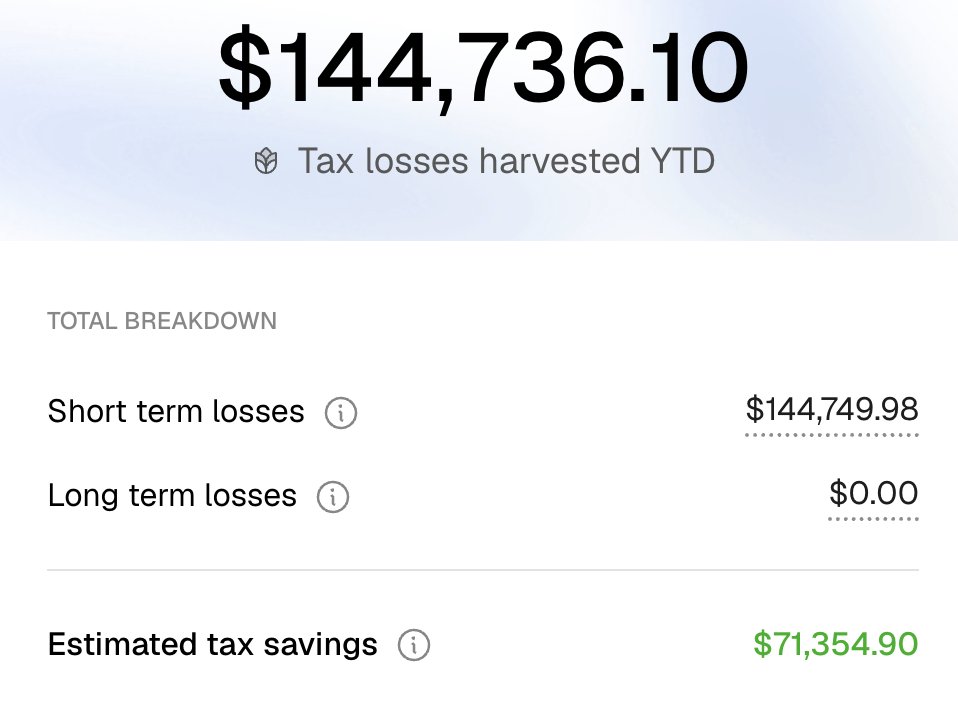

With direct indexing, you own all 500 companies directly

With direct indexing, you own all 500 companies directly

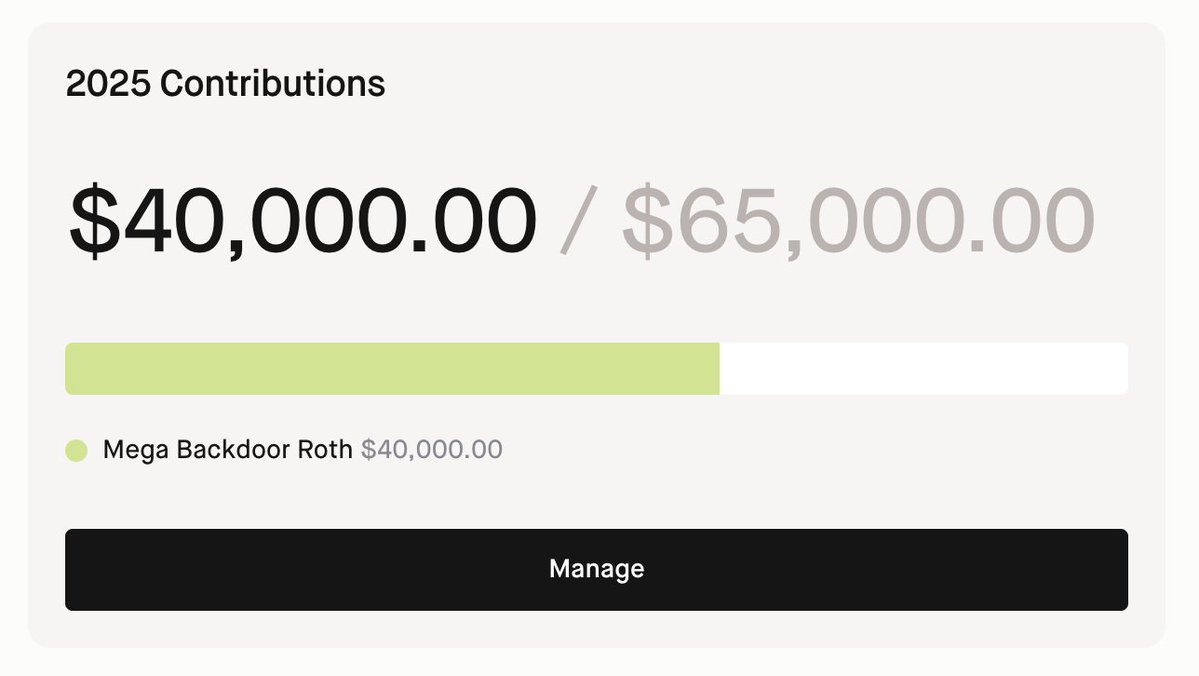

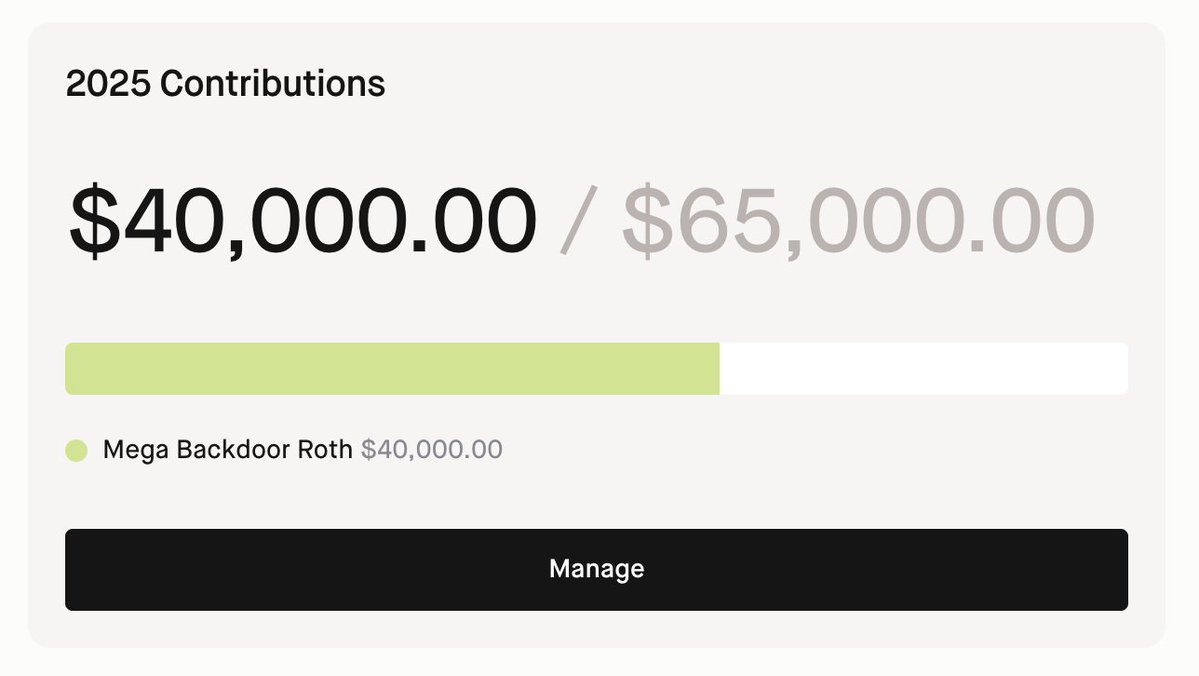

A Roth IRA is super powerful

A Roth IRA is super powerful

1 - Go hike Wadi Shab

1 - Go hike Wadi Shab

1 - Invest in (almost) anything

1 - Invest in (almost) anything