Views my own | @SpartanRace |🔥| For real talk about investments n stuff follow my newsletter | 📰 ⬇️

How to get URL link on X (Twitter) App

This seems to have really hit a chord with a lot of folks! Clearly this is something we need to talk about …

This seems to have really hit a chord with a lot of folks! Clearly this is something we need to talk about …

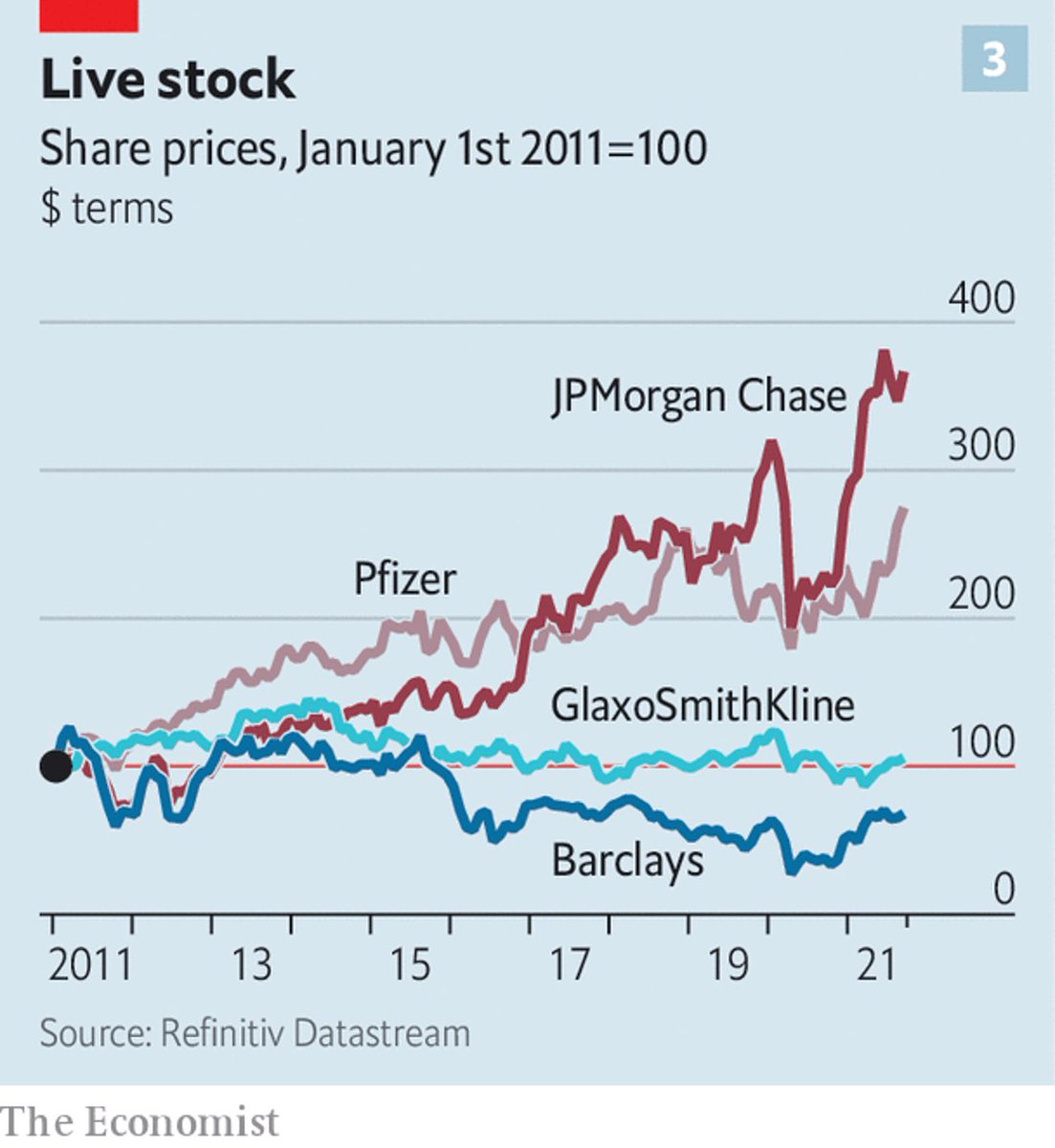

Combination of higher earnings and lower prices.

Combination of higher earnings and lower prices.