How to get URL link on X (Twitter) App

GMX v2 sets out to solve 3 problems:

GMX v2 sets out to solve 3 problems:

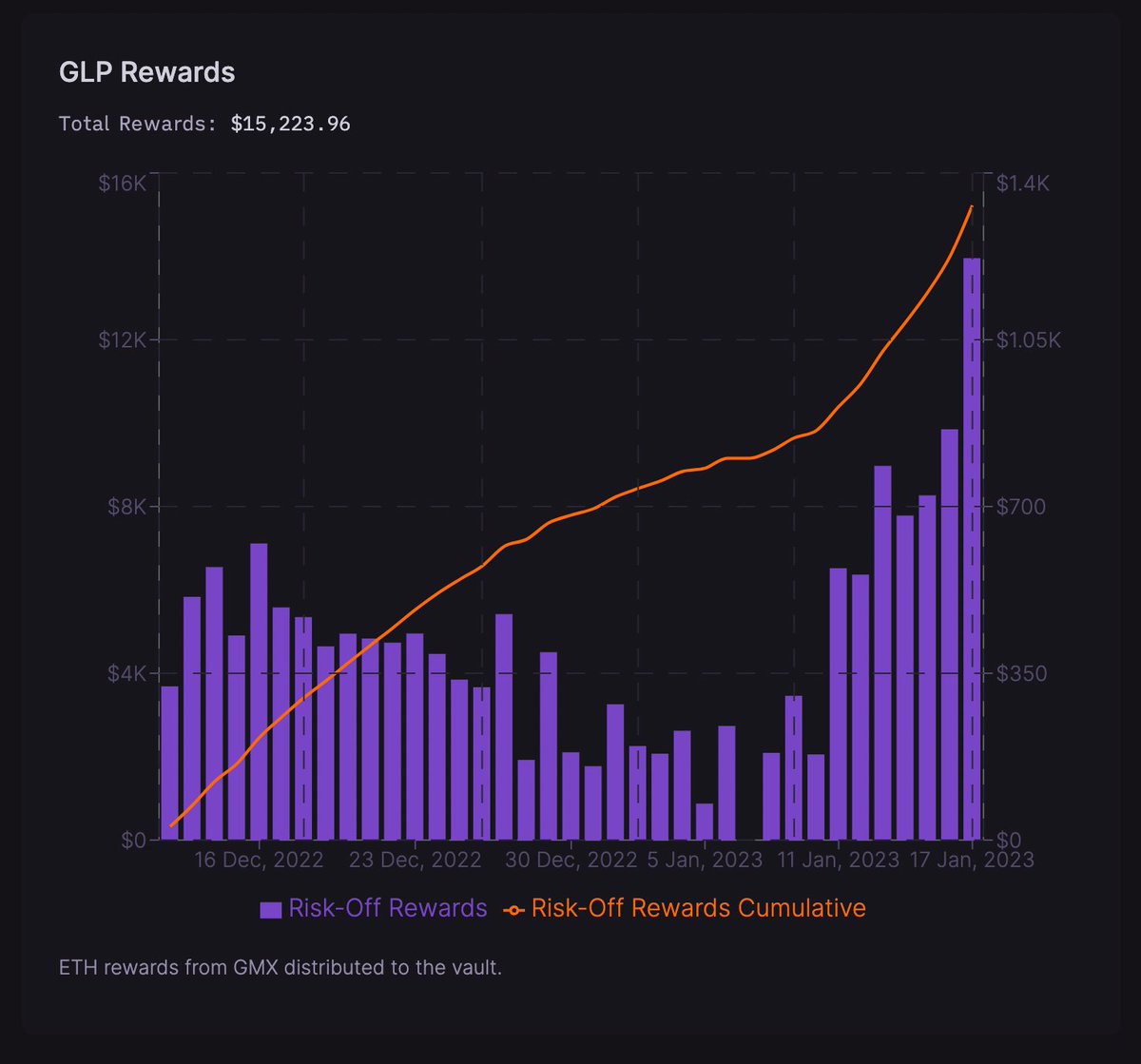

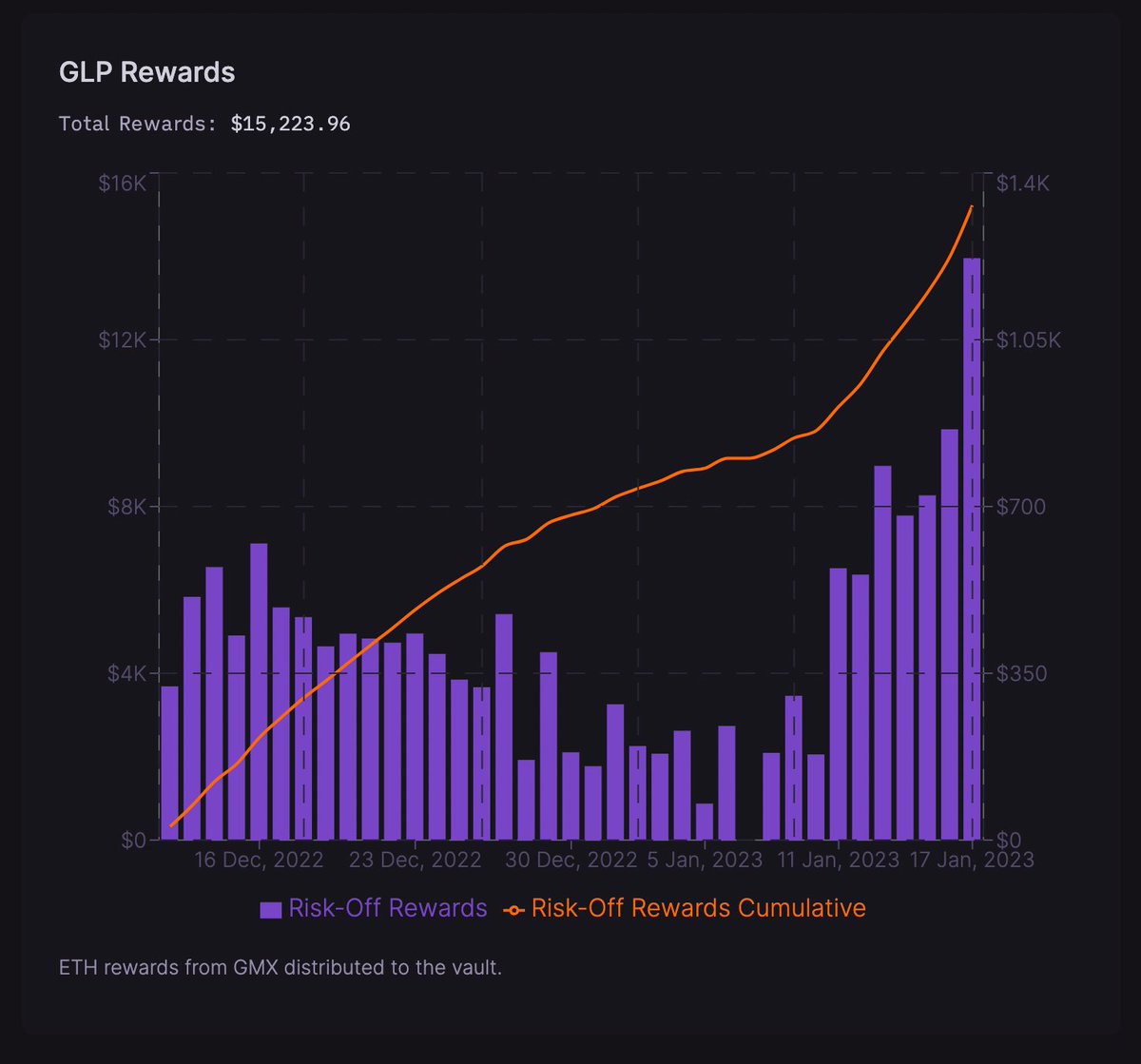

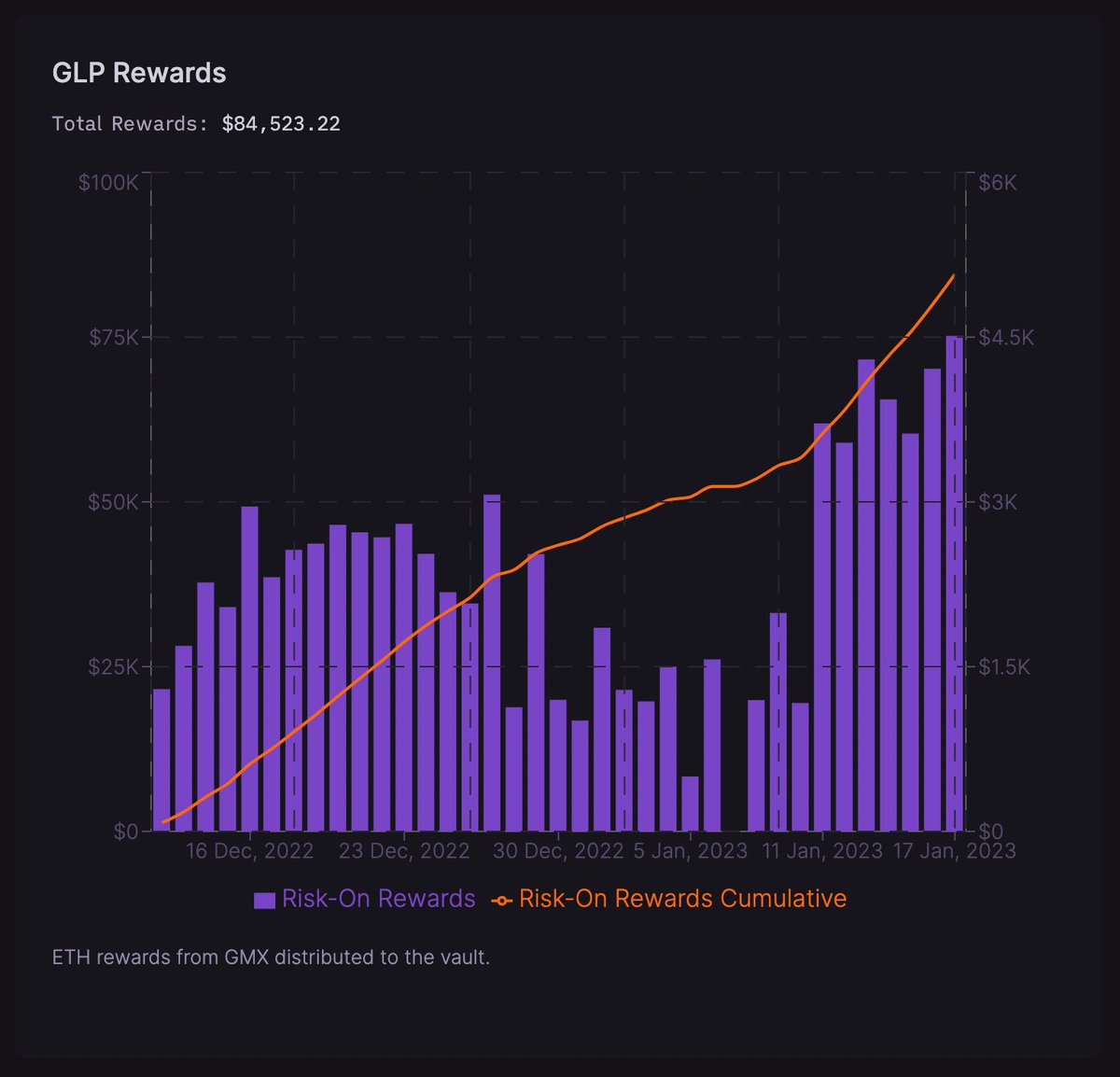

The returns for each vault can be broken down by:

The returns for each vault can be broken down by:

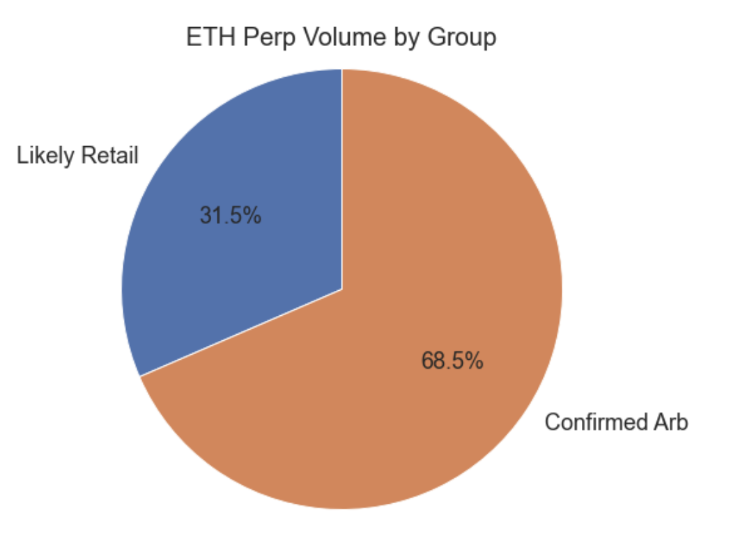

What did we find?

What did we find?

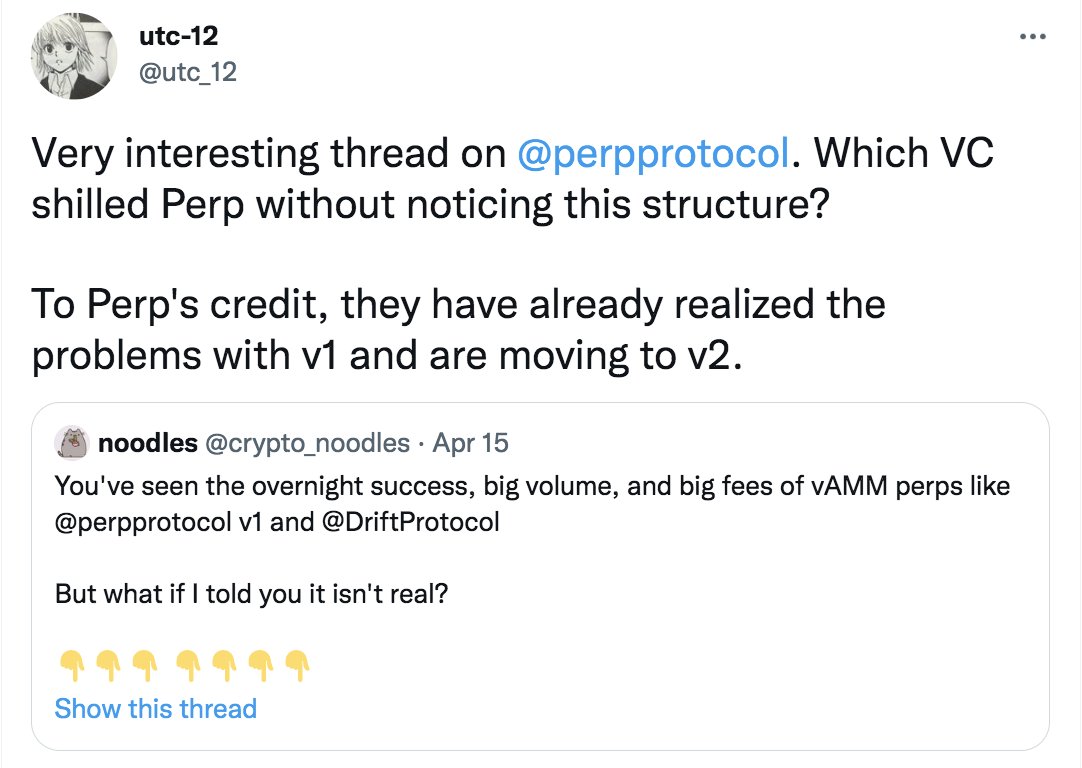

https://twitter.com/0xtuba/status/1438195176166641669On ranges,

https://twitter.com/petejkim/status/1321891517124931584Concerns for both $SOL + $ETH