Co-Founder & CEO @threesigmaxyz Blockchain Security Audits --

Founding Member @felixprotocol

How to get URL link on X (Twitter) App

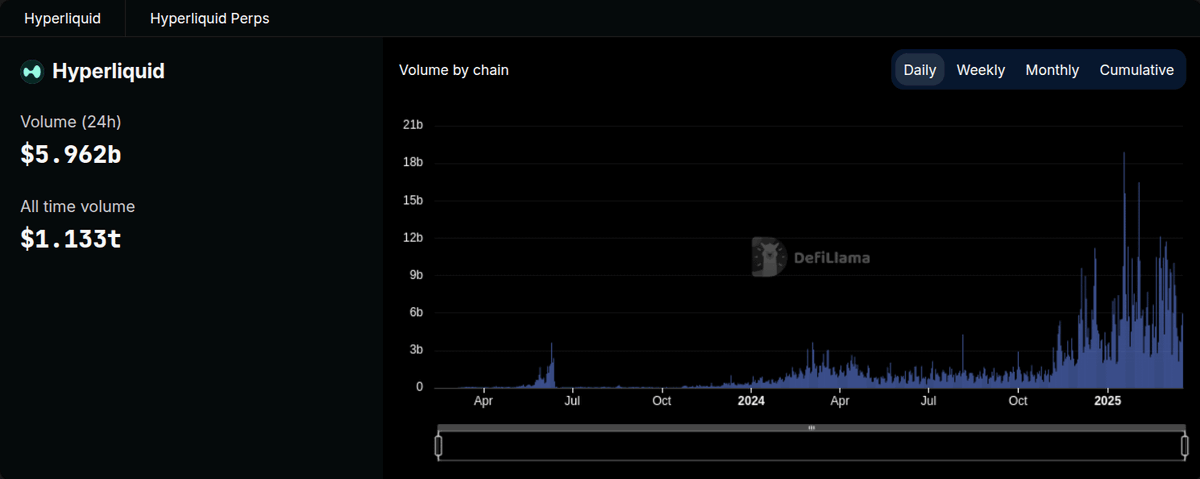

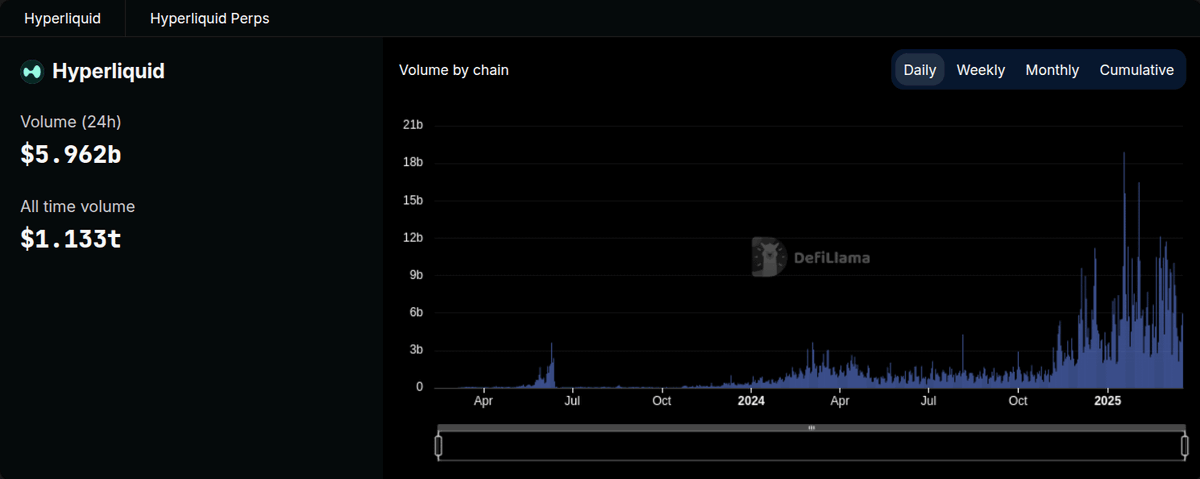

2/ Over the past month, Hyperliquid has shown clear growth, not just through the rise in $HYPE price but also across key performance indicators within both HyperCore and HyperEVM.

2/ Over the past month, Hyperliquid has shown clear growth, not just through the rise in $HYPE price but also across key performance indicators within both HyperCore and HyperEVM.

2/ A builder choosing HUSD as the quote asset could potentionally unlock a new source of income to the ecosystem.

2/ A builder choosing HUSD as the quote asset could potentionally unlock a new source of income to the ecosystem.

2/ The standard model forces every new exchange to recreate the wheel. Teams spend months building infrastructure and paying for depth that quickly decays. Liquidity spreads across too many venues, and all participants pay the cost in form of slower growth, higher friction and worst trading experience.

2/ The standard model forces every new exchange to recreate the wheel. Teams spend months building infrastructure and paying for depth that quickly decays. Liquidity spreads across too many venues, and all participants pay the cost in form of slower growth, higher friction and worst trading experience.

1/🔎 The core challenge:

1/🔎 The core challenge:

2/ A DeFi ecosystem needs one thing before anything else:

2/ A DeFi ecosystem needs one thing before anything else:

2/ To list a token on Hyperliquid, you don’t just deploy.

2/ To list a token on Hyperliquid, you don’t just deploy.

1/ In January 2025, David Balland, co-founder of Ledger, was taken hostage in his own home.

1/ In January 2025, David Balland, co-founder of Ledger, was taken hostage in his own home.

1. Let’s start w/ the obvious: $HYPE is down ~70%.

1. Let’s start w/ the obvious: $HYPE is down ~70%.

2/ Yesterday’s Hyperliquid / JELLY / Binance meltdown wasn’t just chaos, it was a live stress test of decentralization.

2/ Yesterday’s Hyperliquid / JELLY / Binance meltdown wasn’t just chaos, it was a live stress test of decentralization.

1/ For years, perps belonged to CEXs.

1/ For years, perps belonged to CEXs.