Blending single stock, macro and thematic research into differentiated bull and bear cases | 15y Corporate Finance & Equity Research | CFA

How to get URL link on X (Twitter) App

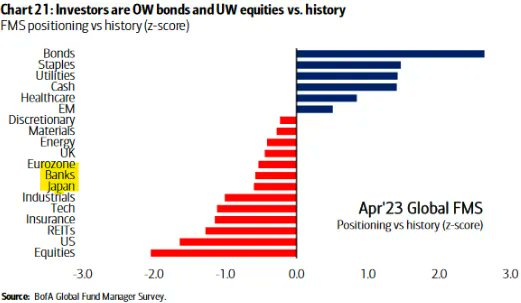

As a professional money manager, it's now a career risk to own regional bank stocks. Their super slow motion car crash is one of the most widely covered crises. Only a question of time until the next blow up. Do you really want to explain to your boss why you are part that?

As a professional money manager, it's now a career risk to own regional bank stocks. Their super slow motion car crash is one of the most widely covered crises. Only a question of time until the next blow up. Do you really want to explain to your boss why you are part that?

1) Why is the relationship negative?

1) Why is the relationship negative?

https://twitter.com/fundstrat/status/1624169079014580244

Let's start with earnings.

Let's start with earnings.

Then the @federalreserve hiked like crazy. But deposit rates operate with a lag because banks take advantage of lazy customers. Look at your bank. Have they raised your interest rate yet?

Then the @federalreserve hiked like crazy. But deposit rates operate with a lag because banks take advantage of lazy customers. Look at your bank. Have they raised your interest rate yet?

Basic mechanism: we produce goods, services & infrastructure (together economic goods), which we offer to others & receive those economic goods in return that we need. To keep this economic process going, a fraction of the fruits of our labor must be retained for future periods.

Basic mechanism: we produce goods, services & infrastructure (together economic goods), which we offer to others & receive those economic goods in return that we need. To keep this economic process going, a fraction of the fruits of our labor must be retained for future periods.

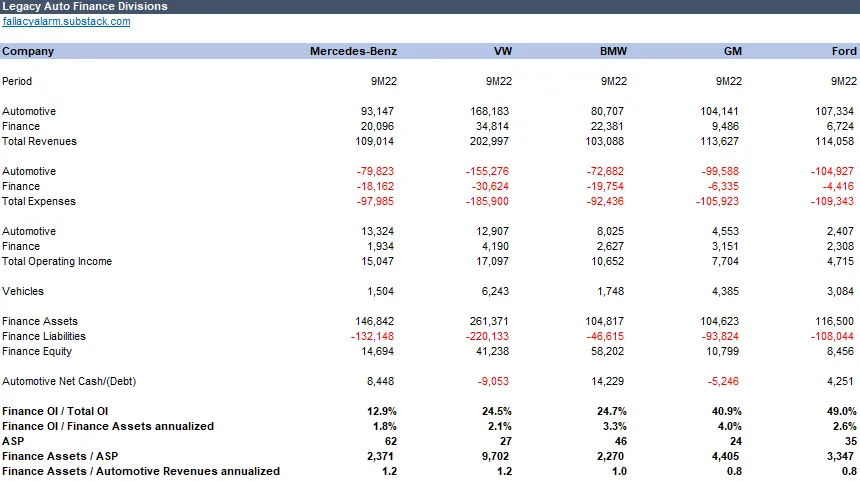

https://twitter.com/madmanx89/status/1573013827628965888Automotive consumer financing is a highly profitable business for legacy auto companies and sometimes it makes the difference between a profitable and an unprofitable year.

2/Plotting PE ratios of the largest US stocks against consensus 3y EPS growth reveals a strong statistical relationship.

2/Plotting PE ratios of the largest US stocks against consensus 3y EPS growth reveals a strong statistical relationship.

https://twitter.com/Sino_Market/status/16111771639397867522/Will refine it with time.

https://twitter.com/elonmusk/status/1602806063606075392

https://twitter.com/elonmusk/status/1568383953370767365?s=20&t=m1NT2frhO9ip928gJ1Ub9A

1. Kick-off of huge 20/21 rally in Oct’19 after 3Q19 earnings

1. Kick-off of huge 20/21 rally in Oct’19 after 3Q19 earnings

https://twitter.com/bankofcanada/status/1600505832046739459?s=20&t=jk9Im6nrnmVwSdLPEUh3NQ

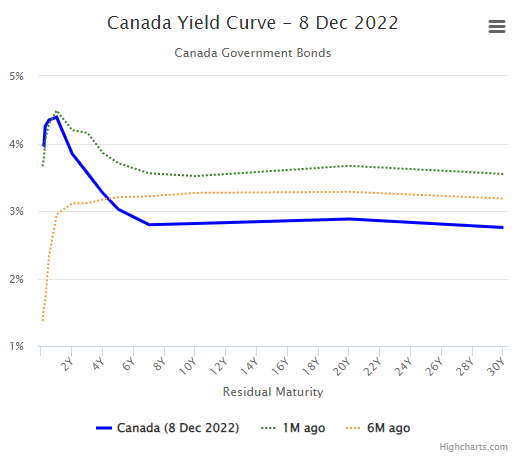

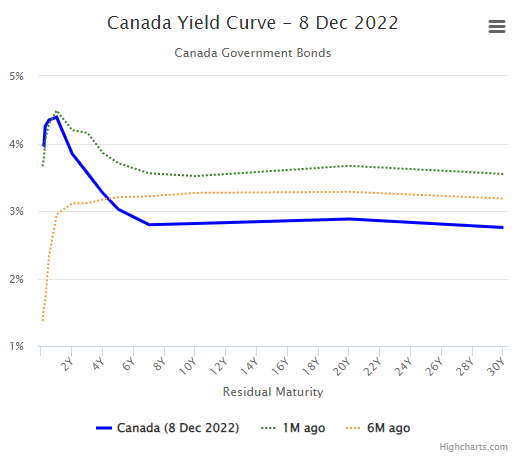

2/The craziest thing is that there is not even excessive inflation. Annualized CPI change since July is 1.8%.

2/The craziest thing is that there is not even excessive inflation. Annualized CPI change since July is 1.8%.

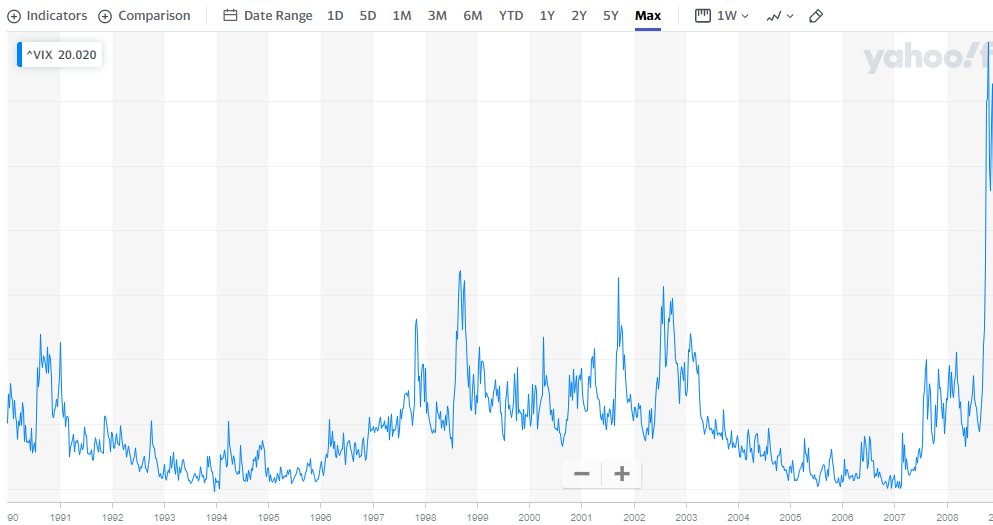

2/This excess premium typically correlates with the degree of uncertainty. The more you fear your house might burn down in a forest fire, the more likely will you demand insurance and the higher the risk that the pricing mechanism overshoots a rational level.

2/This excess premium typically correlates with the degree of uncertainty. The more you fear your house might burn down in a forest fire, the more likely will you demand insurance and the higher the risk that the pricing mechanism overshoots a rational level.

https://twitter.com/fallacyalarm/status/1540383424493391873?s=20&t=TQlBosTVDgCocbNfwiwJEw2/In my investment case above I have hypothesized that the biggest value creation in digitization happens when a new paradigm in the human machine interface (HMI) is established.

2/Fed owns 20% of Treasuries. Their not buying anymore. In fact net sellers at maturities.

2/Fed owns 20% of Treasuries. Their not buying anymore. In fact net sellers at maturities.

2/Private domestic consumption and investment accounts for 90% of the US economy (the top 4 rows in the table above). In aggregate this domestic cyclical component of GDP contributed -0.6%-points to GDP growth after -1.5%-points in the prior quarter.

2/Private domestic consumption and investment accounts for 90% of the US economy (the top 4 rows in the table above). In aggregate this domestic cyclical component of GDP contributed -0.6%-points to GDP growth after -1.5%-points in the prior quarter.

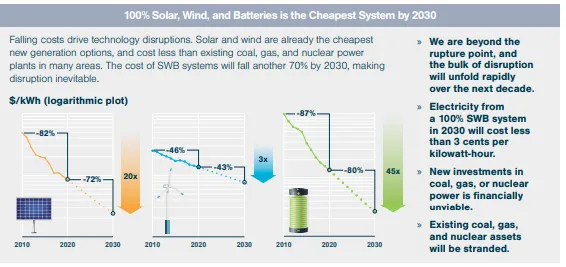

2. Both are riding down exponential cost curves

2. Both are riding down exponential cost curves