Sound Research. Independent Ideas. Compounding Returns. All posts are for learning and educational purposes. SEBI registered RA INH0000**446.

3 subscribers

How to get URL link on X (Twitter) App

CNC Machines as a sector potentially caters to 3000+ sectors/segments. It touches the lives of every individual multiple times in a single day.

CNC Machines as a sector potentially caters to 3000+ sectors/segments. It touches the lives of every individual multiple times in a single day.

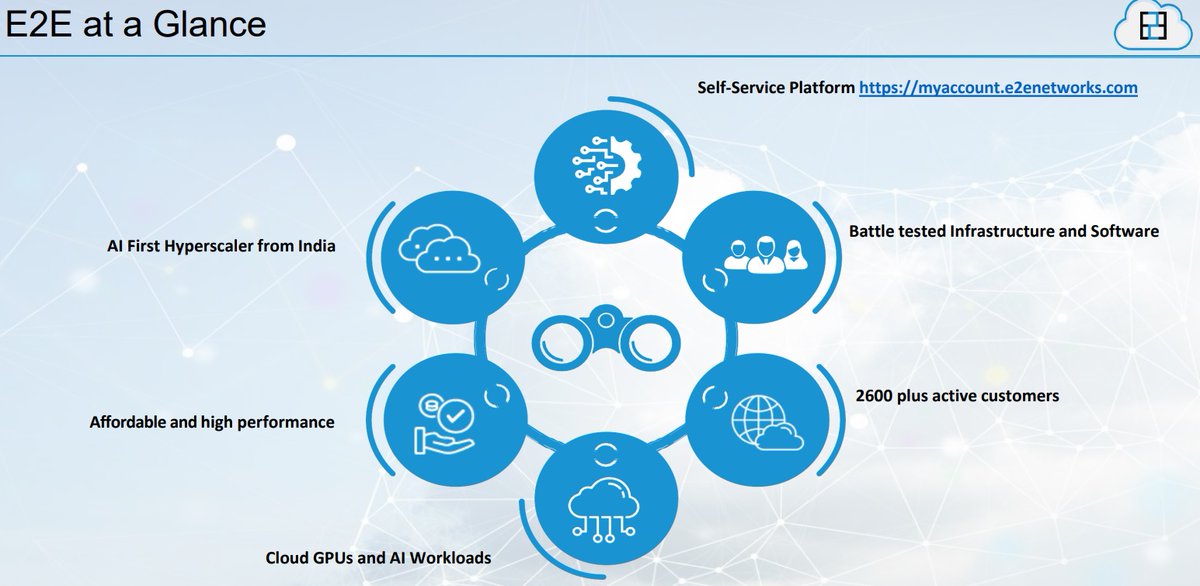

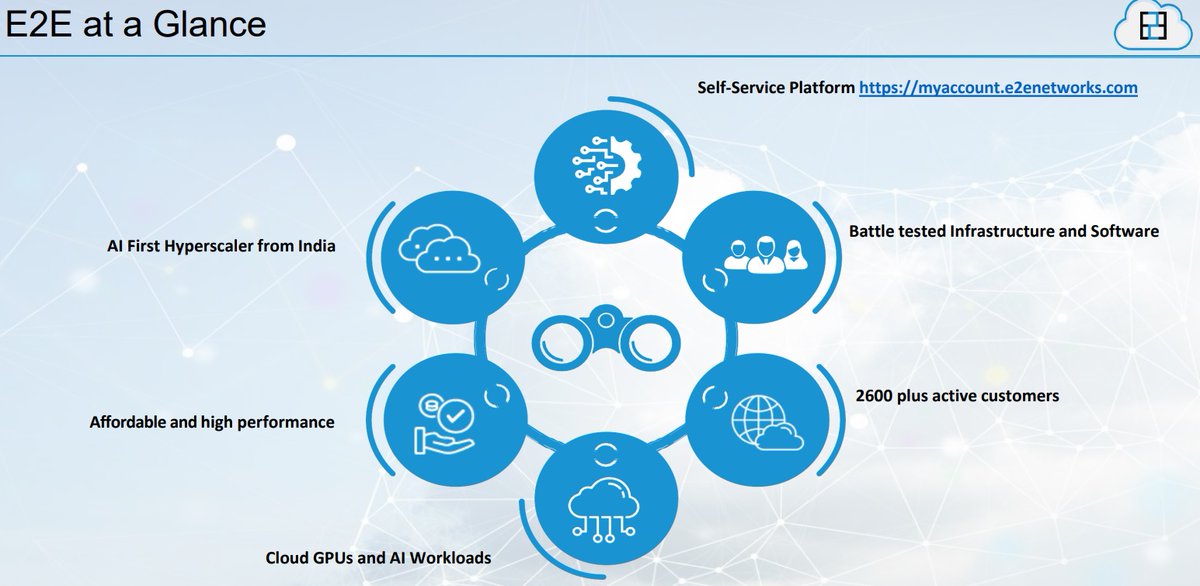

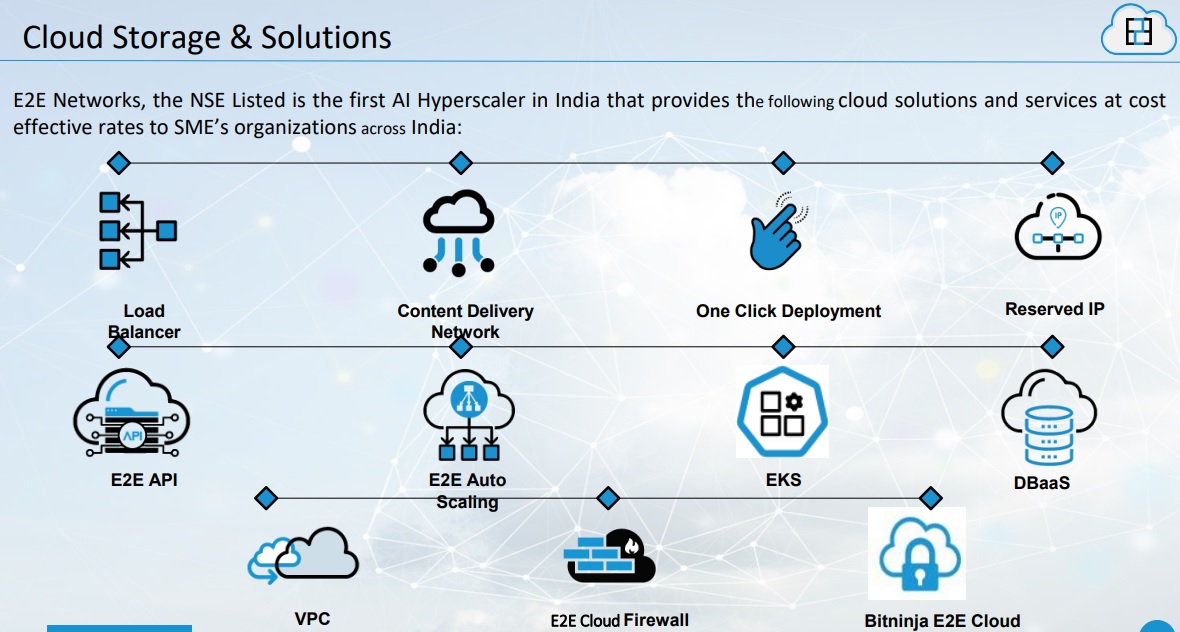

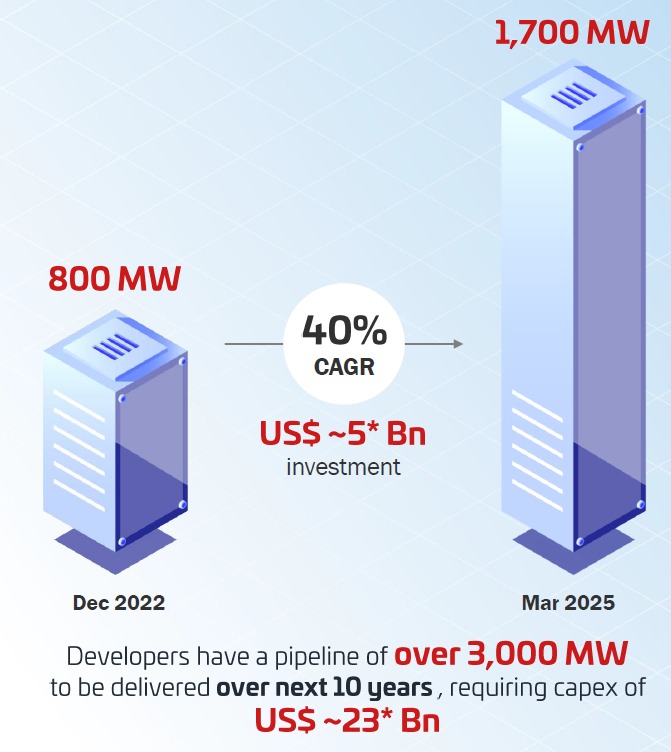

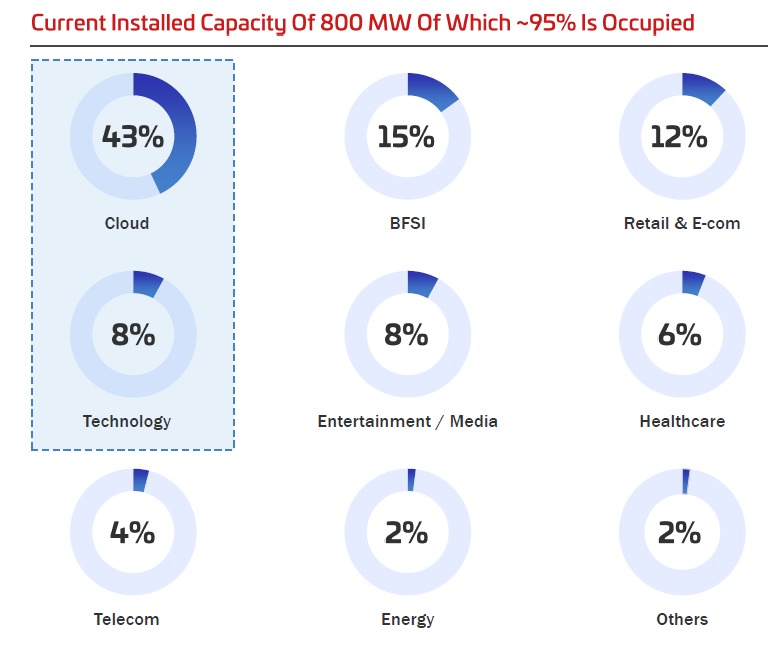

Domestic DC industry at present stands at 1GW power consumption & is projected to grow to 8GW by FY27.

Domestic DC industry at present stands at 1GW power consumption & is projected to grow to 8GW by FY27.

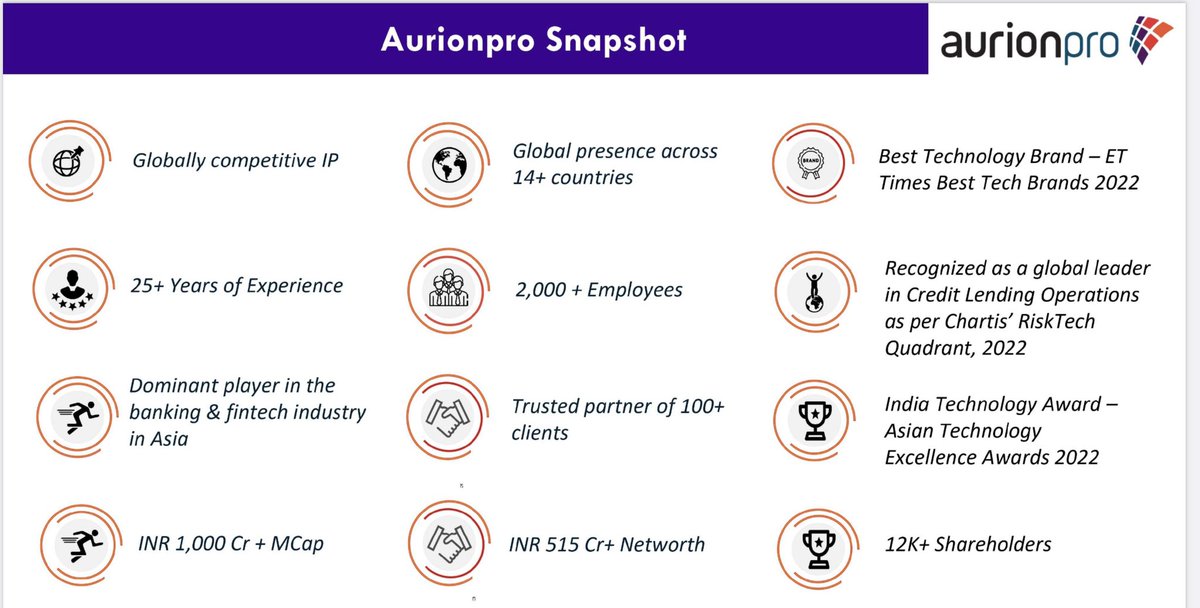

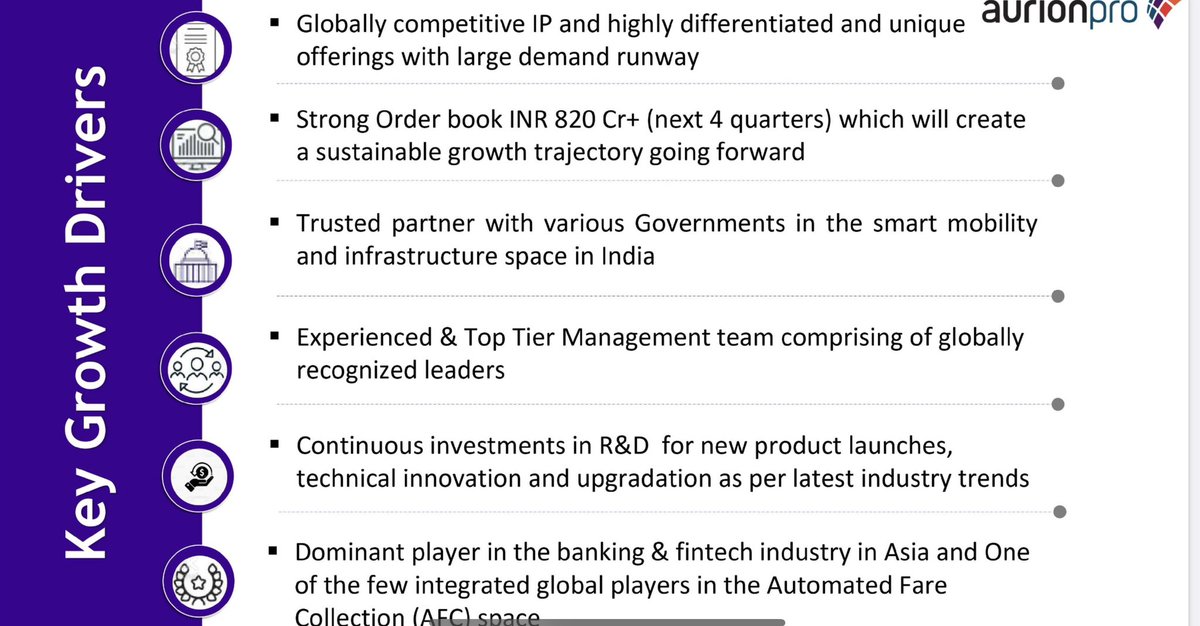

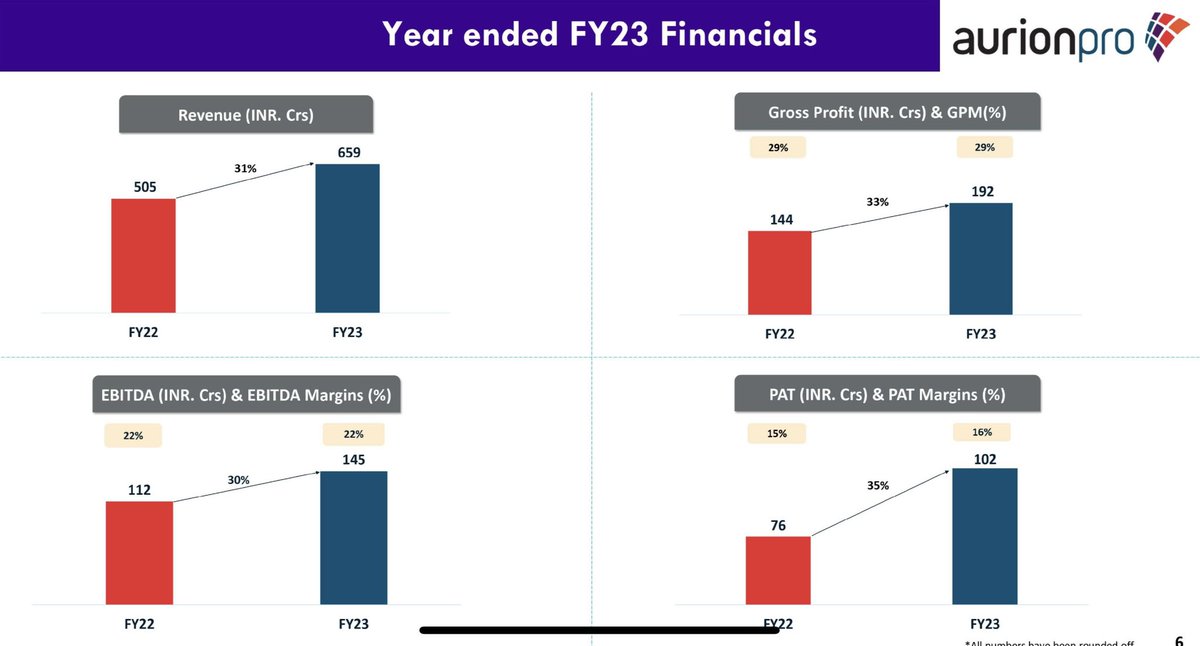

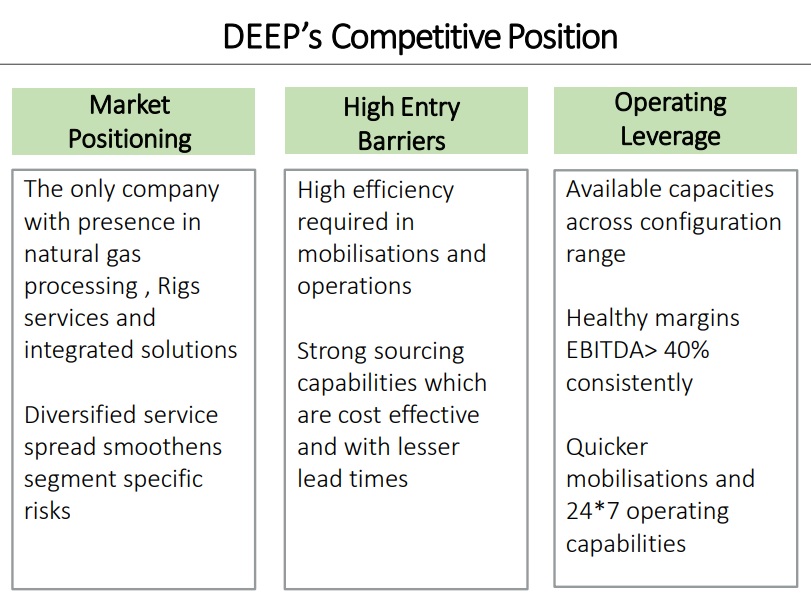

AAA+ management, 45% RoCE, 35% RoE, debt free BS and strong 40% EBIDTA growth guidance with 20% PAT margins for the next 2-3 years – we believe the company is at an earnings inflection point aided by a strong order book and growth visibility.

AAA+ management, 45% RoCE, 35% RoE, debt free BS and strong 40% EBIDTA growth guidance with 20% PAT margins for the next 2-3 years – we believe the company is at an earnings inflection point aided by a strong order book and growth visibility.

3. There are no new eras – excesses are never permanent (again a v IMP reminder)

3. There are no new eras – excesses are never permanent (again a v IMP reminder)

4) 25% ROCE bar for all present & new businesses

4) 25% ROCE bar for all present & new businesses

https://twitter.com/caprize_invest/status/1633692904144207875

3) Vol growth 16%, price growth 6%

3) Vol growth 16%, price growth 6%

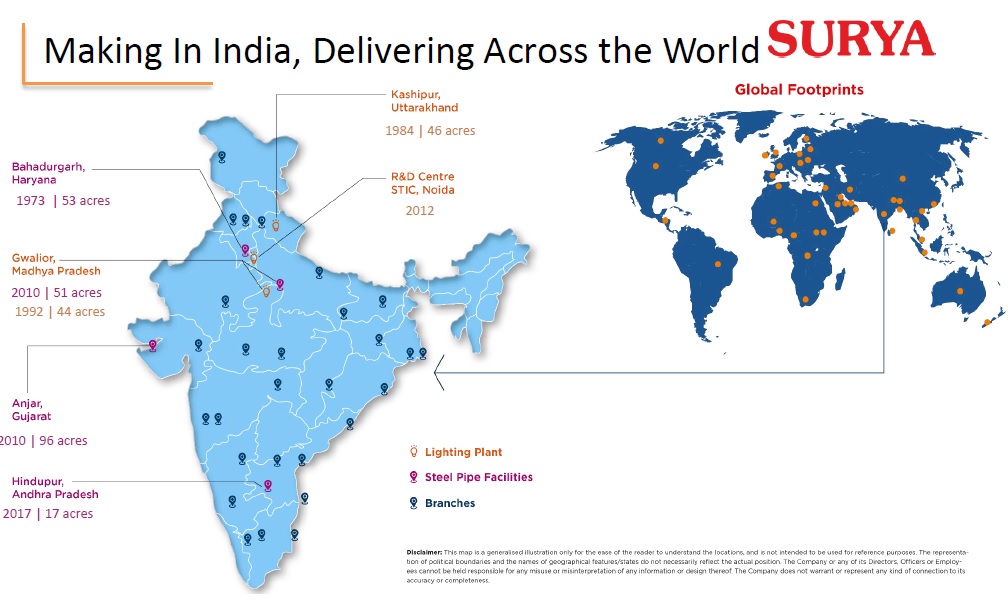

Engaged in 2 businesses viz. 1) Steel Pipes (80% of Rev) & LED lighting/FMEG (20% of Rev), Surya is one of the most respected brands in both these segments within India (72% of Rev) & internationally (28% of Rev).

Engaged in 2 businesses viz. 1) Steel Pipes (80% of Rev) & LED lighting/FMEG (20% of Rev), Surya is one of the most respected brands in both these segments within India (72% of Rev) & internationally (28% of Rev).

What should we know about the co?

What should we know about the co?

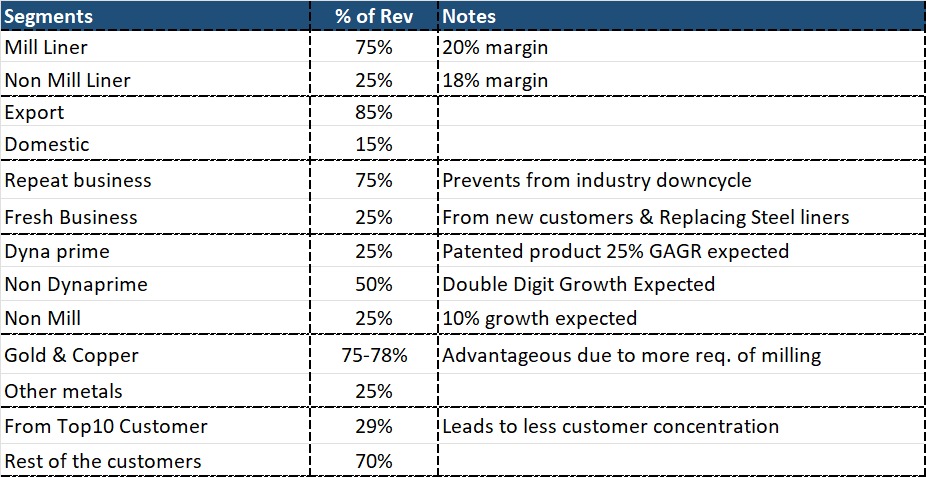

Business:

Business:

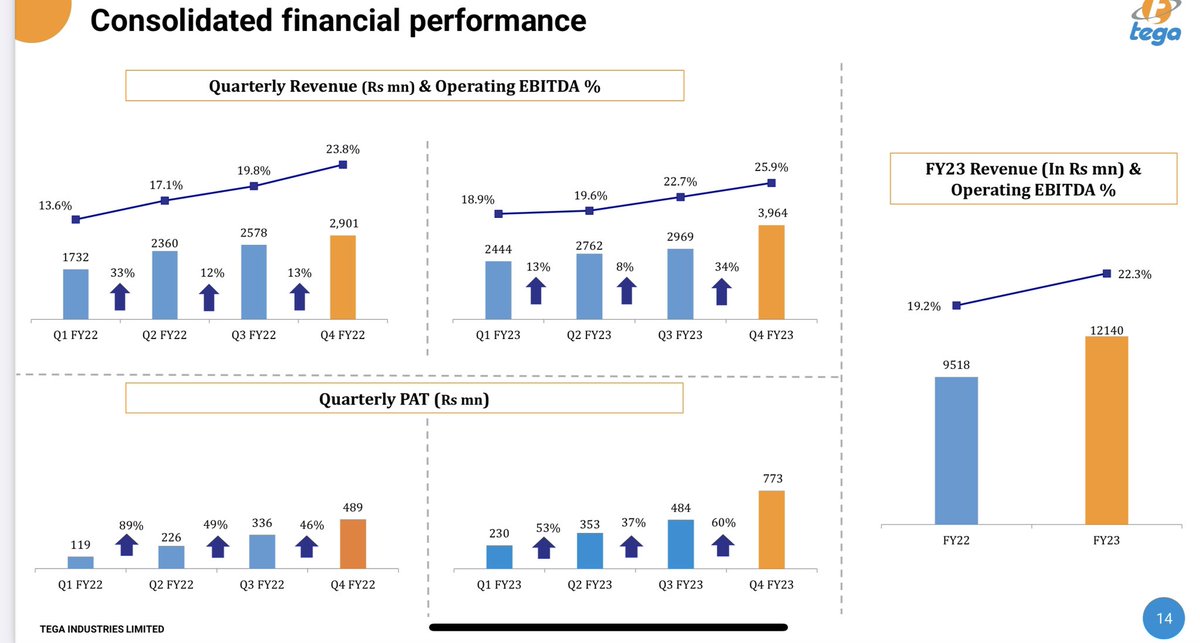

Tega Ind is a a 6 month old listed co. While the IPO band was 443-453, the co listed at 760 – a 68% premium. Since then stock has corrected 40% from its ATHs (MCap 5000cr) & trades at its IPO price – CMP 460 (MCap 3000cr).

Tega Ind is a a 6 month old listed co. While the IPO band was 443-453, the co listed at 760 – a 68% premium. Since then stock has corrected 40% from its ATHs (MCap 5000cr) & trades at its IPO price – CMP 460 (MCap 3000cr).

While these segments might seem “boring” or “old economy”, the biz isn’t. With focus on profitability, co has consistently delivered 40-45% EBIDTA margins & 20-25% PAT margins. The RoCE for the biz stands at 22%+ ex of goodwill. Co is on cards to double earnings by FY23!

While these segments might seem “boring” or “old economy”, the biz isn’t. With focus on profitability, co has consistently delivered 40-45% EBIDTA margins & 20-25% PAT margins. The RoCE for the biz stands at 22%+ ex of goodwill. Co is on cards to double earnings by FY23!