Business & Management l Economics of Strategy I Circular Economy l SAP ERP technologies l Analytics l Contrarian, insightful and omniscient l Arsenal

How to get URL link on X (Twitter) App

2) 🇿🇼 *2003 - RBZ PRINTS BEARERS CHEQUE.* Zimbabwe is now producing less than half its 1996 exports. Pressure is building. That September, RBZ introduces bearer cheques in denominations of $5,000, $10,000 and $20,000. Initially, the bearer cheques are only valid up to January 31, 2004. Again there is a lot of looting at RBZ and other banks by Zanu PF cronies. Zimbabwe’s reserves are down to under US$20 million, about 3 days’ worth of imports.

2) 🇿🇼 *2003 - RBZ PRINTS BEARERS CHEQUE.* Zimbabwe is now producing less than half its 1996 exports. Pressure is building. That September, RBZ introduces bearer cheques in denominations of $5,000, $10,000 and $20,000. Initially, the bearer cheques are only valid up to January 31, 2004. Again there is a lot of looting at RBZ and other banks by Zanu PF cronies. Zimbabwe’s reserves are down to under US$20 million, about 3 days’ worth of imports.

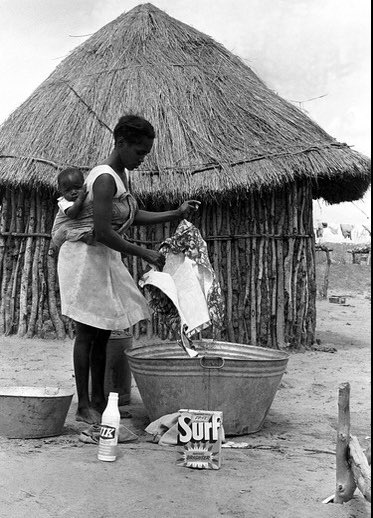

2. Rhodesia's economy was heavily reliant on agriculture, especially tobacco and maize production. In the 1970s, the country faced economic challenges, including a decline in agricultural productivity due to droughts, sanctions and a decrease in investment and foreign aid.

2. Rhodesia's economy was heavily reliant on agriculture, especially tobacco and maize production. In the 1970s, the country faced economic challenges, including a decline in agricultural productivity due to droughts, sanctions and a decrease in investment and foreign aid.

2. Under the Rhodesian model, the government pursued a policy of economic self-sufficiency, with a focus on developing domestic industries and reducing dependence on imports. The government also placed a strong emphasis on maintaining low inflation and a stable currency.

2. Under the Rhodesian model, the government pursued a policy of economic self-sufficiency, with a focus on developing domestic industries and reducing dependence on imports. The government also placed a strong emphasis on maintaining low inflation and a stable currency.

2. West Germany company Giesecke & Devrient was printing money for the Rhodesian government and Rhodesia used to send gold to Germany to insert into the R$ notes. And this created a channel for gold smuggling to Germany which was not a UN member when UN sanctions were agreed.

2. West Germany company Giesecke & Devrient was printing money for the Rhodesian government and Rhodesia used to send gold to Germany to insert into the R$ notes. And this created a channel for gold smuggling to Germany which was not a UN member when UN sanctions were agreed.