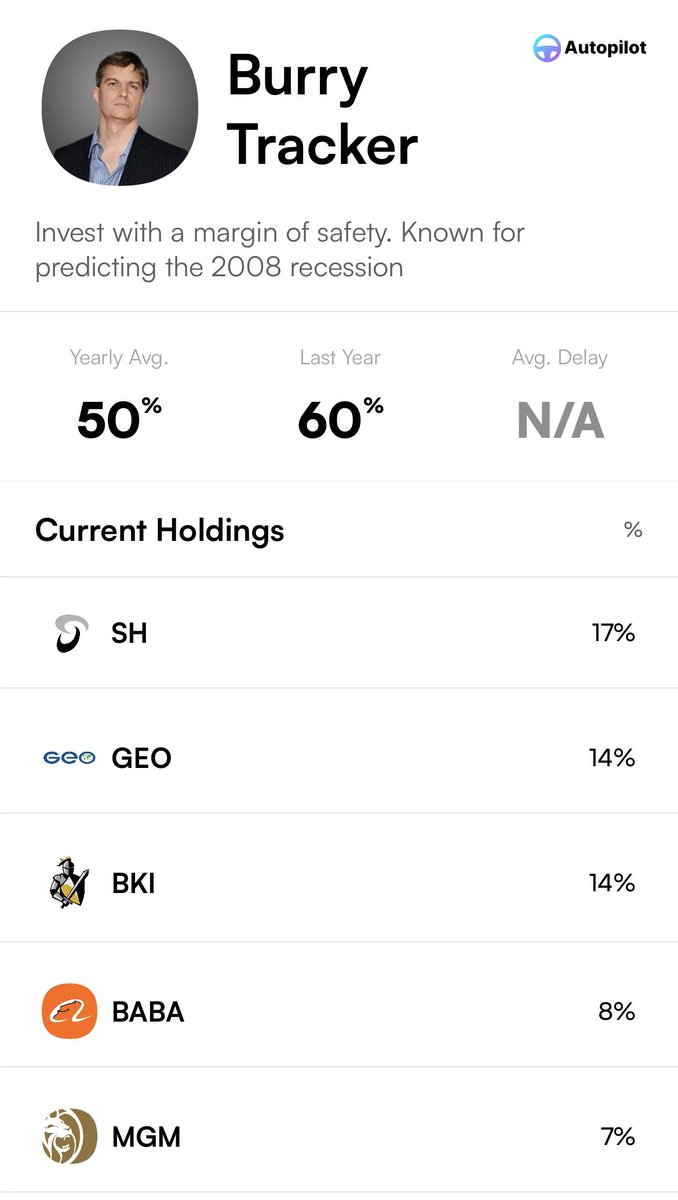

Tracking hedge funds and Burry’s stocks. Powered by @joinautopilot

6 subscribers

How to get URL link on X (Twitter) App

Deep Value Play: EL is down over 55% from 2021 highs.

Deep Value Play: EL is down over 55% from 2021 highs.

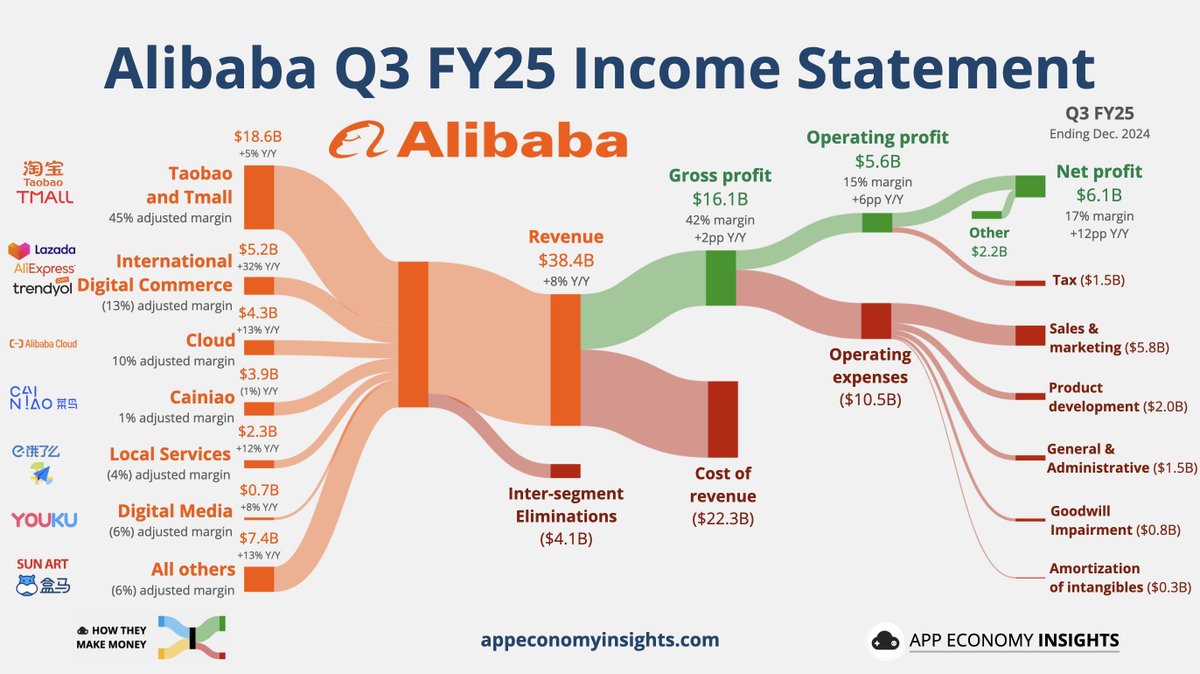

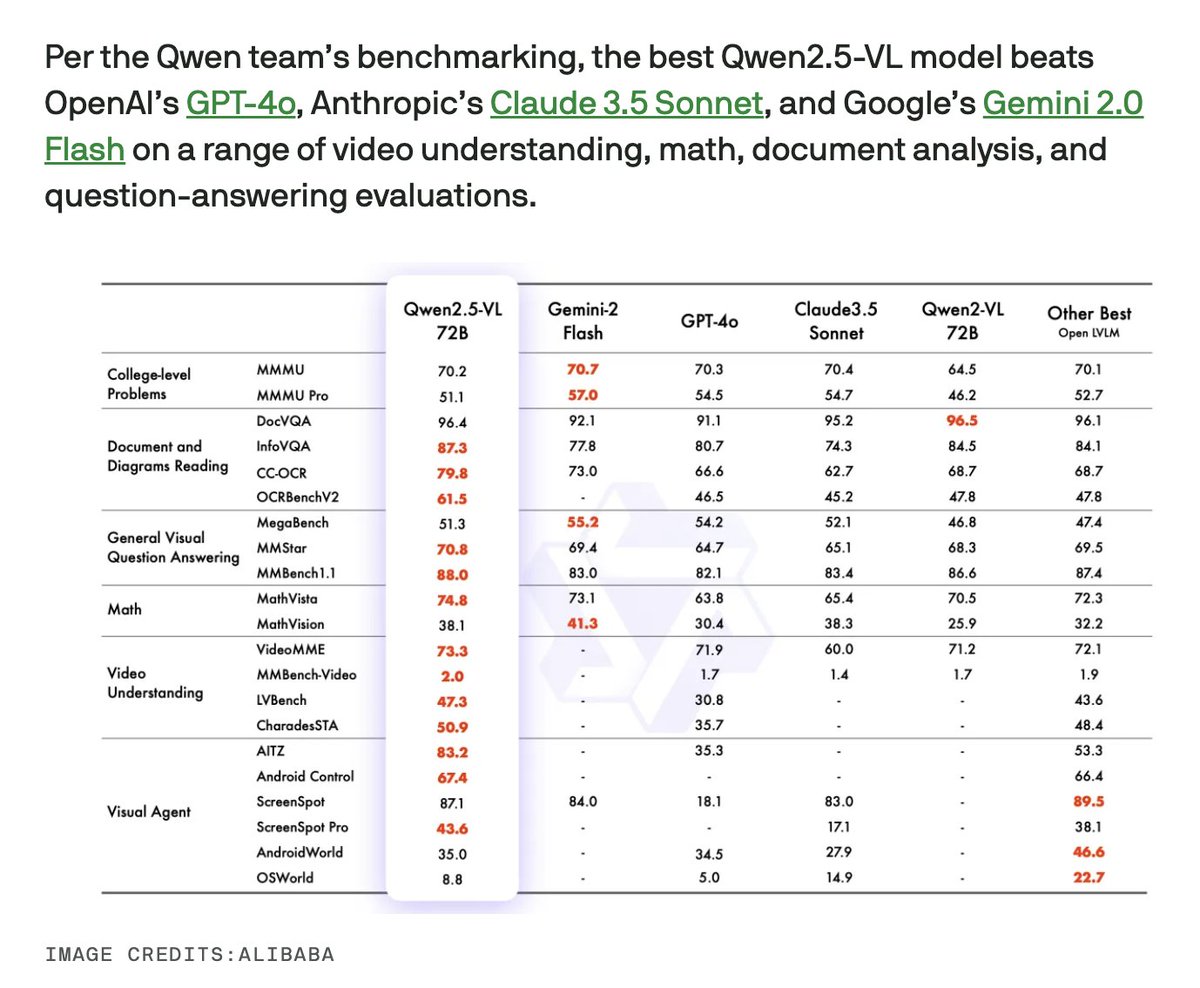

1/ Alibaba $BABA crushed earnings

1/ Alibaba $BABA crushed earnings

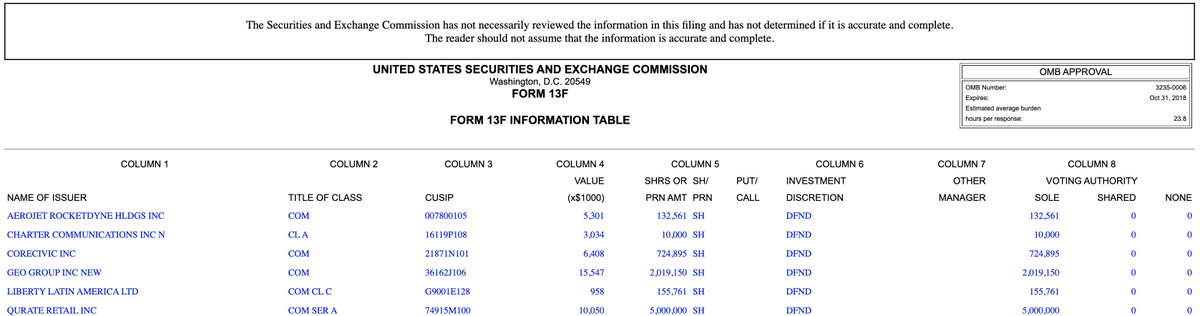

1/ Minotaur Capital was founded by Armina Rosenberg (@ArmsRosenberg) and Thomas Rice (@thomasrice_au)

1/ Minotaur Capital was founded by Armina Rosenberg (@ArmsRosenberg) and Thomas Rice (@thomasrice_au)

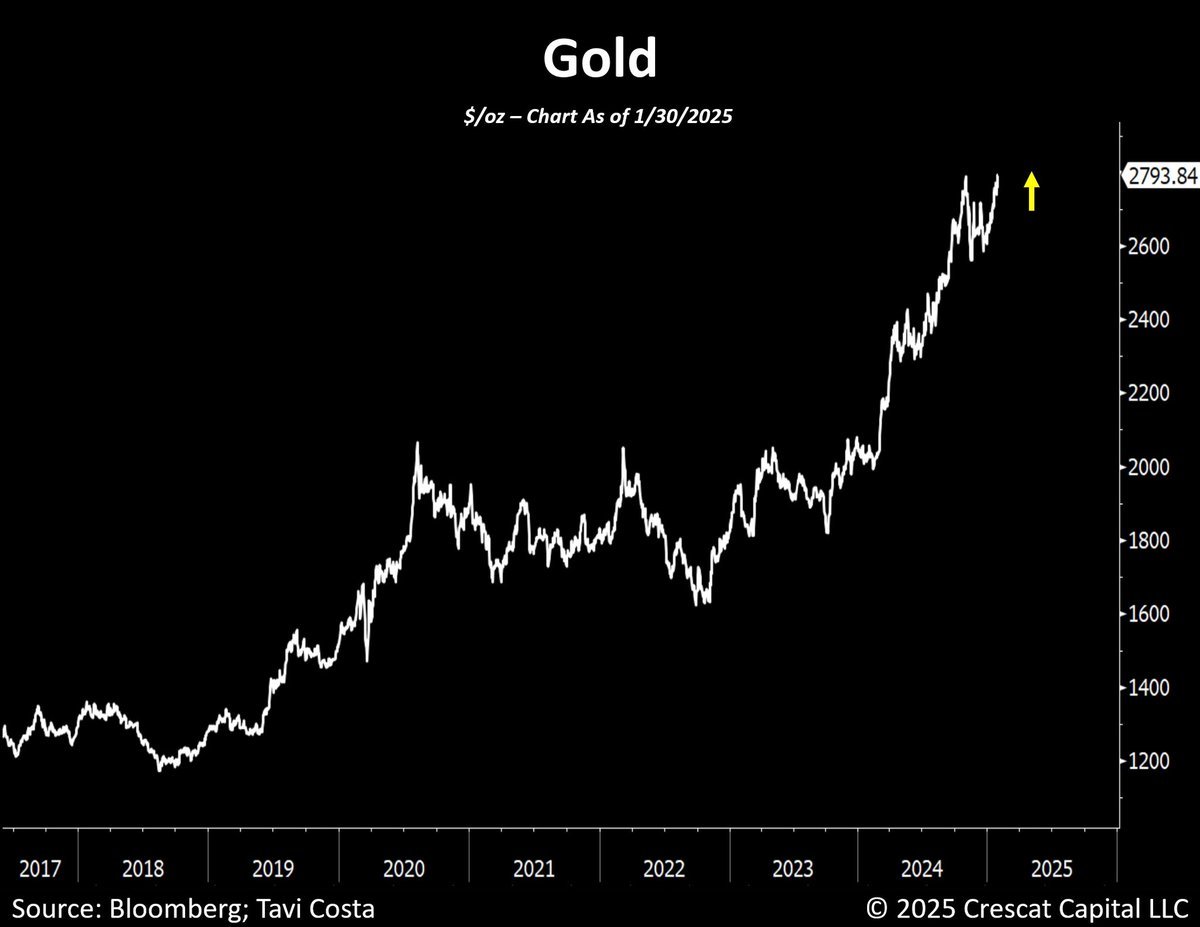

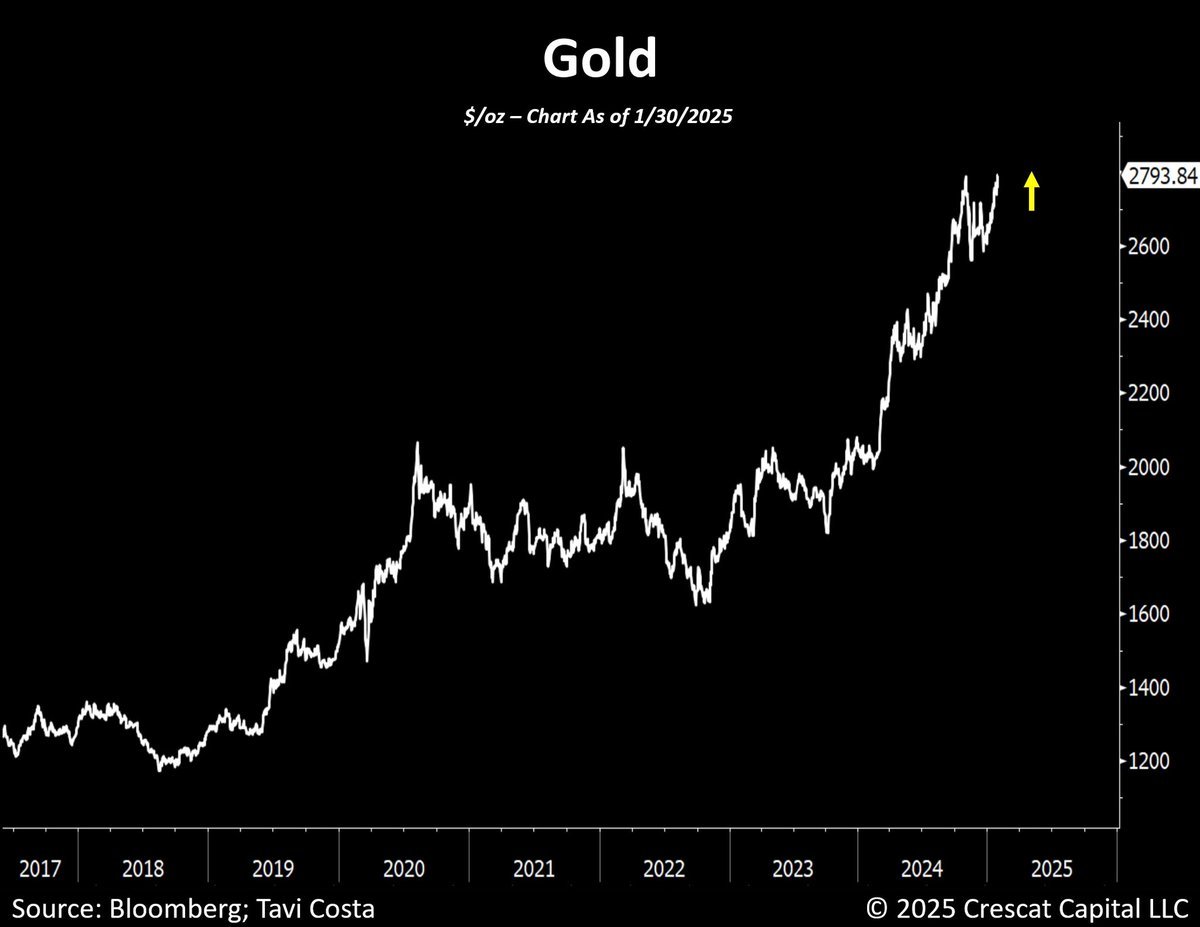

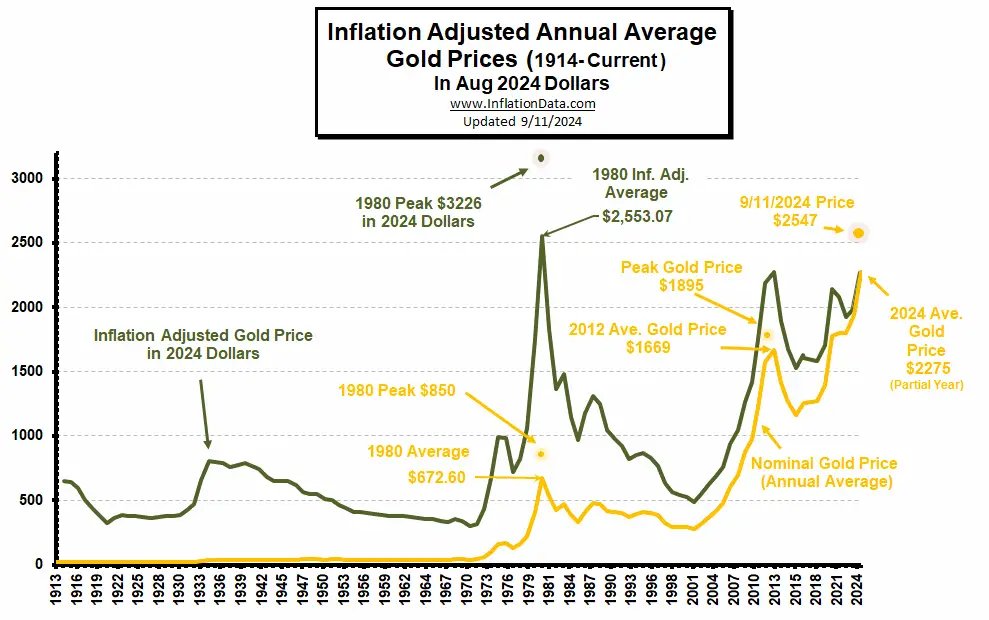

There are 3 specific time periods in which gold saw incredible gains

There are 3 specific time periods in which gold saw incredible gains

Yesterday Alibaba announced some massive updates to their AI model Qwen2.5-Max

Yesterday Alibaba announced some massive updates to their AI model Qwen2.5-Max

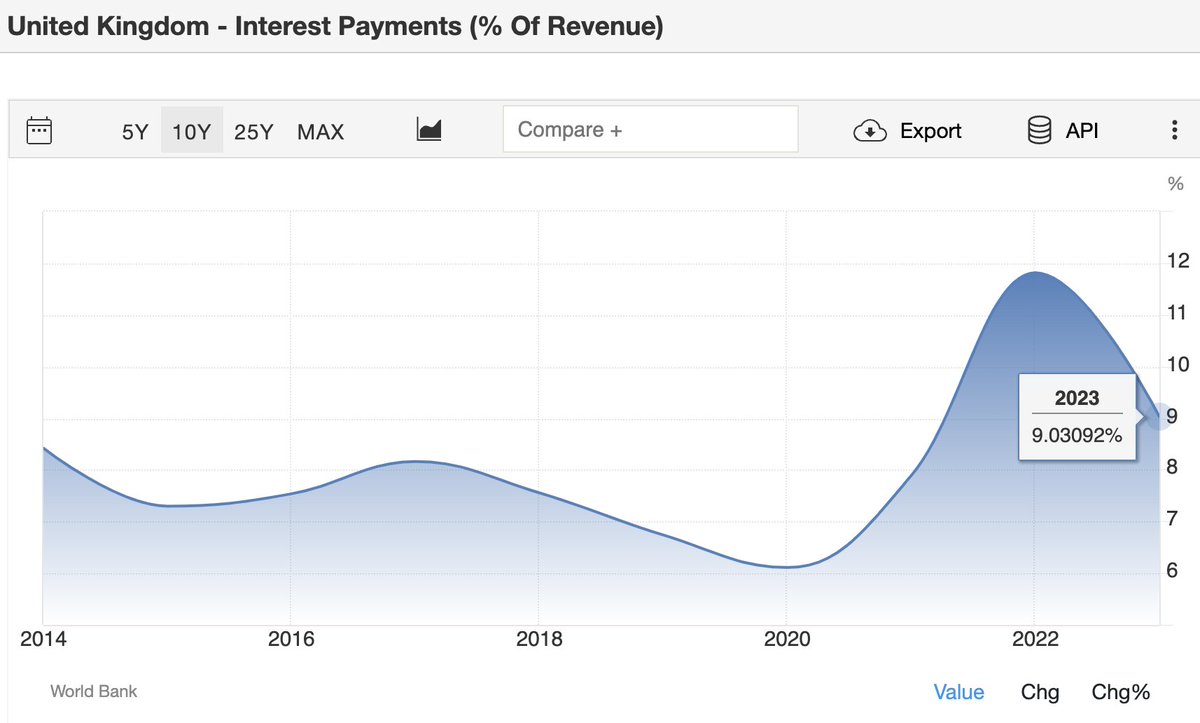

The UK’s annual interest payments on debt are already very high - over £100B a year

The UK’s annual interest payments on debt are already very high - over £100B a year

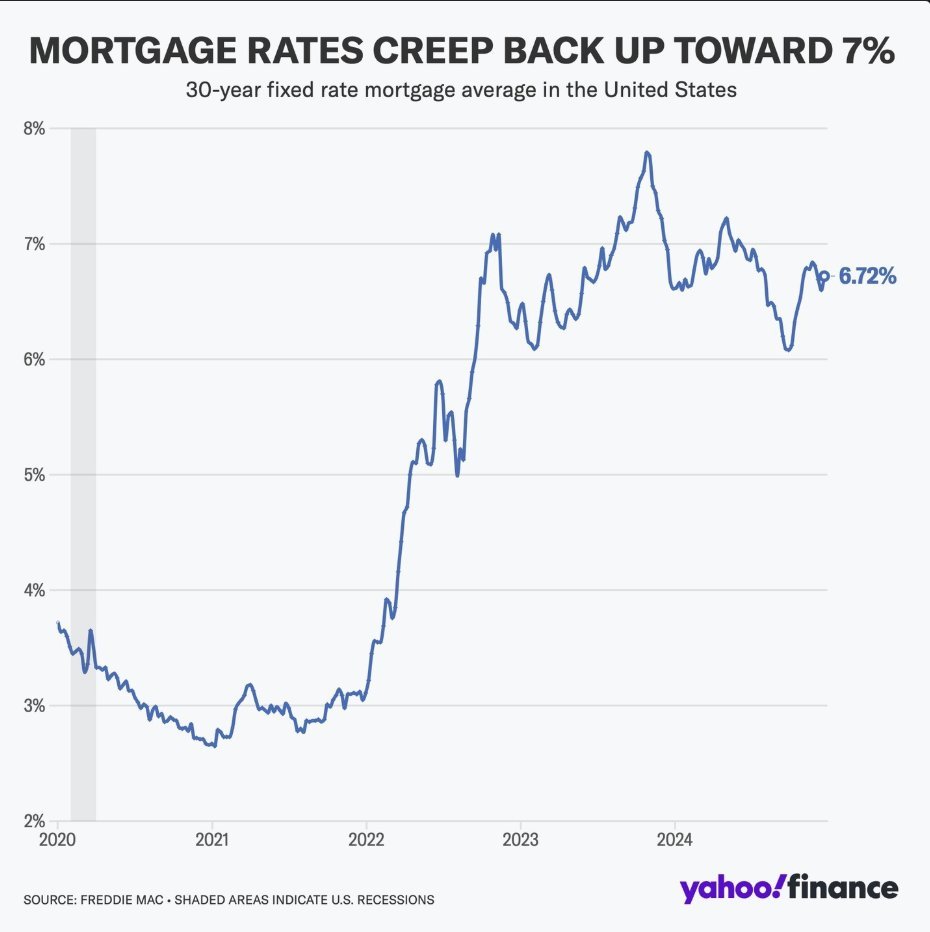

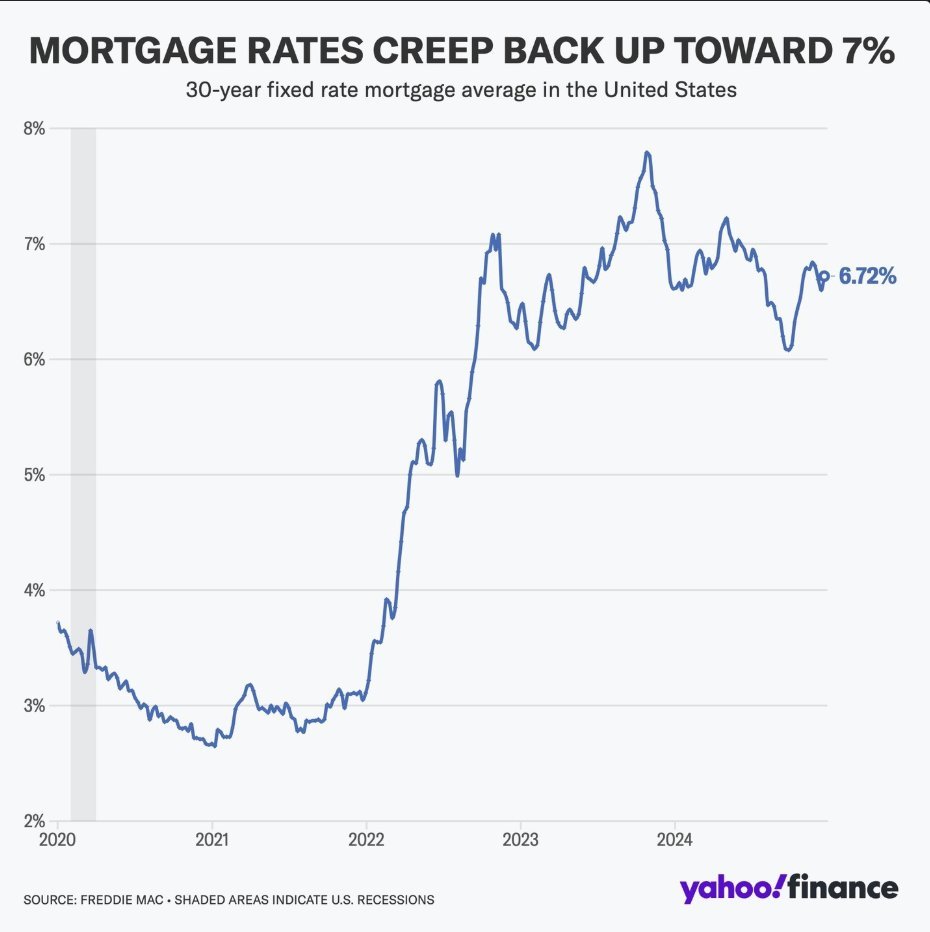

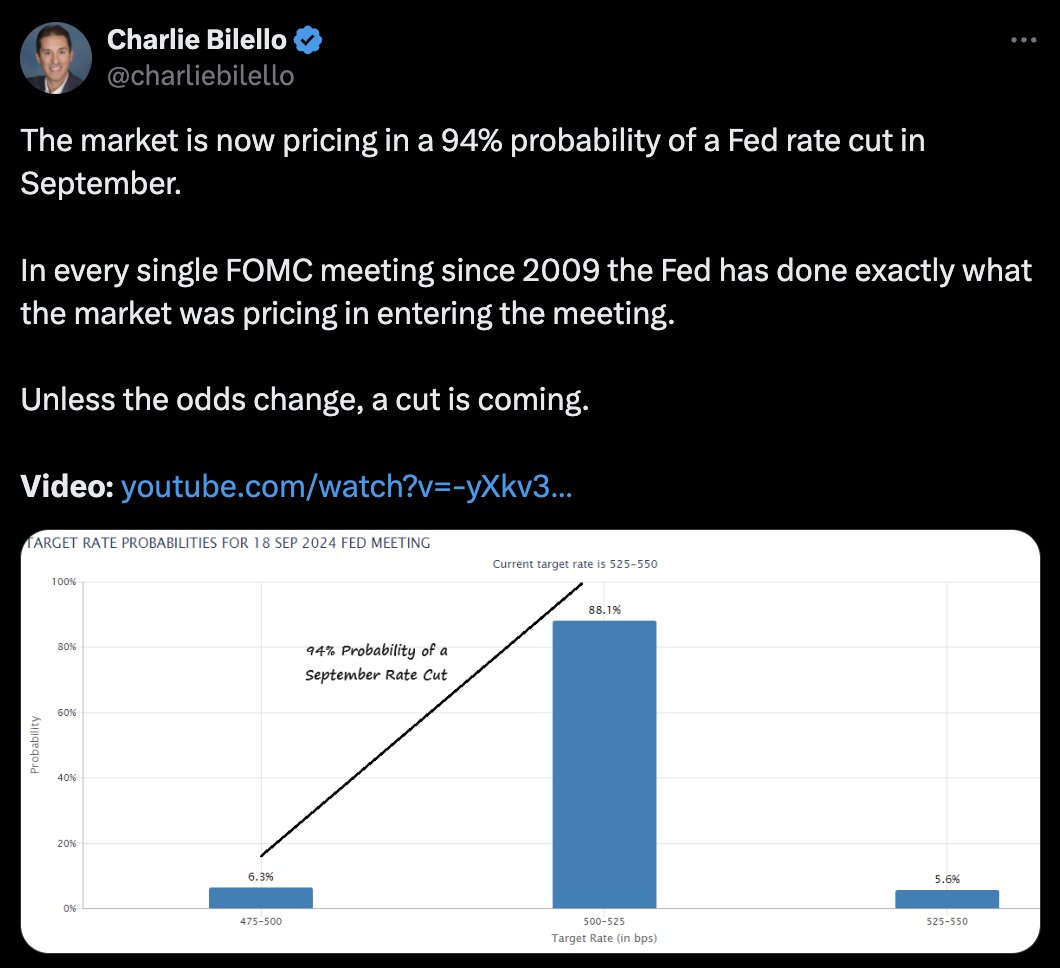

1. The thought is the Fed could make homes more affordable by cutting interest rates

1. The thought is the Fed could make homes more affordable by cutting interest rates

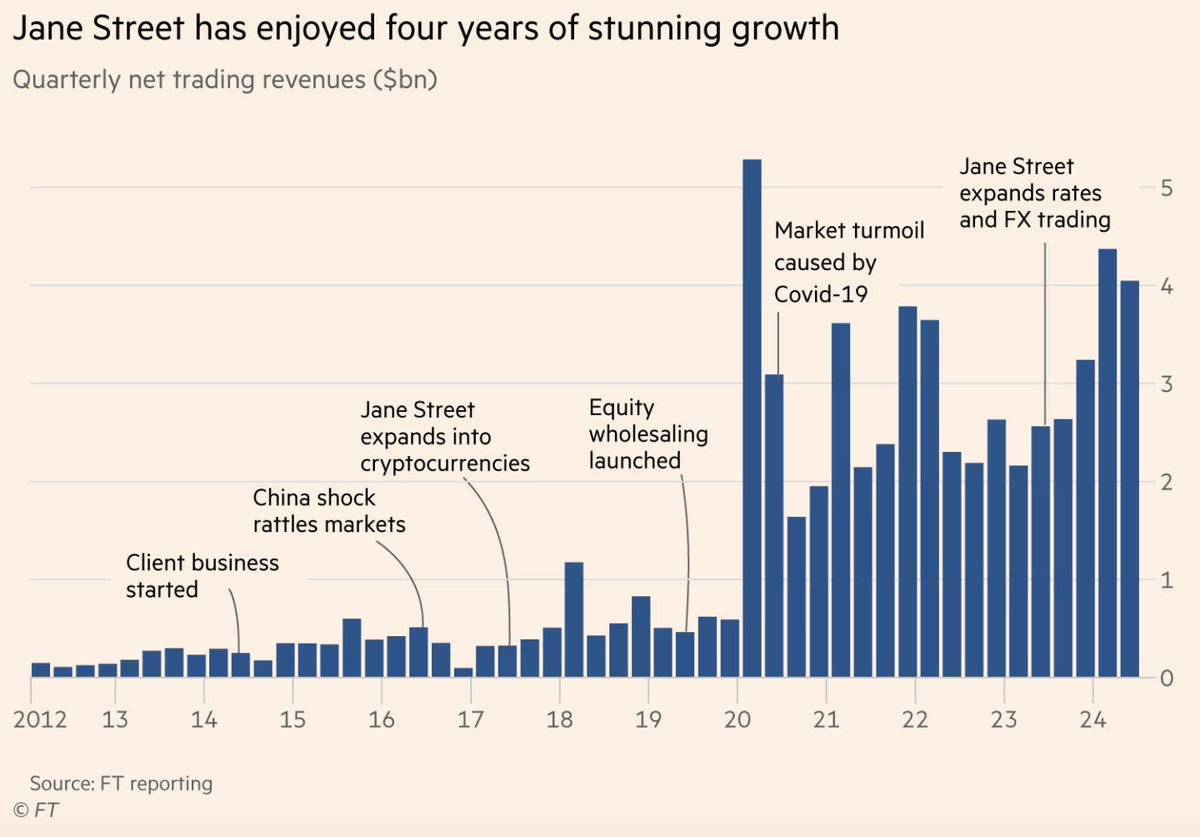

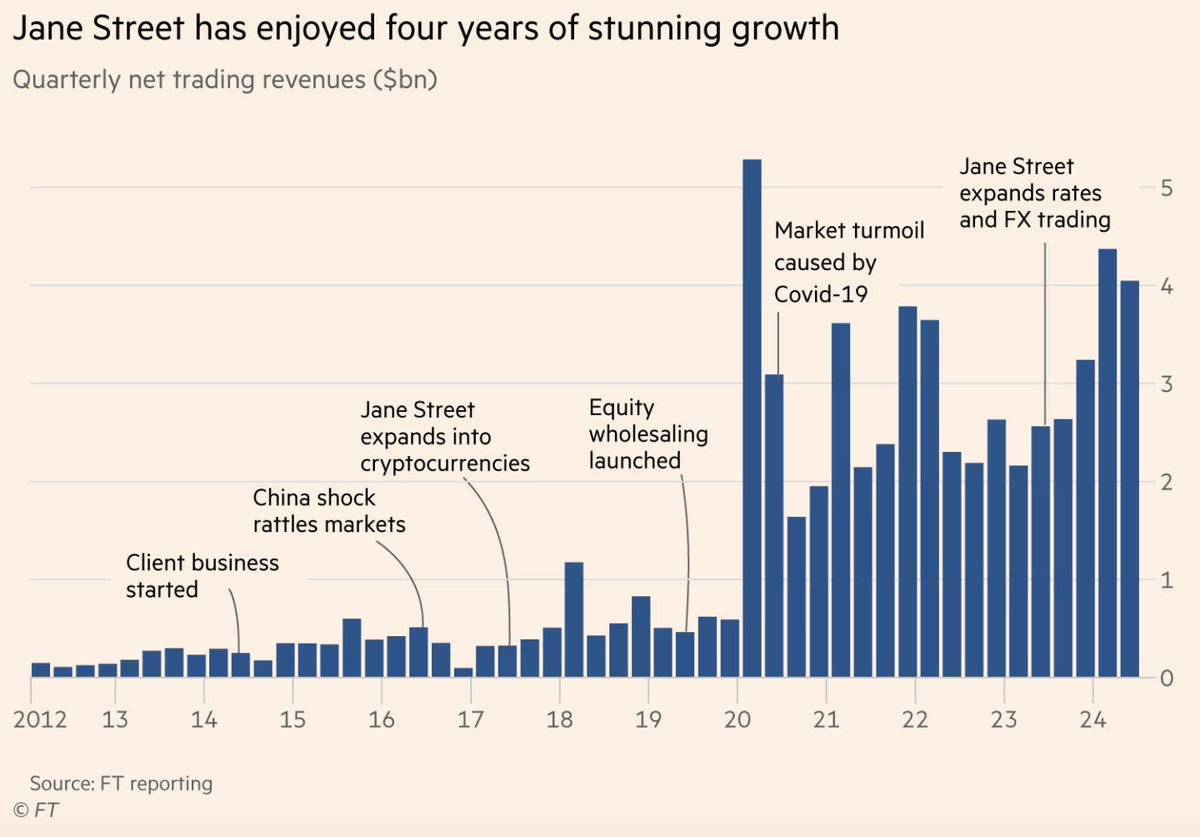

1/ Backstory

1/ Backstory

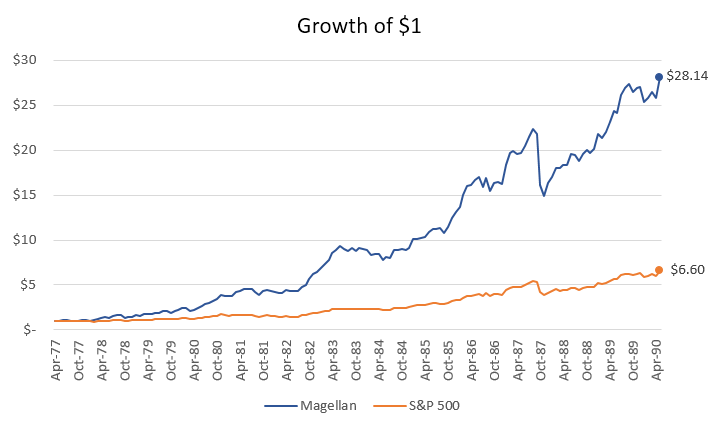

1/ Lynch worked as the manager of the Magellan Fund for Fidelity during his 13-year tenure

1/ Lynch worked as the manager of the Magellan Fund for Fidelity during his 13-year tenure

#1 Isreal Englander - Millennium Management

#1 Isreal Englander - Millennium Management

1/ Burry just exited his Sprott Physical Gold Trust $PHYS position

1/ Burry just exited his Sprott Physical Gold Trust $PHYS position

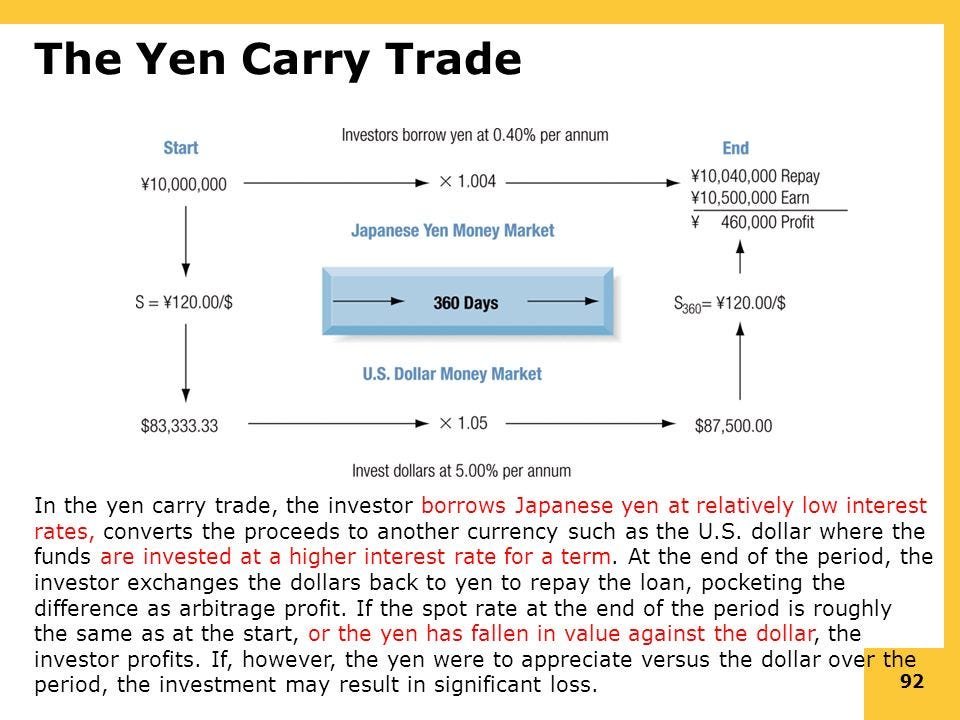

1/ First, what is a carry trade?

1/ First, what is a carry trade?

Spitznagel predicts that this rally will only continue for a couple more months because we are in a “Goldilocks phase” as inflation falls and the Fed easing fuels bets on further gains

Spitznagel predicts that this rally will only continue for a couple more months because we are in a “Goldilocks phase” as inflation falls and the Fed easing fuels bets on further gains

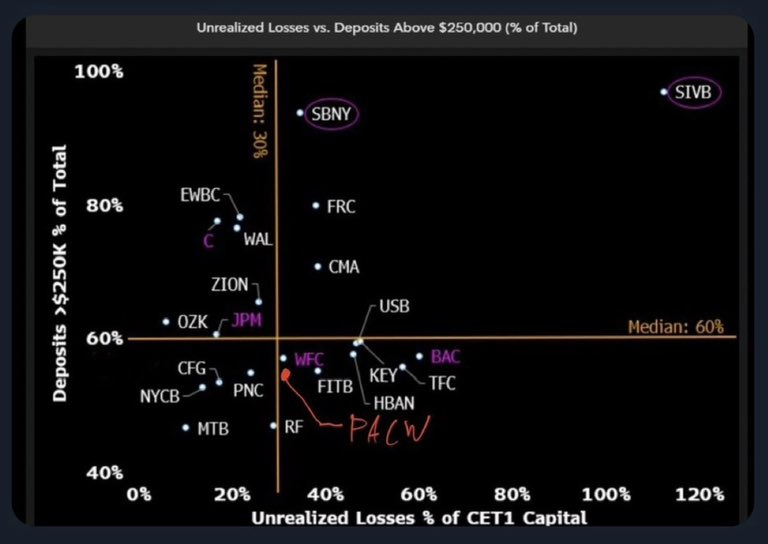

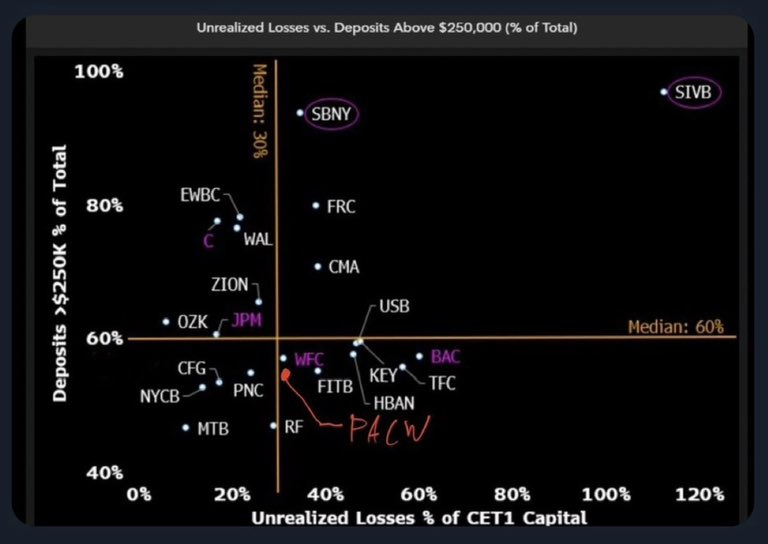

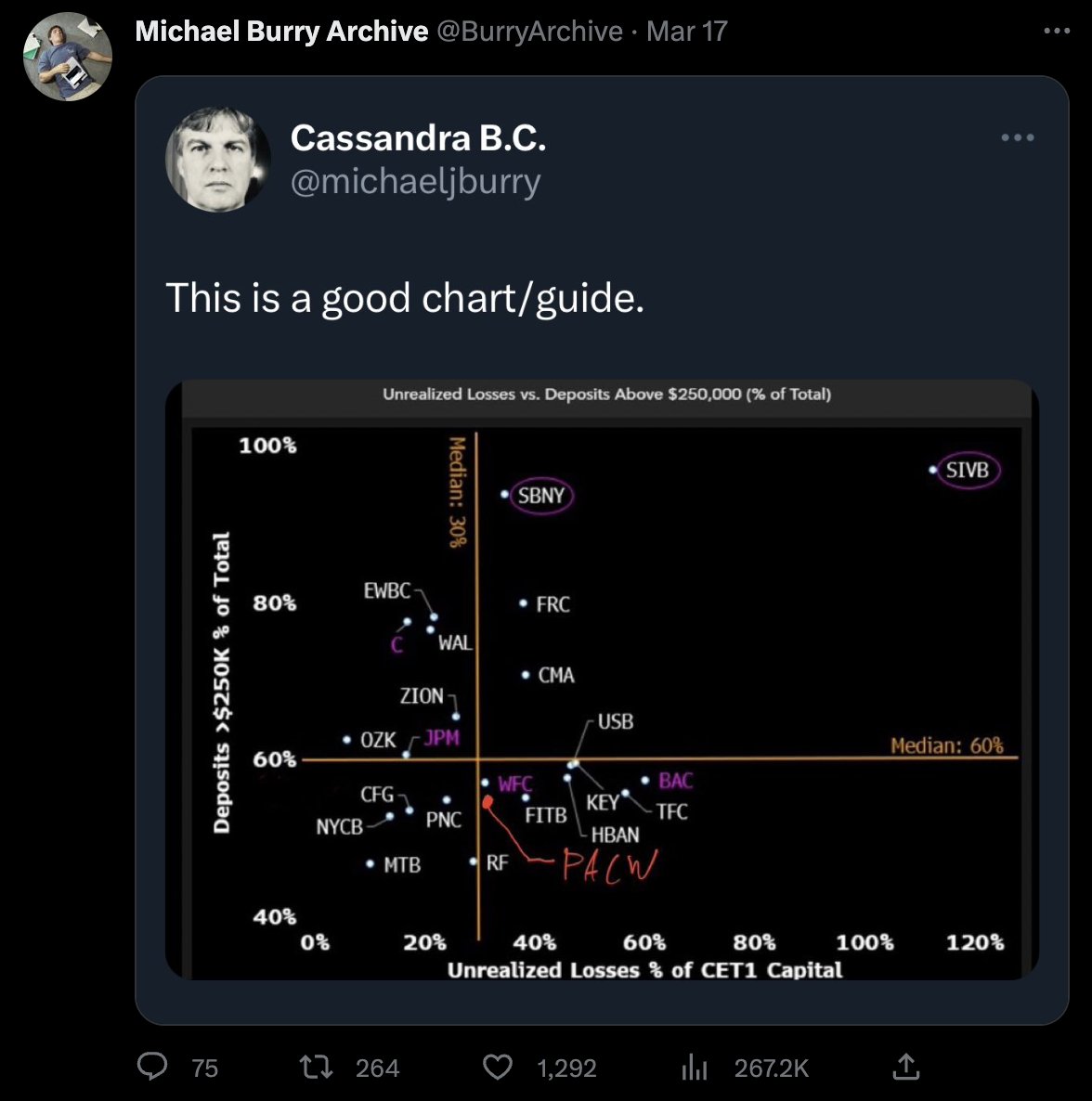

To provide context, here is the full tweet sent on 3/17

To provide context, here is the full tweet sent on 3/17

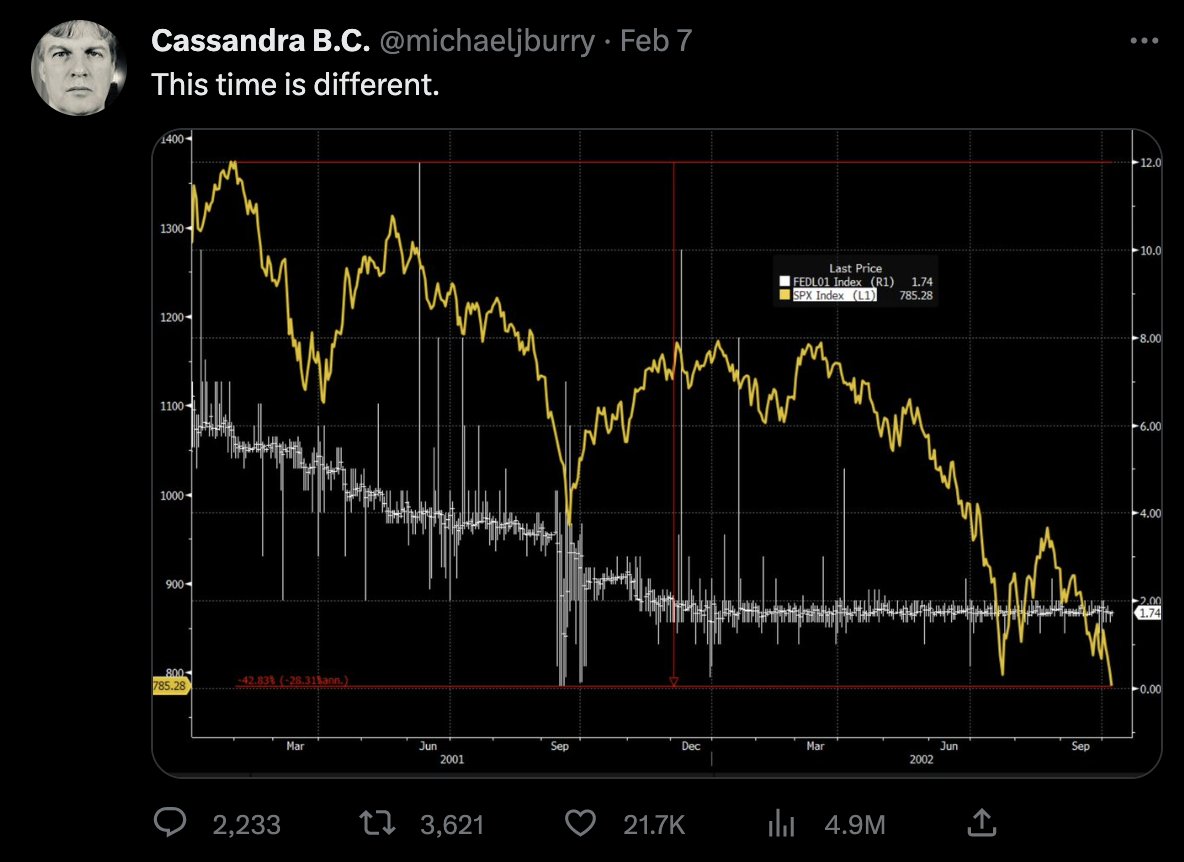

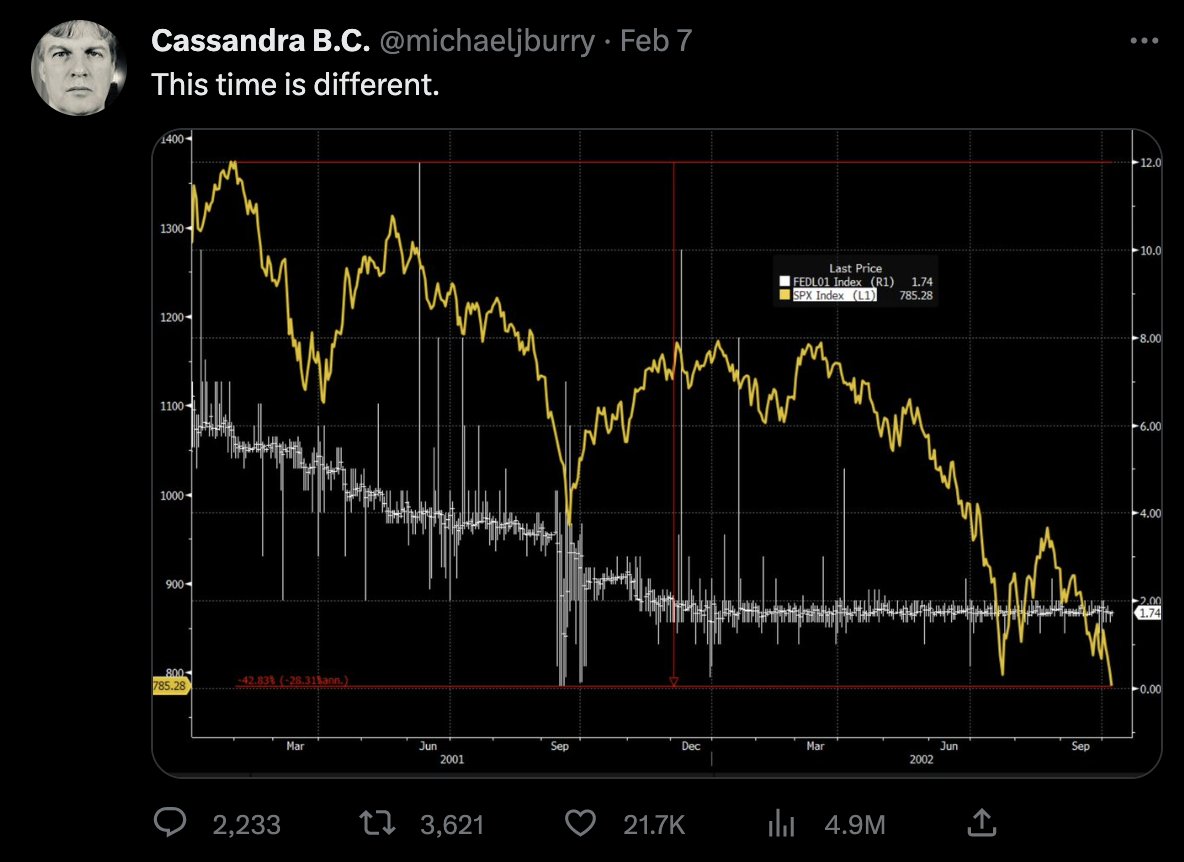

The chart compares the $SPY to the Fed Fund Rate during the Dot Com Bubble

The chart compares the $SPY to the Fed Fund Rate during the Dot Com Bubble