Helping people build wealth since 2017. Author of Just Keep Buying (https://t.co/q98gHouElD) & The Wealth Ladder (https://t.co/dYbDDP3dwc)

6 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/dollarsanddata/status/1770791396137394348My working theory is that as bad as you think some people are at understanding statistics, they are even worse than that.

First off, the essay above is good, but it's also generic and devoid of personality. It sounds like something someone would write to rank well on a Google Search.

First off, the essay above is good, but it's also generic and devoid of personality. It sounds like something someone would write to rank well on a Google Search.https://twitter.com/dmuthuk/status/1436129149727375362See this paper (Do the Rich Save More?):

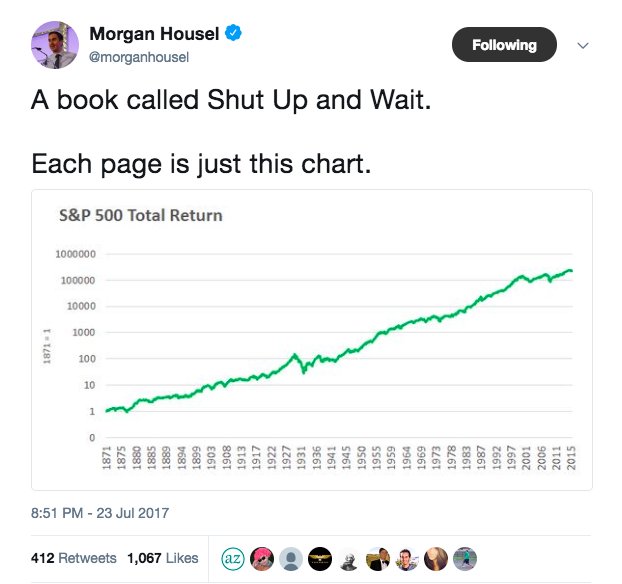

Maybe the most insane thing I've seen this year

Maybe the most insane thing I've seen this year

https://twitter.com/dollarsanddata/status/1107813250257817600