How to get URL link on X (Twitter) App

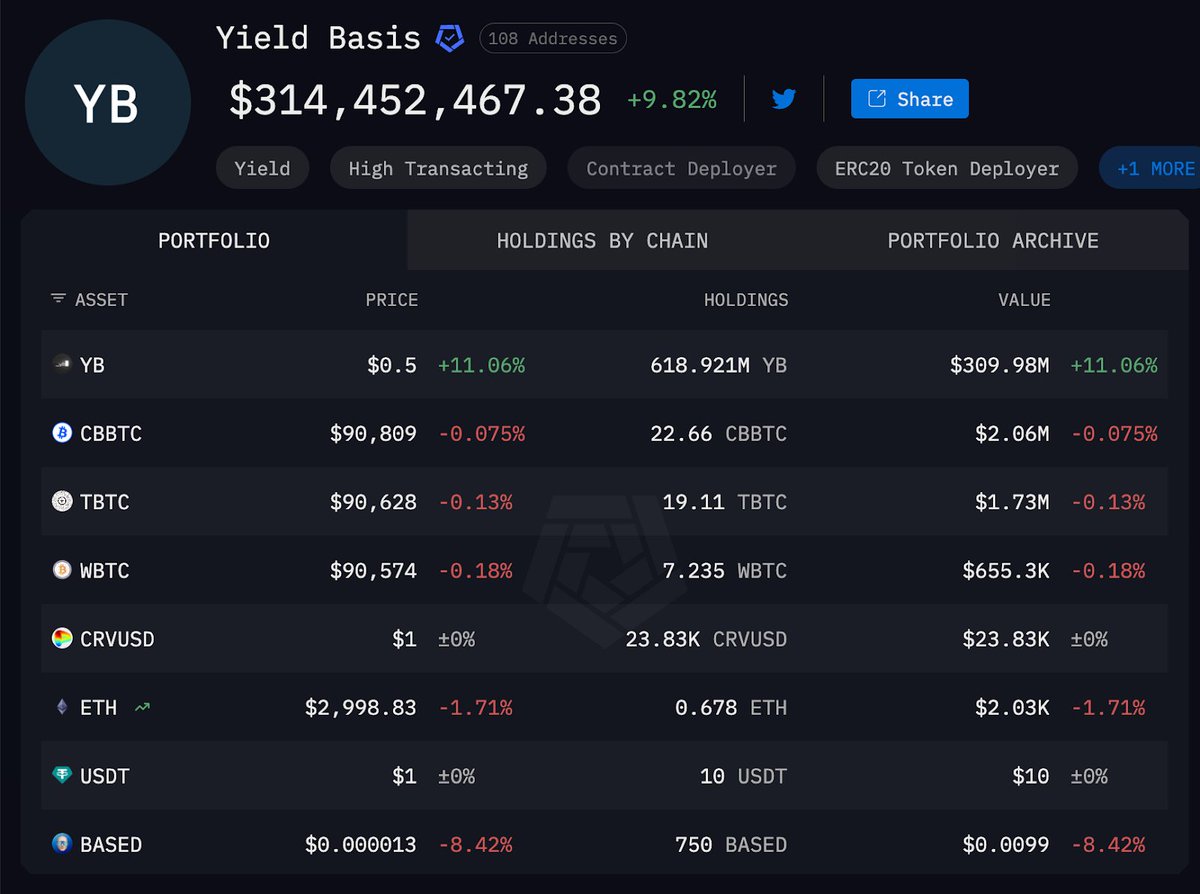

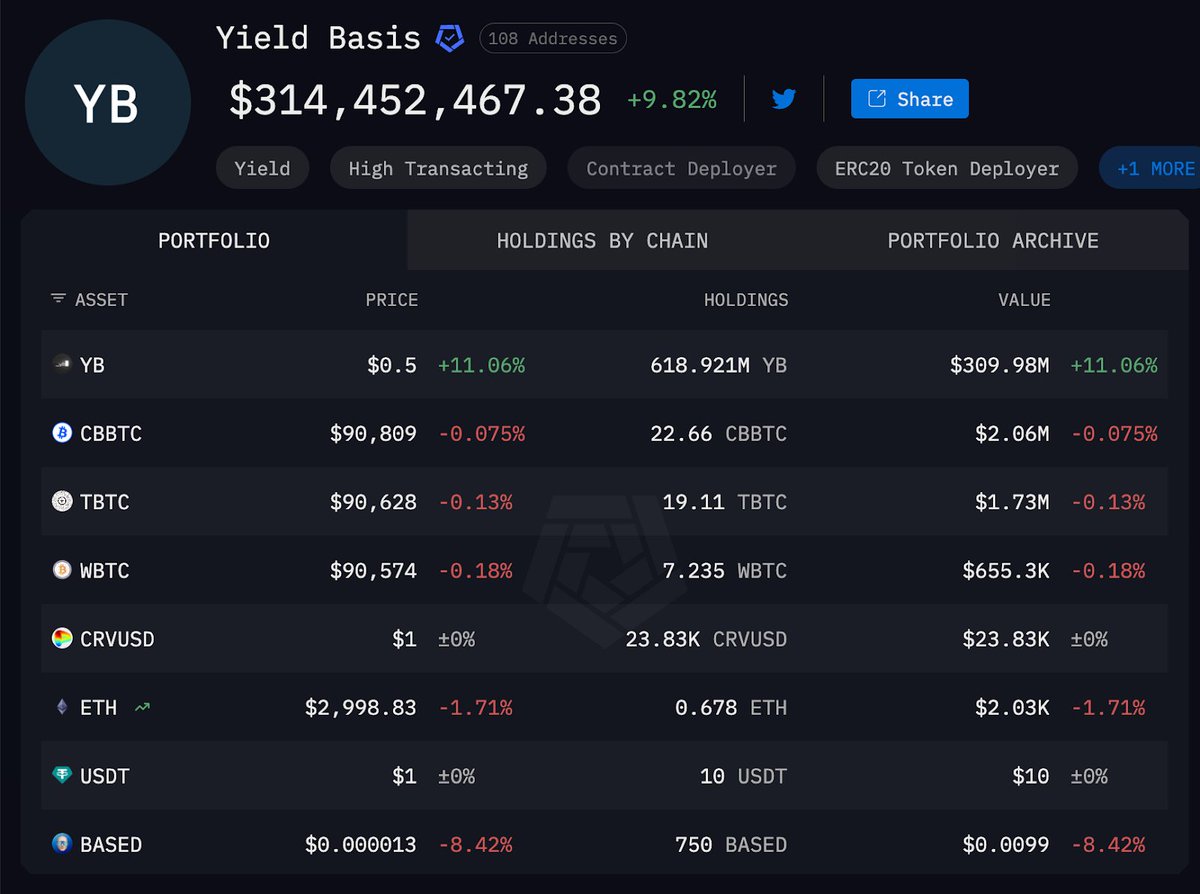

When prices move in DeFi, LPs (Liquidity Providers) incur unrealized losses relative to just holding the underlying assets. This is Impermanent Loss.

When prices move in DeFi, LPs (Liquidity Providers) incur unrealized losses relative to just holding the underlying assets. This is Impermanent Loss.

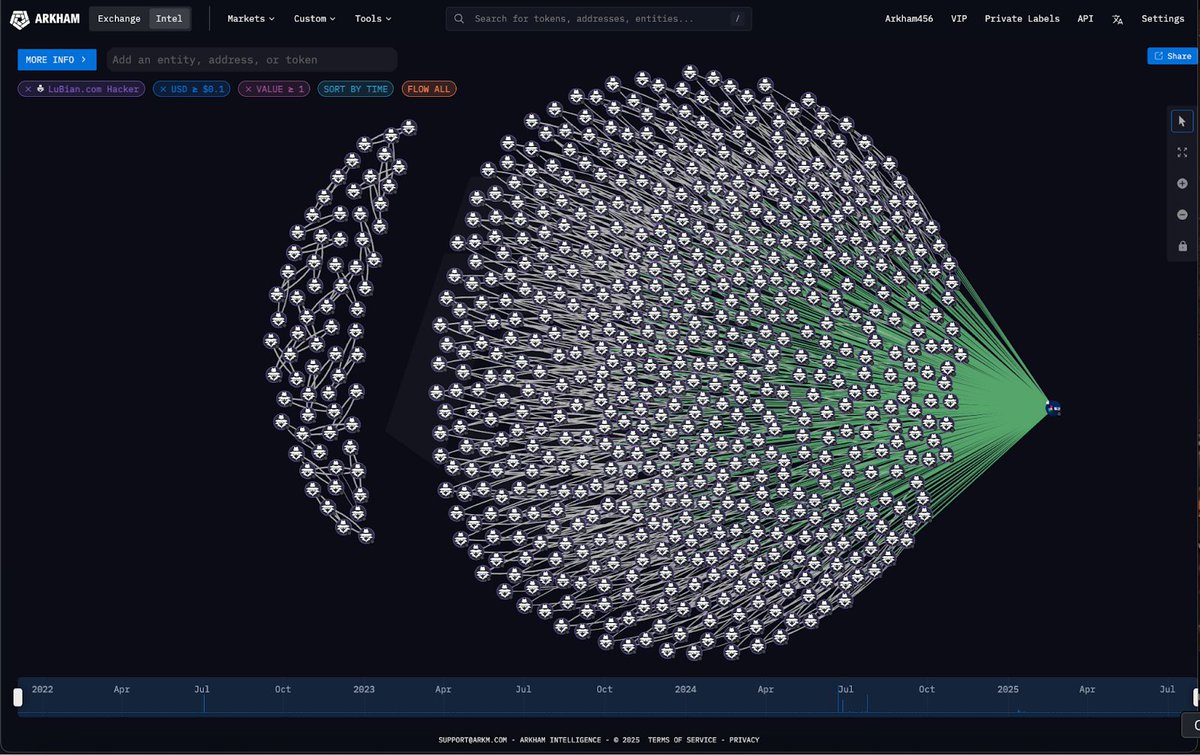

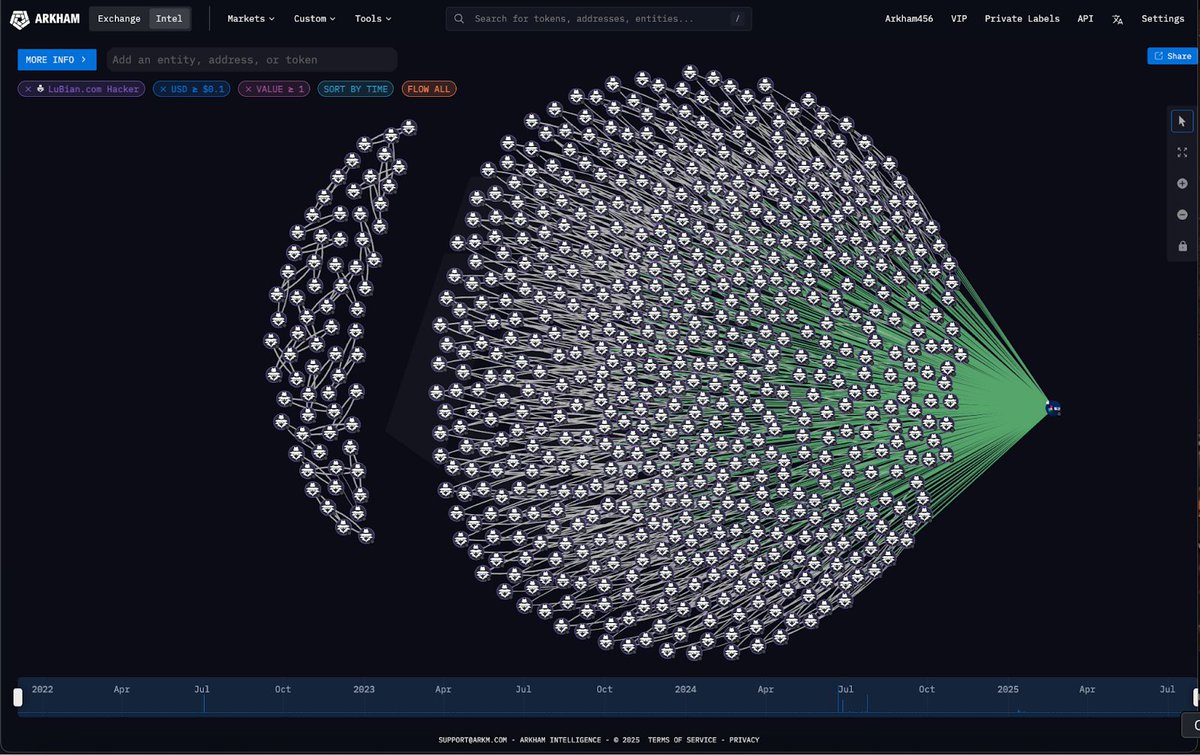

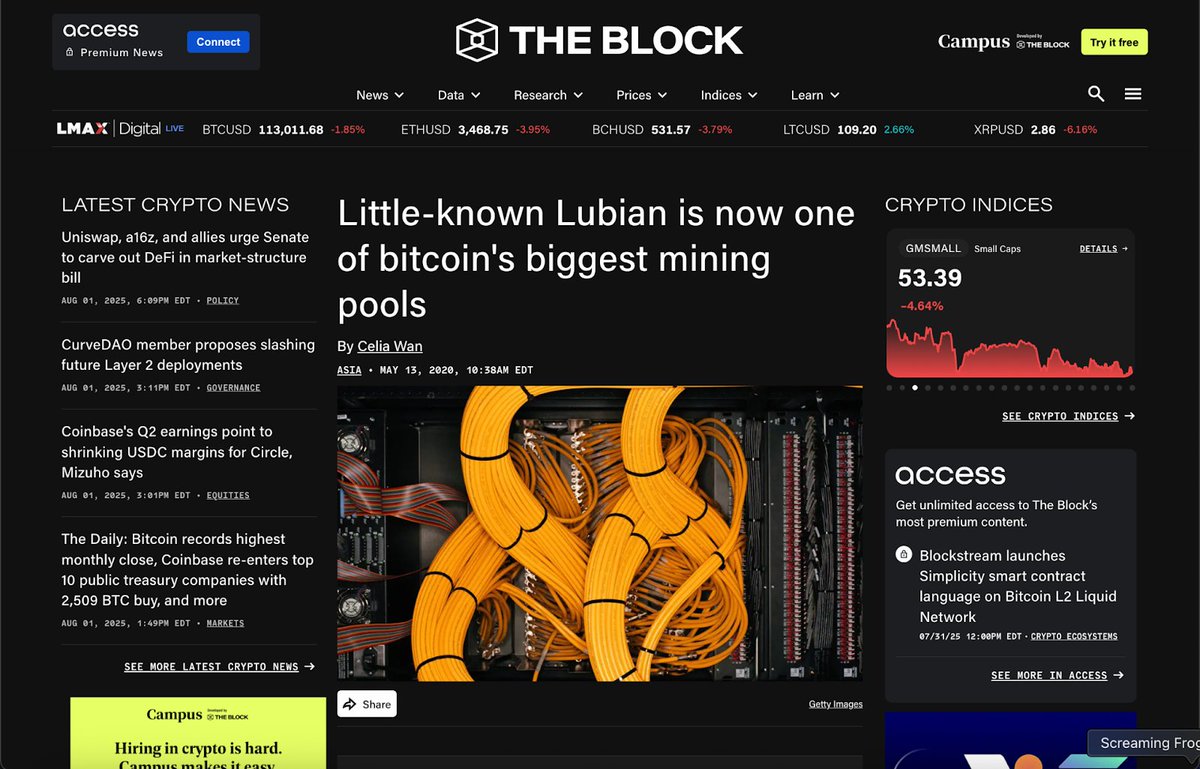

LuBian was one of the world’s largest mining pools in 2020, controlling almost 6% of the Bitcoin network’s total hash-rate as of May 2020.

LuBian was one of the world’s largest mining pools in 2020, controlling almost 6% of the Bitcoin network’s total hash-rate as of May 2020.

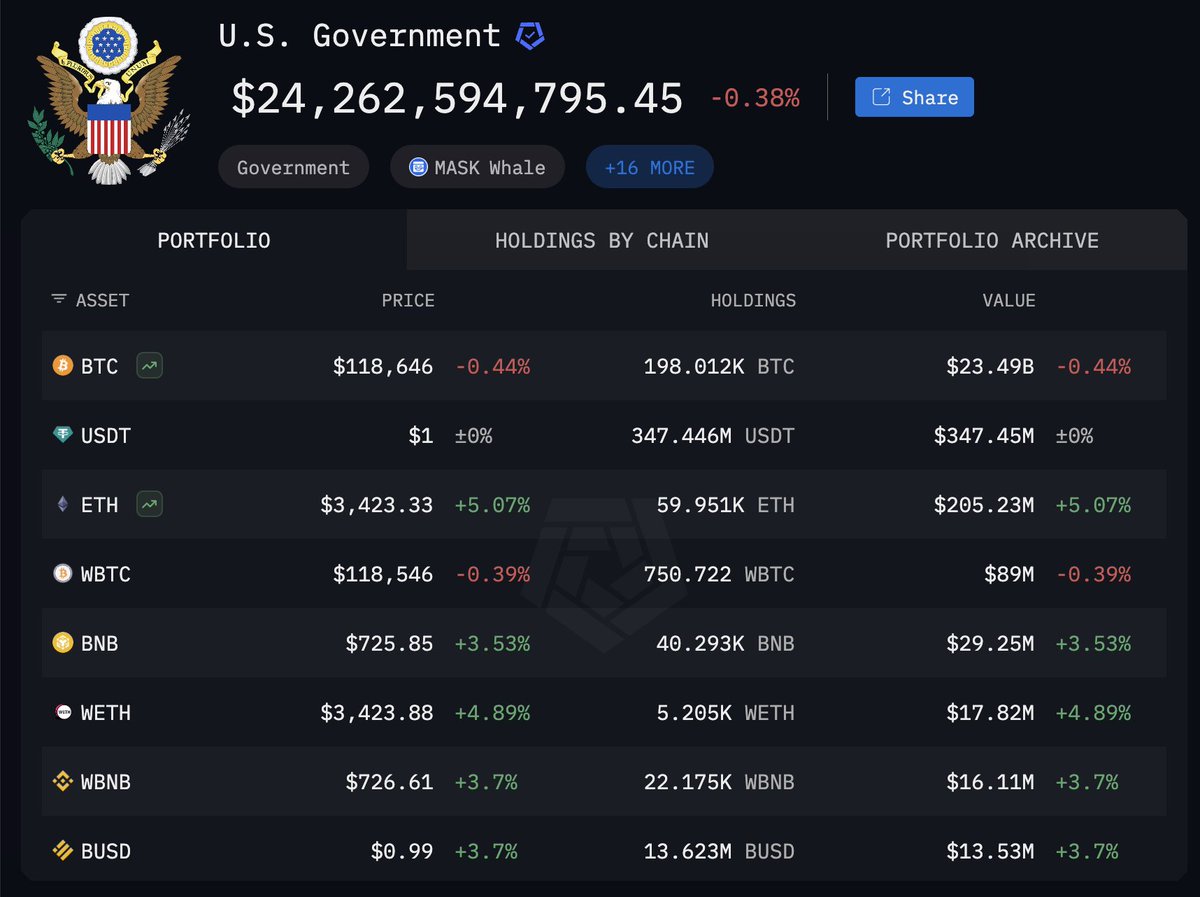

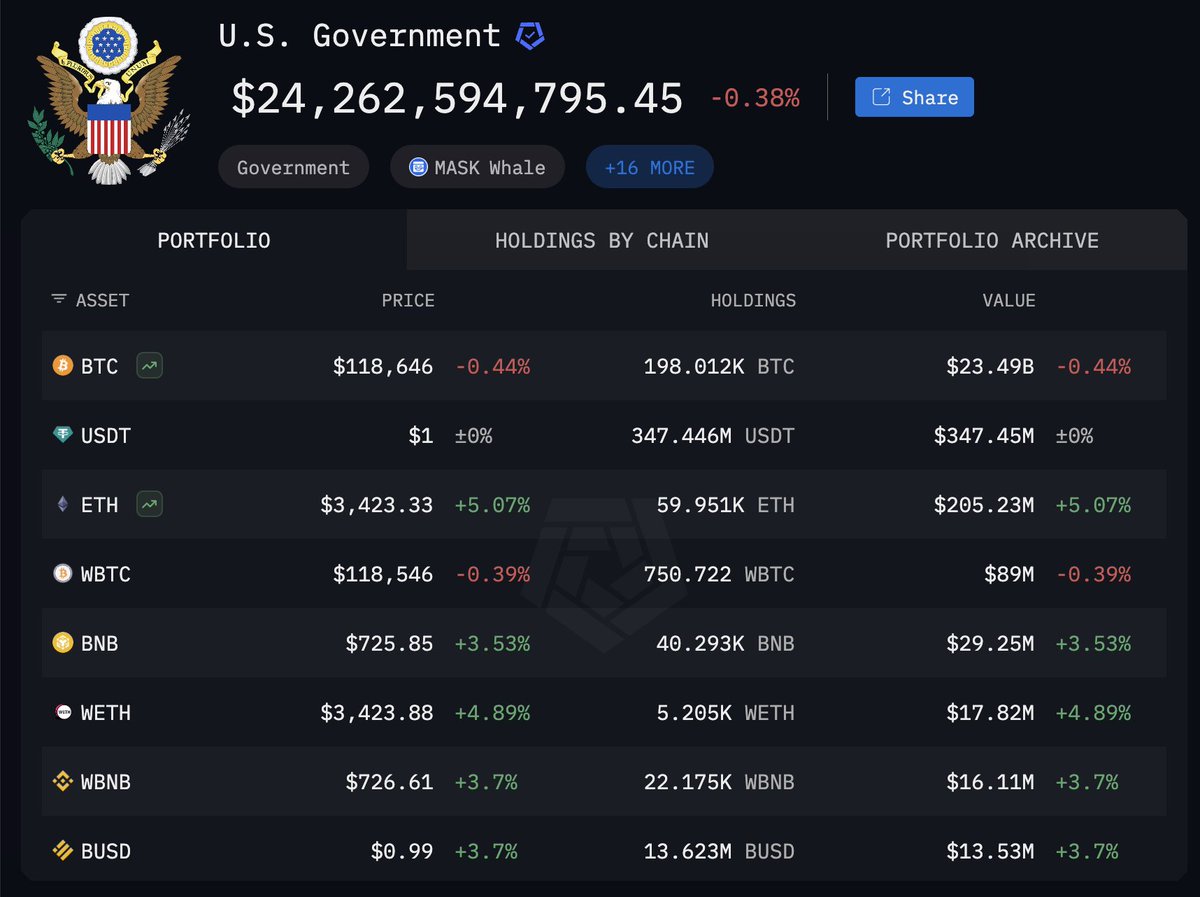

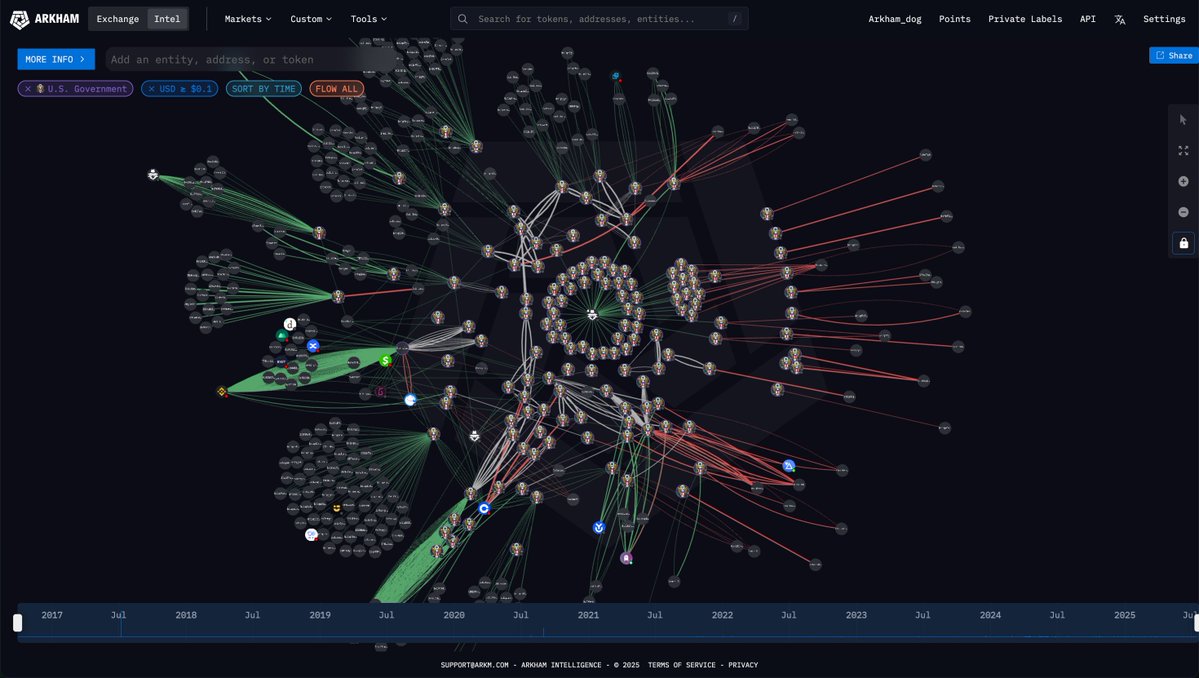

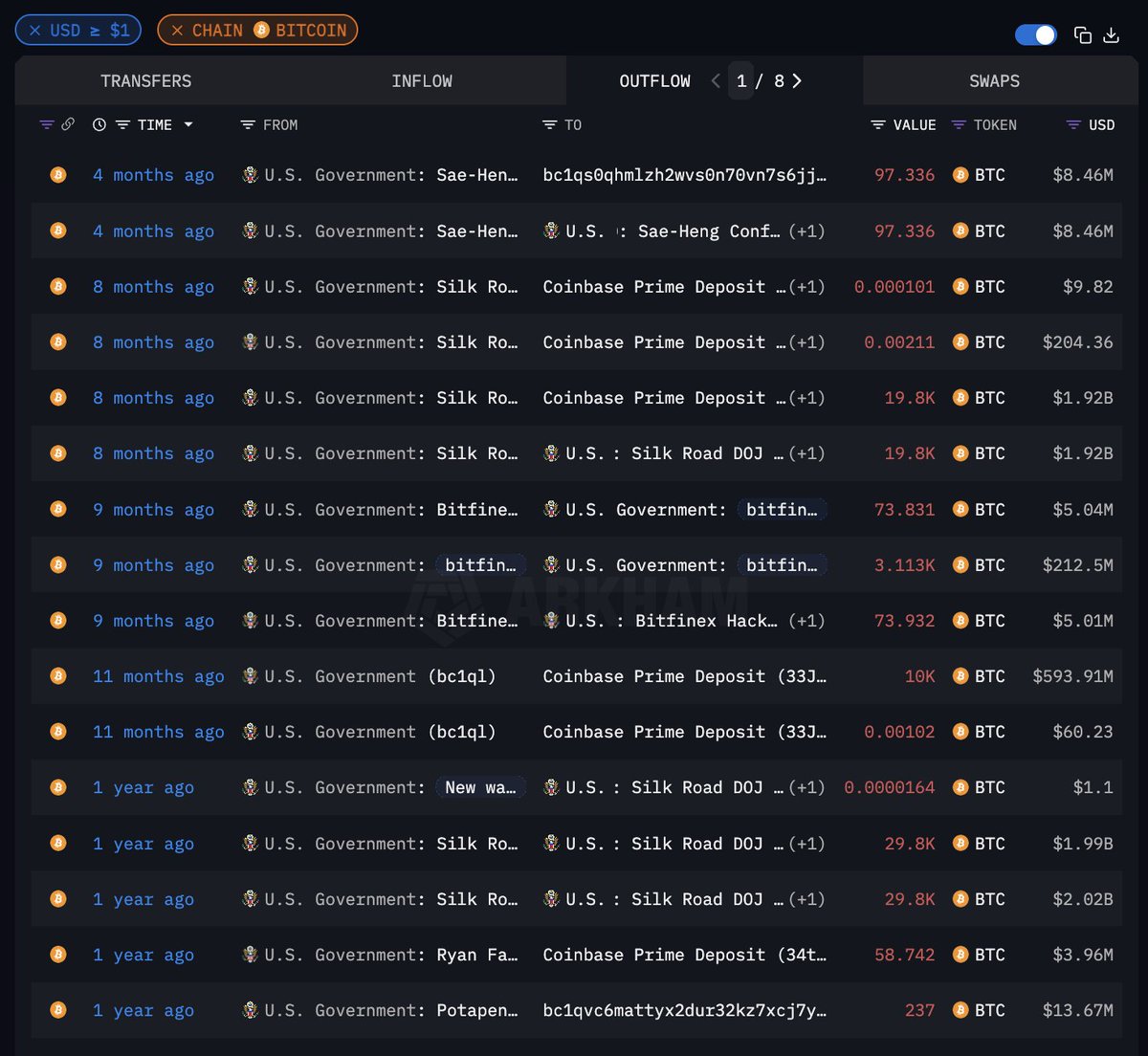

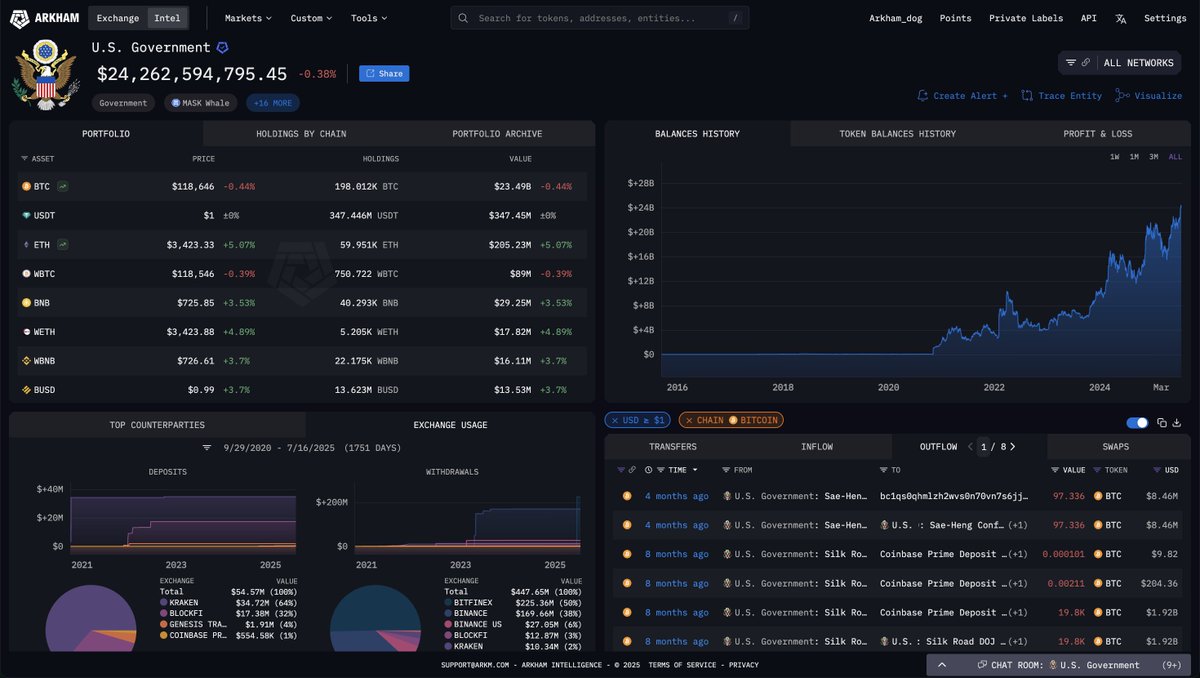

$13.65B of US Government BTC was seized from the Bitfinex Hackers.

$13.65B of US Government BTC was seized from the Bitfinex Hackers.

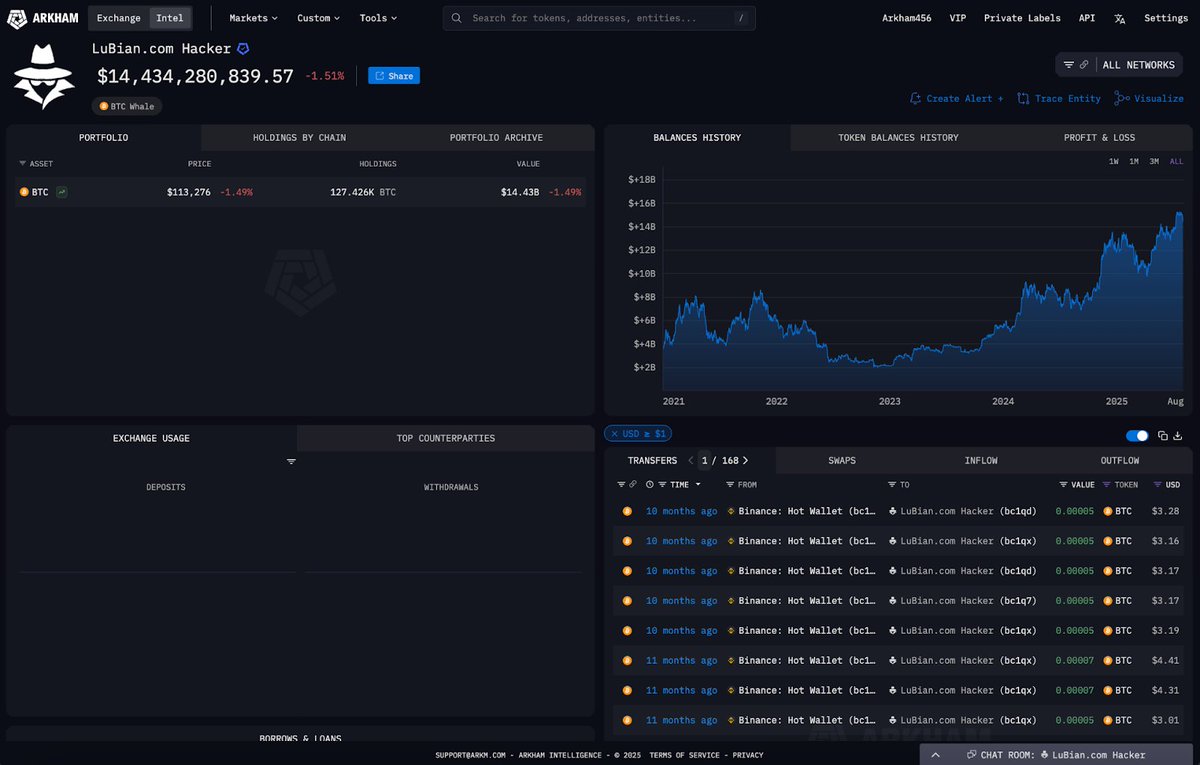

Previously, we tagged:

Previously, we tagged:

He enclosed a message in Chinese: “The CEOs of Kuande Investment: Feng Xin and Xu Yuzhi used brain-computer weapons to persecute all company employees and former employees, and even they themselves were controlled.”

He enclosed a message in Chinese: “The CEOs of Kuande Investment: Feng Xin and Xu Yuzhi used brain-computer weapons to persecute all company employees and former employees, and even they themselves were controlled.”

70% of the supply is held in 2 addresses, while 15% of supply was directly deposited into Meteora LP by the Developer address.

70% of the supply is held in 2 addresses, while 15% of supply was directly deposited into Meteora LP by the Developer address.

Ross Ulbricht’s Solana donation address received 50% of the supply of ROSS (Ross Ulbricht Fund) from the developer last week.

Ross Ulbricht’s Solana donation address received 50% of the supply of ROSS (Ross Ulbricht Fund) from the developer last week.

$TRUMP is 80% locked, with 10% for Liquidity and 10% for ‘Public Distribution’.

$TRUMP is 80% locked, with 10% for Liquidity and 10% for ‘Public Distribution’.

VIPs who open an Exchange account can earn a 10% boost on their earned points so far.

VIPs who open an Exchange account can earn a 10% boost on their earned points so far.

After moving several times from 2011-2014, his Bitcoin was then held dormant for almost 10 YEARS straight - during which it increased in value from $474K to over $80M.

After moving several times from 2011-2014, his Bitcoin was then held dormant for almost 10 YEARS straight - during which it increased in value from $474K to over $80M.

Bhutan is the 4th largest government with Bitcoin holdings on our platform, with over $750M in BTC.

Bhutan is the 4th largest government with Bitcoin holdings on our platform, with over $750M in BTC.

Runes by @rodarmor are fungible tokens running on Bitcoin. The Runes protocol will launch at block 840,000 exactly.

Runes by @rodarmor are fungible tokens running on Bitcoin. The Runes protocol will launch at block 840,000 exactly.

This deposit is connected to the account that @GCRClassic used to purchase the Achi NFT - more commonly known as dogwifhat.

This deposit is connected to the account that @GCRClassic used to purchase the Achi NFT - more commonly known as dogwifhat.

$WIF Fumble: $156M

$WIF Fumble: $156M

For ANY BTC ETF, you can now:

For ANY BTC ETF, you can now:

onchainclown.sol is a user who has traded dozens of meme coins over the past 2 months, some far weirder than others.

onchainclown.sol is a user who has traded dozens of meme coins over the past 2 months, some far weirder than others.

COQINU ran from $4k market cap to $48.9M in under 5 days - kicking off a wave of memecoin speculation on AVAX.

COQINU ran from $4k market cap to $48.9M in under 5 days - kicking off a wave of memecoin speculation on AVAX.

Aerodrome is a fork of the largest DEX on Optimism, @velodromefi.

Aerodrome is a fork of the largest DEX on Optimism, @velodromefi.

https://twitter.com/VenusProtocol/status/1692421277762412586

Last year, the BNB Bridge Exploiter stole 2M BNB tokens from BNB Chain’s Token Hub after exploiting a bug in the BNB Bridge.

Last year, the BNB Bridge Exploiter stole 2M BNB tokens from BNB Chain’s Token Hub after exploiting a bug in the BNB Bridge.

On 13th June at 7pm UTC, Egorov unstaked and removed liquidity for his LDO-ETH position, receiving $2.28M in LDO tokens and $2.23M in ETH.

On 13th June at 7pm UTC, Egorov unstaked and removed liquidity for his LDO-ETH position, receiving $2.28M in LDO tokens and $2.23M in ETH.

This transaction was performed by an arbitrage bot that used Flashloans in order to supply the capital for its transaction.

This transaction was performed by an arbitrage bot that used Flashloans in order to supply the capital for its transaction.