Compute @ Anthropic | Formerly AI strategy @ Google and tech equity research @ Bernstein Research

15 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/waymo/status/1933543634583818390

2/ This paper shows autonomous driving follows the same scaling laws as the rest of ML - performance improves predictably on a log linear basis with data and compute

2/ This paper shows autonomous driving follows the same scaling laws as the rest of ML - performance improves predictably on a log linear basis with data and compute

2/ Source is this retrospective written by Jeffrey Flier (former dean of Harvard Medical School) about his biotech startup MetaBio in the late 1980s: muse.jhu.edu/article/936213

2/ Source is this retrospective written by Jeffrey Flier (former dean of Harvard Medical School) about his biotech startup MetaBio in the late 1980s: muse.jhu.edu/article/936213

2/ When IBM invented the mainframe in the 50s, there were no independent software companies - IBM bundled their hardware with a COBOL compiler, which customers then used to write custom software themselves

2/ When IBM invented the mainframe in the 50s, there were no independent software companies - IBM bundled their hardware with a COBOL compiler, which customers then used to write custom software themselves

2/ This slide deck was posted on Hacker News earlier this week but just got taken down

2/ This slide deck was posted on Hacker News earlier this week but just got taken down

2/ OBSERVATION #1 - Yes, everything really does run on WeChat

2/ OBSERVATION #1 - Yes, everything really does run on WeChat

2/ A hobby is mine to read books about the future, written in the past (how else could you grade the author's work?)

2/ A hobby is mine to read books about the future, written in the past (how else could you grade the author's work?)

2/ Twenty years ago, everybody in the software industry was already debating whether "best of breed" applications would triumph over integrated solutions from Accenture ("one throat to choke")

2/ Twenty years ago, everybody in the software industry was already debating whether "best of breed" applications would triumph over integrated solutions from Accenture ("one throat to choke")

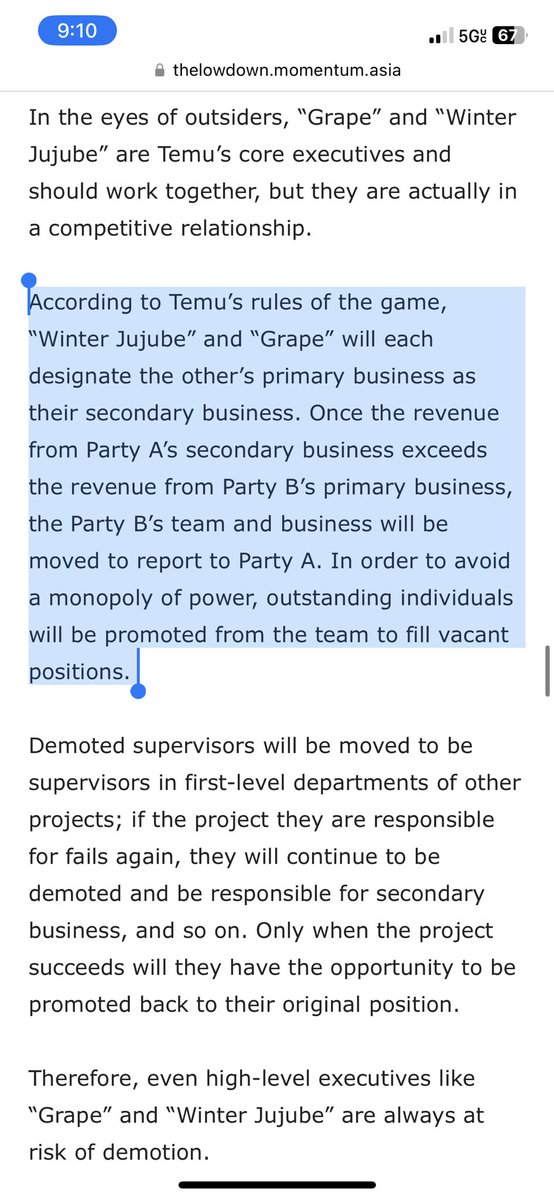

2/ It starts out talking about how Temu’s org chart is structured into two warring factions trying to take each other over

2/ It starts out talking about how Temu’s org chart is structured into two warring factions trying to take each other over

2/ The following excerpts all come from Appendix D of the recently-updated Sevilla et. al (2023) arxiv.org/abs/2202.05924

2/ The following excerpts all come from Appendix D of the recently-updated Sevilla et. al (2023) arxiv.org/abs/2202.05924

2/ The paper essentially argues that Japan’s software industry has suffered from a double bind ever since the 90s:

2/ The paper essentially argues that Japan’s software industry has suffered from a double bind ever since the 90s:

2/ The methodology: the book manually compiled data on 200 unicorns and 200 randomly selected startups (out of the 20,000 that raised $3M+ in funding from 2005 to 2018 per Pitchbook), and manually benchmarked each company across 65 attributes

2/ The methodology: the book manually compiled data on 200 unicorns and 200 randomly selected startups (out of the 20,000 that raised $3M+ in funding from 2005 to 2018 per Pitchbook), and manually benchmarked each company across 65 attributes

2/ For those who don't remember, Webvan was the first real online grocery delivery startup of the internet era

2/ For those who don't remember, Webvan was the first real online grocery delivery startup of the internet era

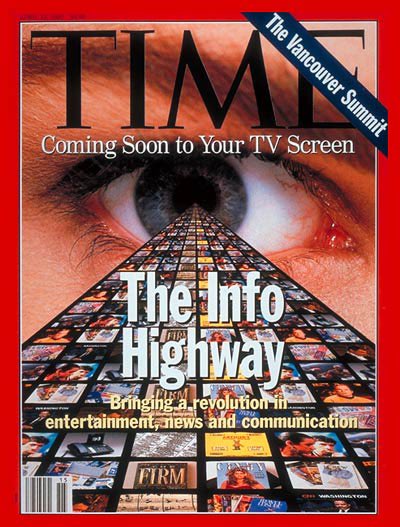

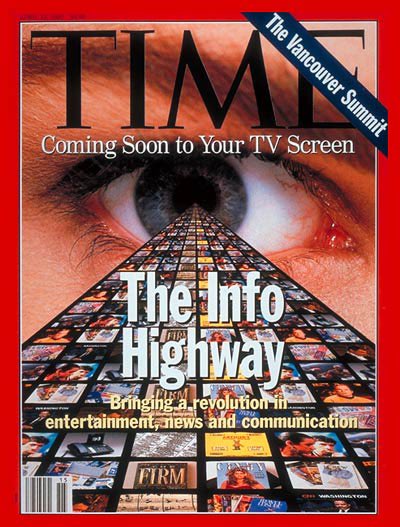

2/ The birth of the consumer internet was arguably in late 1994, when Netscape launched. But something you realize after cursory historical research is that by 1993, virtually every important person in media and tech knew *something* approximating the internet was going to emerge

2/ The birth of the consumer internet was arguably in late 1994, when Netscape launched. But something you realize after cursory historical research is that by 1993, virtually every important person in media and tech knew *something* approximating the internet was going to emerge

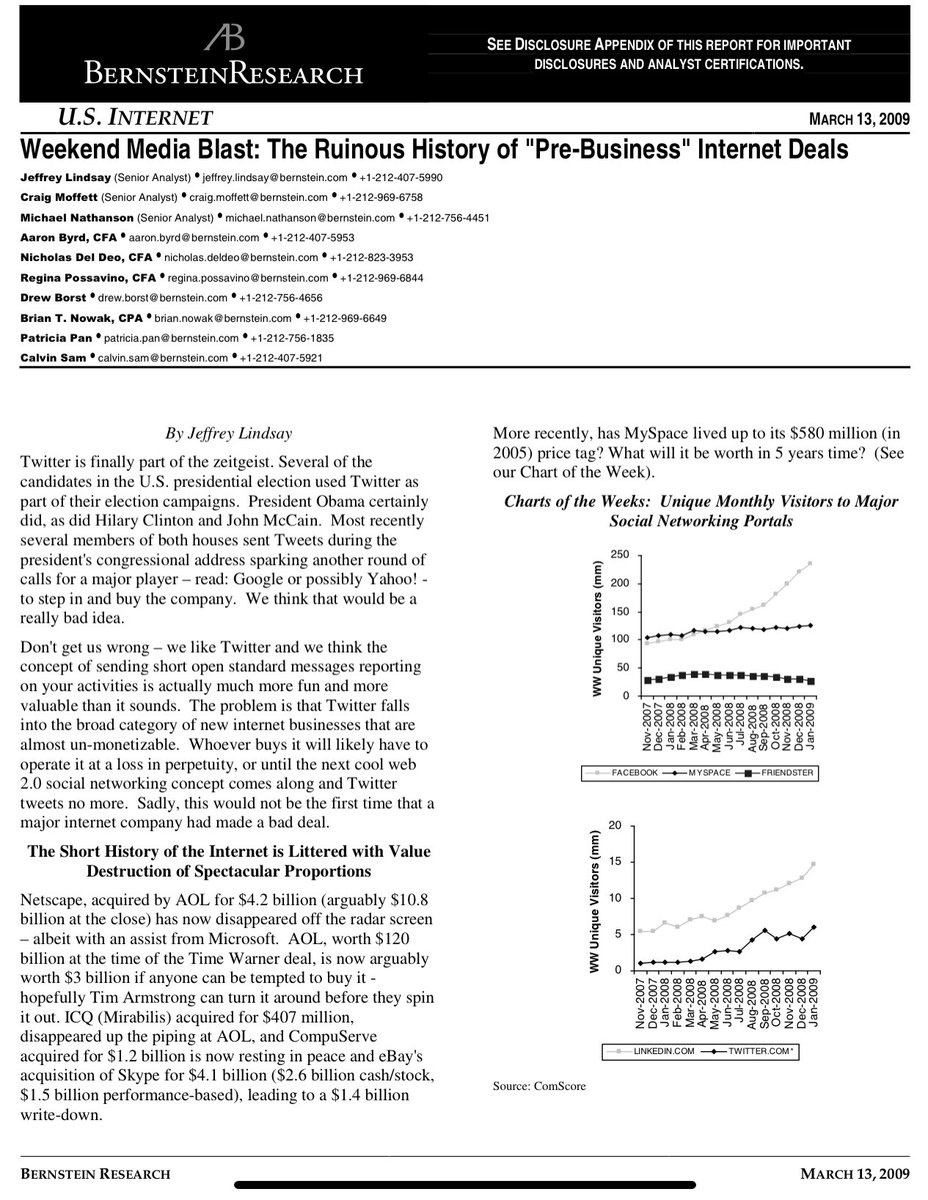

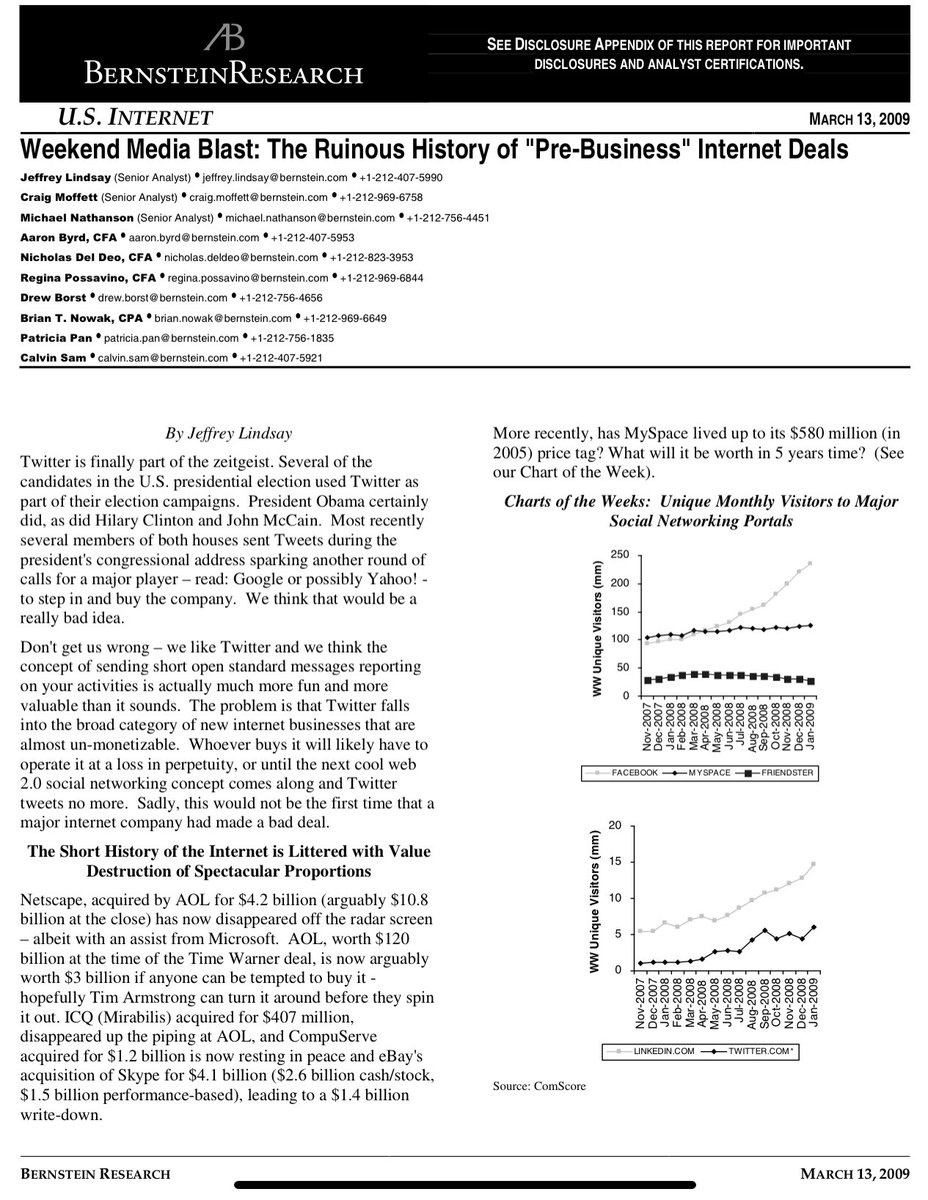

2/ In retrospect, investors "overlearned" the lessons of history from the tech bubble. By the late 2000s, the collapse of AOL, Yahoo, and other Web 1.0 properties had "proven" it was impossible to make money advertising on general-use social platforms

2/ In retrospect, investors "overlearned" the lessons of history from the tech bubble. By the late 2000s, the collapse of AOL, Yahoo, and other Web 1.0 properties had "proven" it was impossible to make money advertising on general-use social platforms