The world's premier investing publication since 1921.

For customer support, visit https://t.co/HkyUtq6BNr

How to get URL link on X (Twitter) App

U.S. farmers are flourishing. Deere, CNH Industrial, AGCO, and other giants of the industry are poised to benefit. barrons.com/articles/econo…

U.S. farmers are flourishing. Deere, CNH Industrial, AGCO, and other giants of the industry are poised to benefit. barrons.com/articles/econo…

That’s due to a historic run-up in home prices, a recent surge in mortgage rates, and a stubbornly low inventory of available homes.

That’s due to a historic run-up in home prices, a recent surge in mortgage rates, and a stubbornly low inventory of available homes.

Teens might not have much to invest, but brokerage firms are eagerly courting them. What to know about youth trading accounts barrons.com/articles/SB519…

Teens might not have much to invest, but brokerage firms are eagerly courting them. What to know about youth trading accounts barrons.com/articles/SB519…

How and when to retire on dividends—plus 10 dividend stocks for the long haul barrons.com/articles/yes-y…

How and when to retire on dividends—plus 10 dividend stocks for the long haul barrons.com/articles/yes-y…

GameStop is just the beginning. How the trends powering this past week will change investing barrons.com/articles/the-g…

GameStop is just the beginning. How the trends powering this past week will change investing barrons.com/articles/the-g…

For investors, Powell is arguably a more important figure in Washington than whoever will occupy the White House come 2021. Here's why barrons.com/articles/why-j…

For investors, Powell is arguably a more important figure in Washington than whoever will occupy the White House come 2021. Here's why barrons.com/articles/why-j…

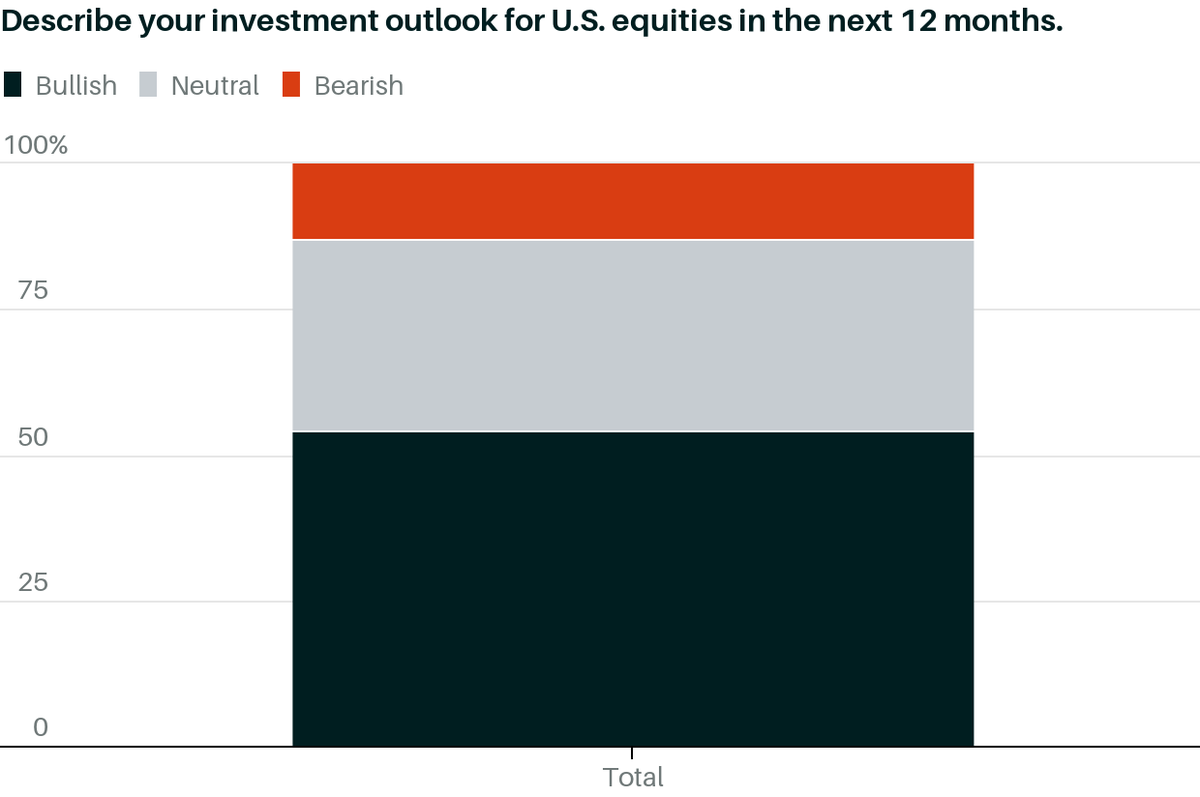

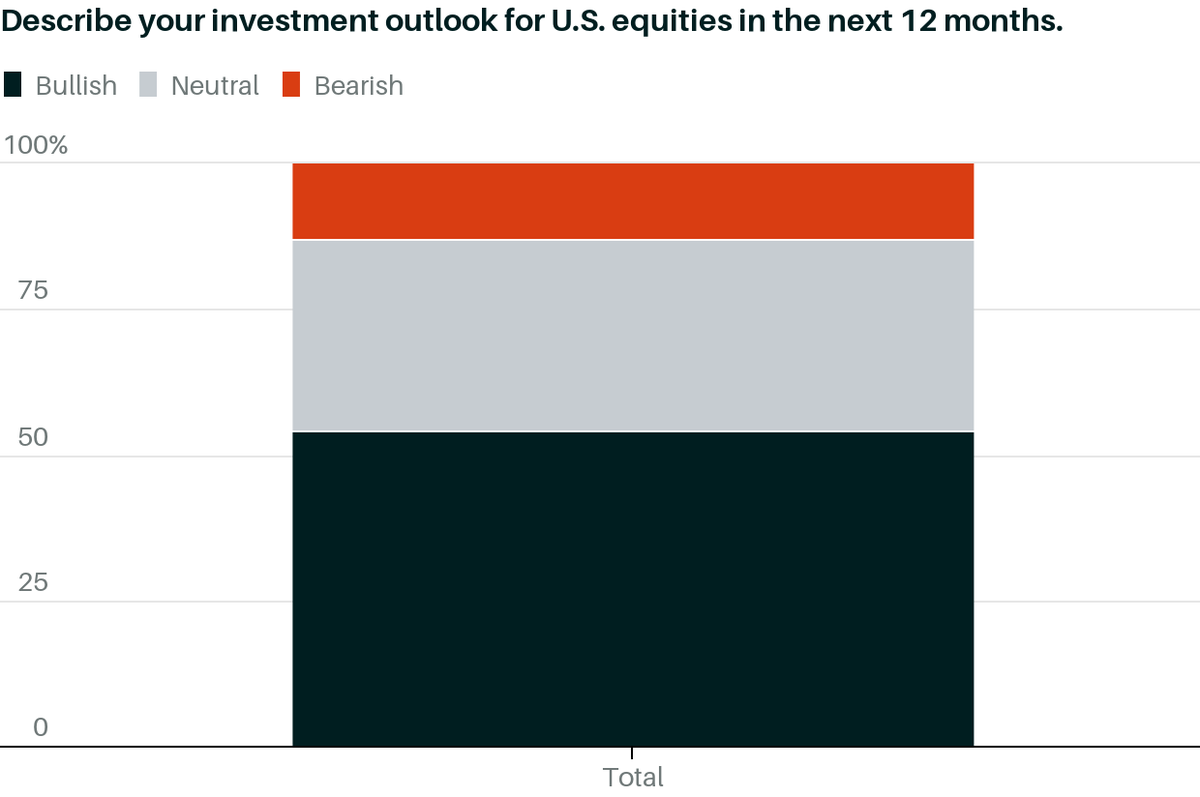

In an exclusive Barron’s survey of U.S. money managers, respondents say they’re bullish on the prospects for stocks after a year of turmoil. Here’s how they’re planning to put money to work on.barrons.com/3o9pYS6

In an exclusive Barron’s survey of U.S. money managers, respondents say they’re bullish on the prospects for stocks after a year of turmoil. Here’s how they’re planning to put money to work on.barrons.com/3o9pYS6