"Accruals capture adjustments reflecting performance, whereas abnormal accruals are induced by management to distort earnings."

How to get URL link on X (Twitter) App

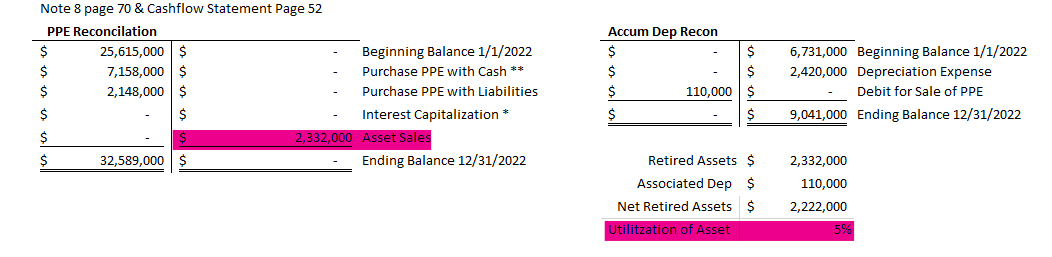

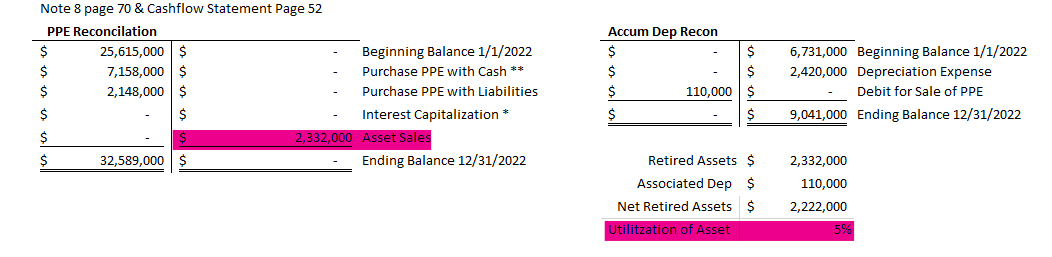

Attached are the journal entries with the calculation. IT IS AN ESTIMATION SO ACCEPT IT AS SUCH. The loss is an historical estimate. $239mm potentially over capitalized. (2/8)

Attached are the journal entries with the calculation. IT IS AN ESTIMATION SO ACCEPT IT AS SUCH. The loss is an historical estimate. $239mm potentially over capitalized. (2/8)