Shitposts, macro, crypto. Host of podcast & newsletter @forwardguidance

4 subscribers

How to get URL link on X (Twitter) App

core goods which have been the largest driver of the disinflation story over the past couple years have bottomed and are beginning to move higher.

core goods which have been the largest driver of the disinflation story over the past couple years have bottomed and are beginning to move higher.

Congress holds the power of setting a limit on the amount of National Debt that the government can have.

Congress holds the power of setting a limit on the amount of National Debt that the government can have.

First, what are swap lines?

First, what are swap lines?

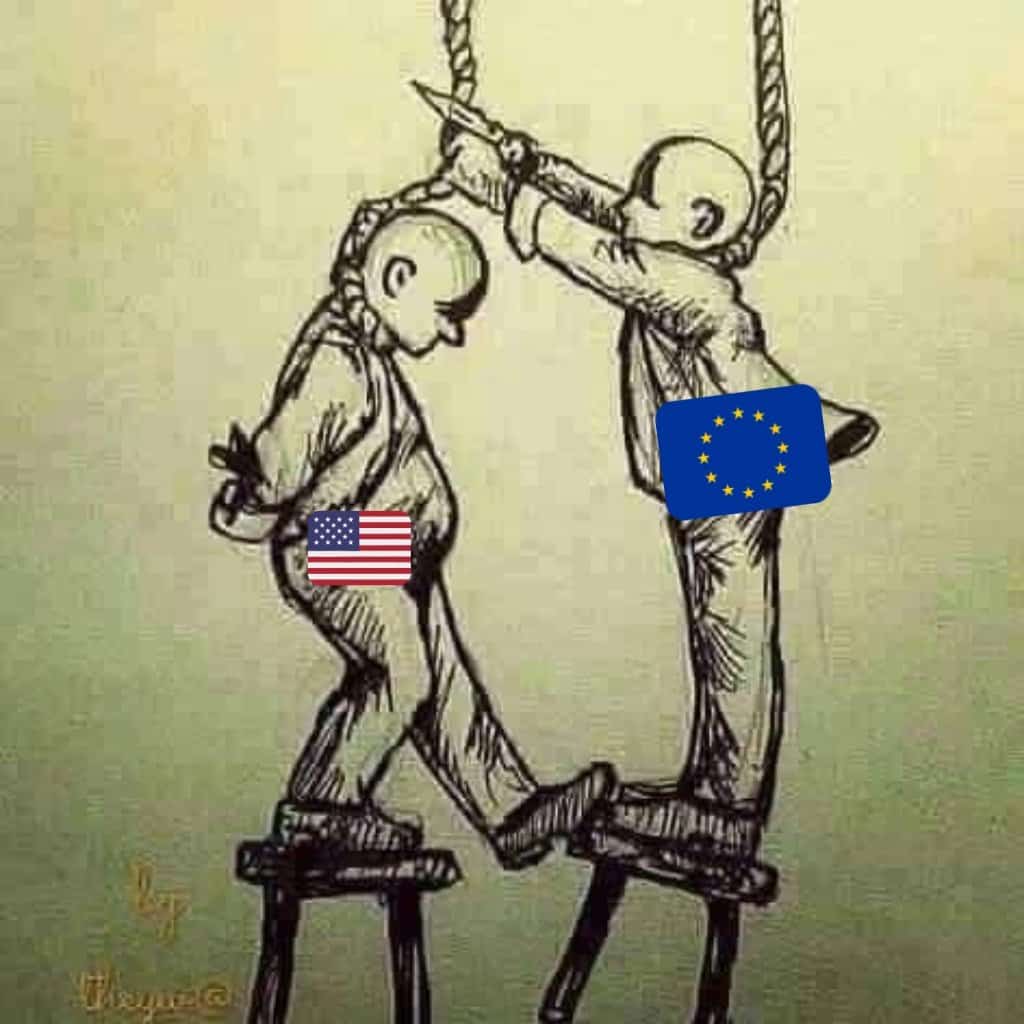

Putin strongarms Europe by shutting off Energy pipelines, causing a spike in prices.

Putin strongarms Europe by shutting off Energy pipelines, causing a spike in prices.

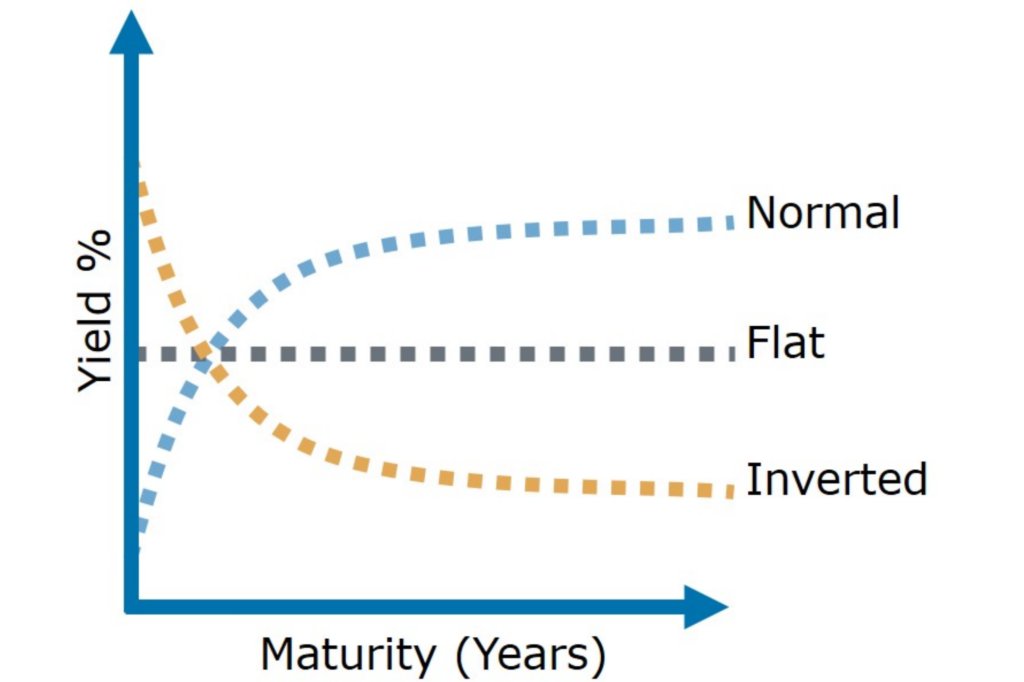

Yield curve inversions normalize through two ways:

Yield curve inversions normalize through two ways: