Silicon Valley entrepreneur (cofounder@ TrialPay, Yub, Affirm, Point, TXN), investor (General Partner @a16z), husband, father and sarcast (one who is sarcastic)

9 subscribers

How to get URL link on X (Twitter) App

2/ Let’s say an agent is paid all-in $75,000/year and answers 2000 tickets per year.

2/ Let’s say an agent is paid all-in $75,000/year and answers 2000 tickets per year.

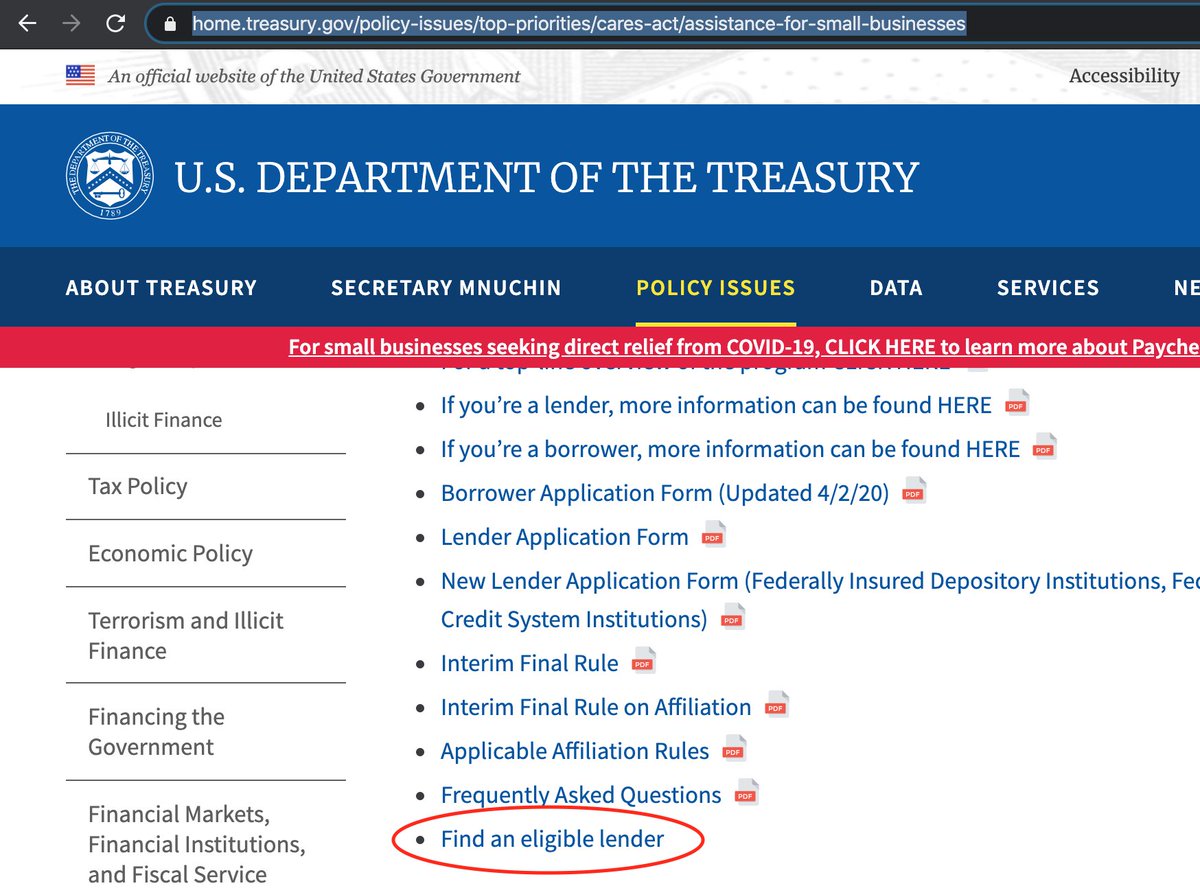

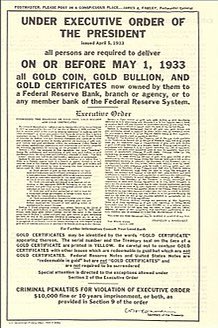

2/ At the same time, banks in 2023 do MUCH MORE than just lend and deposit money. They provide pipes and technology for *everything.* Payments are mostly electronic, not cash. Payroll goes to a payroll company which…has its own bank.

2/ At the same time, banks in 2023 do MUCH MORE than just lend and deposit money. They provide pipes and technology for *everything.* Payments are mostly electronic, not cash. Payroll goes to a payroll company which…has its own bank.

2/ You’ll see “Target Debit Card” and “Target Credit Cards” (source: Target 10Q)

2/ You’ll see “Target Debit Card” and “Target Credit Cards” (source: Target 10Q)

2/ In other words, card volume can grow as overall (all tender type) volume shrinks. This was inevitable but just as the pandemic accelerated e-commerce (see second chart above), it’s also accelerating contactless, mobile payments, and even outright bans on cash (virus❤️ paper?)

2/ In other words, card volume can grow as overall (all tender type) volume shrinks. This was inevitable but just as the pandemic accelerated e-commerce (see second chart above), it’s also accelerating contactless, mobile payments, and even outright bans on cash (virus❤️ paper?)