How to get URL link on X (Twitter) App

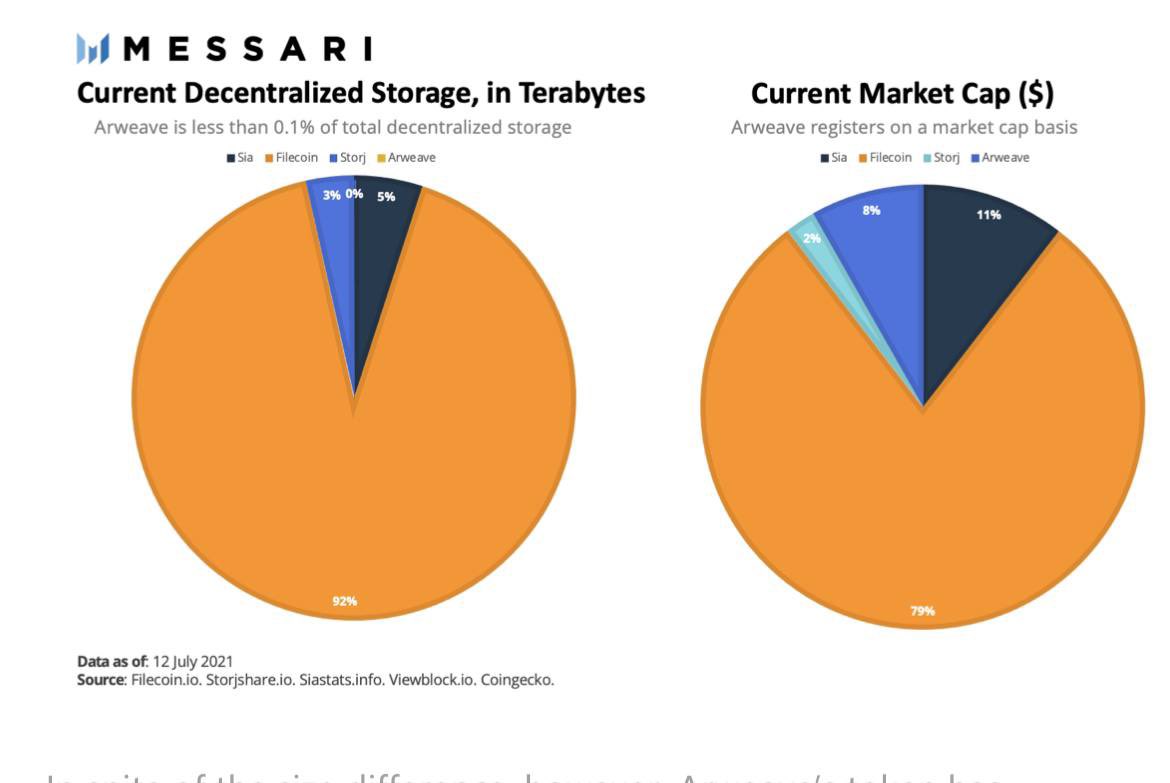

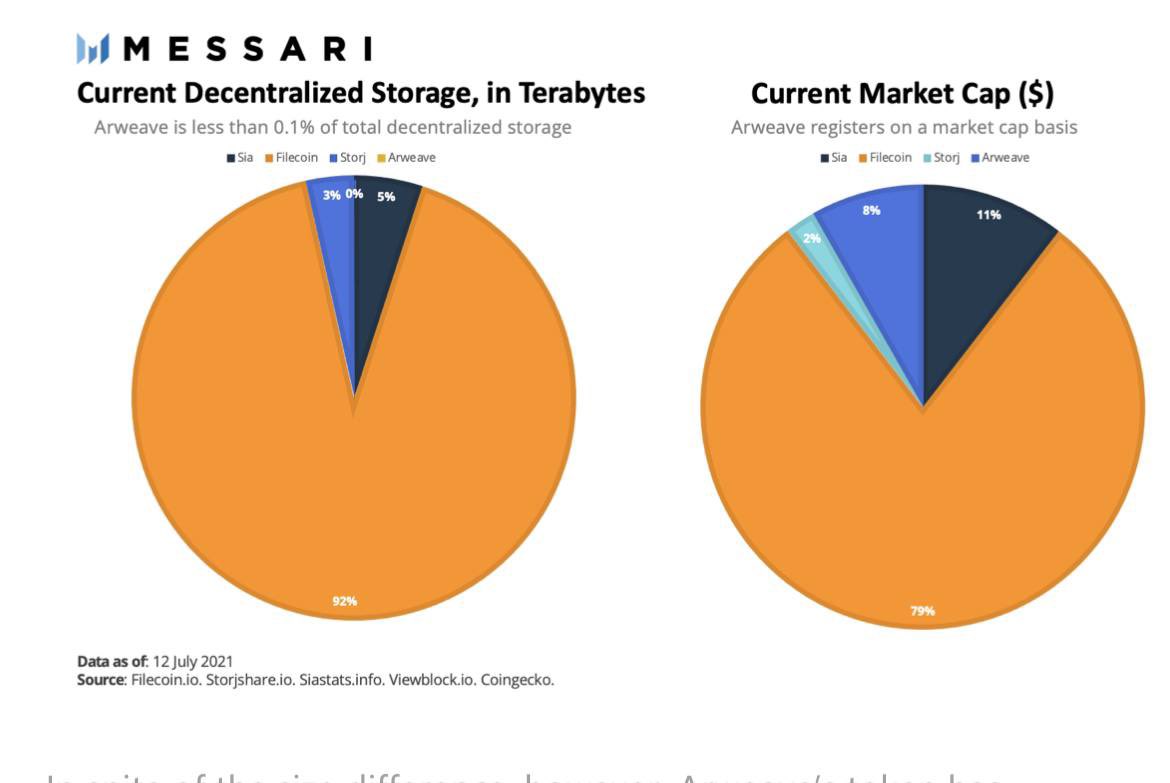

2) Why we need decentralised data storage? Public chain like Ethereum ain’t design for data storage,the cost to same size of data on it is million times higher than web2 clouding computing & storage service. So normally only BLL and DAL data will stored on the etherum.

2) Why we need decentralised data storage? Public chain like Ethereum ain’t design for data storage,the cost to same size of data on it is million times higher than web2 clouding computing & storage service. So normally only BLL and DAL data will stored on the etherum.

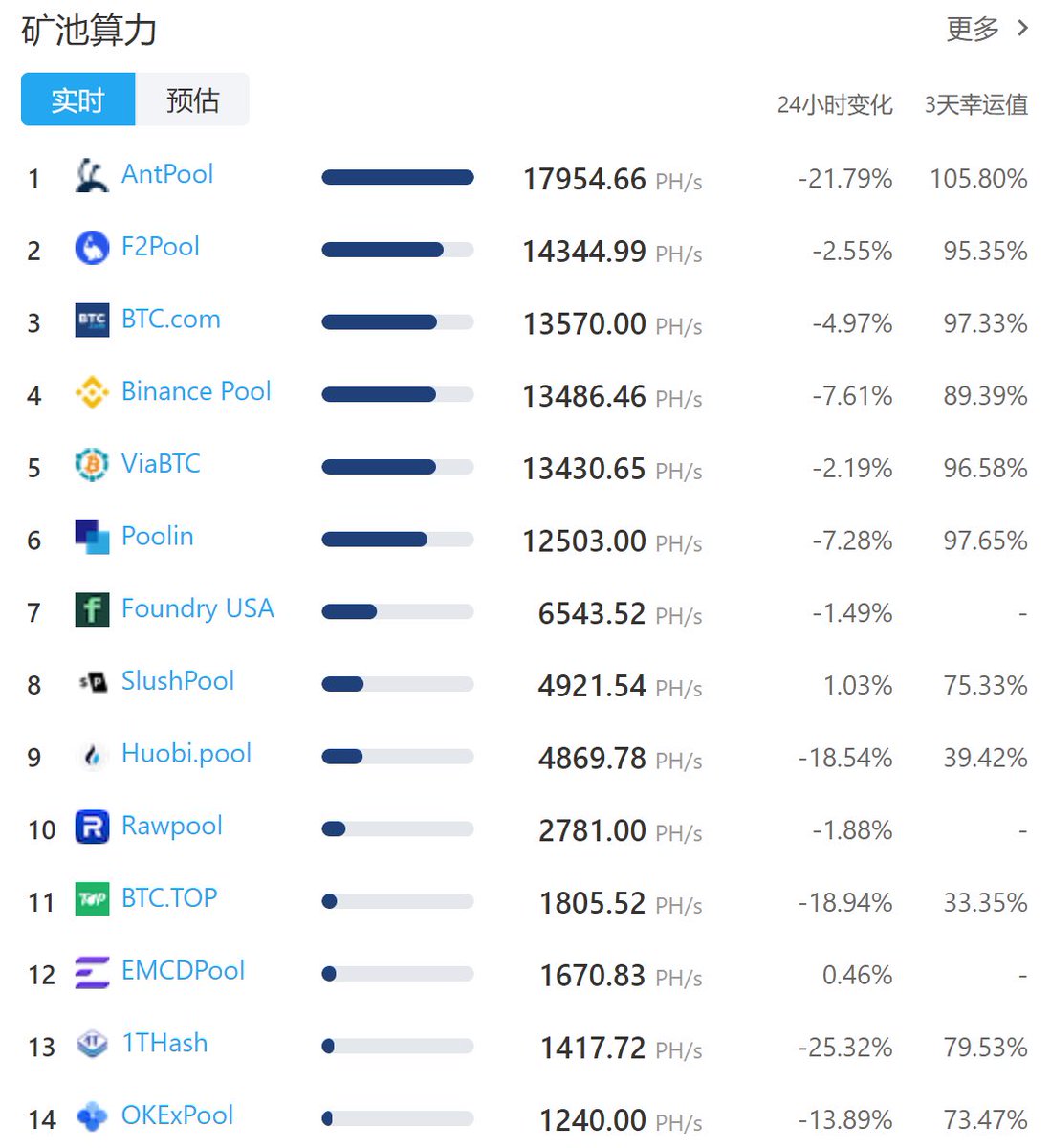

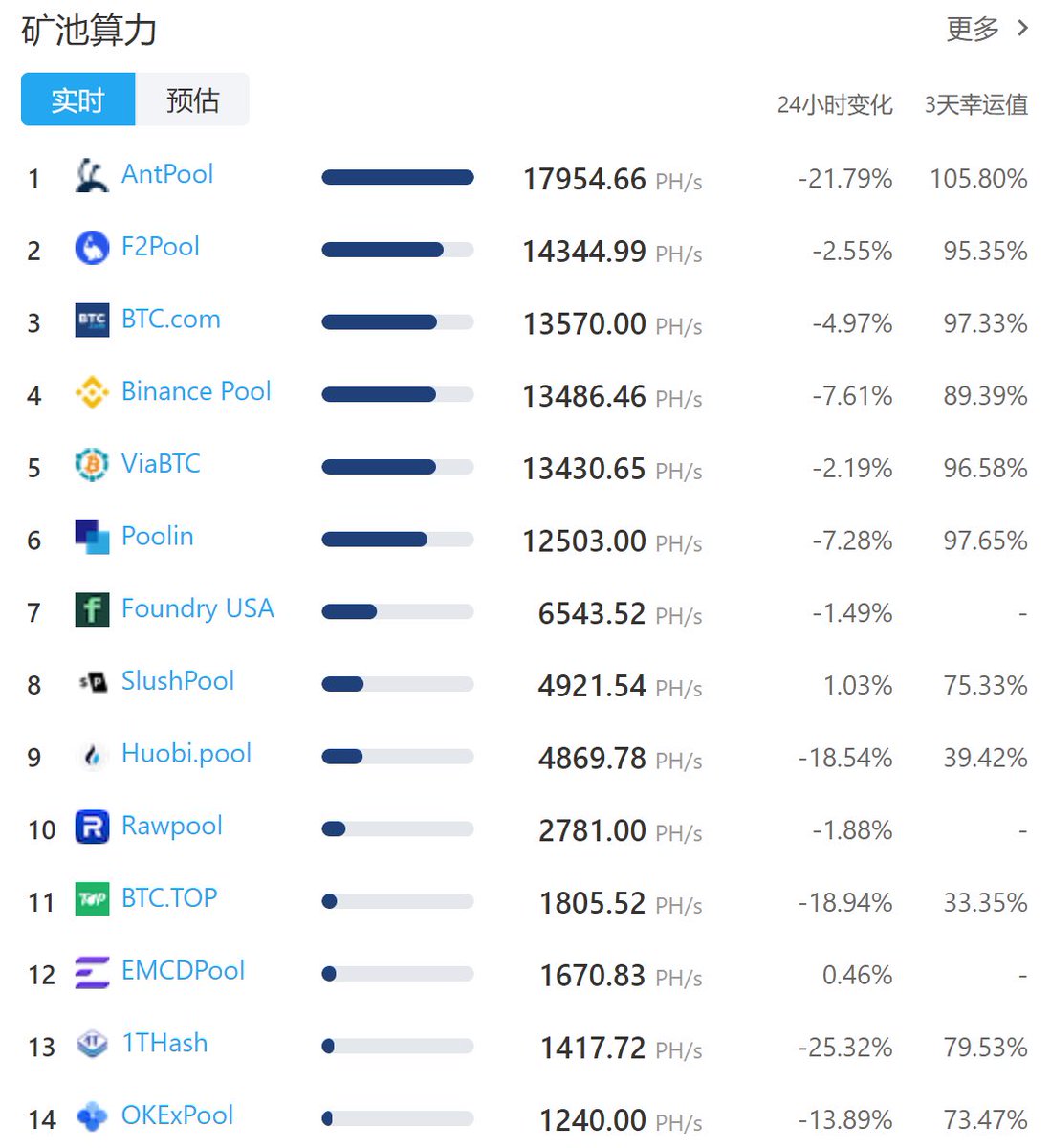

Some mining farms already starting shutdown their facilities.

Some mining farms already starting shutdown their facilities.

2.Curve’s multi-chain plan

2.Curve’s multi-chain plan