Chief Market Strategist @ Creative Planning

Investor | Writer | Reader | Thinker

Trying to become a little wiser every day.

19 subscribers

How to get URL link on X (Twitter) App

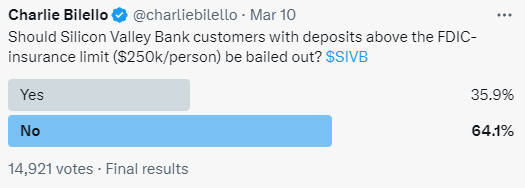

I think we'll know the answer soon, but a government bailout of SVB doesn't seem likely. Best outcome would be something similar to the Washington Mutual failure - quick sale to larger bank where all depositors are protected with full access to their money this week.

I think we'll know the answer soon, but a government bailout of SVB doesn't seem likely. Best outcome would be something similar to the Washington Mutual failure - quick sale to larger bank where all depositors are protected with full access to their money this week.

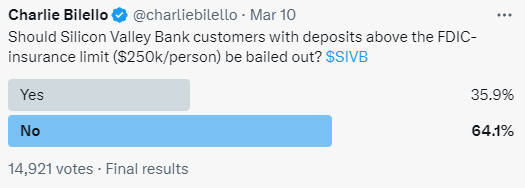

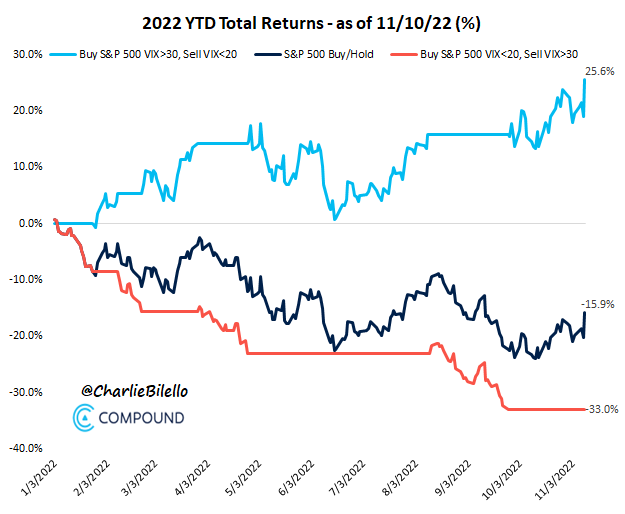

What this illustrates: buying weakness and selling strength has worked well this year and if you've been doing the opposite it's been a source of additional pain.

What this illustrates: buying weakness and selling strength has worked well this year and if you've been doing the opposite it's been a source of additional pain.

While home prices rose, sales continue to plummet, down 14% over the last year and at their lowest levels since June 2020.

While home prices rose, sales continue to plummet, down 14% over the last year and at their lowest levels since June 2020.

The US yield curve spread between the 10-year and 3-month is down to 81 bps. If current Fed rate hike expectations are correct (75 bps in July, 50 bps in September, 50 bps in November), we could see an inversion before the end of the year.

The US yield curve spread between the 10-year and 3-month is down to 81 bps. If current Fed rate hike expectations are correct (75 bps in July, 50 bps in September, 50 bps in November), we could see an inversion before the end of the year.

The Fed has already become highly politicized with its invention of "inclusive monetary policy" and using it as a justification for not hiking rates in the face of an inflationary spiral last year. But the passage of this bill would endorse and codify it.

The Fed has already become highly politicized with its invention of "inclusive monetary policy" and using it as a justification for not hiking rates in the face of an inflationary spiral last year. But the passage of this bill would endorse and codify it.https://twitter.com/charliebilello/status/1459549914392846341?s=20&t=IliE-3GDGDj7Gx0Pq435_Q

Perspective: a 75 bps hike would merely bring the Fed Funds Rate back to where it was before the 2020 crash: 1.50%-1.75%. Given 8.6% inflation rate and 3.6% unemployment rate, that's still extraordinarily easy monetary policy.

Perspective: a 75 bps hike would merely bring the Fed Funds Rate back to where it was before the 2020 crash: 1.50%-1.75%. Given 8.6% inflation rate and 3.6% unemployment rate, that's still extraordinarily easy monetary policy.