How to get URL link on X (Twitter) App

I've said a few times that perhaps my edge isn't actually sourcing or anything tricky like that

I've said a few times that perhaps my edge isn't actually sourcing or anything tricky like that

Part of sourcing is watching a lot of channels

Part of sourcing is watching a lot of channelshttps://x.com/financeguy725/status/1743367926751592723

EVERYTHING IS A SIGNAL

EVERYTHING IS A SIGNAL

Here's a thread about the fund and our thesis

Here's a thread about the fund and our thesishttps://x.com/financeguy725/status/1742208096997437458

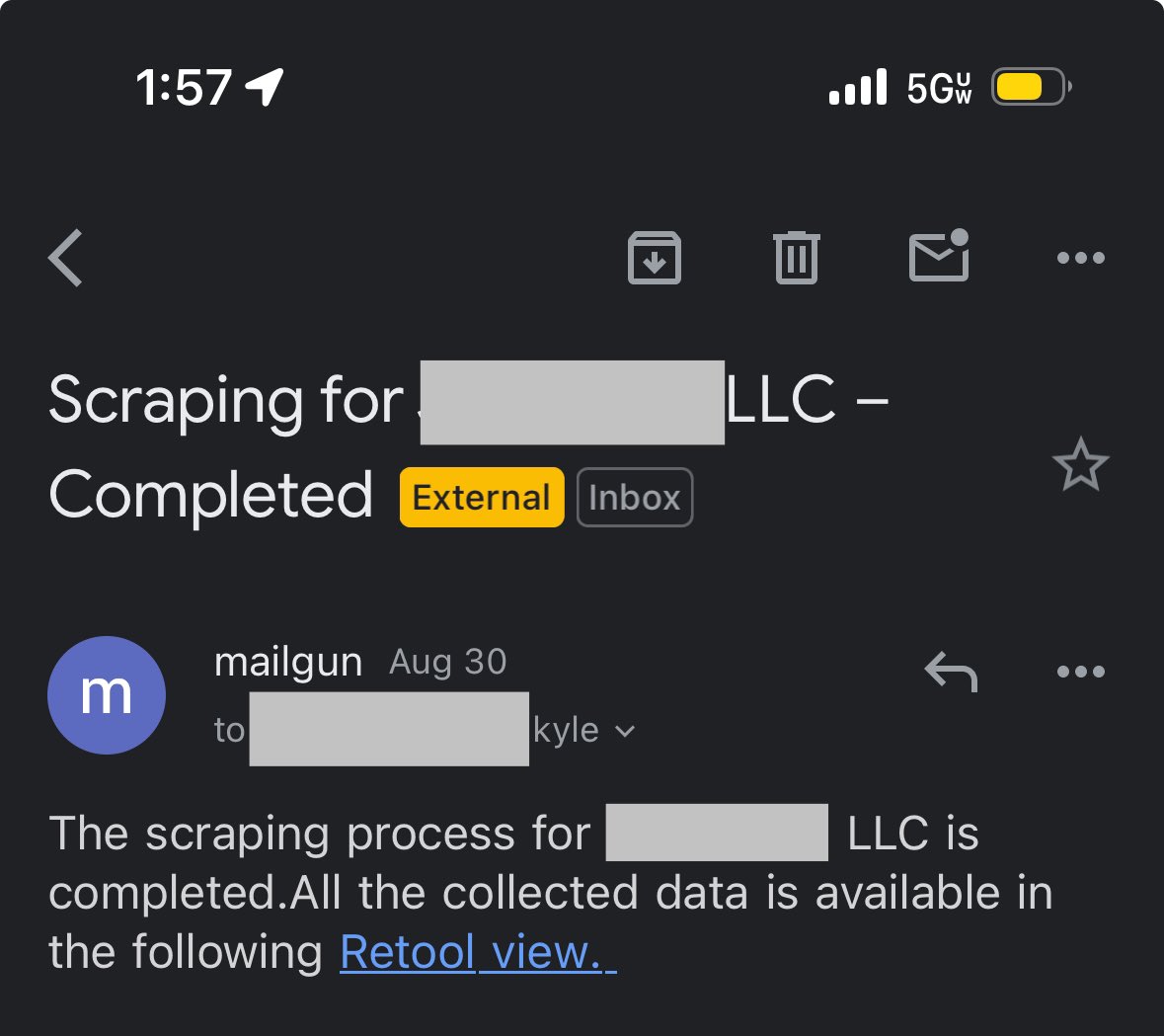

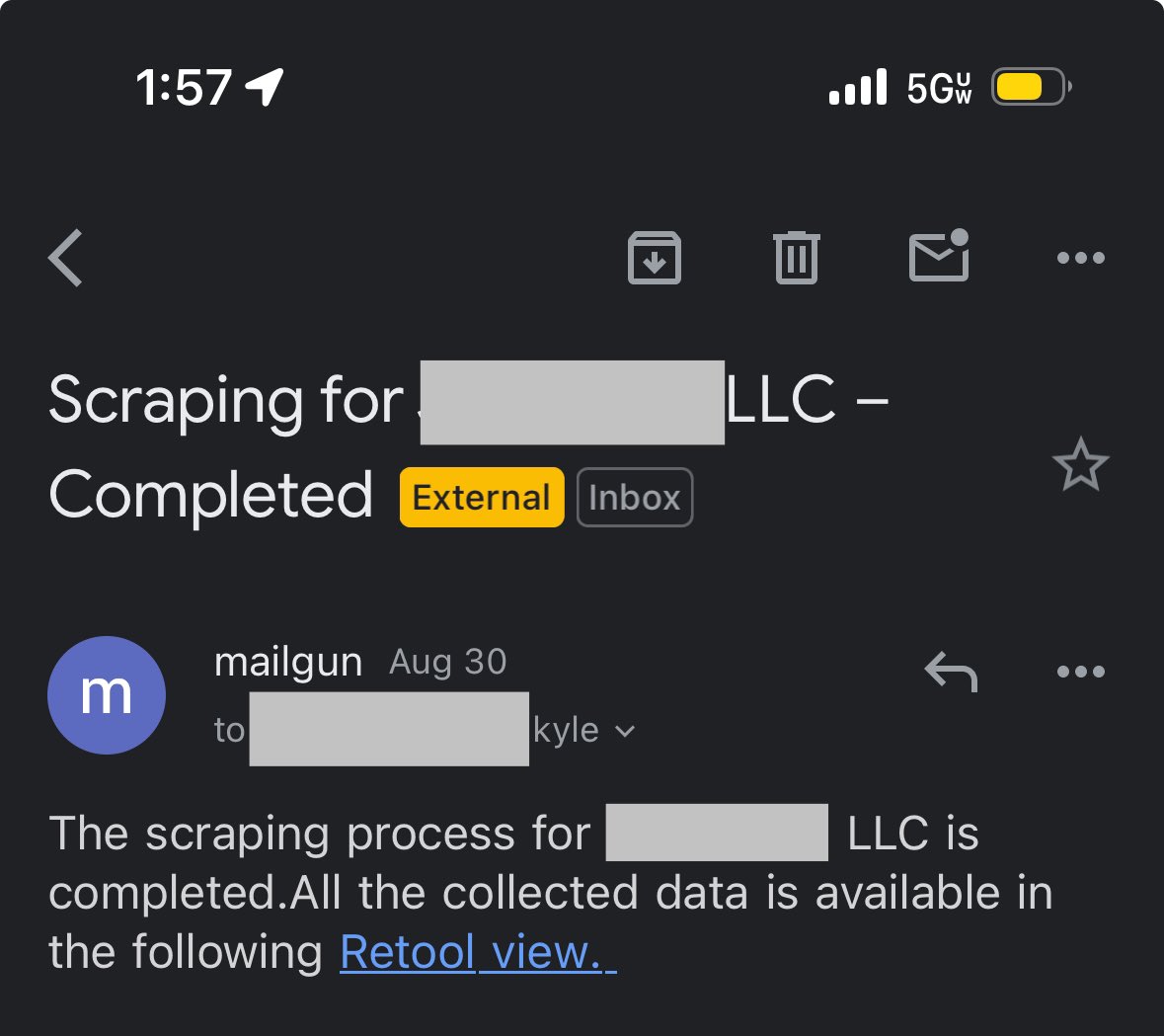

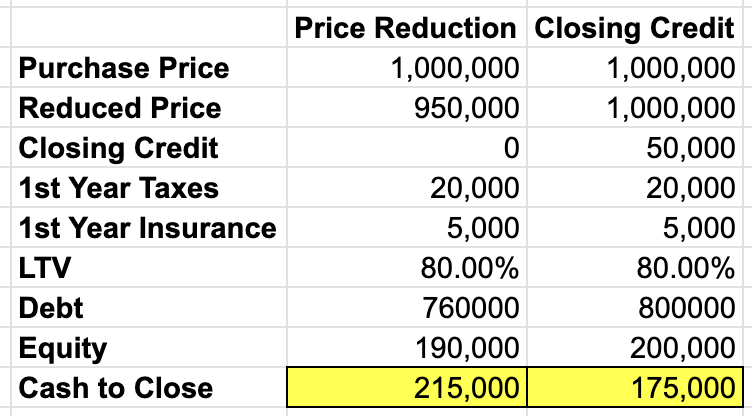

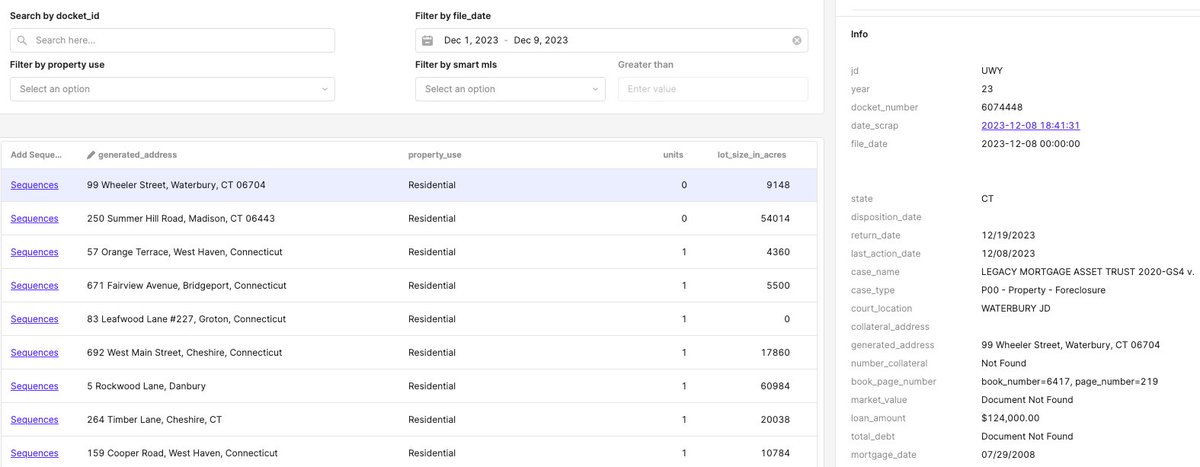

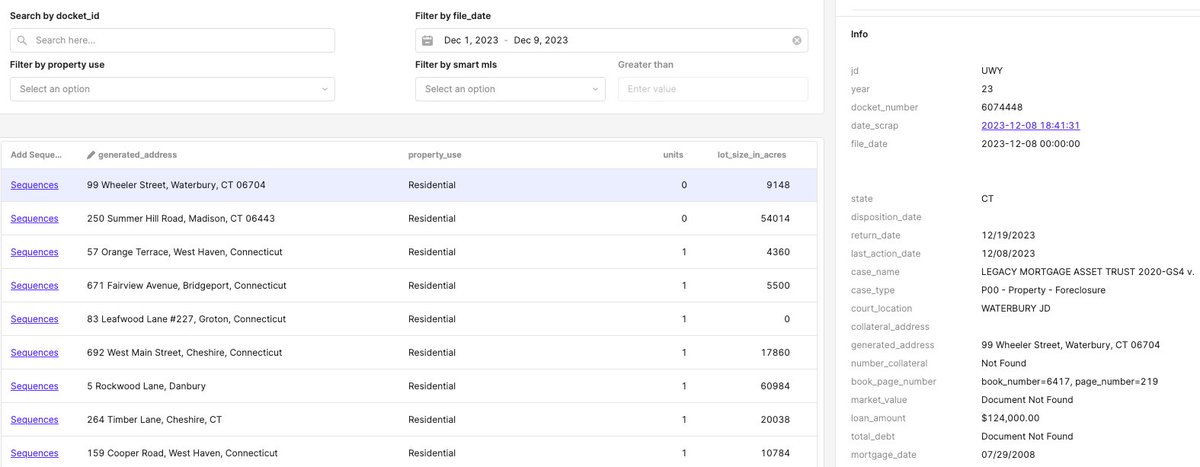

almost 6 years ago, when I still worked at a hedge fund, I was looking for clever ways to find real estate deals

almost 6 years ago, when I still worked at a hedge fund, I was looking for clever ways to find real estate deals

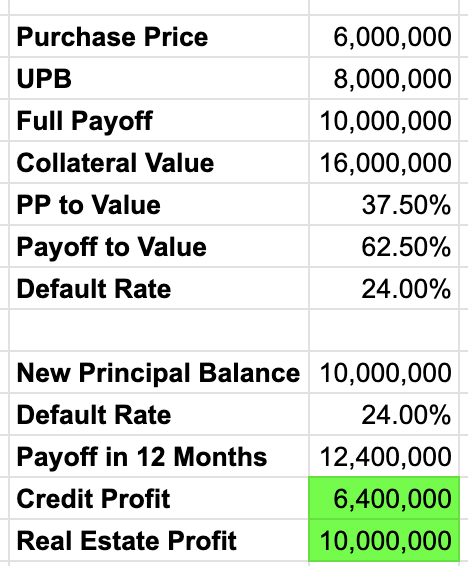

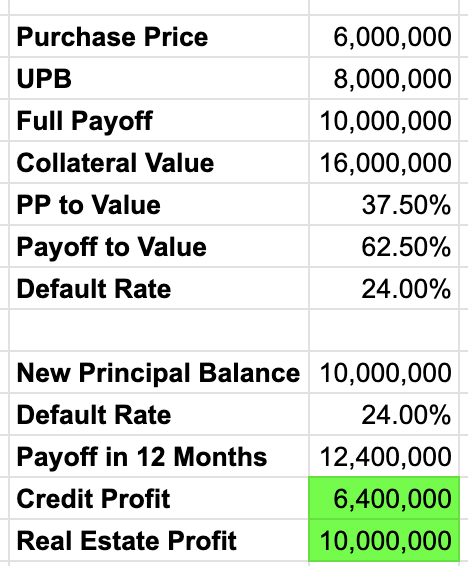

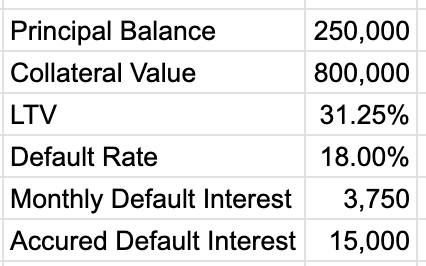

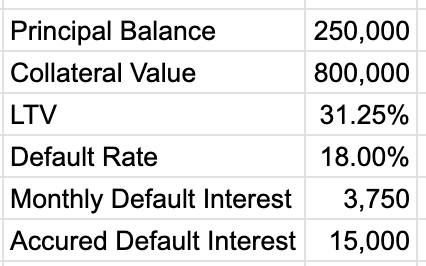

If you're gonna invest in distressed real estate (equity or debt) you have to understand the concept of priority

If you're gonna invest in distressed real estate (equity or debt) you have to understand the concept of priority

So where do you start?

So where do you start?

https://twitter.com/financeguy725/status/1587924709508845573

https://twitter.com/financeguy725/status/1576724957031288832