How to get URL link on X (Twitter) App

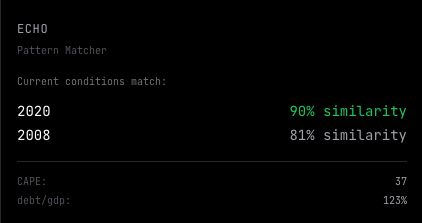

2/ Every government debt crisis ends the same way:

2/ Every government debt crisis ends the same way:

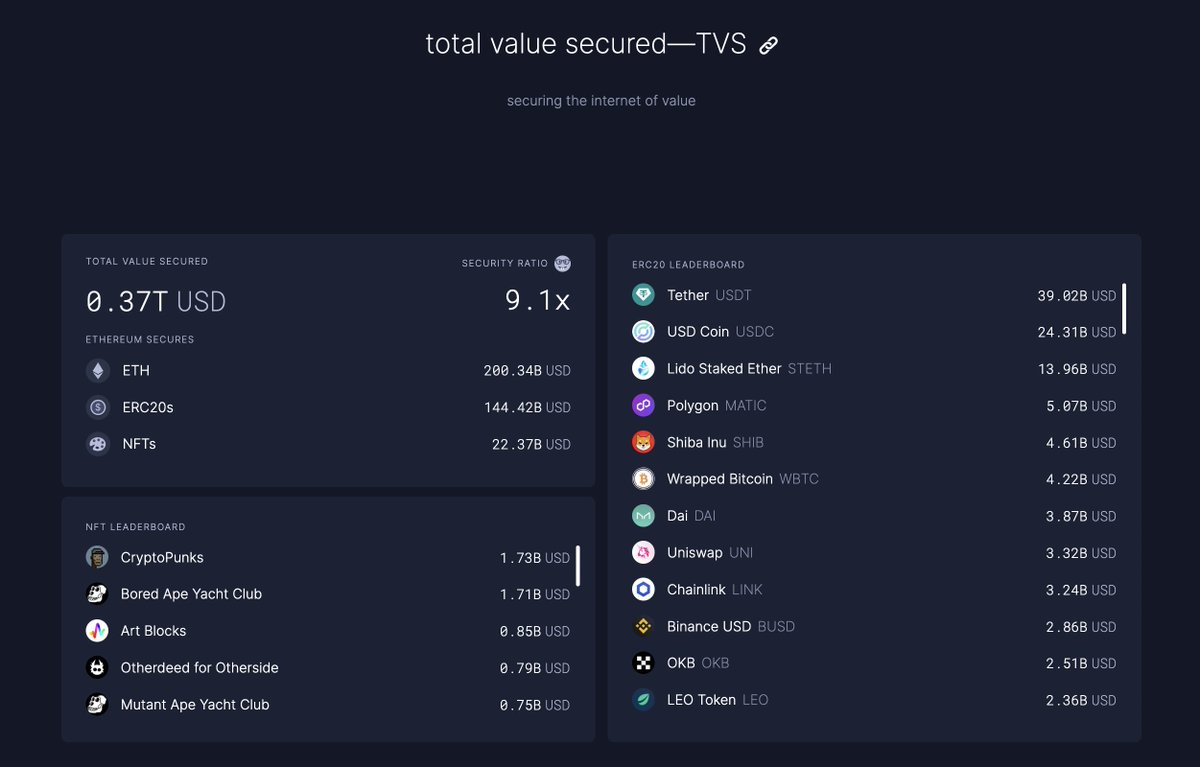

@ethereum 2/ This thread is split into 4 sections.

@ethereum 2/ This thread is split into 4 sections.

2/ This 46-tweet megathread is split into 4 sections:

2/ This 46-tweet megathread is split into 4 sections:

@Zcash 2/ This megathread is split into 4 sections:

@Zcash 2/ This megathread is split into 4 sections:https://x.com/naval/status/1973254136394293708

@SonicLabs 2/ The rise of stablecoins is unstoppable:

@SonicLabs 2/ The rise of stablecoins is unstoppable:

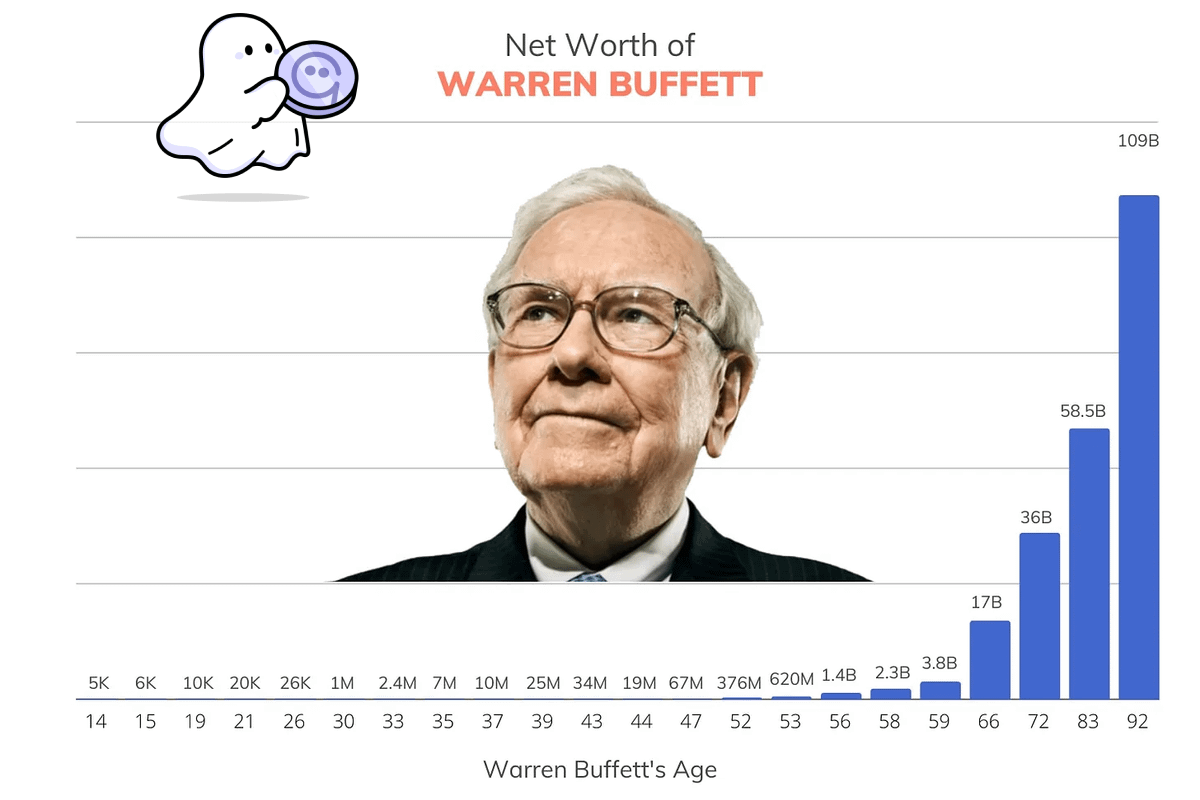

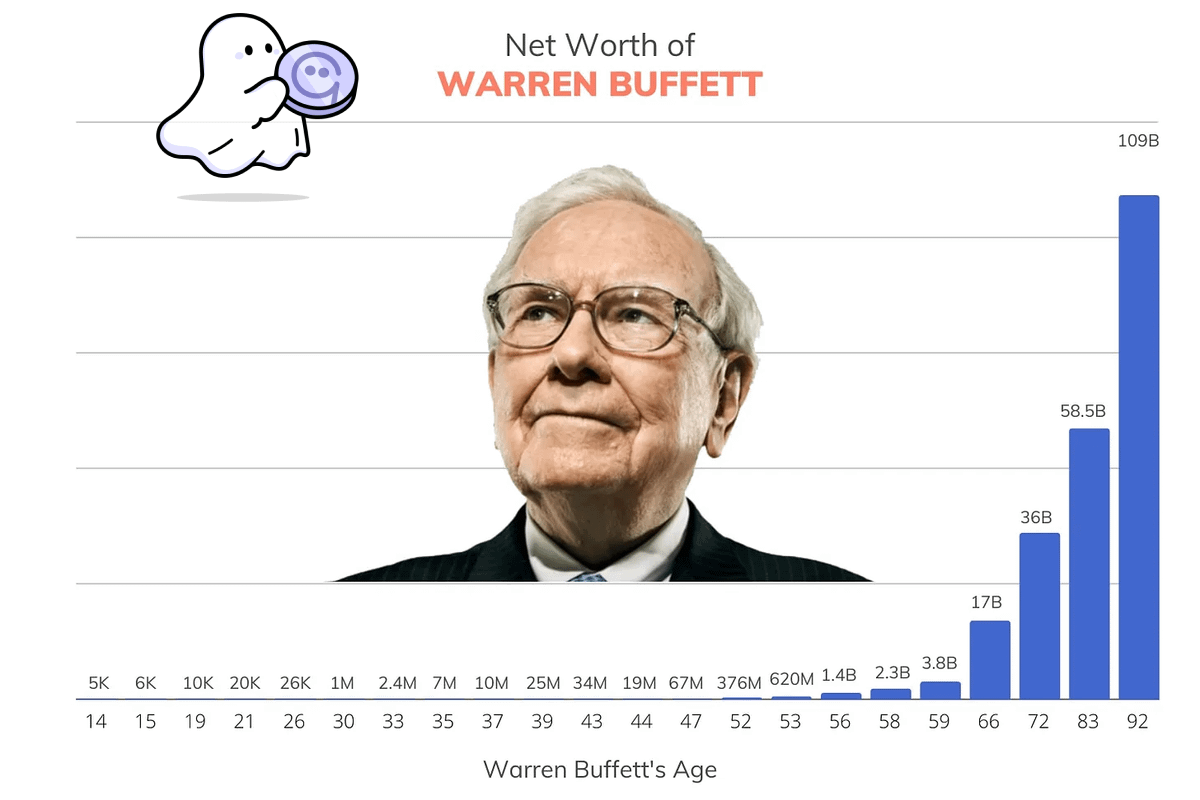

2/ Warren Buffet directs his capital at “wonderful businesses at fair prices”.

2/ Warren Buffet directs his capital at “wonderful businesses at fair prices”.

The AppChain thesis.

The AppChain thesis.https://twitter.com/defi_naly/status/1574037700155305984?s=20

2/ Why hold $ETH when you can hold an interest-bearing version?!

2/ Why hold $ETH when you can hold an interest-bearing version?!

2/ The @ByteMasons are a team that has become synonymous with building highly respected DeFi protocols.

2/ The @ByteMasons are a team that has become synonymous with building highly respected DeFi protocols.

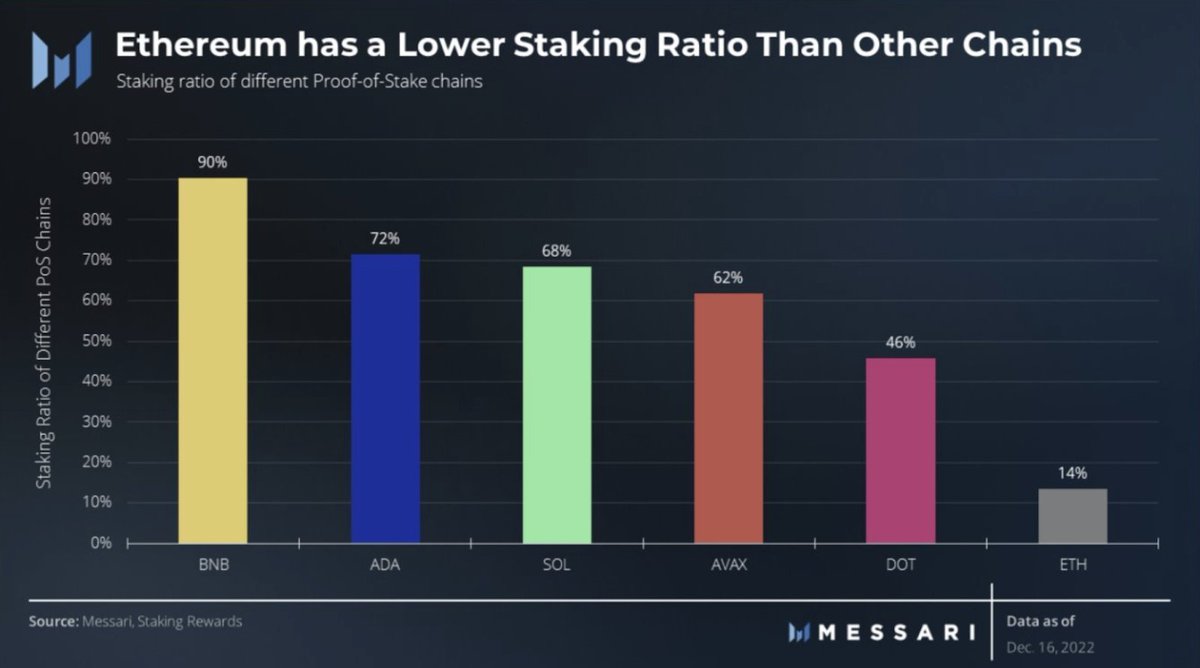

2/ So, why is there a narrative around LSDs anyway?

2/ So, why is there a narrative around LSDs anyway?

2/ In a stagnant bear market, swap volume subsides considerably. DEXs protocol revenue falls.

2/ In a stagnant bear market, swap volume subsides considerably. DEXs protocol revenue falls.

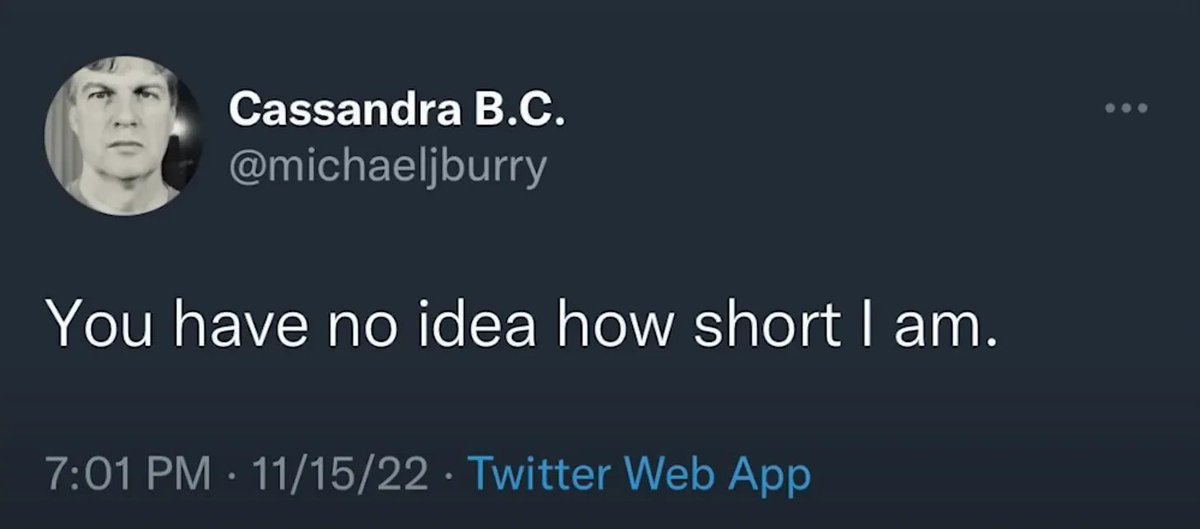

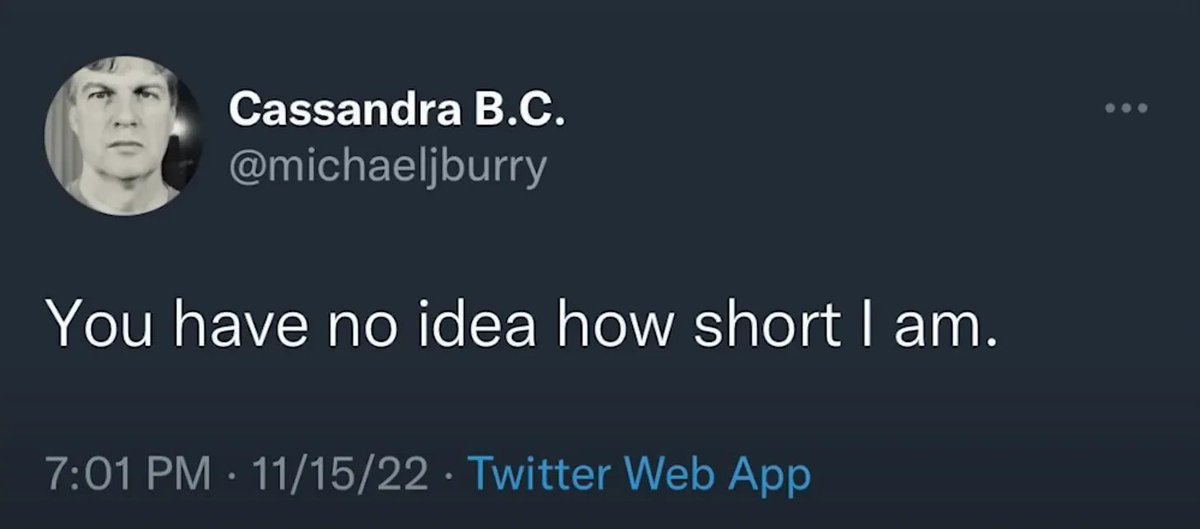

2/ Most notably famous for shorting the Great Financial Crash in 2008,

2/ Most notably famous for shorting the Great Financial Crash in 2008,

2/ In this thread, we will break down:

2/ In this thread, we will break down:

First off, let's make sure we know what a bond is.

First off, let's make sure we know what a bond is.

2/ This thread is split into 4 sections:

2/ This thread is split into 4 sections:

2/ This mega 🧵 is split into 4 sections.

2/ This mega 🧵 is split into 4 sections.

2/ This megathread is split into 3 sections

2/ This megathread is split into 3 sections