Founder & CIO @disciplinefunds 📊 | Author @pragcap 📖| PM of DSCF 💰| Defined Duration Investing ⌛| Board at Cambria ETFs 💸

3 subscribers

How to get URL link on X (Twitter) App

That chart might make you think that the 2 year is leading the Fed and foreshadowing that they're behind the curve.

That chart might make you think that the 2 year is leading the Fed and foreshadowing that they're behind the curve.

The reason for this is because household debt is now comprised increasingly of more interest sensitive debts and because banks are slow to pass on interest rate increases.

The reason for this is because household debt is now comprised increasingly of more interest sensitive debts and because banks are slow to pass on interest rate increases.

We'd expect this to primarily impact private investment and how the private sector borrows to finance new investment.

We'd expect this to primarily impact private investment and how the private sector borrows to finance new investment.

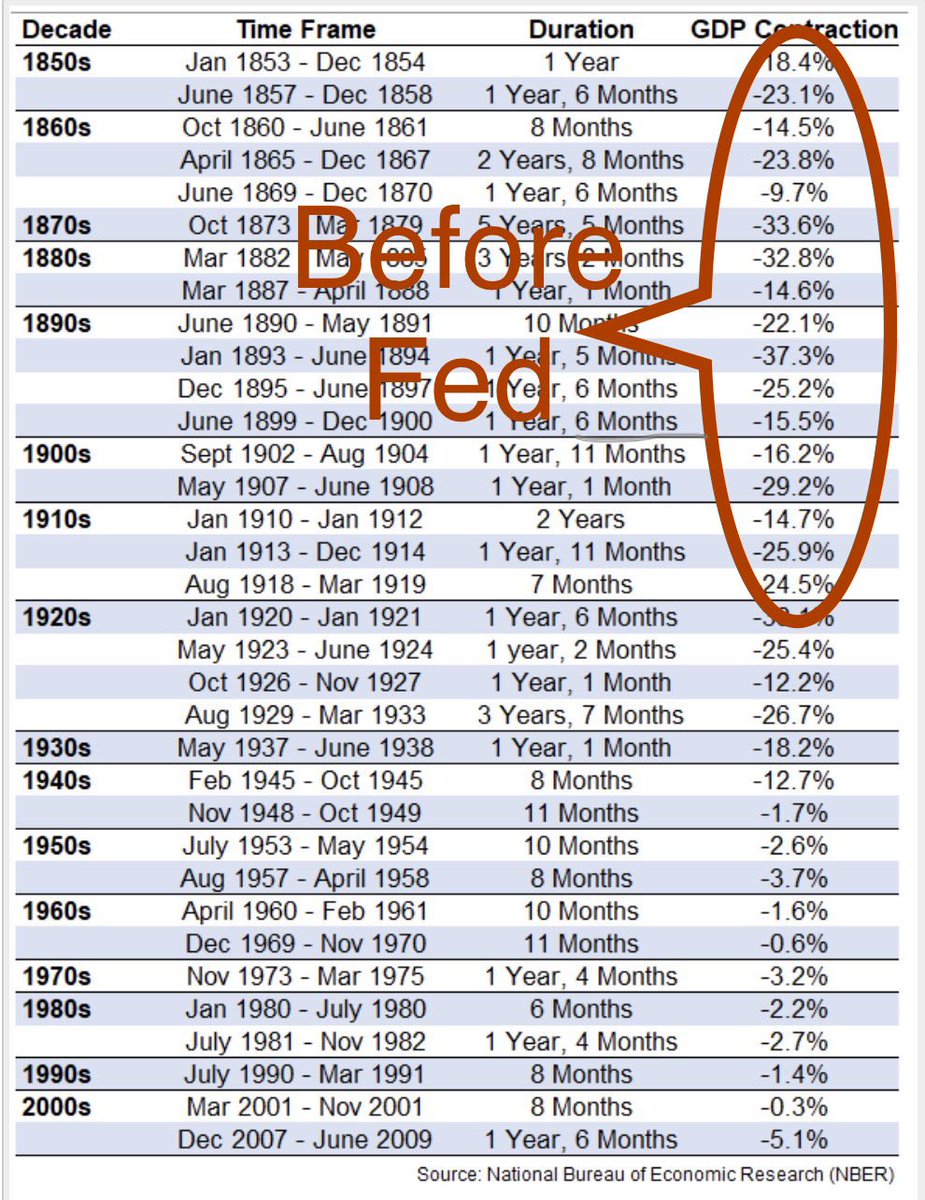

Bear markets in perspective. From the excellent macro analyst @MacroAlf

Bear markets in perspective. From the excellent macro analyst @MacroAlf https://twitter.com/MacroAlf/status/1608576353951186944

Rents lag and the data clearly shows rents have peaked and are turning lower. 2023 is going to be one persistent disinflation theme.

Rents lag and the data clearly shows rents have peaked and are turning lower. 2023 is going to be one persistent disinflation theme.

https://twitter.com/cullenroche/status/1476598339172900864In the aggregate we should expect financial liabilities AND assets to rise over time. In fact, we need them to. This is why total debt always rises in the long-run. See, eg, household debt:

https://twitter.com/AdamSinger/status/1475507875359469569At its core the Fed is just an interbank clearinghouse.

https://twitter.com/paulkrugman/status/1459940021599887361The big lesson from the financial crisis was that QE and Fed policy isn't as powerful as many assumed and that fiscal policy is in fact, a huge powerful bazooka.

First, we know from the financial crisis that M1 is a terrible, I repeat, TERRIBLE measure of future inflation.

First, we know from the financial crisis that M1 is a terrible, I repeat, TERRIBLE measure of future inflation. https://twitter.com/NikkiHaley/status/1253325061265620994Why do states ultimately *NEED* federal aid? Because they're not businesses! They're in the business of putting out fires, etc and that's not a profitable business.

Cobblestone, or sampietrini, as the ancient Romans referred to it, is basically a cement surface with huge rock aggregates. That is, it's large stone connected with a cement bond. It's only as strong as the bonding agent used.

Cobblestone, or sampietrini, as the ancient Romans referred to it, is basically a cement surface with huge rock aggregates. That is, it's large stone connected with a cement bond. It's only as strong as the bonding agent used.

https://twitter.com/realDonaldTrump/status/1191350738536083459Source: NBER working paper no 24,085. Household Wealth Trends in the United States, 1962 to 2016: Has Middle Class Wealth Recovered?