ethereum poster, world computer adherent. pronouns: NFA/DYOR

unaffiliated with @ethereumfndn

notintern.eth

How to get URL link on X (Twitter) App

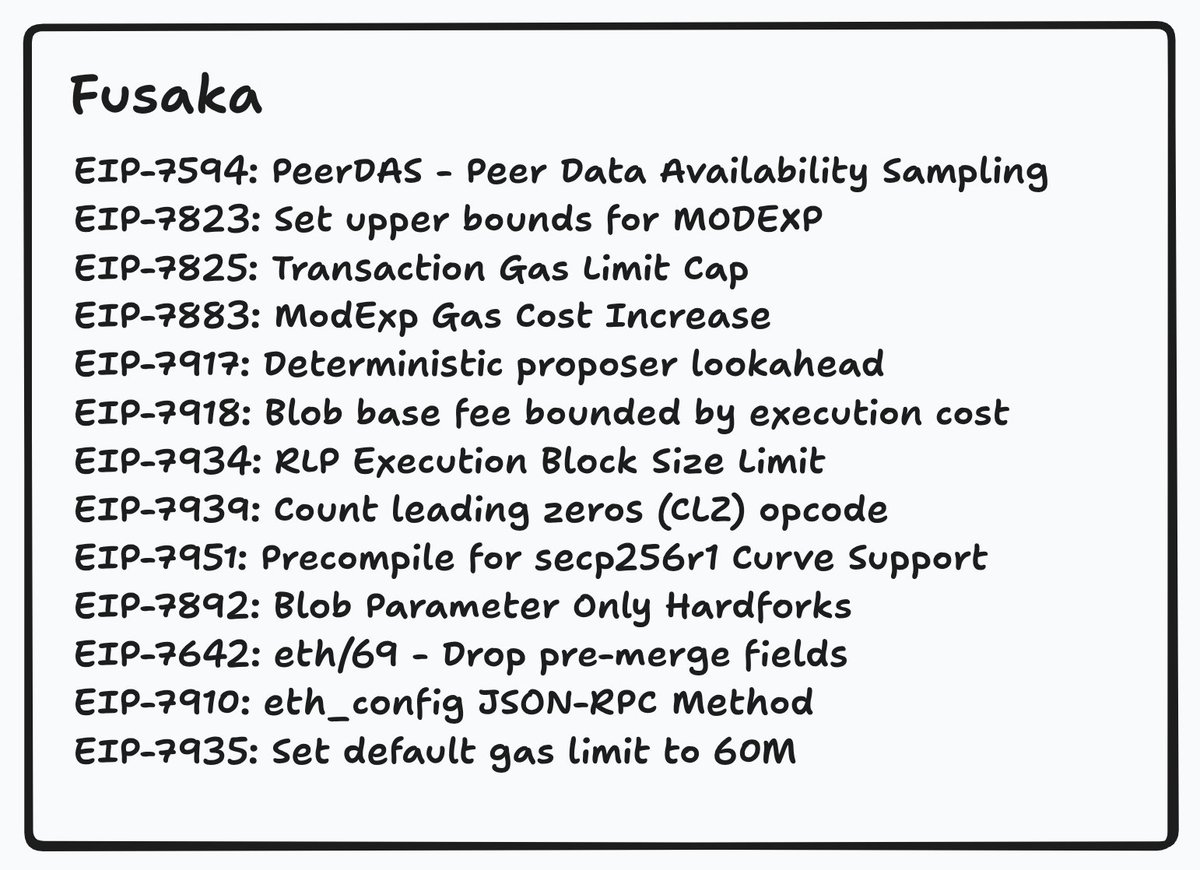

Fusaka, like any other upgrade, consists of various EIPs, which are smaller protocol changes. We will be going through each one from coolest to less cool (completely subjective ordering!)

Fusaka, like any other upgrade, consists of various EIPs, which are smaller protocol changes. We will be going through each one from coolest to less cool (completely subjective ordering!)

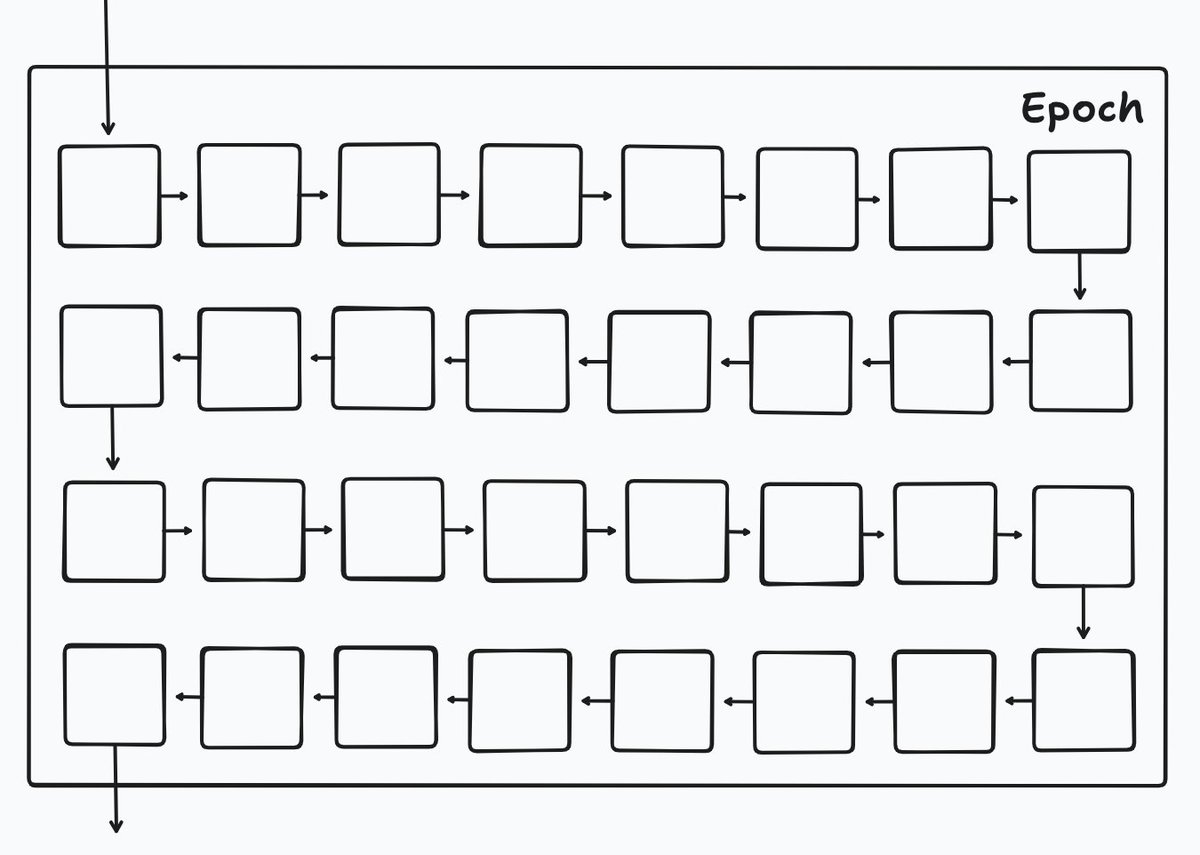

First of all, time on the Beacon Chain is subdivided into epochs and slots. One epoch is 32 slots (~6.4 minutes), and one slot is 12 seconds long.

First of all, time on the Beacon Chain is subdivided into epochs and slots. One epoch is 32 slots (~6.4 minutes), and one slot is 12 seconds long.

@SolanaFndn the Merge was a catastrophe which marked the top for ETHBTC.

@SolanaFndn the Merge was a catastrophe which marked the top for ETHBTC.

@protocol_fx DISCLAIMER: i have received booster rewards from them in the past for my previous thread that included f(x). though it's very appreciated (ty fx!!!), i try not to make it impact my writing

@protocol_fx DISCLAIMER: i have received booster rewards from them in the past for my previous thread that included f(x). though it's very appreciated (ty fx!!!), i try not to make it impact my writinghttps://x.com/ethereumintern_/status/1828087117077188660

pendle PTs: do you want fixed passive income? then sit back and buy some @pendle_fi PTs.

pendle PTs: do you want fixed passive income? then sit back and buy some @pendle_fi PTs.

tevm: a library built on the viem API allowing local transaction simulation and deeper typescript-solidity integration

tevm: a library built on the viem API allowing local transaction simulation and deeper typescript-solidity integration

wtf are perpetual options? (feel free to skip this if you aren't interested in the details)

wtf are perpetual options? (feel free to skip this if you aren't interested in the details)

EVM Object Format: a whole set of sweeping changes to the EVM. it will:

EVM Object Format: a whole set of sweeping changes to the EVM. it will: