Texas Industrial & Multifamily | 7-fig app business destroyed by Apple | Lives on a tropical fruit farm | YC

2 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/evanmr/status/1611437643195355137?s=20&t=CpgcDq_78LfviHDkGvIJuw

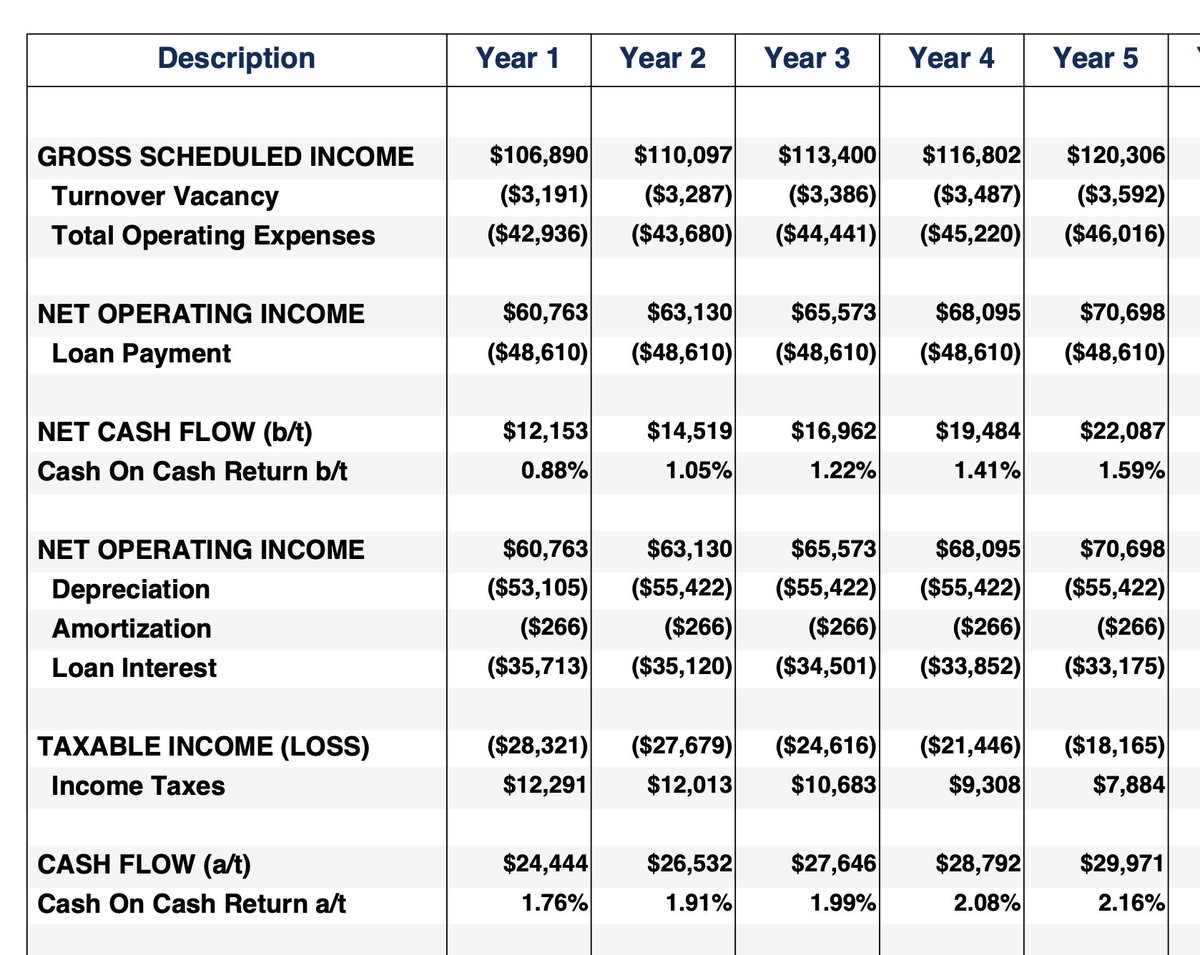

Recently closed on this, upleg #2 of my latest 1031.

Recently closed on this, upleg #2 of my latest 1031.

Early into my real estate career, having enjoyed a taste of success, I became known in my small circle for doing deals involving 1031 exchanges with TIC structures.

Early into my real estate career, having enjoyed a taste of success, I became known in my small circle for doing deals involving 1031 exchanges with TIC structures.https://twitter.com/evanmr/status/1532050407626665984?s=20&t=MrdceEyuH9EsXV_lCRyTXw

It began with a 4-unit in Silicon Valley, which I owned from 2013 to 2017.

It began with a 4-unit in Silicon Valley, which I owned from 2013 to 2017.https://twitter.com/evanmr/status/1531675544458211328?s=20&t=aXD4RK0ofZjmUB3g8cR6MQ

Summary

Summary

Short recap. I started with a 4-unit in Silicon Valley, which I owned from 2013 to 2017.

Short recap. I started with a 4-unit in Silicon Valley, which I owned from 2013 to 2017.https://twitter.com/evanmr/status/1447935590763225088

https://twitter.com/RohunJauhar/status/1388225836034236417

Summary

Summary

https://twitter.com/evanmr/status/1420402439400787970

Background. In the building trades (plumbing, electrical, HVAC, etc), there are several possible business lines:

Background. In the building trades (plumbing, electrical, HVAC, etc), there are several possible business lines: