How to get URL link on X (Twitter) App

2/ The result: A database of 6,380 venture capital funding deals over the past 6 years, 110 pages of analysis, and nearly 100 different charts breaking down the trends and evolution of capital allocation to the sector.

2/ The result: A database of 6,380 venture capital funding deals over the past 6 years, 110 pages of analysis, and nearly 100 different charts breaking down the trends and evolution of capital allocation to the sector.

2/ In 2017/18, ICOs were the main driver of capital allocation as opposed to VC. ICOs were riddled with scams & terrible ideas, but the Public ICO model was more democratic than what we have today. Sure, VCs were investing, but it could be on the same terms as your average joe.

2/ In 2017/18, ICOs were the main driver of capital allocation as opposed to VC. ICOs were riddled with scams & terrible ideas, but the Public ICO model was more democratic than what we have today. Sure, VCs were investing, but it could be on the same terms as your average joe.

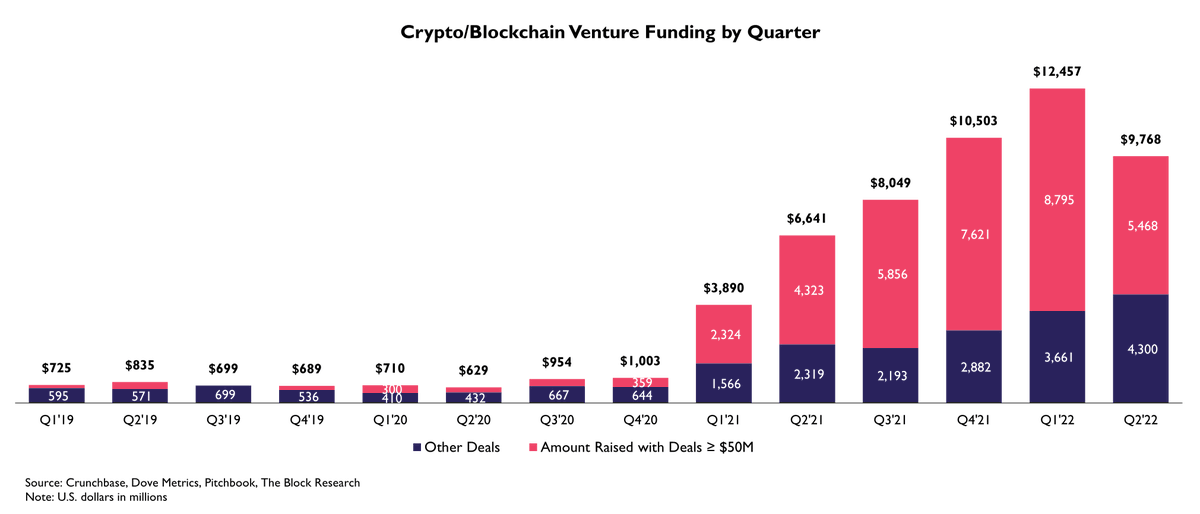

2/ Venture funding in the blockchain sector by $ amount declined 22%, from $12.5 billion to $9.8 billion. Before this decrease, investment had increased for seven consecutive quarters.

2/ Venture funding in the blockchain sector by $ amount declined 22%, from $12.5 billion to $9.8 billion. Before this decrease, investment had increased for seven consecutive quarters.

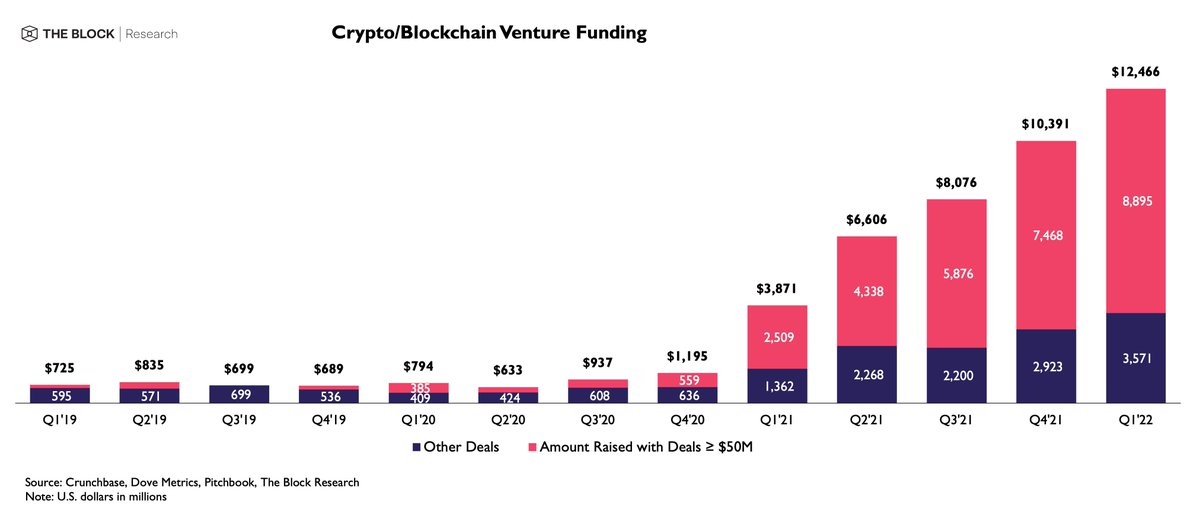

2/ With another quarter in the books, there was another record in venture funding for the crypto/blockchain sector. Private investment was up nearly 21% Q/Q with nearly $8 billion allocated across 423 total deals.

2/ With another quarter in the books, there was another record in venture funding for the crypto/blockchain sector. Private investment was up nearly 21% Q/Q with nearly $8 billion allocated across 423 total deals.

2/ For perspective on how insane private investment in the sector was this quarter, in all of 2020 in aggregate, there was less total funding with $3.07 billion in private financing than just this recent quarter.

2/ For perspective on how insane private investment in the sector was this quarter, in all of 2020 in aggregate, there was less total funding with $3.07 billion in private financing than just this recent quarter.

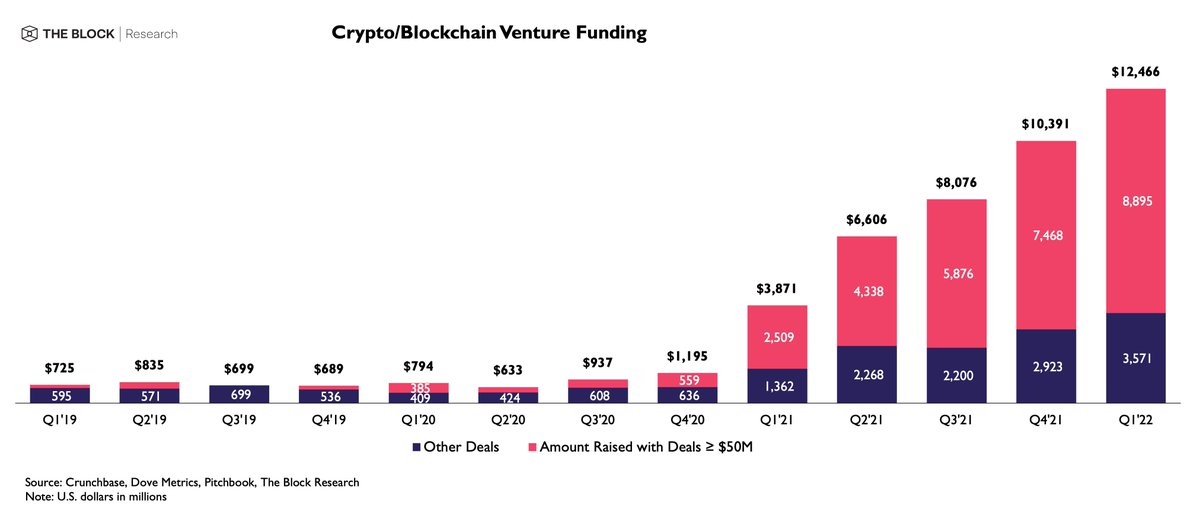

2/ Roughly $3.1 billion in venture funding was allocated to crypto/blockchain projects in 2020. Year-over-year, venture funding stayed relatively consistent despite a 61% drop off in total funding from Q1 to Q2 due to the COVID-19 pandemic.

2/ Roughly $3.1 billion in venture funding was allocated to crypto/blockchain projects in 2020. Year-over-year, venture funding stayed relatively consistent despite a 61% drop off in total funding from Q1 to Q2 due to the COVID-19 pandemic.

Three regions — specifically Asia, Europe, and North America — are the most catered-to areas for cryptocurrency exchanges, in which they make up roughly 69% of the businesses in aggregate

Three regions — specifically Asia, Europe, and North America — are the most catered-to areas for cryptocurrency exchanges, in which they make up roughly 69% of the businesses in aggregate

2/ Early adopters operate on the mantra, “Not your keys, not your coins”, however, this is not ideal for all users nor is it possible, at least in the U.S., for institutions managing more than $150 million that are required by law to have their assets safeguarded by a custodian

2/ Early adopters operate on the mantra, “Not your keys, not your coins”, however, this is not ideal for all users nor is it possible, at least in the U.S., for institutions managing more than $150 million that are required by law to have their assets safeguarded by a custodian