How to get URL link on X (Twitter) App

https://x.com/SheaKetsdever/status/1861480598000304148

Today 95% of blocks on Ethereum are built by just two parties. This centralization threatens Ethereum's neutrality and resilience.

Today 95% of blocks on Ethereum are built by just two parties. This centralization threatens Ethereum's neutrality and resilience.

https://twitter.com/blairlmarshall/status/1726661383184683070

https://twitter.com/bertcmiller/status/1536738736372842497

https://twitter.com/BowTiedPickle/status/1634415551450587138The user's $2m ended up in a Uni v2 pool, which an MEV bot was quick to snatch up for basically nothing of course. They paid a premium to a miner for this $2m but it really wasn't anything (~20 ETH).

https://twitter.com/BowTiedPickle/status/1634415557708509184

MEV-Share builds on MEV-Boost by further unbundling the transaction supply chain.

MEV-Share builds on MEV-Boost by further unbundling the transaction supply chain. https://twitter.com/bertcmiller/status/1613257826654392320h/t: @YannickCrypto

https://twitter.com/danielmckinn0n/status/1597619887018737664

This is also the *exact opposite* of what we want. MEV should be open, permissionless and transparent - not driven by business development done behind closed doors 😬

This is also the *exact opposite* of what we want. MEV should be open, permissionless and transparent - not driven by business development done behind closed doors 😬

https://twitter.com/hasufl/status/1595492544074305539

https://twitter.com/bertcmiller/status/1592549848234196993

MEV-Boost was created to mitigate the centralization risk that MEV posed to Ethereum validators.

MEV-Boost was created to mitigate the centralization risk that MEV posed to Ethereum validators.

https://twitter.com/phildaian/status/1330868059603611649

Proposer profit - the difference between what the proposer is paid for a block and what the the value of a mempool block would have been

Proposer profit - the difference between what the proposer is paid for a block and what the the value of a mempool block would have beenhttps://twitter.com/PhABCD/status/1395017173006012418Some details in case you're curious. I believe the conclusion was he could've been liquidated but wasn't by chance and a bunch of bot misfires.

https://twitter.com/bertcmiller/status/1395090885092773892

1inch routing tries to not keep erc20 tokens in its router, but occasionally leaves dollars of tokens in the router for gas reasons

1inch routing tries to not keep erc20 tokens in its router, but occasionally leaves dollars of tokens in the router for gas reasons

If we dig into the rescuer's transaction history we can see them rapidly making a lot of transactions to themself, then deploying the rescue transaction

If we dig into the rescuer's transaction history we can see them rapidly making a lot of transactions to themself, then deploying the rescue transaction

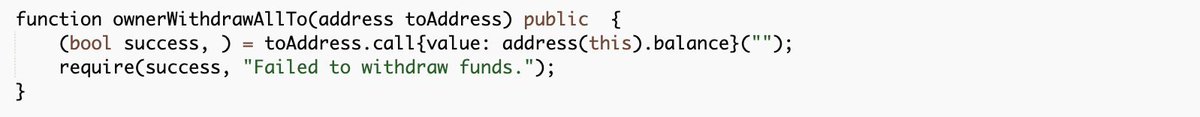

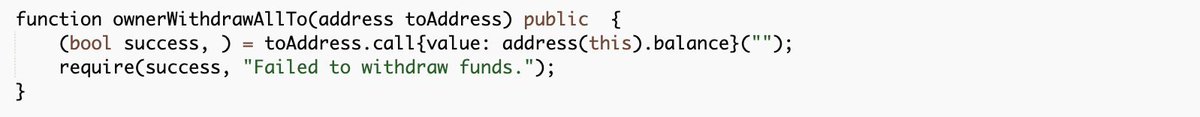

The vulnerability here is simple.

The vulnerability here is simple.