Hello Internet, this is Daniel. I am an Assistant Professor of Economics @LSEEcon with interests in behavioral & public economics.

How to get URL link on X (Twitter) App

Economists classically use revealed preferences to infer preferences from choices – if 70% of people select x over y, then 70% of people prefer x to y. But what if choices vary by some seemingly arbitrary factor (a “frame”)?

Economists classically use revealed preferences to infer preferences from choices – if 70% of people select x over y, then 70% of people prefer x to y. But what if choices vary by some seemingly arbitrary factor (a “frame”)?

https://twitter.com/J_C_Suarez/status/1184620924139659264This is not a thought experiment, I am really hung up on this problem in some ongoing work on distributional issues. Surely the macro literature has confronted this problem??

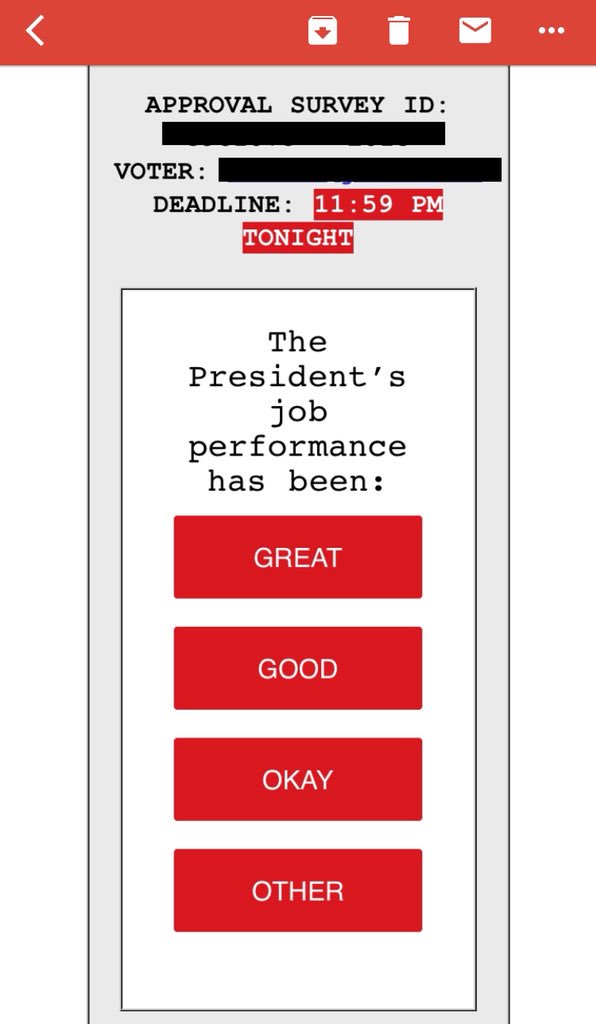

This came from rnchq.com, which is a domain registered to the actual RNC.

This came from rnchq.com, which is a domain registered to the actual RNC.