Founder & CEO-Marigold Wealth

Ex-Banker

Risk Management

Retail Assets, Credit Cards, Wealth Management

FMS Alumni

Guest faculty at B Schools

4 subscribers

How to get URL link on X (Twitter) App

Share by value of loans disbursed - Private banks share in Digital loans is 55%, NBFCs have a 30% share by value.

Share by value of loans disbursed - Private banks share in Digital loans is 55%, NBFCs have a 30% share by value.

6. ABSL MF saw a drop of Rs 3900 Cr in AUMs in Dec

6. ABSL MF saw a drop of Rs 3900 Cr in AUMs in Dec

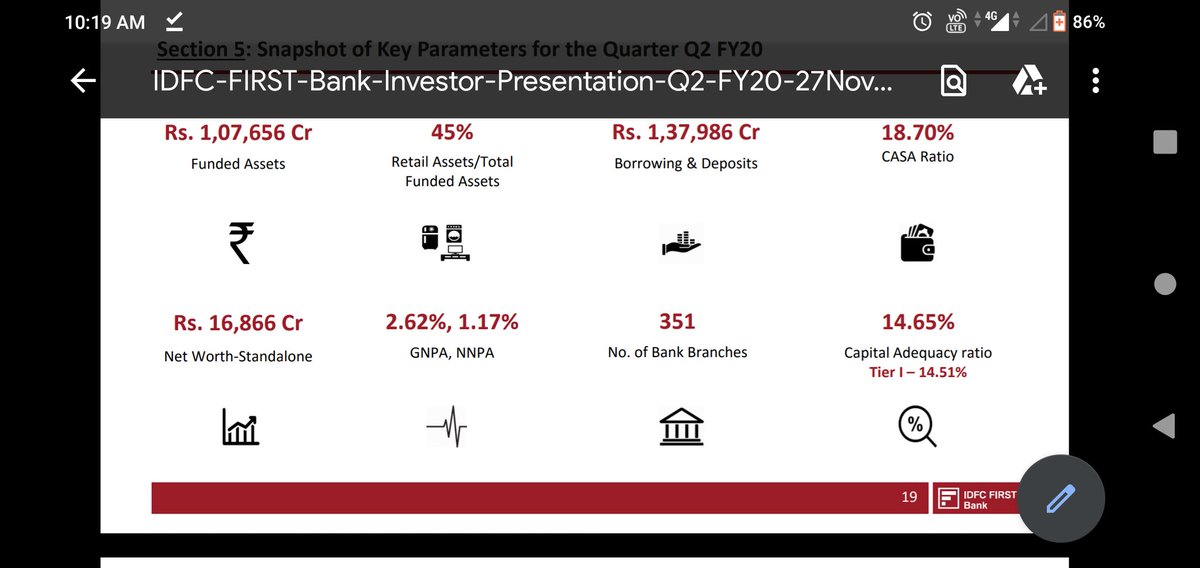

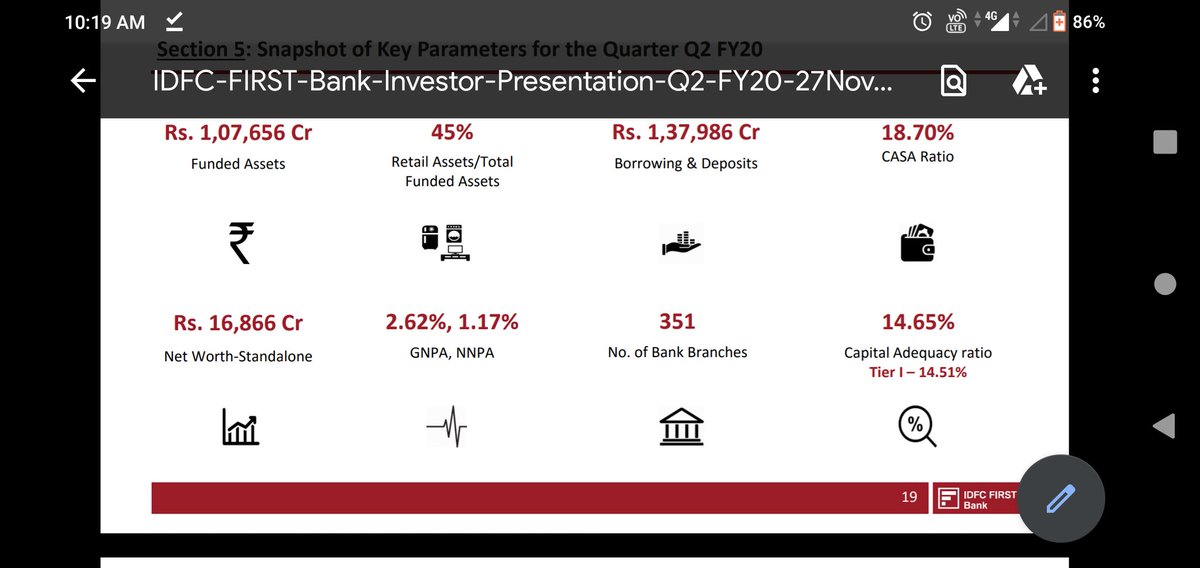

3. CASA ratio is 18.7% & growing. It has grown 10% in last 9 months. Which is very good. Anything over 30% is considered a decent CASA ratio. HDFC Bank CASA ratio is 39.5% & Kotak is 52%. IDFC First has a long way ahead to reach 30%+ ratio.

3. CASA ratio is 18.7% & growing. It has grown 10% in last 9 months. Which is very good. Anything over 30% is considered a decent CASA ratio. HDFC Bank CASA ratio is 39.5% & Kotak is 52%. IDFC First has a long way ahead to reach 30%+ ratio.