Founder. CMD. First Global. Cutting edge PMS & Global funds/portfolios using Human+ Machine System. Gold Medalist IIMA,Lucknow Univ

https://t.co/qqP6fvmmPs

How to get URL link on X (Twitter) App

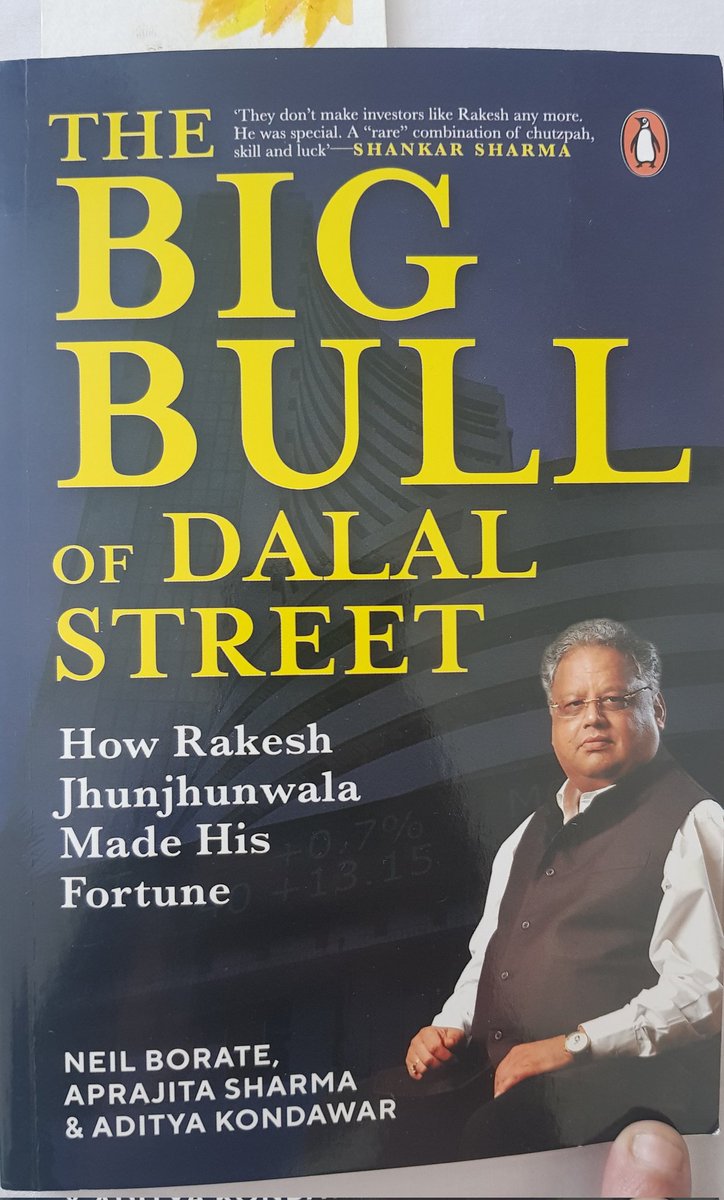

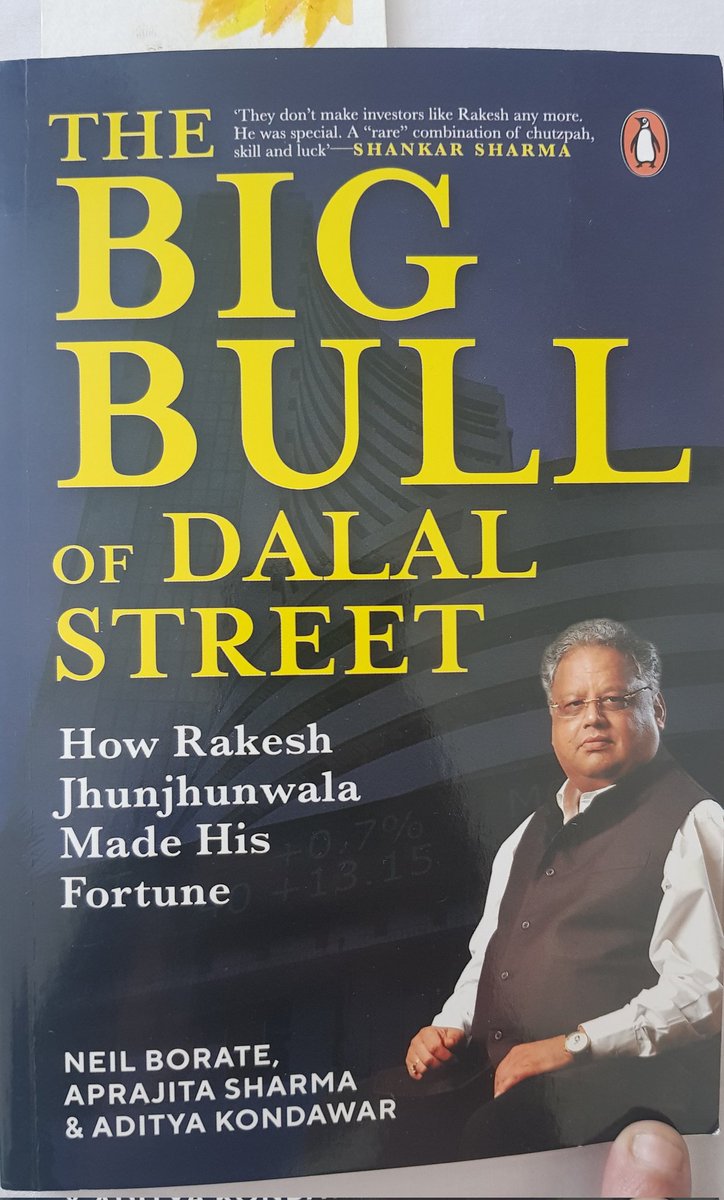

...internalise one RJ superpower, this is it!

...internalise one RJ superpower, this is it!

...which is the reason it took time to finish.

...which is the reason it took time to finish.

Prof. Damodaran himself mentions an equity risk premium over risk-free rate of 4.5%

Prof. Damodaran himself mentions an equity risk premium over risk-free rate of 4.5%