Private investor, consultant to businesses navigating the startup world. #mightygreenhouse; #suviefood; #puraclenz; #marineguardian; #livrecovery; #GMTMsports

How to get URL link on X (Twitter) App

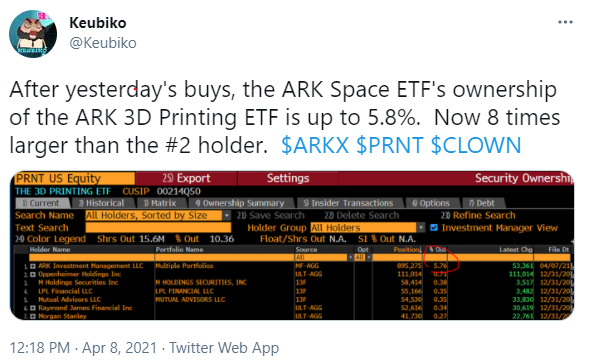

2/ Before getting into Sec 12, many funds routinely purchase shares of other registered investment companies. And for clarity’s sake, a registered investment company is an open-end mutual fund, a closed-end, or an ETF.

2/ Before getting into Sec 12, many funds routinely purchase shares of other registered investment companies. And for clarity’s sake, a registered investment company is an open-end mutual fund, a closed-end, or an ETF.

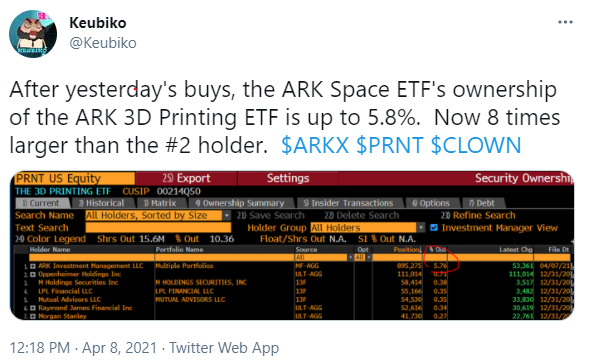

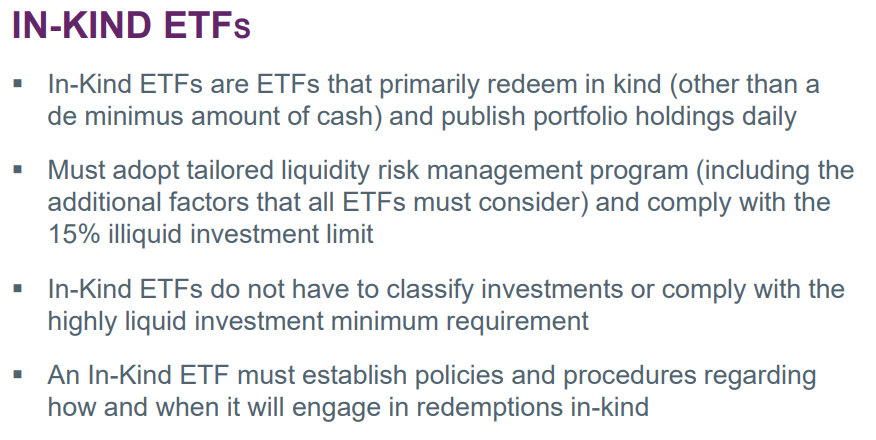

2/ You remember the breathless reporting from Bloomberg and others that discussed ARK's astronomical asset growth relative to the other big industry players, the real shops, and you might have rightly wondered, "where is the growth coming from?"

2/ You remember the breathless reporting from Bloomberg and others that discussed ARK's astronomical asset growth relative to the other big industry players, the real shops, and you might have rightly wondered, "where is the growth coming from?"

https://twitter.com/orthereaboot/status/13276739259925913622/ requirements and regulatory compliance), and they oversee your factsheets and public communications (as does internal compliance). For that, most statutory distributor relations cost between 5-10 basis points per year. Kelso/Resolute was Ark's distributor.

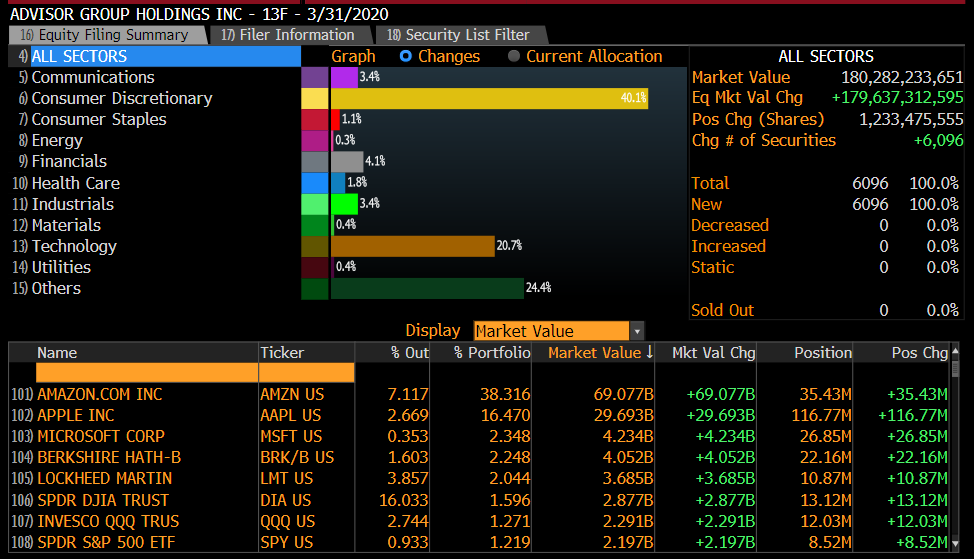

Page 2. T Rowe a big seller again. Whale Rock is a Boston hedge fund, ex-Fidelity. Advisor Group is a new holder. Here are their top holdings.

Page 2. T Rowe a big seller again. Whale Rock is a Boston hedge fund, ex-Fidelity. Advisor Group is a new holder. Here are their top holdings.

https://twitter.com/Paul91701736/status/1287470957918068736?s=202/ We agree with Michael on this subject and have had conversations w him about it. Still we all need context around the amounts in question. Passives have a role for sure, but don’t underestimate how much money is sloshing around in the hands of idiots (RobinHODLr’s).

https://twitter.com/fleckcap/status/12672721483404902412/ Indeed, our feed is swamped by almost identical viewpoints from hundreds of others. Just try investing in Tesla since 2017 and you’ll know what we mean.

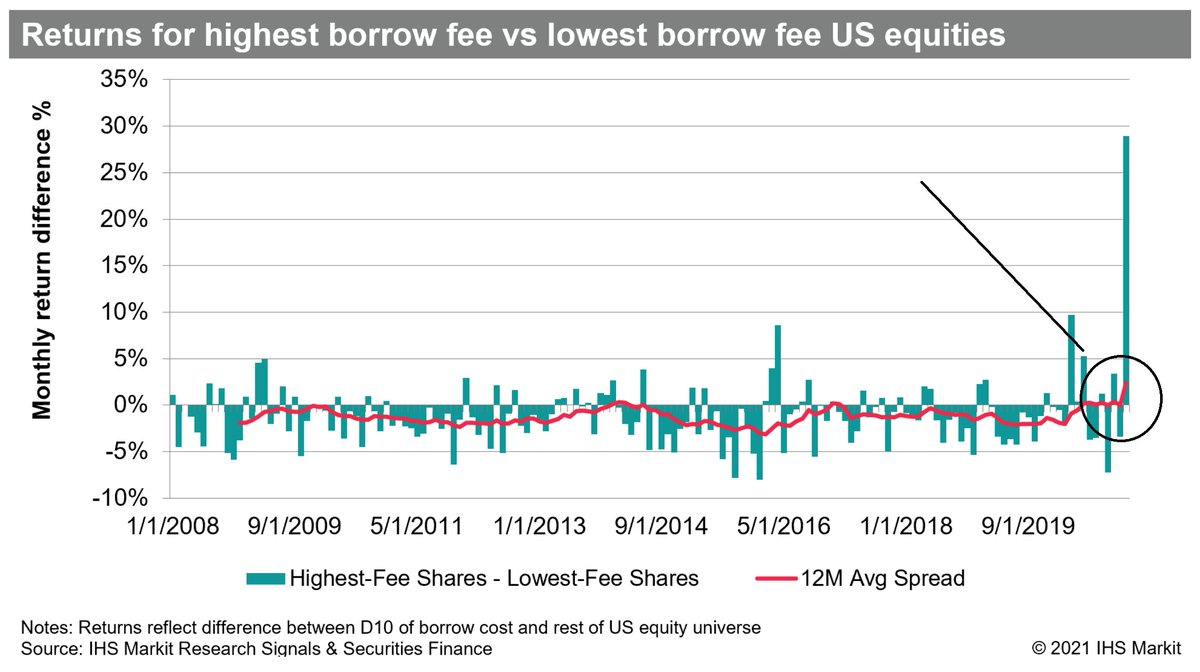

https://twitter.com/cppinvest/status/12639443230428733442/ There is no one real willing to pay these prices for Tezzler shares. ETF's cannot participate in secondaries. So, he has to go to the broader market for support. And the broader market is telling him to stick it next to Vern's sub. Don't believe me? Here's a picture. . .