Your everyday wizard. Research and views are not financial advice.

7 subscribers

How to get URL link on X (Twitter) App

II. TL;DR of pre-story:

II. TL;DR of pre-story:https://twitter.com/1453619273503494144/status/1957853410650099899

II.

II.

II. "... @berachain has 'bear' in the name—it's down 65% since its ATH. @redstone_defi has 'red' in the name—will this become a coincidence?"

II. "... @berachain has 'bear' in the name—it's down 65% since its ATH. @redstone_defi has 'red' in the name—will this become a coincidence?"

II. "The rails are here, it's time to build."

II. "The rails are here, it's time to build."https://twitter.com/1442176296356696064/status/1883215570591768692

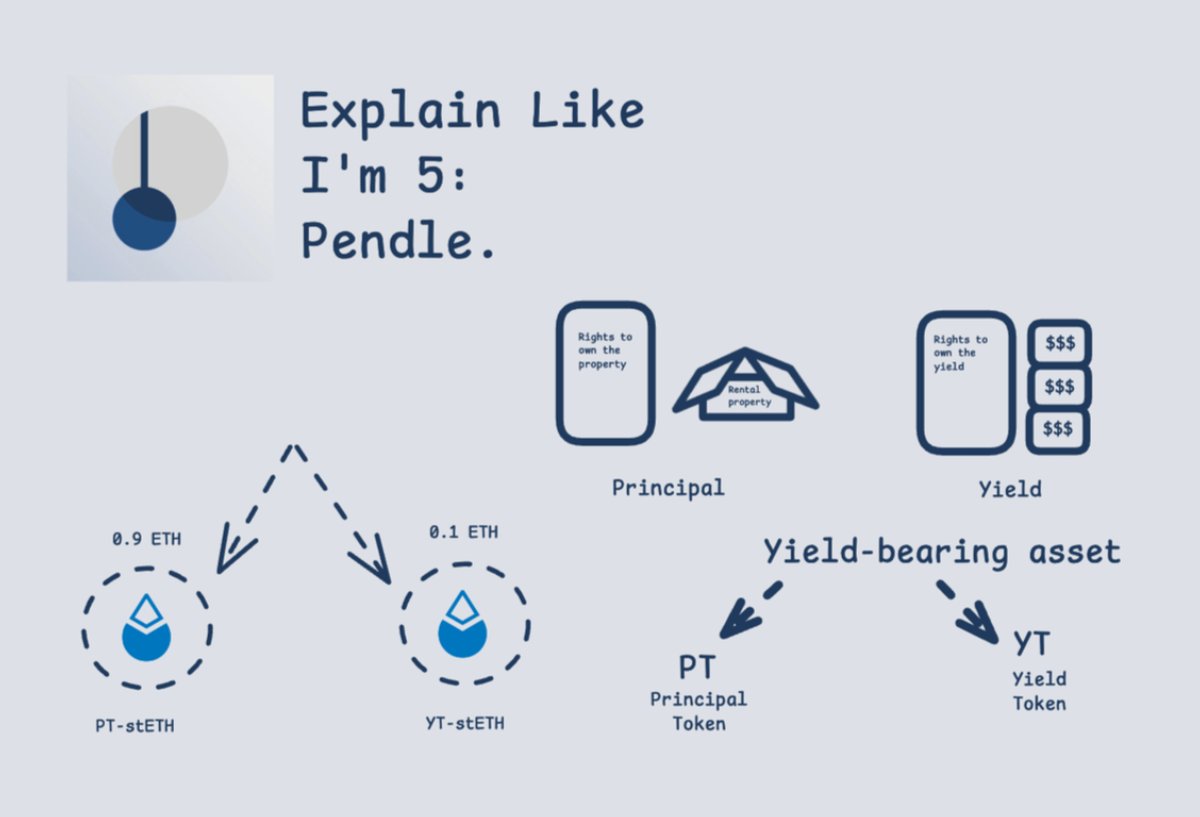

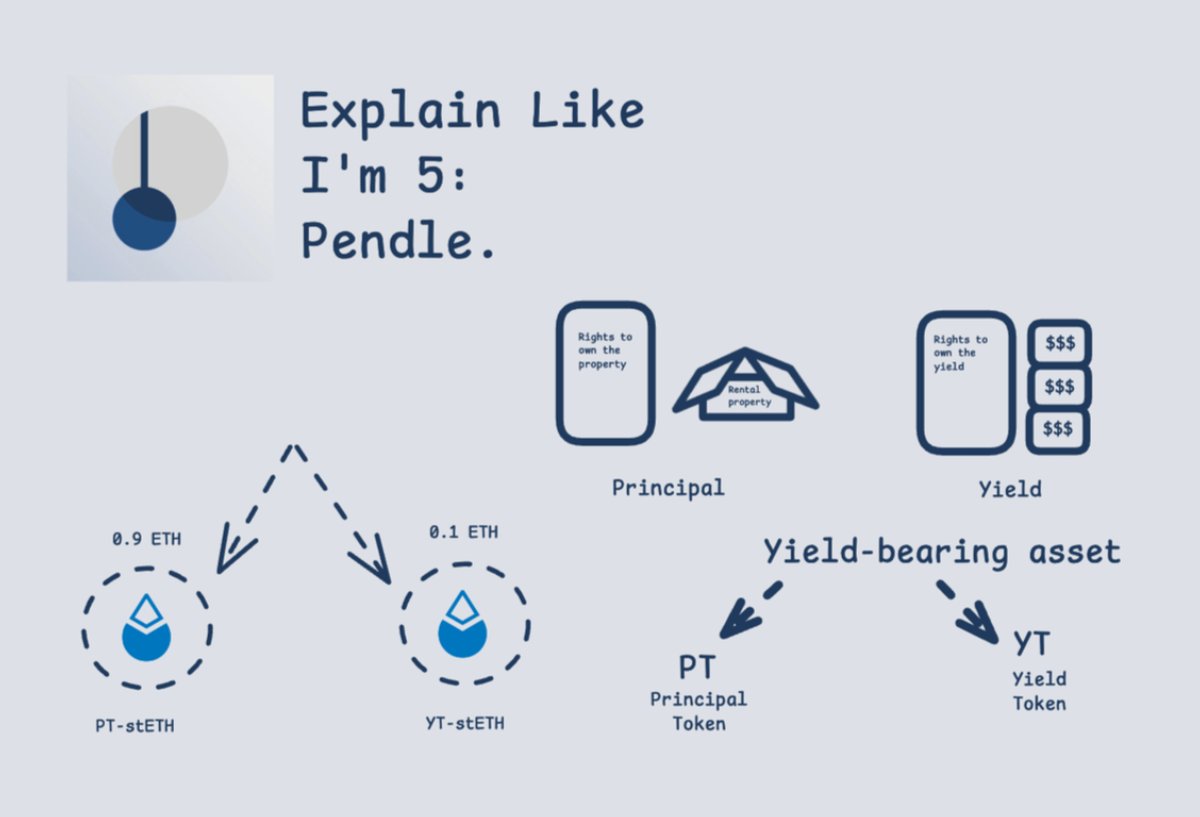

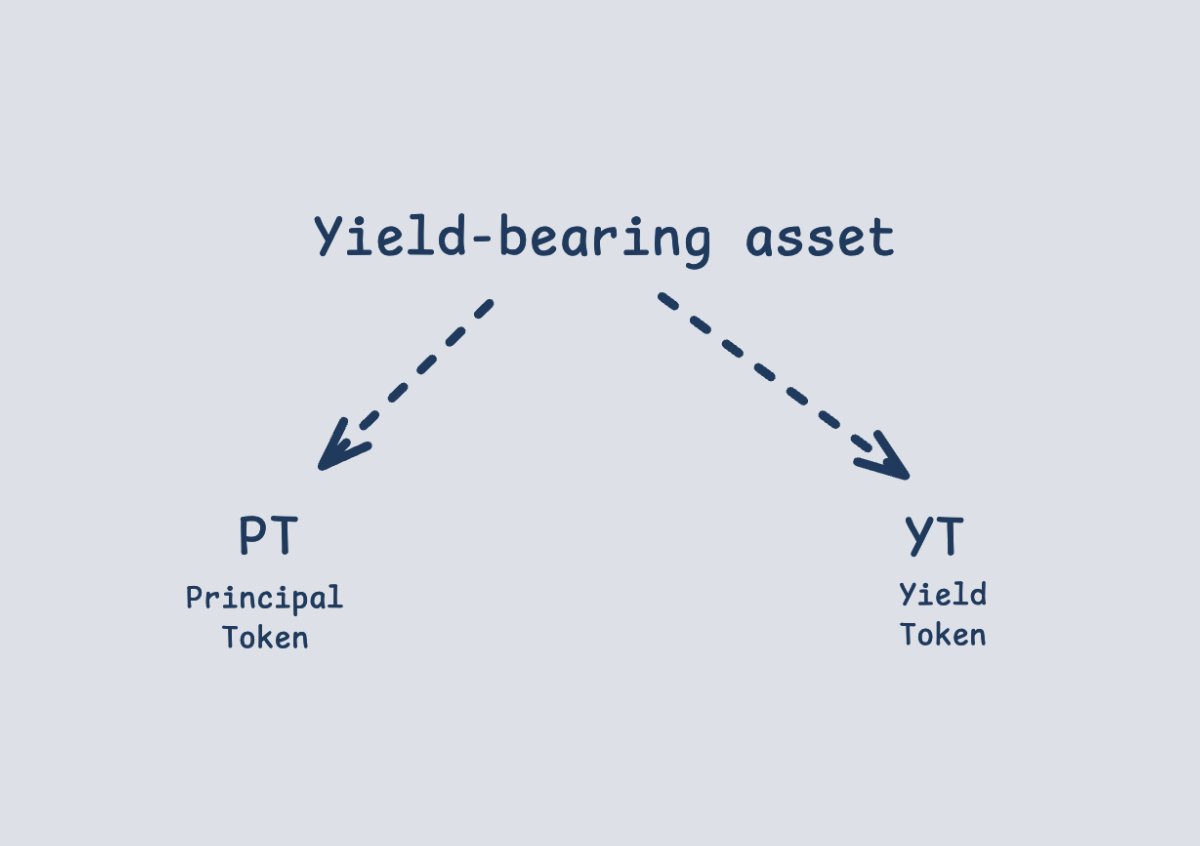

II. "Tbh, @pendle_fi is hard... I know people who struggle to understand its concept."

II. "Tbh, @pendle_fi is hard... I know people who struggle to understand its concept."

II. Chainlink is at the heart of the newly built financial rail, connecting TradFi with blockchains.

II. Chainlink is at the heart of the newly built financial rail, connecting TradFi with blockchains.

II. Firstly,

II. Firstly,https://twitter.com/shawmakesmagic/status/1874489537810083966

II. Before we start, here's a (hyper) fun fact: @MicroStrategy convinced investors to pay $520K per Bitcoin.

II. Before we start, here's a (hyper) fun fact: @MicroStrategy convinced investors to pay $520K per Bitcoin.

II.

II.

II. Disclaimer: @0xkyle__ is the author of "hypenai16z thesis."

II. Disclaimer: @0xkyle__ is the author of "hypenai16z thesis."

II. Why future? Why machine learning? Why do I even mention AI Agents? Predict macroconditions? Why parallel universes and its implications?

II. Why future? Why machine learning? Why do I even mention AI Agents? Predict macroconditions? Why parallel universes and its implications?https://twitter.com/14130366/status/1866167429367468422

II. "Oh, don't make it too complicated, make ELI5, please"

II. "Oh, don't make it too complicated, make ELI5, please"

II. Before we start, I'd like to ask you a favor - to look at the numbers:

II. Before we start, I'd like to ask you a favor - to look at the numbers:

II. Binance will have no choice but to list $GOAT.

II. Binance will have no choice but to list $GOAT.

II. "What are you talking about??"

II. "What are you talking about??"

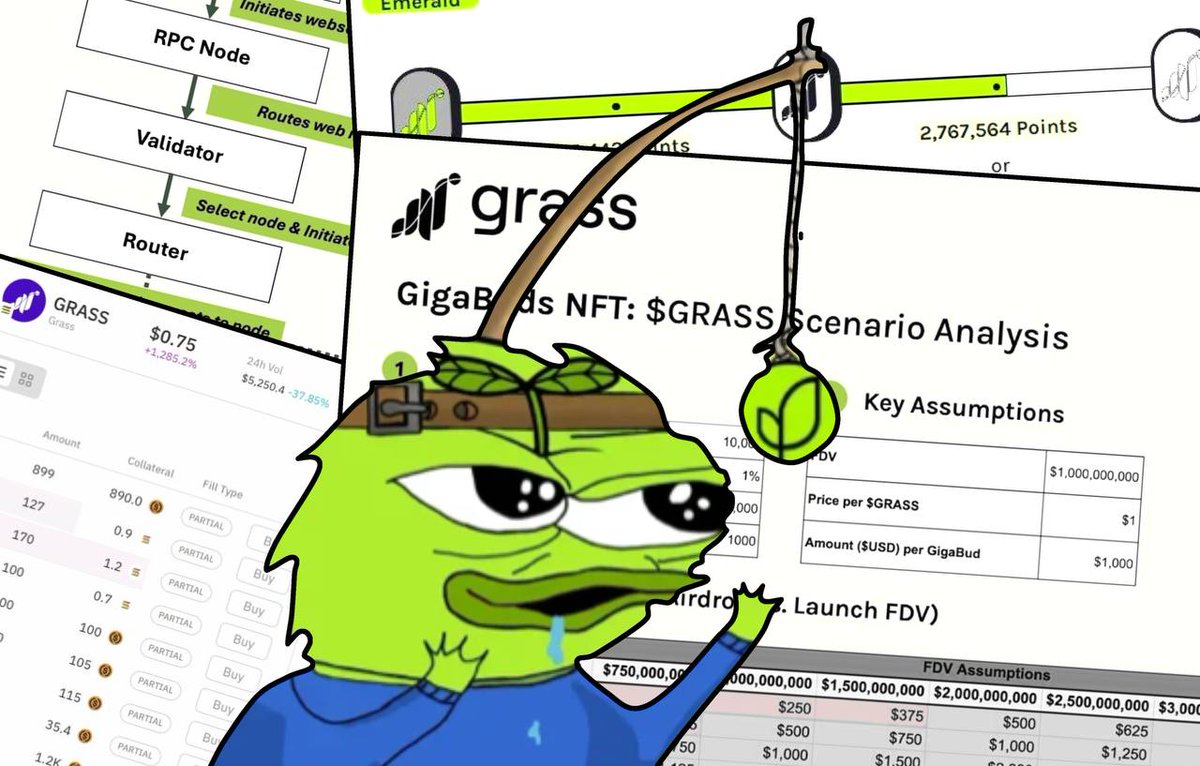

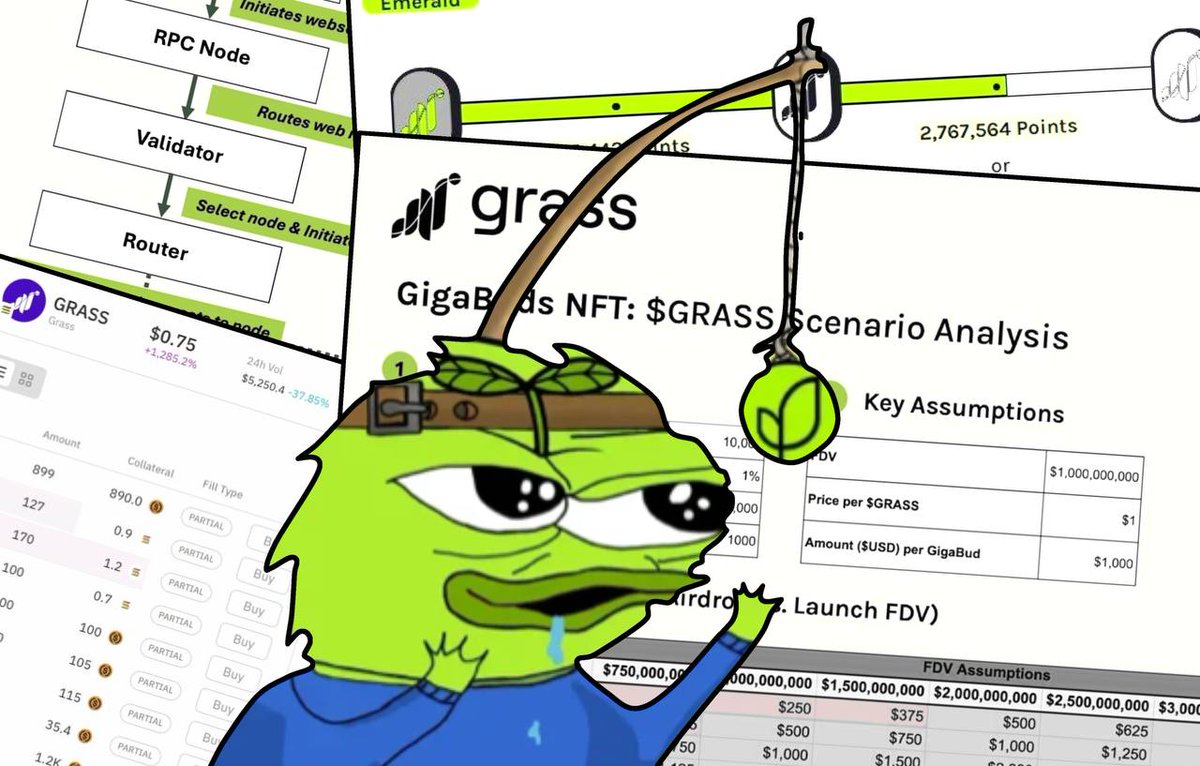

II. The amount of Series A raise is not disclosed yet, but it is estimated to have brought @getgrass_io's valuation to ~$1B.

II. The amount of Series A raise is not disclosed yet, but it is estimated to have brought @getgrass_io's valuation to ~$1B.

II. TL;DR:

II. TL;DR: