Co-Founder & CEO of Iris - Giving you a better CFO for cheaper using AI @IrisFinanceCo | Fmr CFO @madrabbittattoo | Tweets about finance & ops at brands

How to get URL link on X (Twitter) App

Ryan & his co founder Arjun bootstrapped & started this beauty brand in 2022 starting with Shower heads + Filters aimed at improving skin & hair health.

Ryan & his co founder Arjun bootstrapped & started this beauty brand in 2022 starting with Shower heads + Filters aimed at improving skin & hair health.

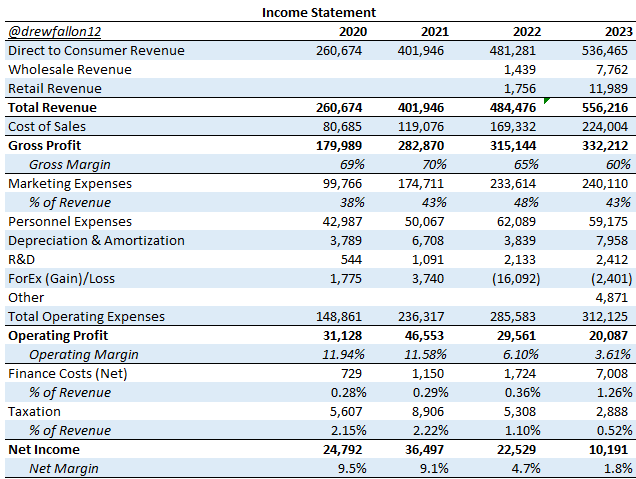

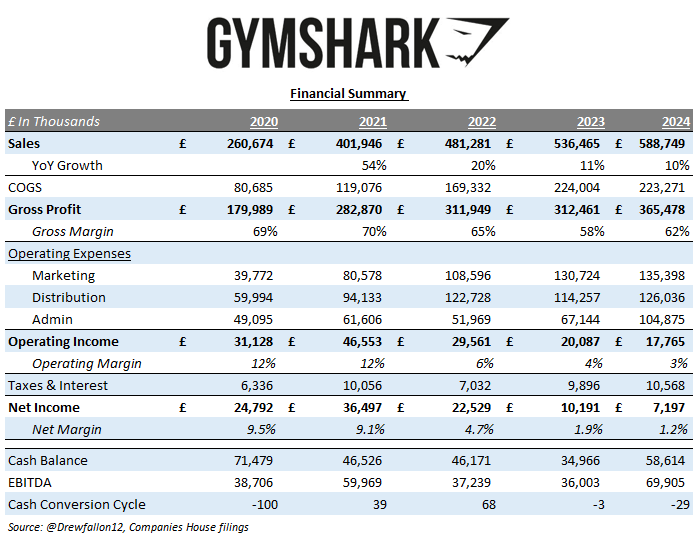

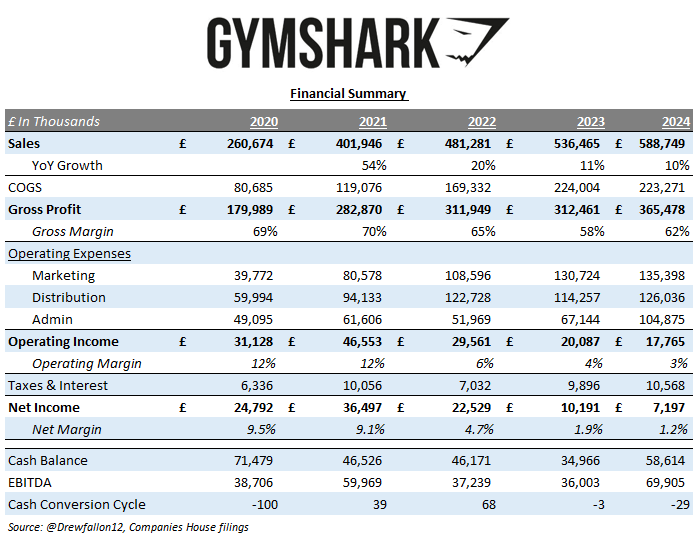

Gymshark's 2024 results can be summarized as follows:

Gymshark's 2024 results can be summarized as follows:

1/ Founding & Early Growth

1/ Founding & Early Growth

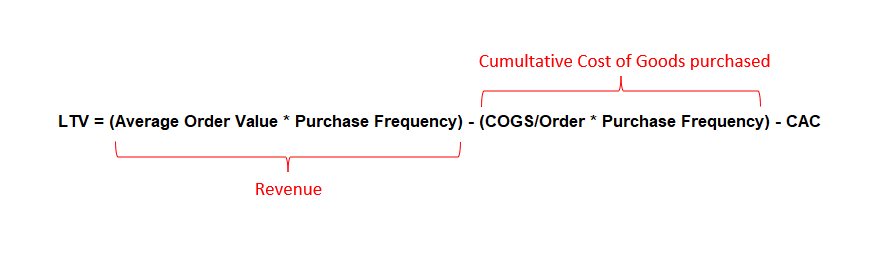

1/ Definition

1/ Definition

1/ First a brief history on Lush

1/ First a brief history on Lush

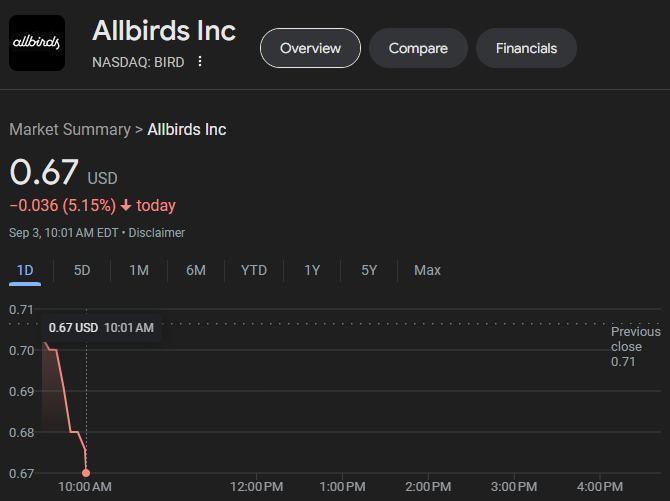

1/ A brief history of allbirds

1/ A brief history of allbirds

First, some juicy KPIs for the DTC nerds:

First, some juicy KPIs for the DTC nerds: