Ex-Founder & investment banker.

I analyse IPOs & write detailed business breakdowns & fundamental valuation theses.

Passed CFA Level 3 exam.

How to get URL link on X (Twitter) App

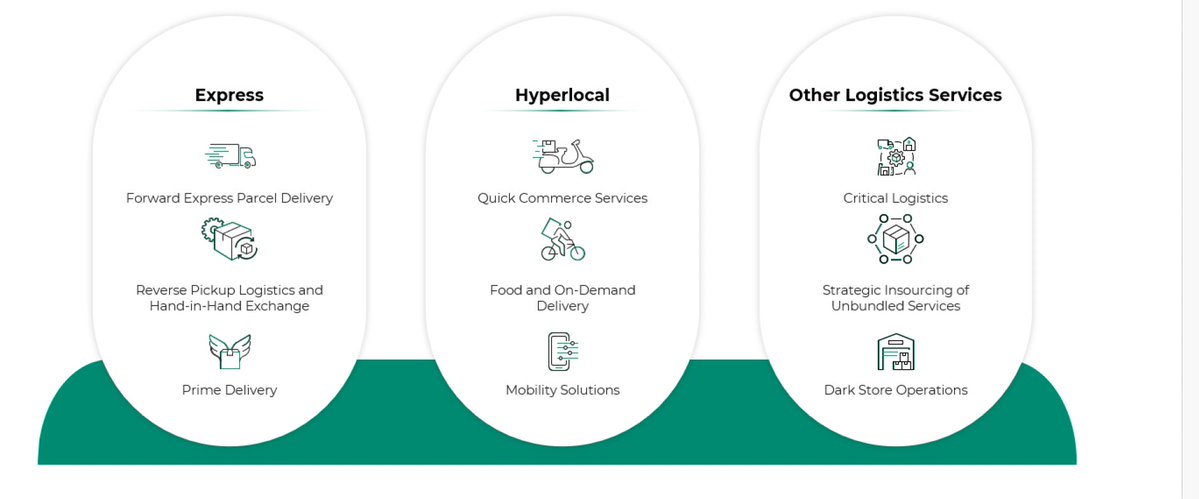

About Shadowfax (1)

About Shadowfax (1)

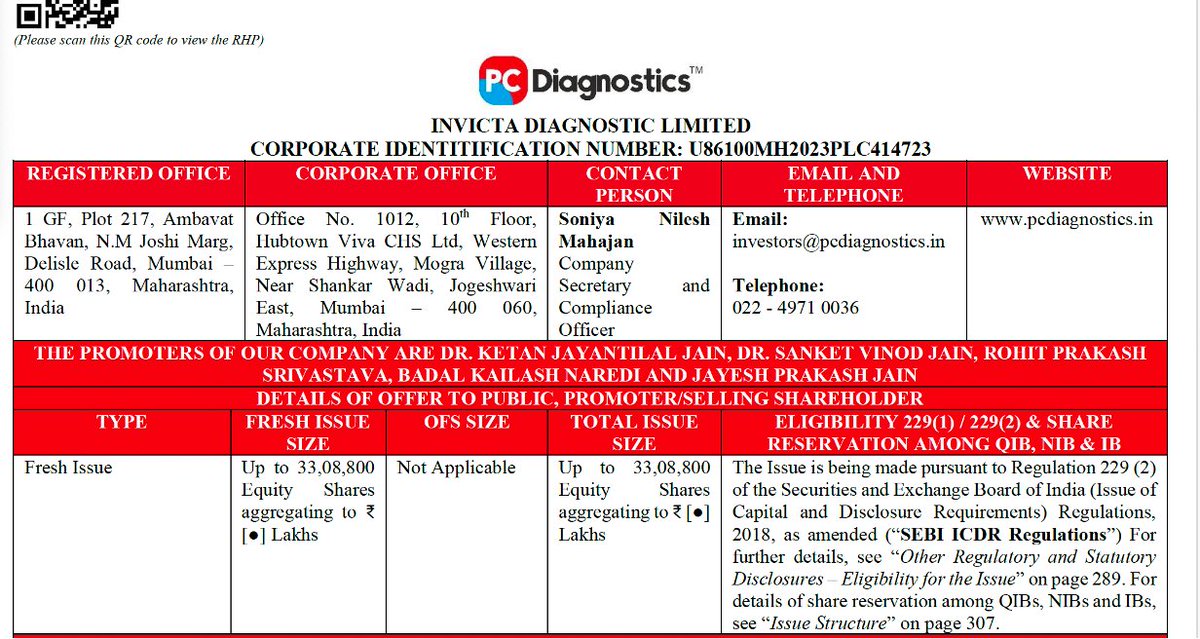

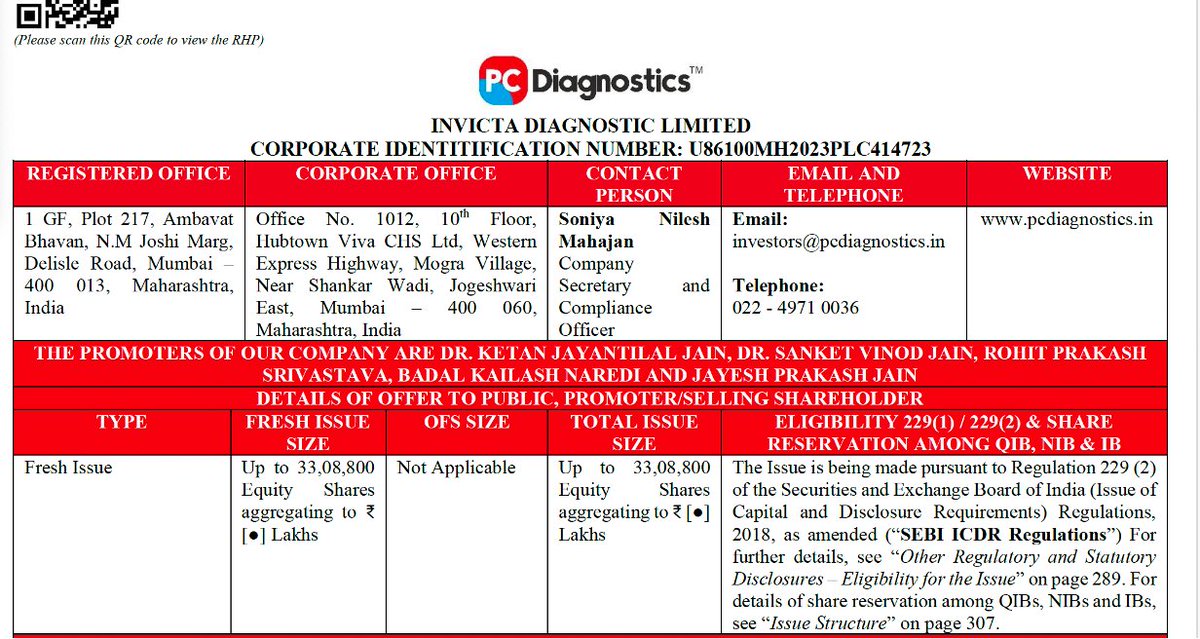

About Invicta (1)

About Invicta (1)

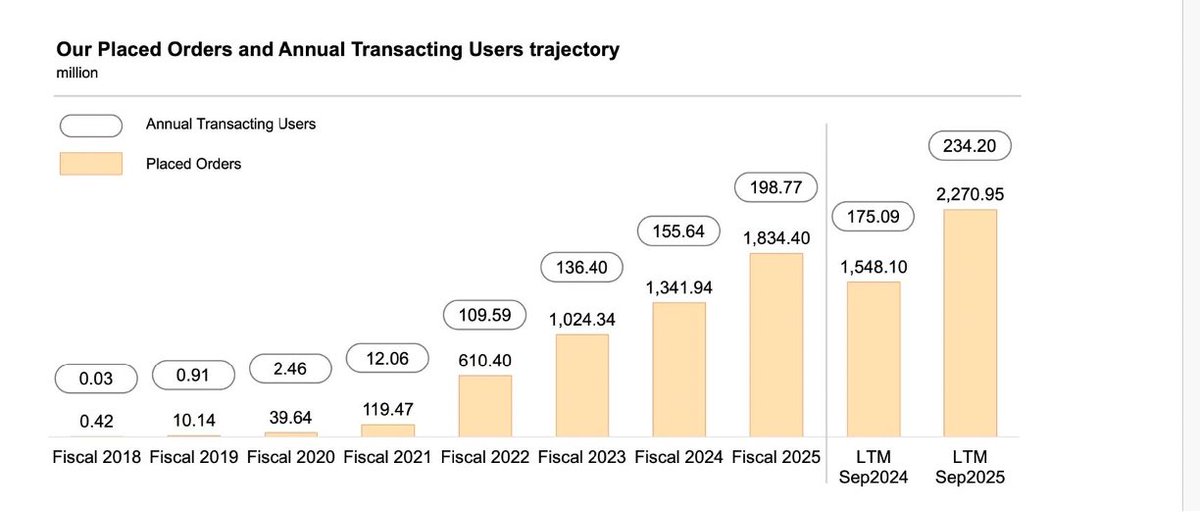

Meesho's Origin (2)

Meesho's Origin (2)

About Lenskart & Origin (2)

About Lenskart & Origin (2)

About Zappfresh/DSM Fresh Foods (2)

About Zappfresh/DSM Fresh Foods (2)

About LT Elevators (2)

About LT Elevators (2)

About Urban Company (1)

About Urban Company (1)

About Mangal Electrical Industries Limited (1)

About Mangal Electrical Industries Limited (1)

Business Model (1)

Business Model (1)

About Smartworks (1)

About Smartworks (1)

#JaybeeLamination

#JaybeeLamination

IGIL, established in Belgium in 1975, is the world’s second-largest independent Diamond certification player, with a worldwide market share of approximately 33%, competing with the Gemological Institute of America & Hoge Raad Voor Diamant (HRD).

IGIL, established in Belgium in 1975, is the world’s second-largest independent Diamond certification player, with a worldwide market share of approximately 33%, competing with the Gemological Institute of America & Hoge Raad Voor Diamant (HRD).

A quick background

A quick background

offers services in Renewable Power and Non Renewable Power sector Also holds 26% in HKRP innovations, IOT solutions provider to the energy sector (did 130 Cr in rev). Did 280 Cr in FY24, Order book of 2400Cr, expected to close 700CR in FY25.

offers services in Renewable Power and Non Renewable Power sector Also holds 26% in HKRP innovations, IOT solutions provider to the energy sector (did 130 Cr in rev). Did 280 Cr in FY24, Order book of 2400Cr, expected to close 700CR in FY25.