I don’t read DMs and won’t DM you. Not affiliated with anything I tweet about. $awhale

6 subscribers

How to get URL link on X (Twitter) App

2/*I’m talking about natural moves that don’t need ETFs, influencer pumps, Chamath or Novogratz tweets etc.

2/*I’m talking about natural moves that don’t need ETFs, influencer pumps, Chamath or Novogratz tweets etc.

https://twitter.com/dexhunterio/status/1795100502503346450

https://twitter.com/cardexscan/status/1779163270055616663

https://twitter.com/LenfiOfficial/status/1760632271424393356

https://twitter.com/indigo_protocol/status/1745836281492365376

https://twitter.com/teddyswap/status/1730347989267353895

https://twitter.com/inputoutputhk/status/1720368018679583201

https://twitter.com/dexhunterio/status/1713893652617936942

https://twitter.com/optionflowteam/status/1706138580353941555

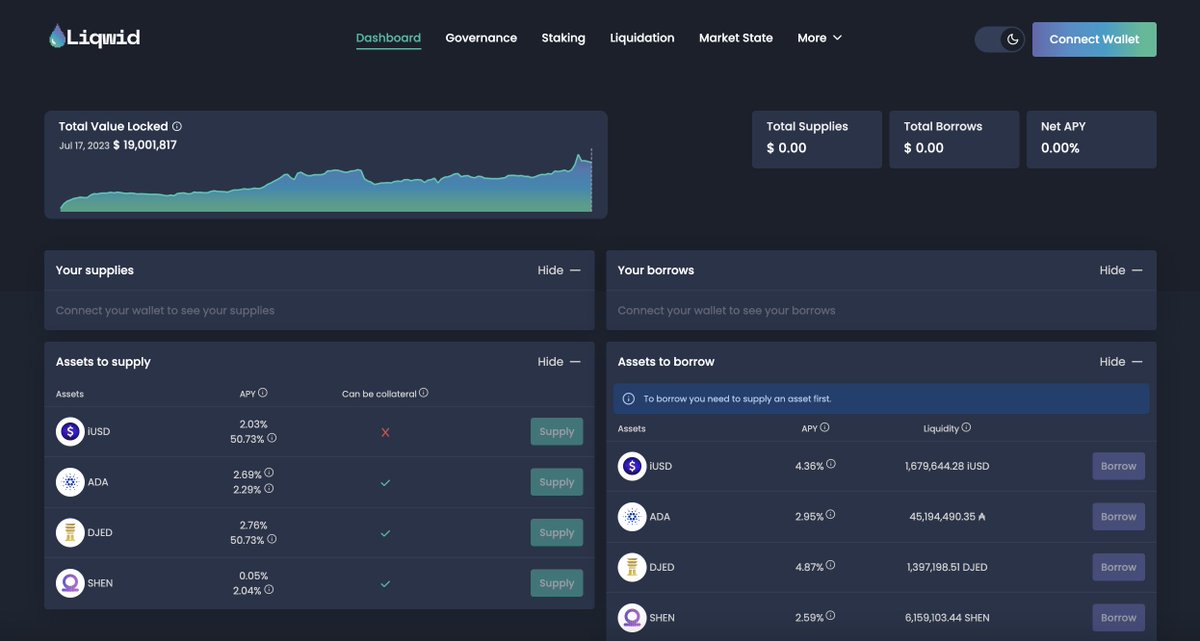

https://twitter.com/astarterdefihub/status/1697082734676750673

https://twitter.com/store_optimal/status/1672986141493018624