Head of macroeconomics & AI @IPPR. Former @bankofengland economist and @IMFnews fellow.

How to get URL link on X (Twitter) App

https://x.com/demishassabis/status/1878940489816355029

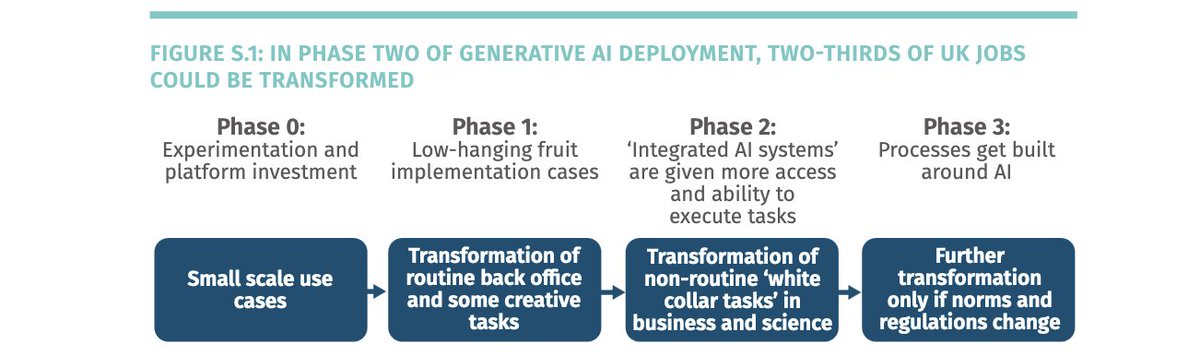

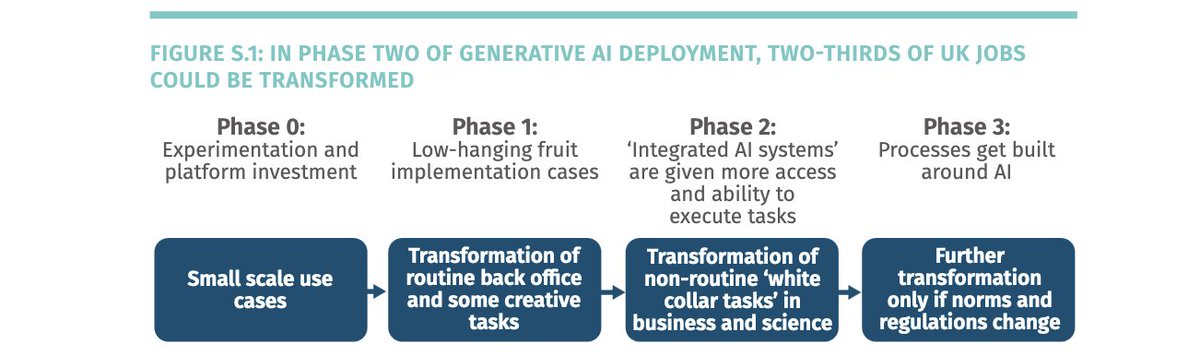

Currently most employers are still experimenting with the technology. But soon, in the first phase of deployment, 11% of work could be exposed to 'here and now' AI.

Currently most employers are still experimenting with the technology. But soon, in the first phase of deployment, 11% of work could be exposed to 'here and now' AI.

https://twitter.com/Jeremy_Hunt/status/1744789237831004265(2) While it's not my job to defend Labour’s specific plans, your tax calculation seems off. Can can you share how it was done? For one, public investment brings financial returns which don't seem to be factored in. That’s why so many economists think investment should be boosted

Some implications: First, given the importance of this, people should state very clearly what their assumptions are. Where are they on this table and or where are their assumptions different? We need a transparent debate about this - not black box claims! (2/9)

Some implications: First, given the importance of this, people should state very clearly what their assumptions are. Where are they on this table and or where are their assumptions different? We need a transparent debate about this - not black box claims! (2/9)

The bulk of the rise in profits is driven by small number of companies. 25 companies accounted for 90% of the increase in profits - mostly basic materials (incl. mining and commodities) and energy firms. (2/6)

The bulk of the rise in profits is driven by small number of companies. 25 companies accounted for 90% of the increase in profits - mostly basic materials (incl. mining and commodities) and energy firms. (2/6)

Assume a scenario where two workers have the same skills and are doing the same type of job (as is often the case in low-paid jobs). And now assume their firm has only 50% of its usual demand for some time, because of covid. (2/6)

Assume a scenario where two workers have the same skills and are doing the same type of job (as is often the case in low-paid jobs). And now assume their firm has only 50% of its usual demand for some time, because of covid. (2/6)

Assume a scenario where two workers have the same skills and are doing the same type of job (as is often the case in low-paid jobs). And now assume their firm has only 50% of its usual demand for some time, because of covid. (2/6)

Assume a scenario where two workers have the same skills and are doing the same type of job (as is often the case in low-paid jobs). And now assume their firm has only 50% of its usual demand for some time, because of covid. (2/6)

The bridge (2/4). A work sharing scheme can keep people in work during the recovery. Eg if a business has only half of its usual demand, it could let its workers work half the time (rather than firing half of them). This would be temporary, with a return to full time in 2021.

The bridge (2/4). A work sharing scheme can keep people in work during the recovery. Eg if a business has only half of its usual demand, it could let its workers work half the time (rather than firing half of them). This would be temporary, with a return to full time in 2021.

(2/3) The covid crisis has shown that new, more flexible working patterns are possible. For instance, more than a third of workers in defence manufacuting have worked either more flexibly or shorter hours during the crisis. This shows that work time patterns can change.

(2/3) The covid crisis has shown that new, more flexible working patterns are possible. For instance, more than a third of workers in defence manufacuting have worked either more flexibly or shorter hours during the crisis. This shows that work time patterns can change.

Many of these investments could take place soon and they have high environmental and social benefits. (2/4)

Many of these investments could take place soon and they have high environmental and social benefits. (2/4)