Rebellionaire | World-first, unique, balanced Tesla research | AI & Technology | NVIDIA | 🔋🕵🏻♂️

2 subscribers

How to get URL link on X (Twitter) App

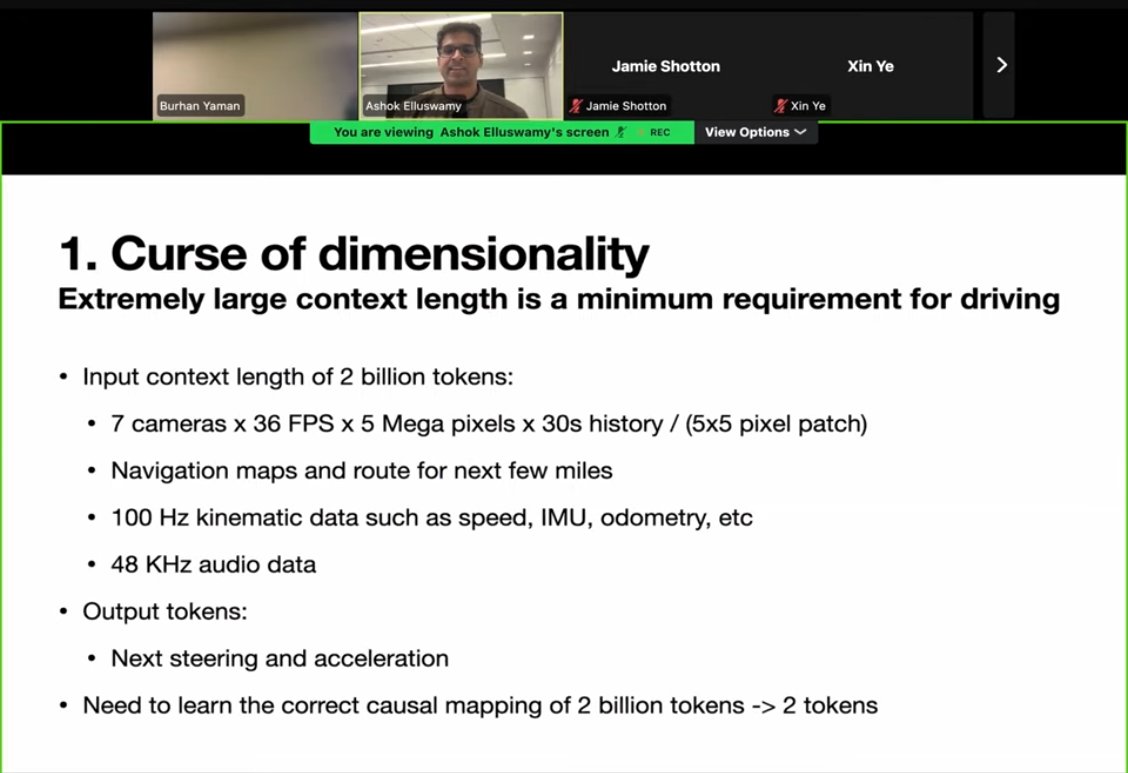

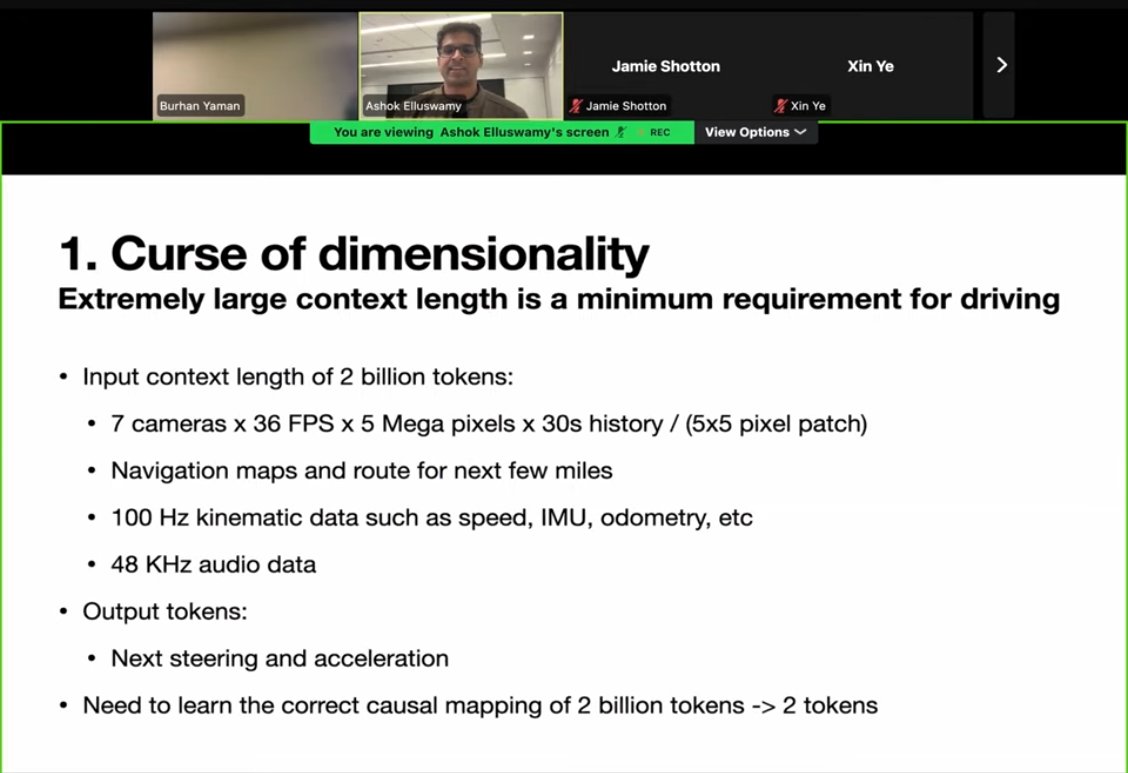

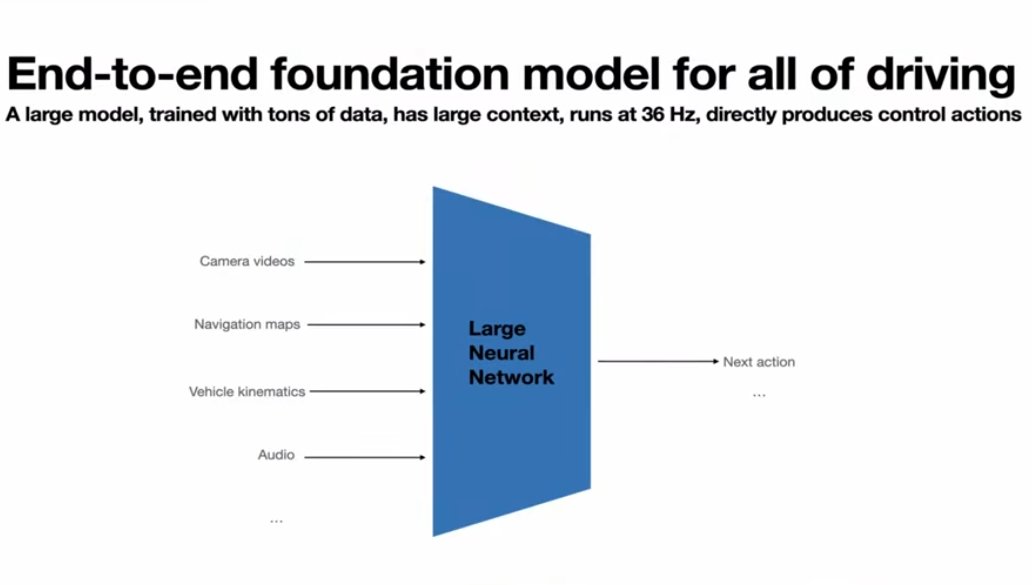

The system uses a single large end-to-end neural network. Pixels and sensor data go in → steering and acceleration come out. No explicit perception modules. Raw video streams directly to actions. This approach has been powering Tesla's FSD for years now.

The system uses a single large end-to-end neural network. Pixels and sensor data go in → steering and acceleration come out. No explicit perception modules. Raw video streams directly to actions. This approach has been powering Tesla's FSD for years now.

https://twitter.com/ray4tesla/status/1868836843929977256Most bulls fear losing shares in a revaluation scenario (and $TSLA moons). So we asked ourselves, how did a simple covered call strategy work in 2020 when the stock went up 730%?

‘The U.S. Department of Defense must act now. CATL, a Chinese battery company, threatens our national security. It has ties to the Chinese Communist Party and military. We need to put CATL on the Section 1260H List. This list names Chinese military companies working in the U.S.’

‘The U.S. Department of Defense must act now. CATL, a Chinese battery company, threatens our national security. It has ties to the Chinese Communist Party and military. We need to put CATL on the Section 1260H List. This list names Chinese military companies working in the U.S.’

https://twitter.com/SawyerMerritt/status/1823087544621543856Now there is no line for Foundation Series and Tesla is asking, "Anyone else? Final chance!"

https://twitter.com/matchasmmatt/status/1700135090276257814

🫃🏻 Smaller size and lighter weight.

🫃🏻 Smaller size and lighter weight. https://twitter.com/alexlavelle5/status/1636036238623887362🔧Legacy auto focused on incremental improvements, missing disruptive electric vehicles potential.🔋 2/

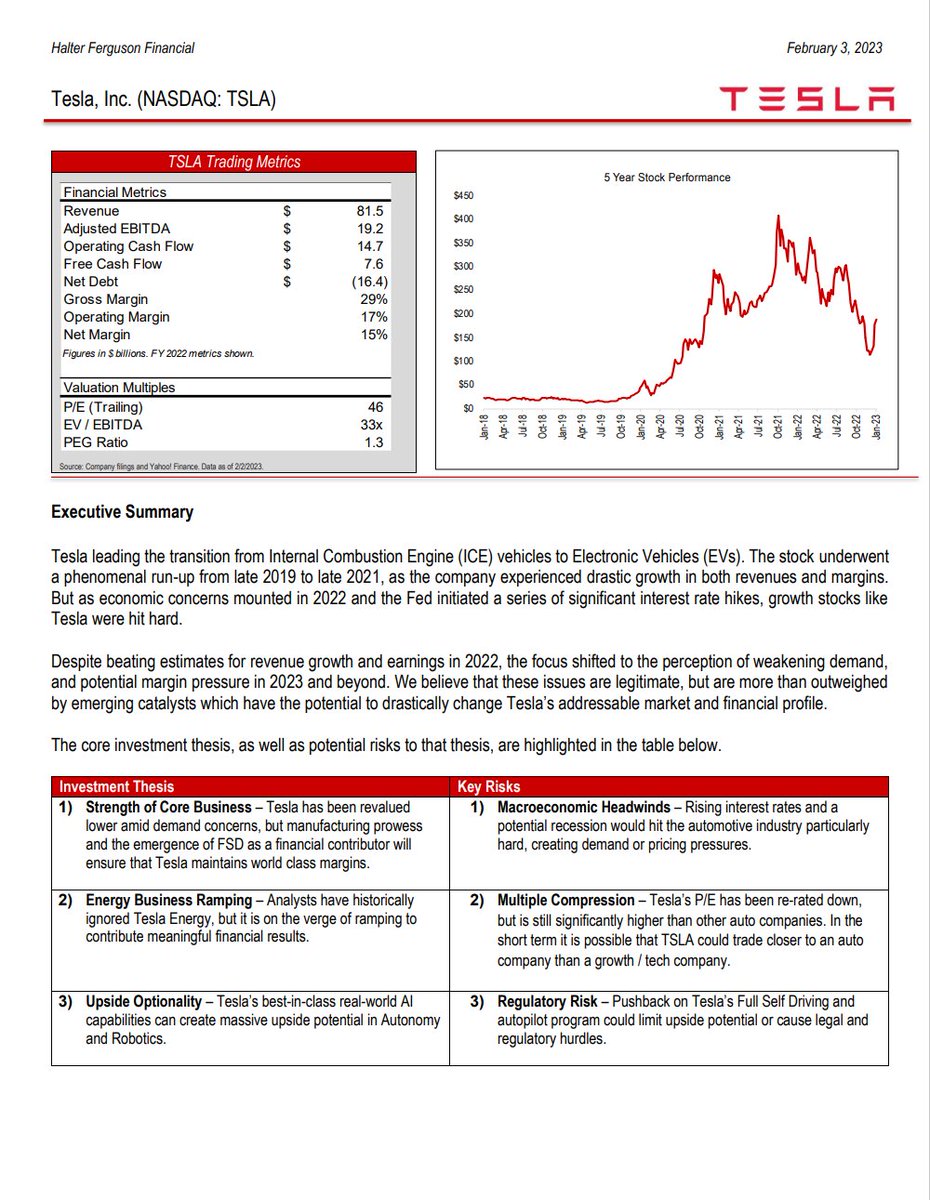

$TSLA underwent a phenomenal run-up from late 2019 to late 2021 as the company experienced drastic growth in both revenues and margins. But as economic concerns mounted in 2022 and the Fed initiated a series of sharp interest rate hikes, growth stocks like Tesla were hit hard.

$TSLA underwent a phenomenal run-up from late 2019 to late 2021 as the company experienced drastic growth in both revenues and margins. But as economic concerns mounted in 2022 and the Fed initiated a series of sharp interest rate hikes, growth stocks like Tesla were hit hard.

https://twitter.com/divestech/status/1622557086570741760Many of these incremental price upgrades recently have the feeling of what I term as “bandwagon following.”

https://twitter.com/bradsferguson/status/1622296589413801991It wasn’t because investors got robbed by Wall Street.

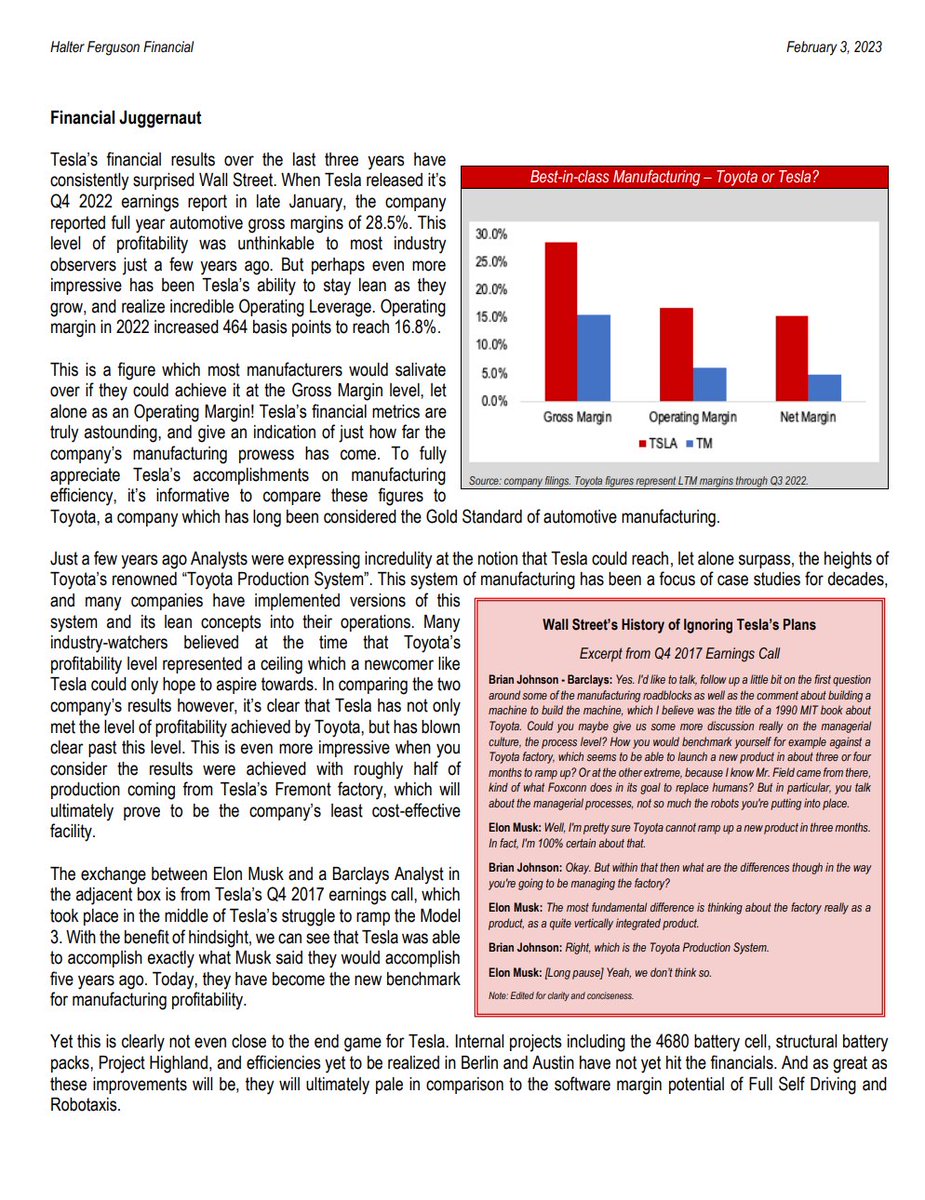

On pages 3 & 4, we discuss how $TSLA became a financial juggernaut, surpassed Toyota in manufacturing prowess, and begin to peel back the onion on Tesla Megapack.

On pages 3 & 4, we discuss how $TSLA became a financial juggernaut, surpassed Toyota in manufacturing prowess, and begin to peel back the onion on Tesla Megapack.

I had to show off my Orange Theory Fitness "Hell Week" shirt in the video. 4 tough workouts

I had to show off my Orange Theory Fitness "Hell Week" shirt in the video. 4 tough workouts

https://twitter.com/TeslaBoomerMama/status/1565720048521453568A distracted management would have added new models as Giga Texas and Giga Berlin scale for the first time. Instead, Tesla's mgmt is focused.